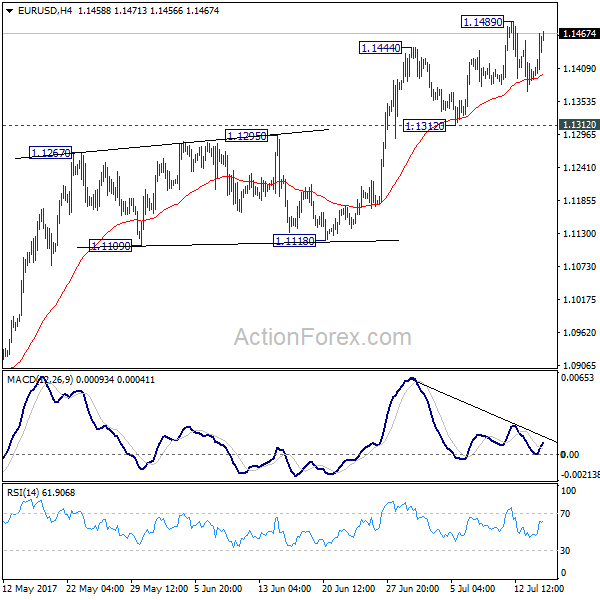

Daily Pivots: (S1) 1.1278; (P) 1.1312; (R1) 1.1348; More…

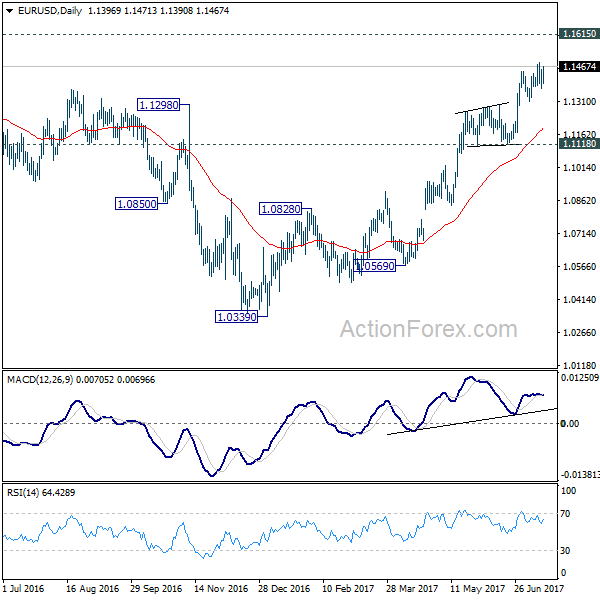

Intraday bias in EUR/USD remains neutral as range trading continues. On the upside, firm break of 1.1385 resistance will resume the rebound from 1.1186. Sustained trading above 55 day EMA (now at 1.1392) will bring stronger rise back to 1.1663 support turned resistance. On the downside, break of 1.1185 will resume larger decline from 1.2348. Next target is 161.8% projection of 1.2265 to 1.1663 from 1.1908 at 1.0934.

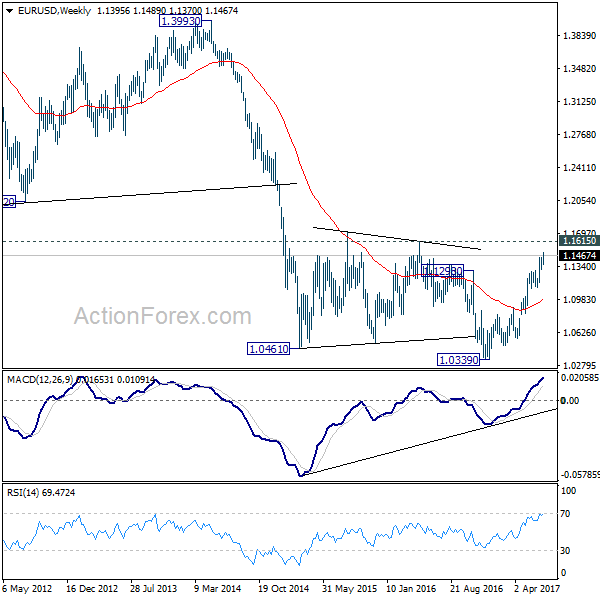

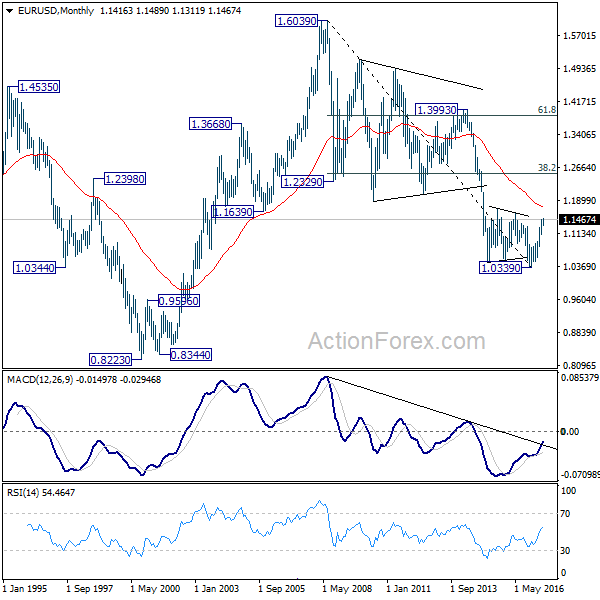

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.