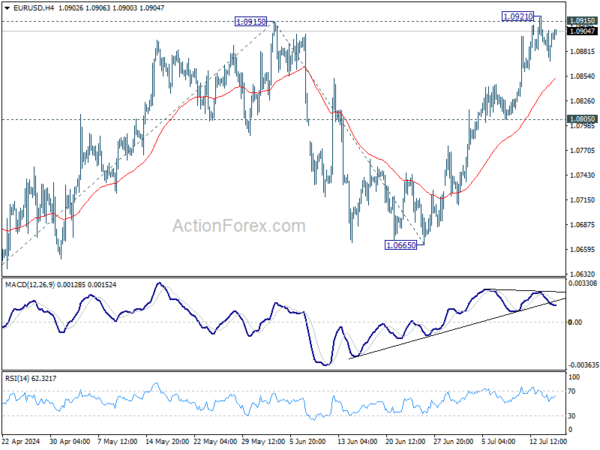

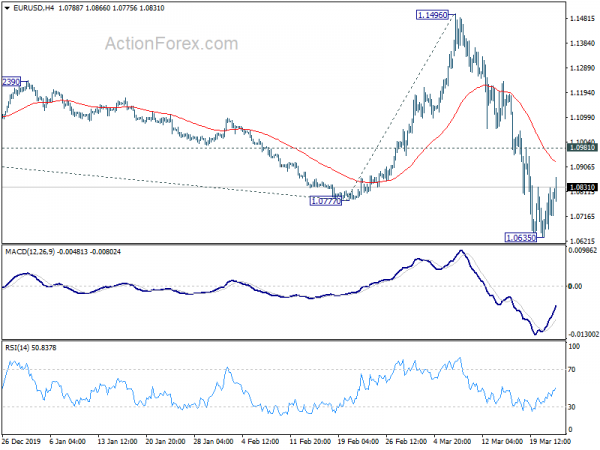

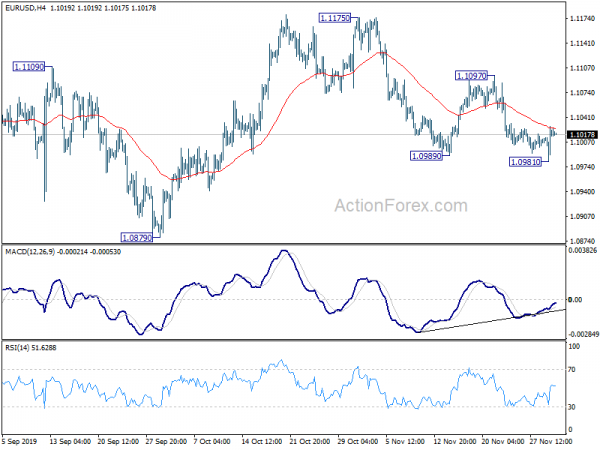

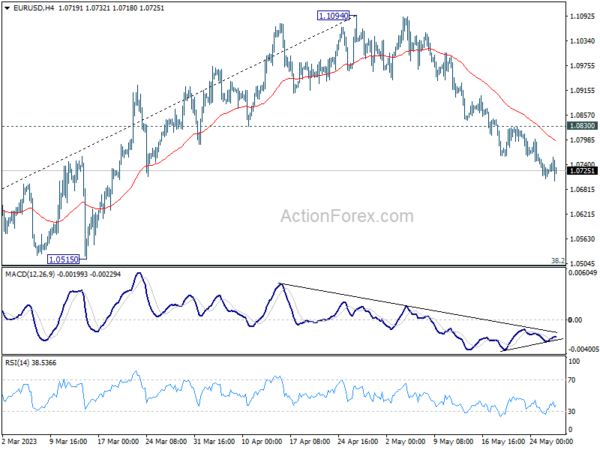

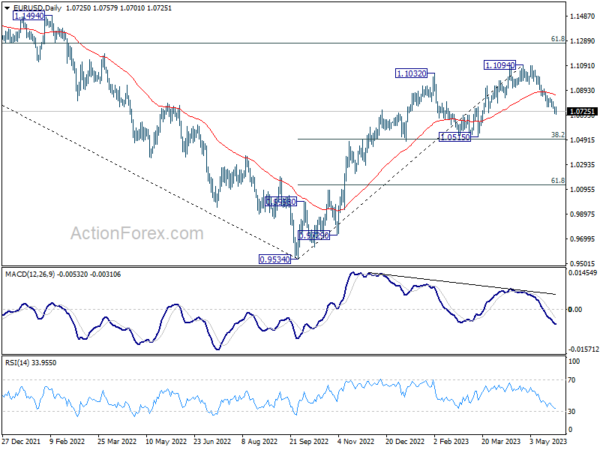

Daily Pivots: (S1) 1.0877; (P) 1.0900; (R1) 1.0916; More….

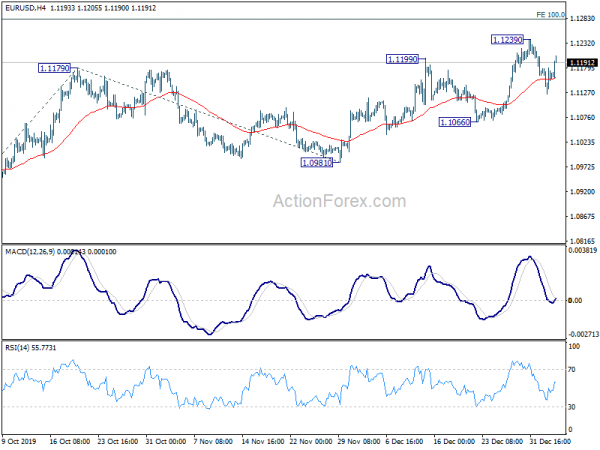

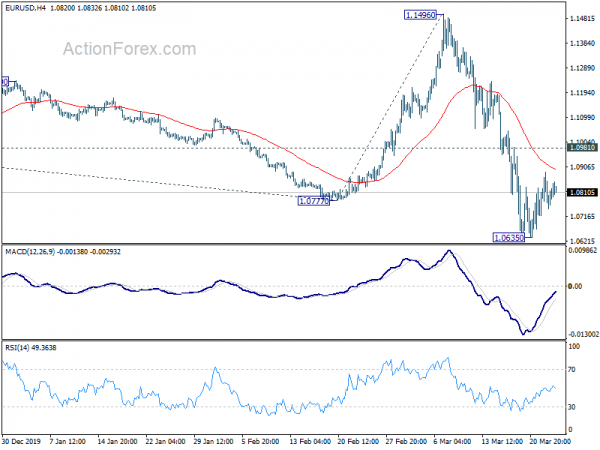

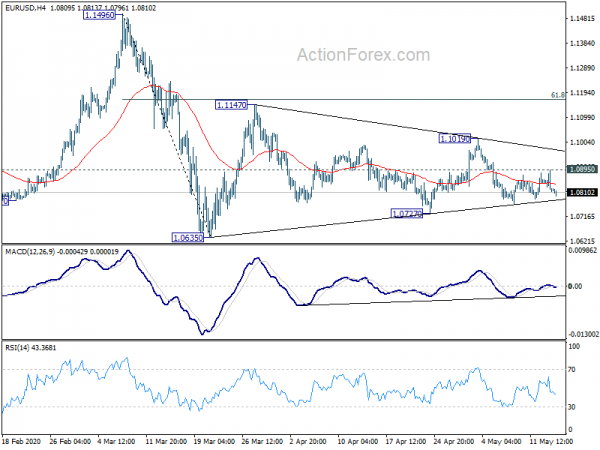

Intraday bias in EUR/USD remains neutral for the moment. Further rally is expected as long as 1.0805 support holds. Firm break of 1.0915/21 will will resume whole rise from 1.0601 to 100% projection of 1.0601 to 1.0915 from 1.0665 at 1.0979. However, break of 1.0805 will turn bias back to the downside for deeper pullback.

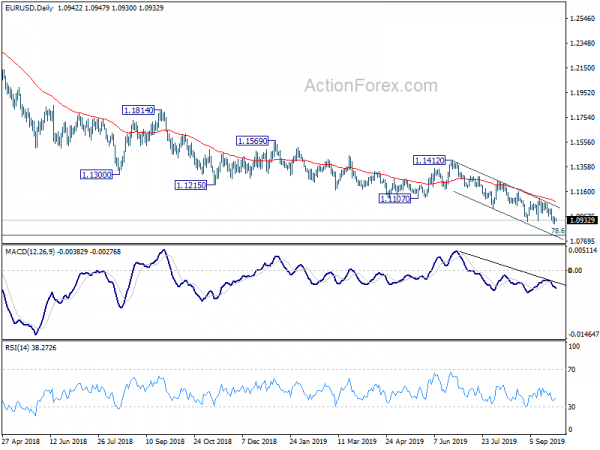

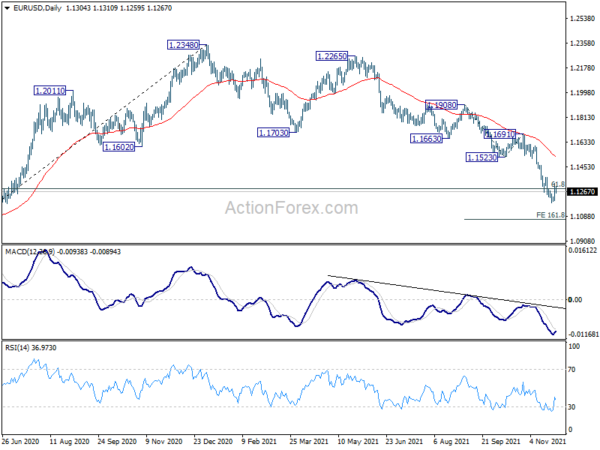

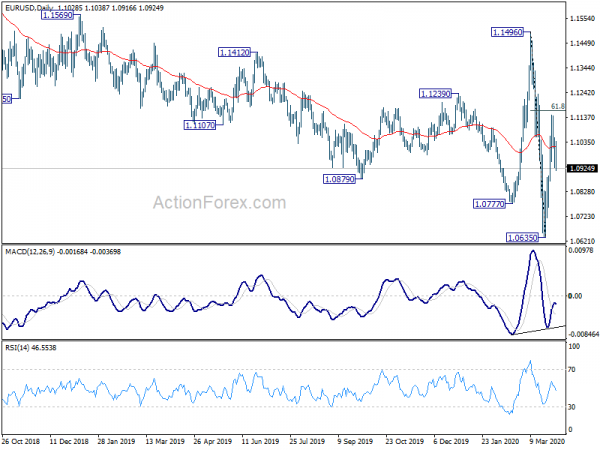

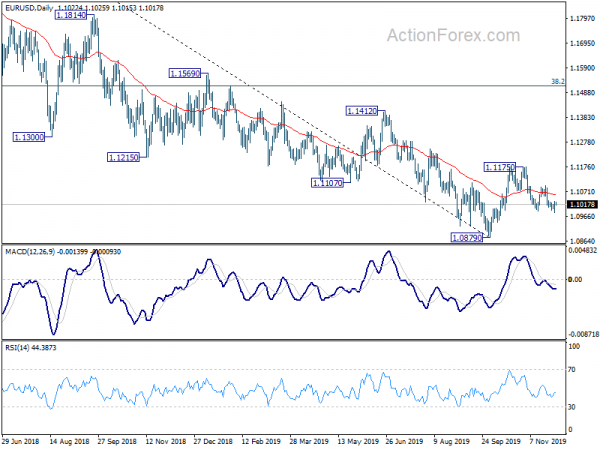

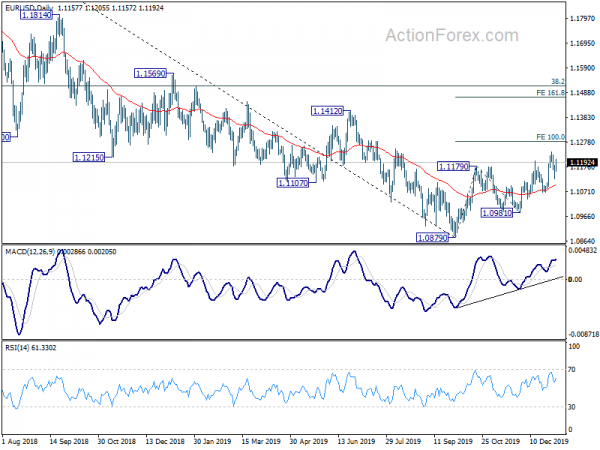

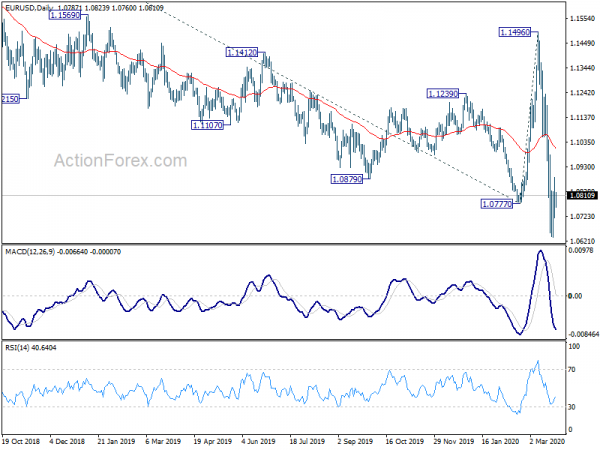

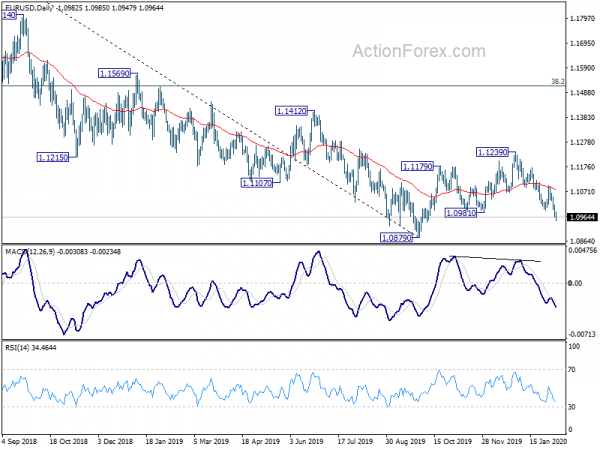

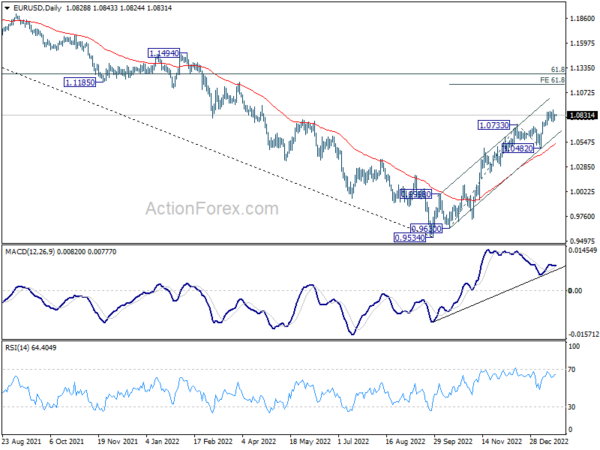

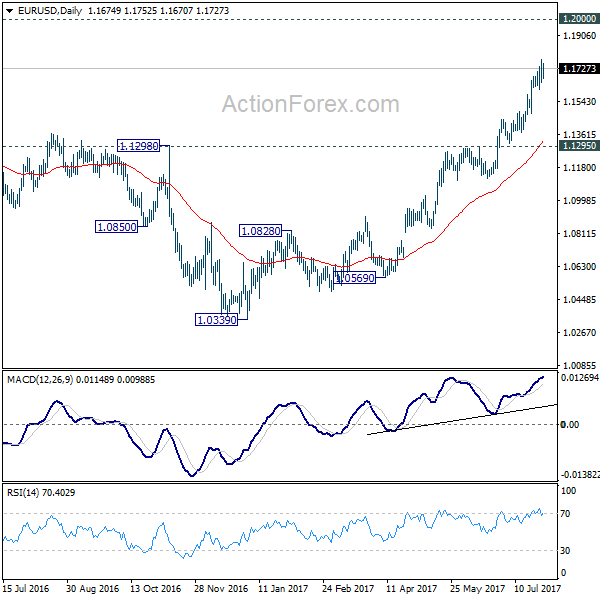

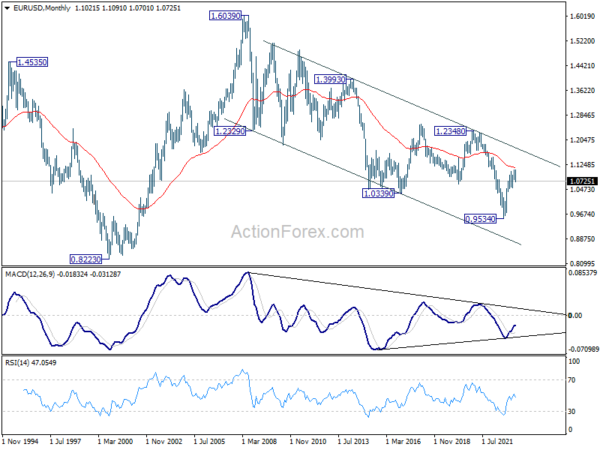

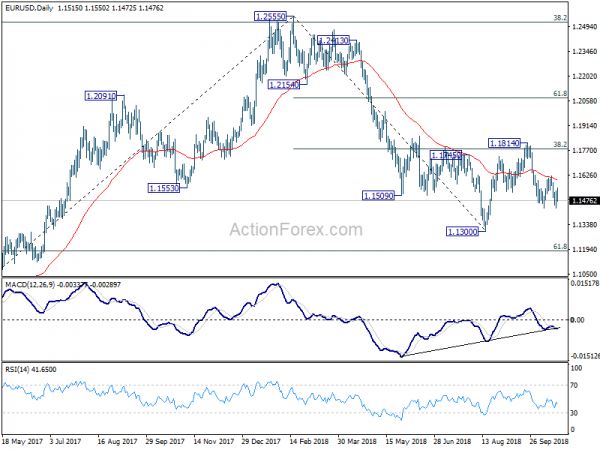

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern, possibly a triangle, that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). This will now remain the favored case as long as 1.0601 support holds.