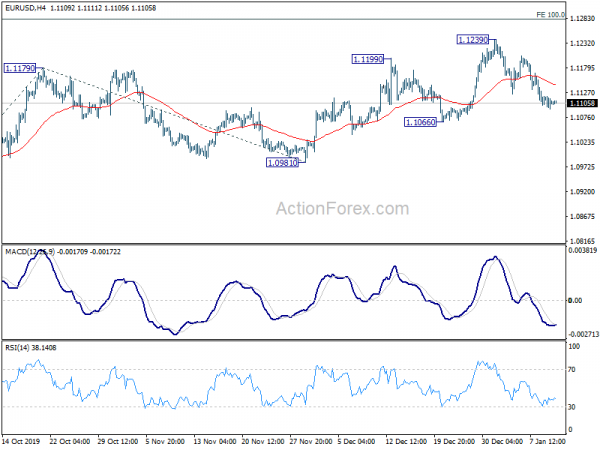

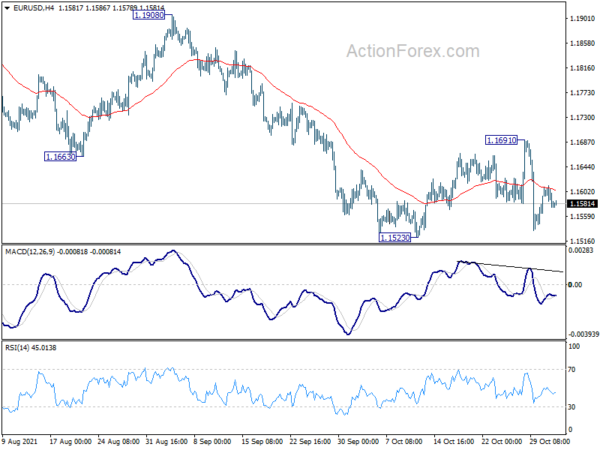

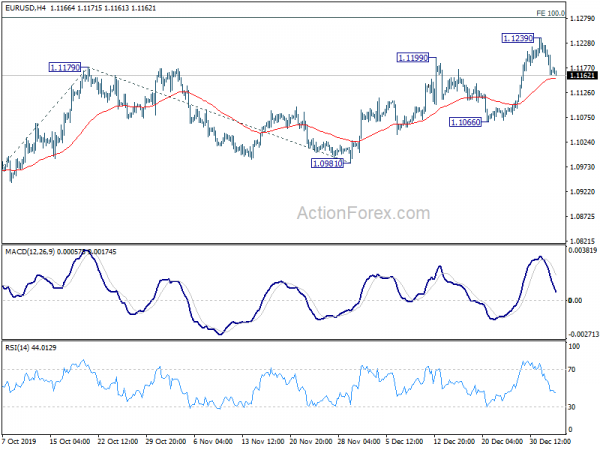

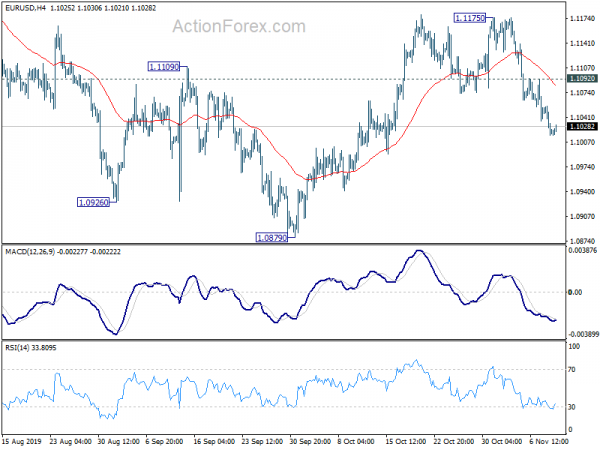

Daily Pivots: (S1) 1.1093; (P) 1.1106; (R1) 1.1120; More…

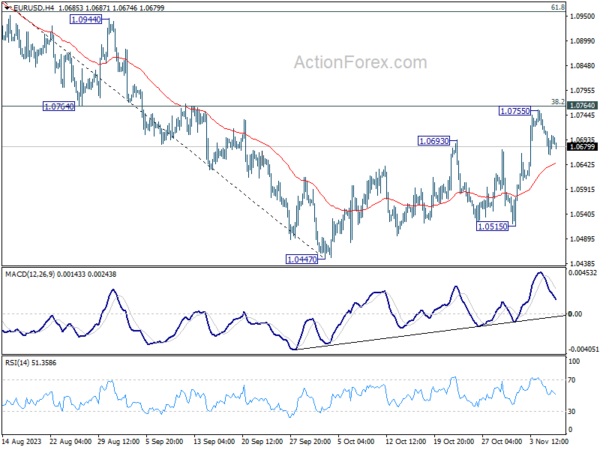

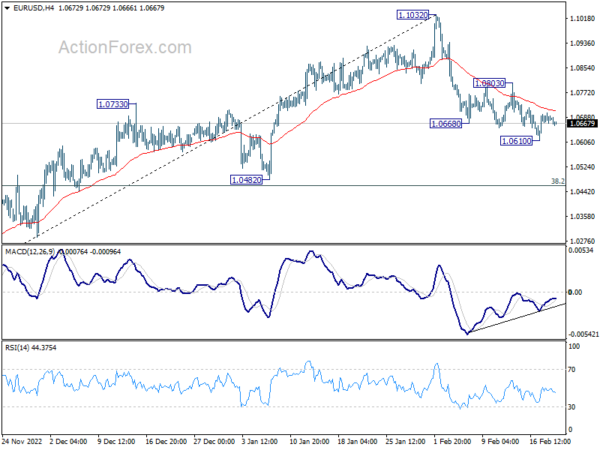

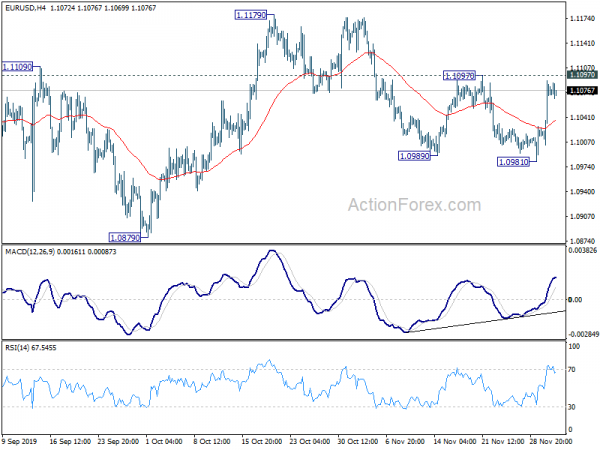

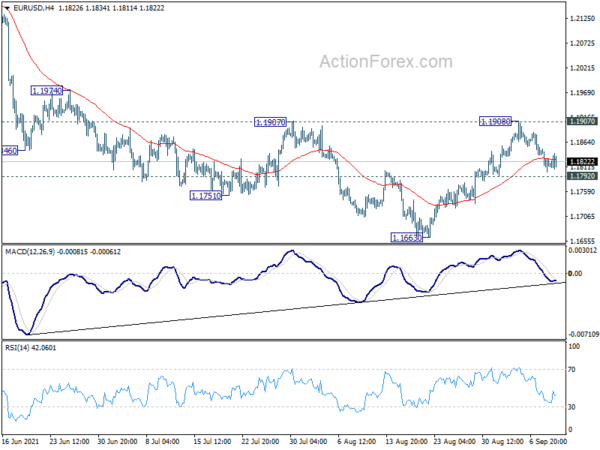

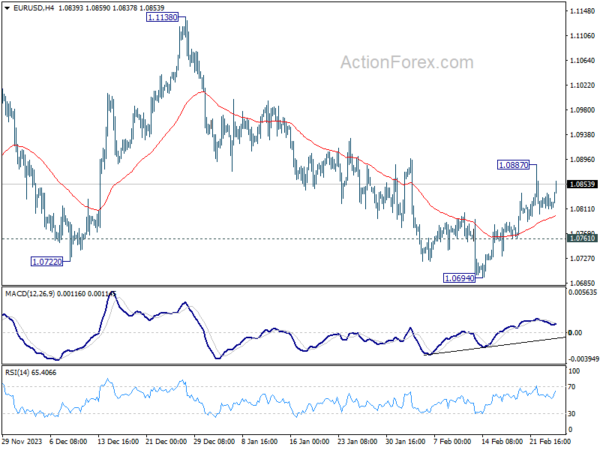

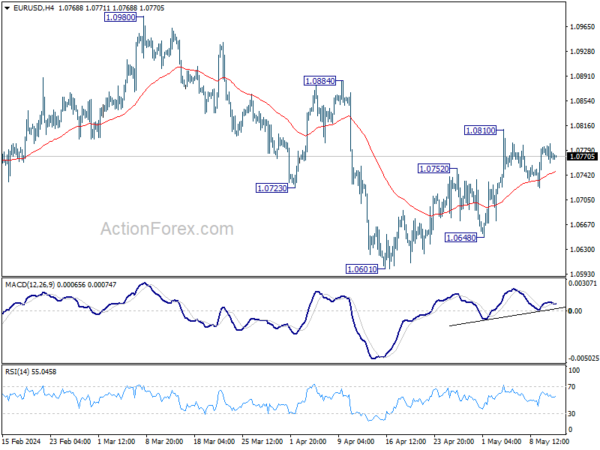

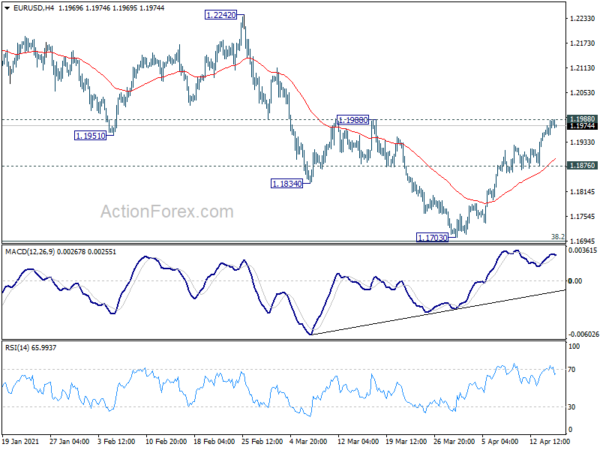

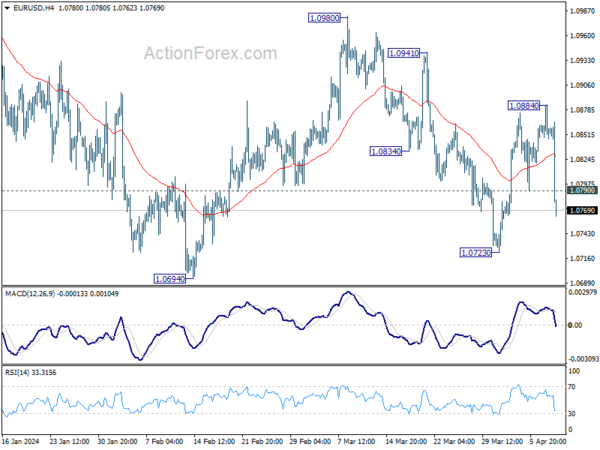

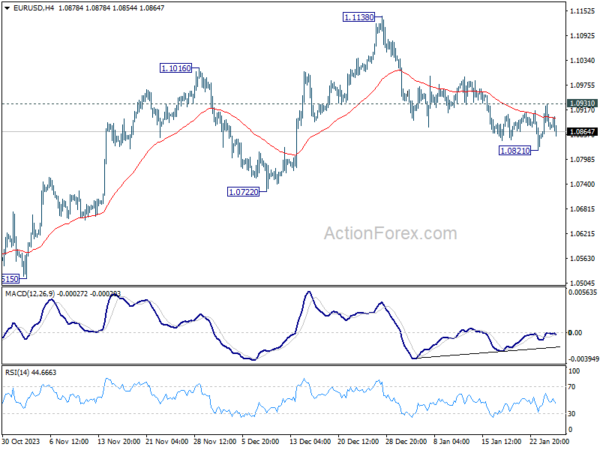

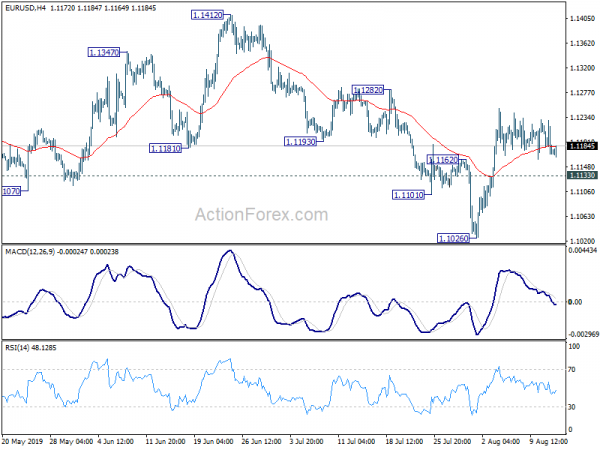

Intraday bias in EUR/USD remains neutral at this point and further rise is expected with 1.1066 support intact. On the upside, break of 1.1239 will extend whole rally from 1.0879 to 100% projection of 1.0879 to 1.1179 from 1.0981 at 1.1281 next. However, firm break of 1.1066 will argue that whole rise from 1.0879 has completed. In this case, intraday bias will be turned back to the downside for 1.0981 support for confirmation.

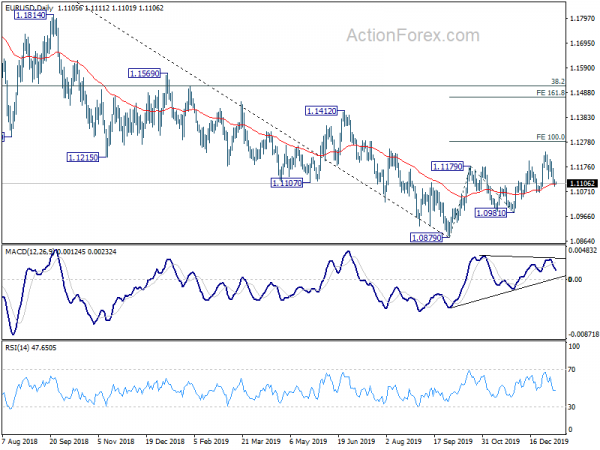

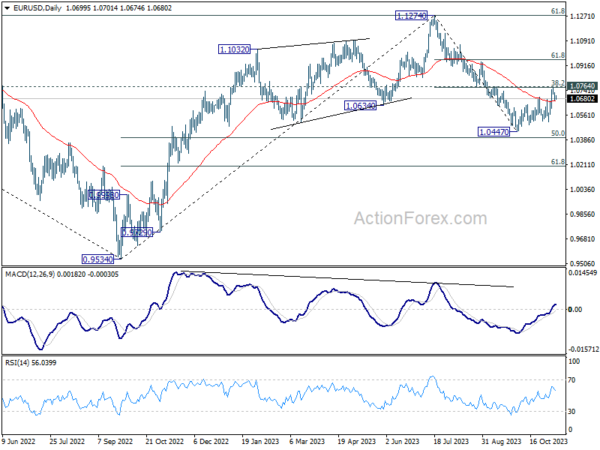

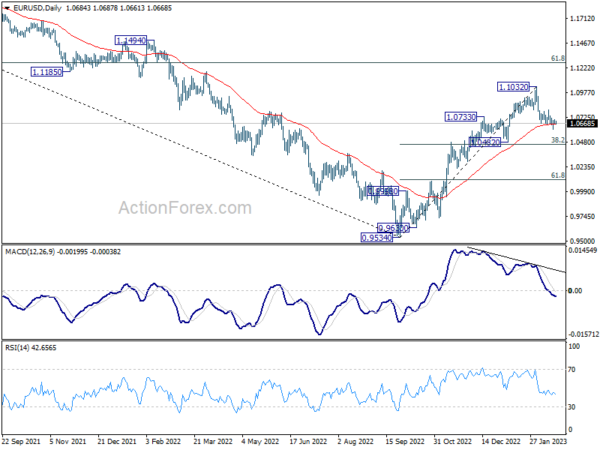

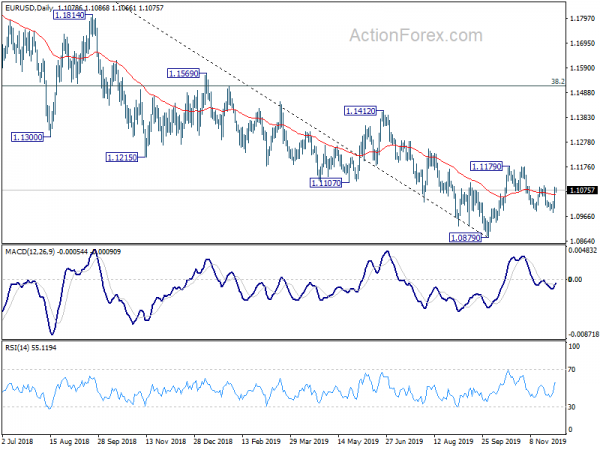

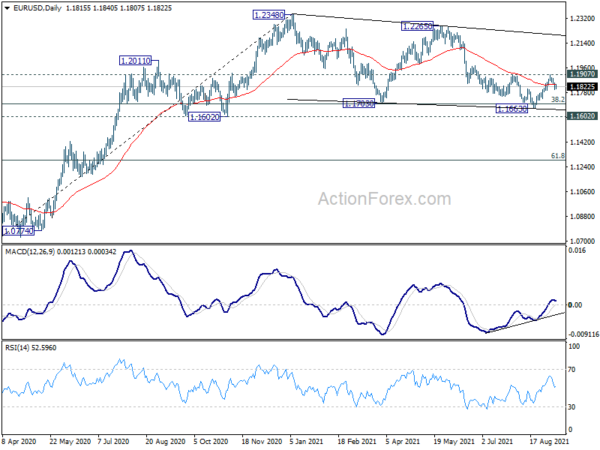

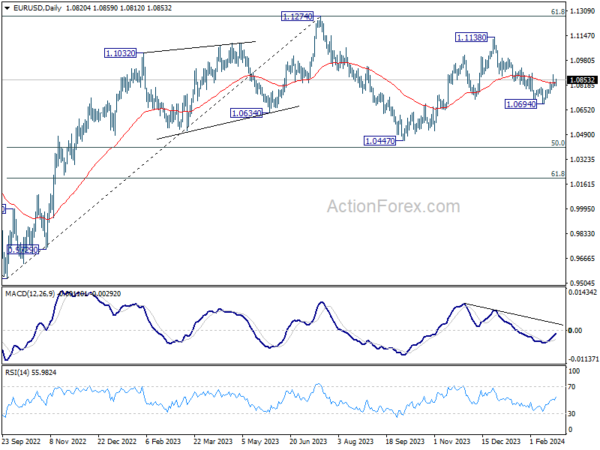

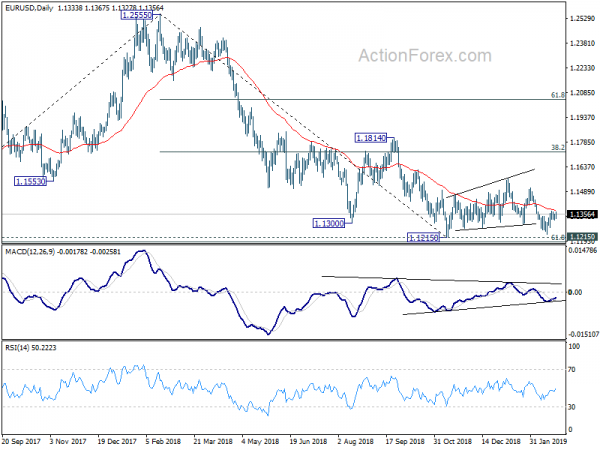

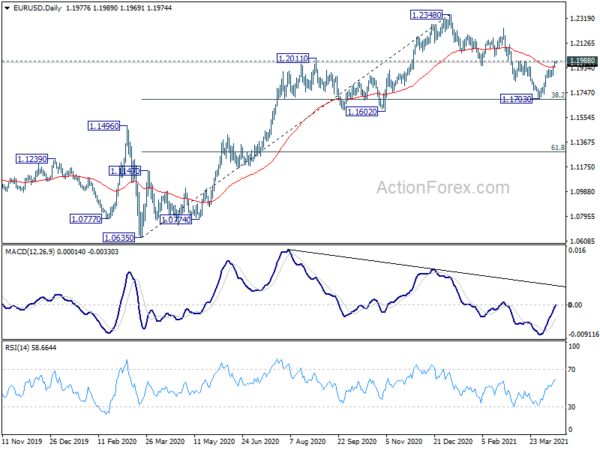

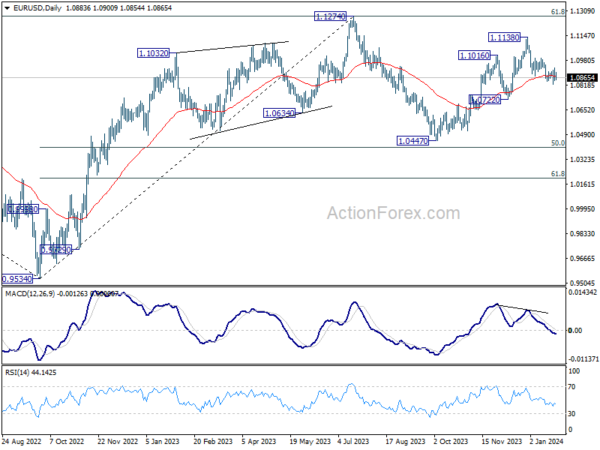

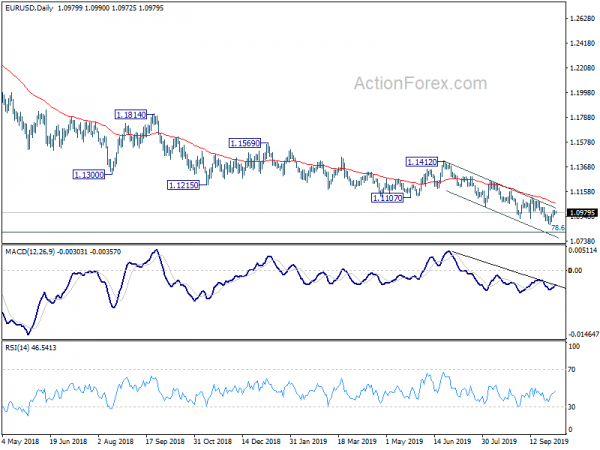

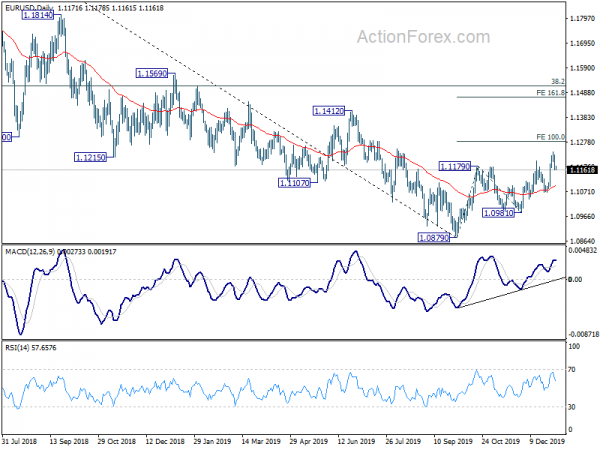

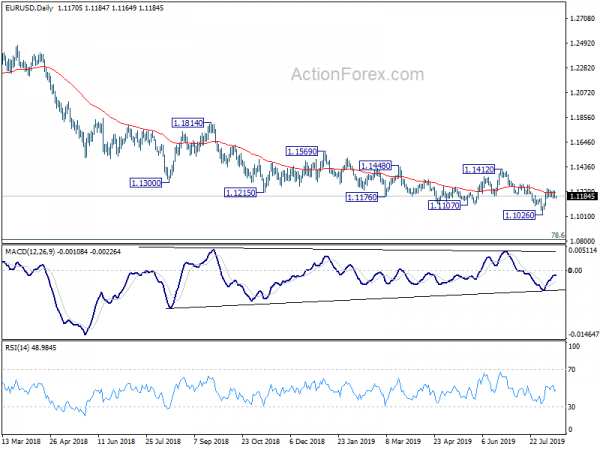

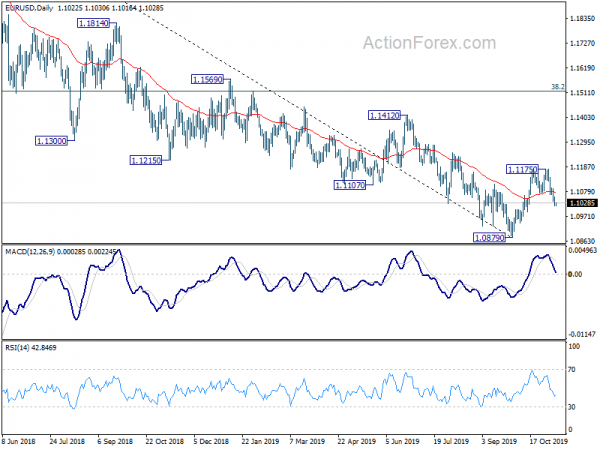

In the bigger picture, rebound from 1.0879 is seen as a corrective move at this point. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.