Daily Pivots: (S1) 1.0406; (P) 1.0471 (R1) 1.0506; More…

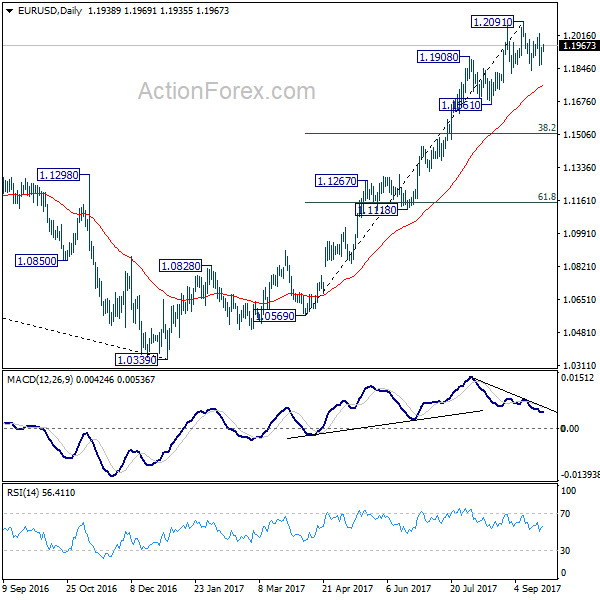

EUR/USD is still staying above 1.0339/58 support zone with today’s decline. Intraday bias stays neutral first. Further fall is in favor with 1.0614 minor resistance intact. On the downside, sustained break of 1.0339/48 will resume larger down trend. Next target is long term projection level at 1.0090. On the upside, above 1.0614 will turn bias back to the upside for 1.0786 resistance instead.

In the bigger picture, focus stays on 1.0339 long term support (2017 low). Decisive break there will resume whole down trend from 1.6039 (2008 high). Next target is 61.8% projection of 1.3993 to 1.0339 from 1.2348 at 1.0090. However, firm break of 1.0805 support turned resistance will delay this bearish case, and bring stronger rebound first.