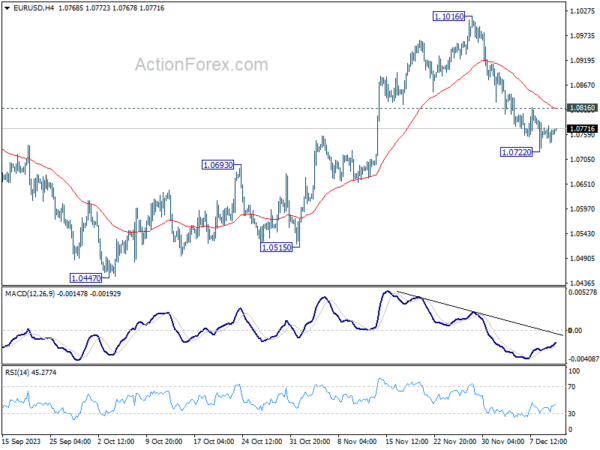

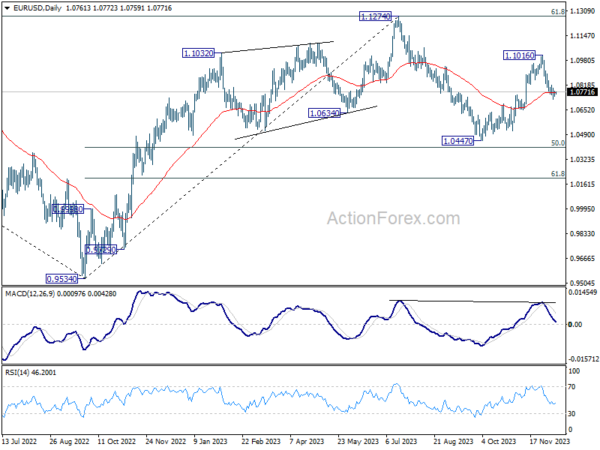

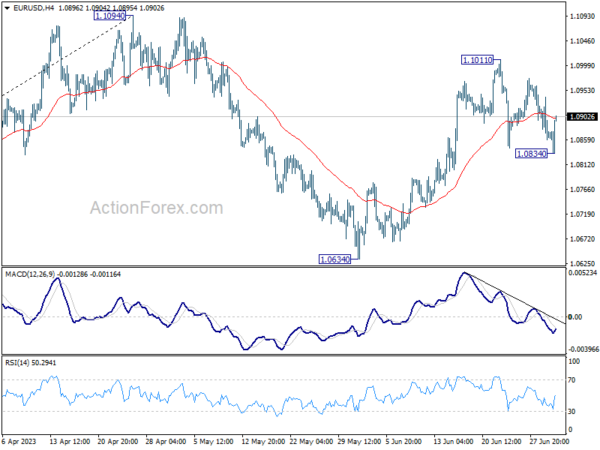

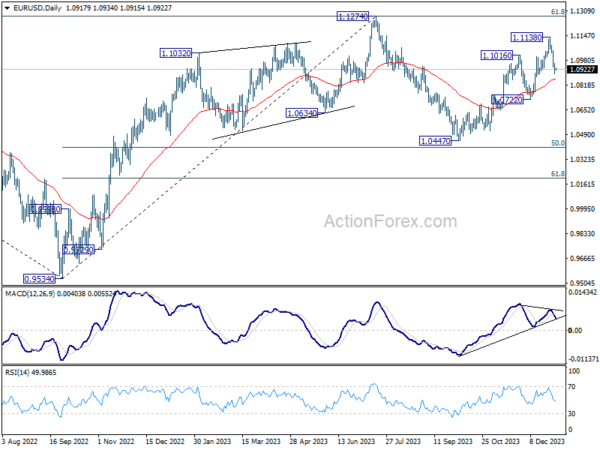

Daily Pivots: (S1) 1.0789; (P) 1.0812; (R1) 1.0856; More…

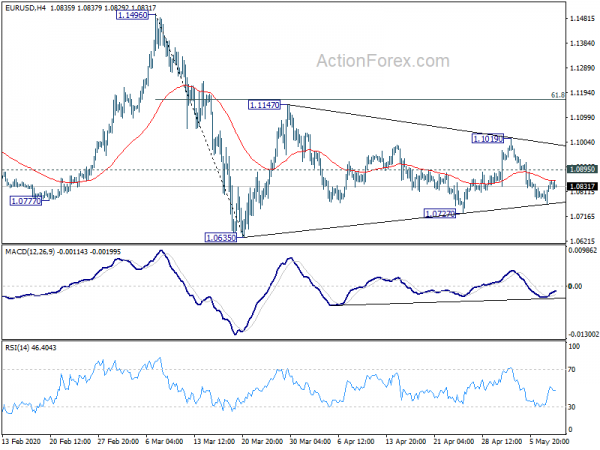

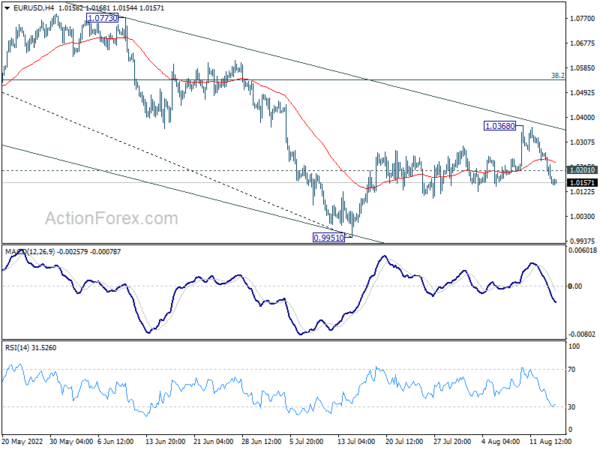

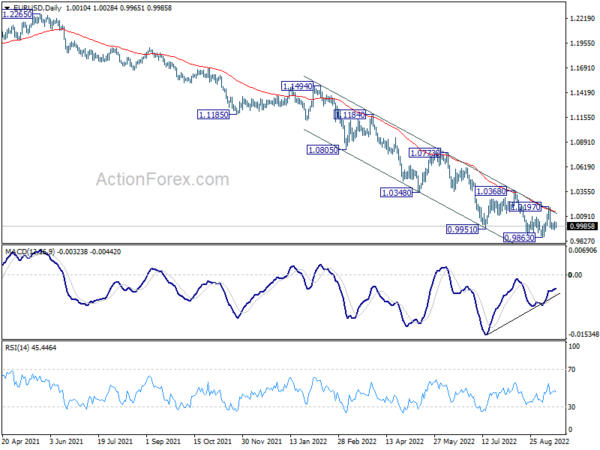

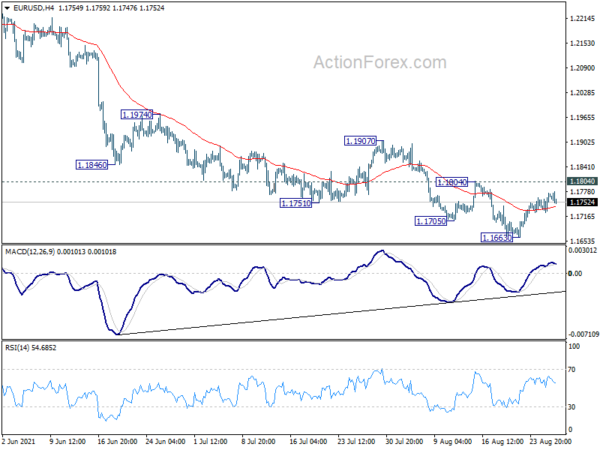

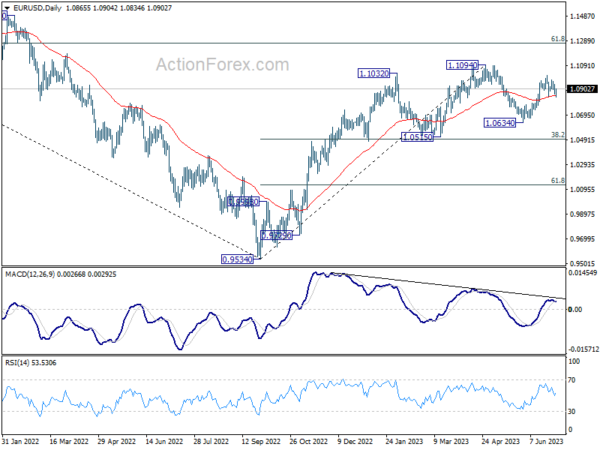

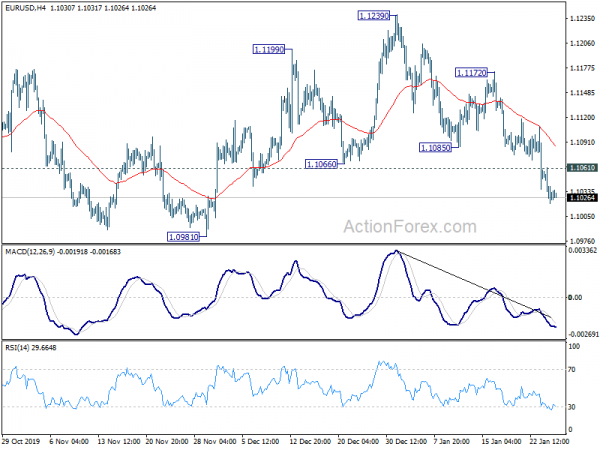

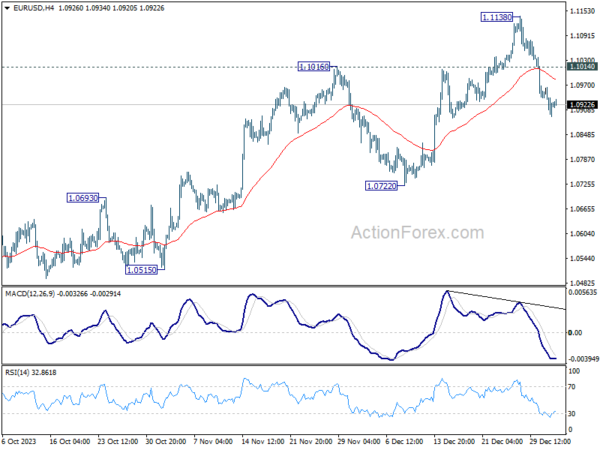

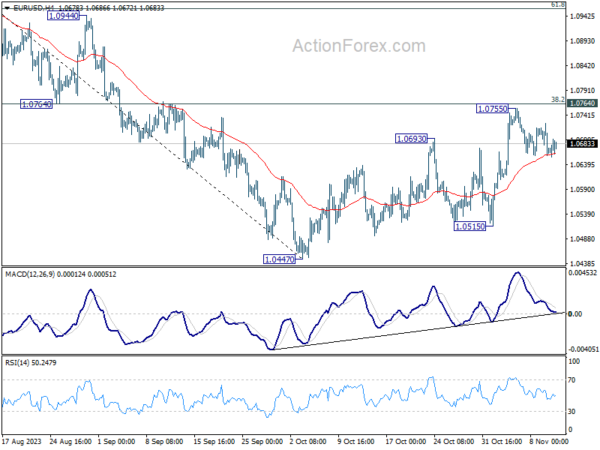

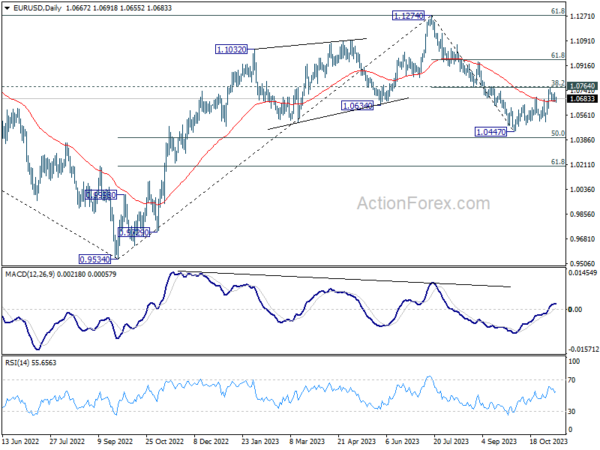

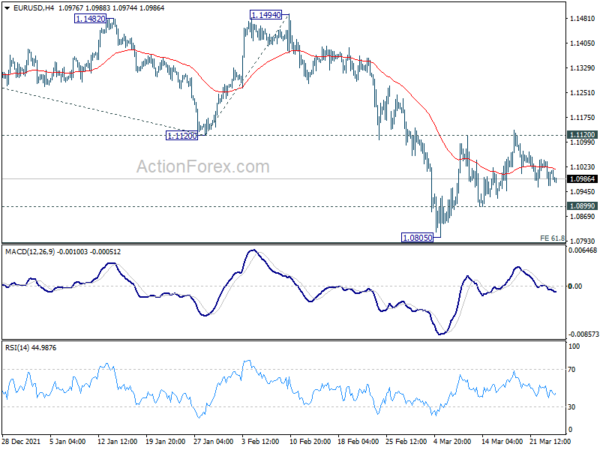

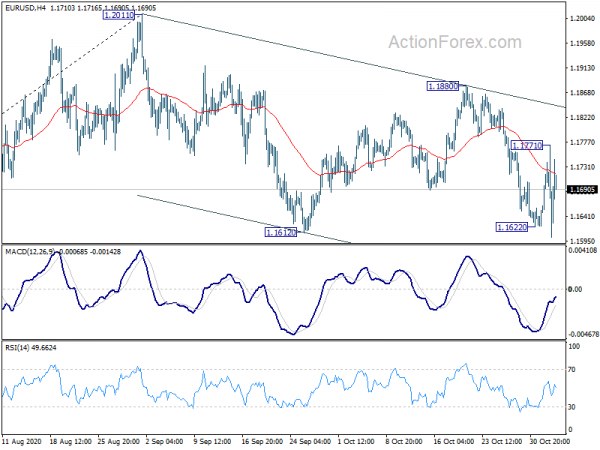

Intraday bias in EUR/USD remains neutral at this point. Overall, consolidation from 1.0635 is still extending. Above 1.0899 minor resistance will bring another rise to 1.1019 resistance and above. But upside should be by 61.8% retracement of 1.1496 to 1.0635 at 1.1167. On the downside, break of 1.0727 will bring retest of 1.0635 low next.

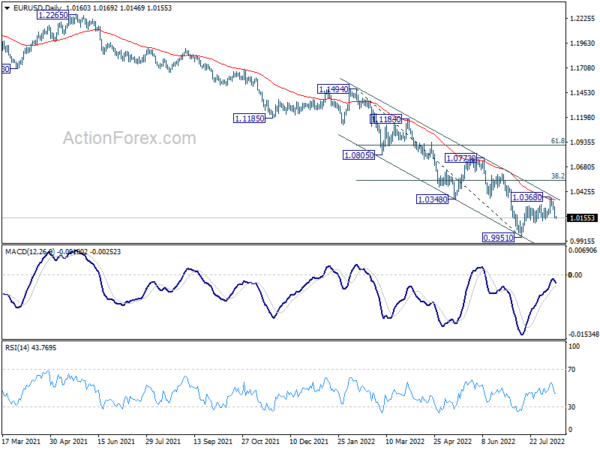

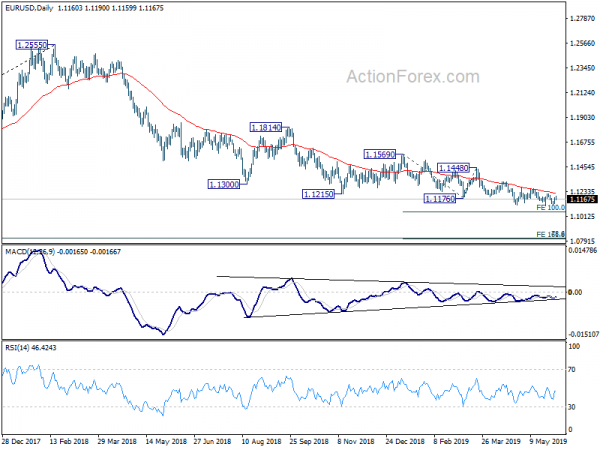

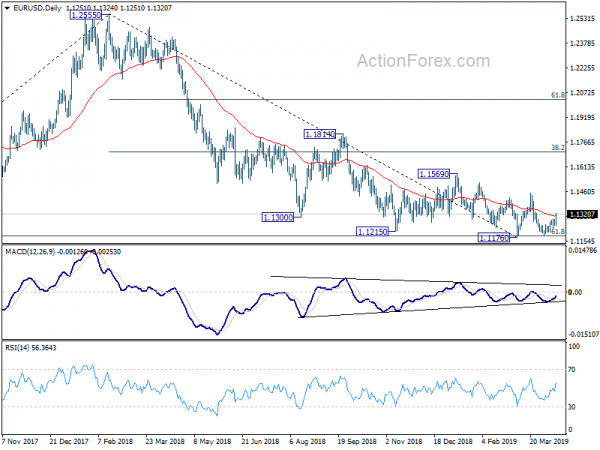

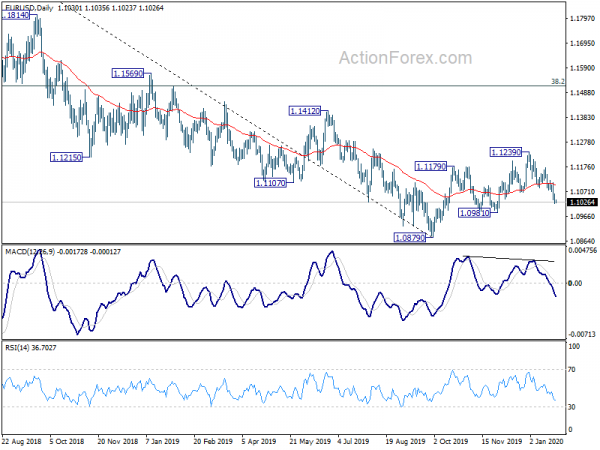

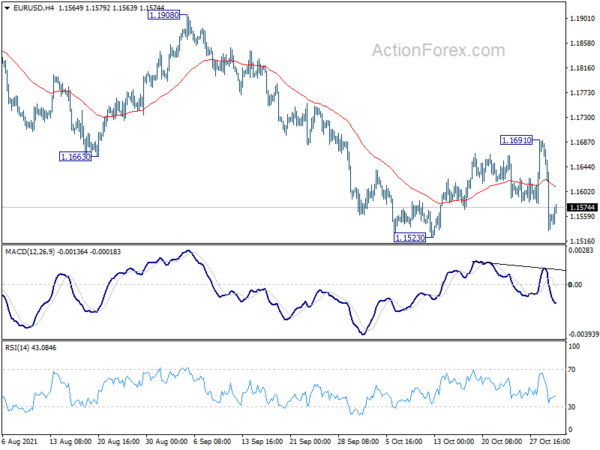

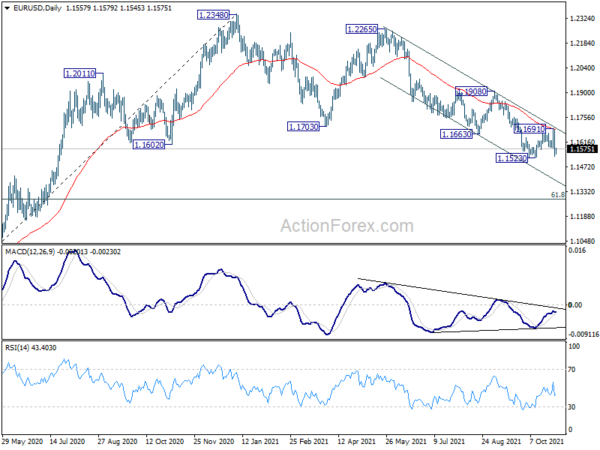

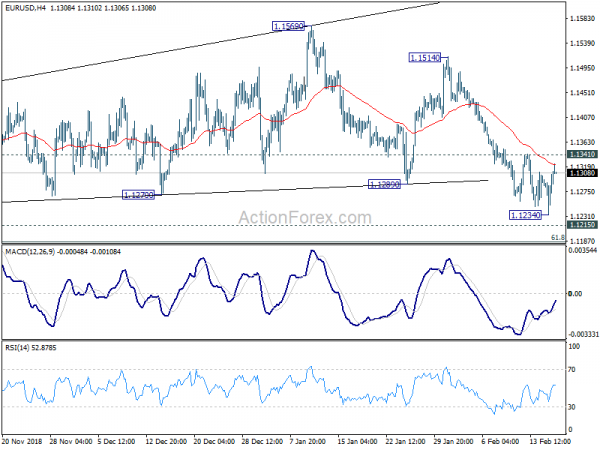

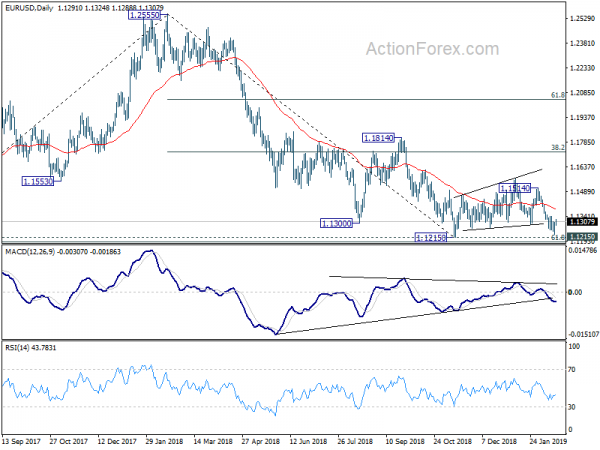

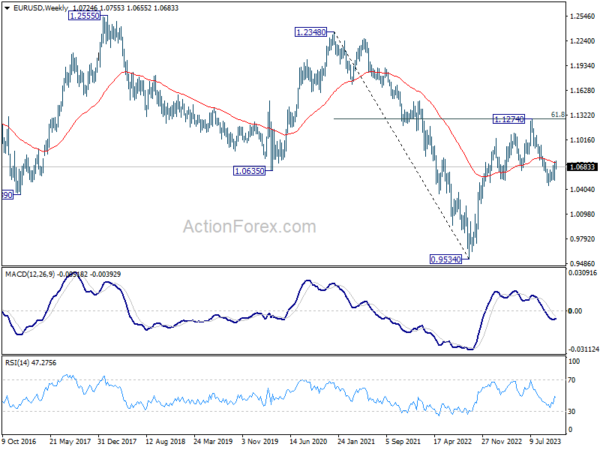

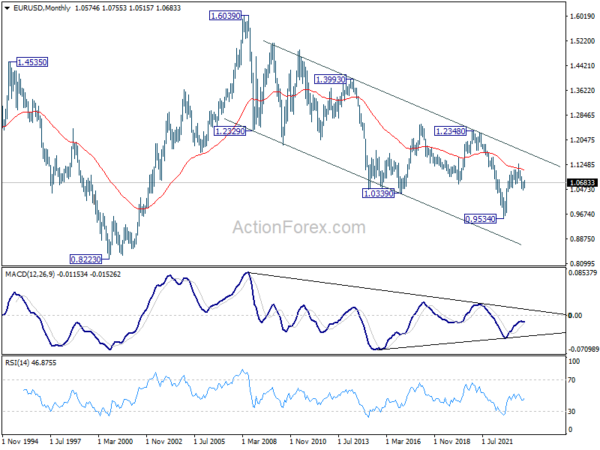

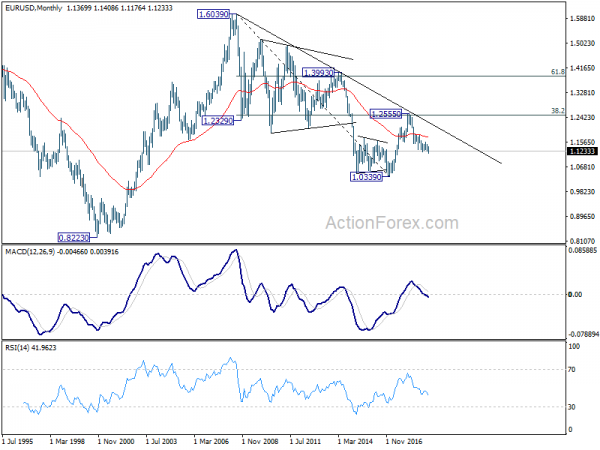

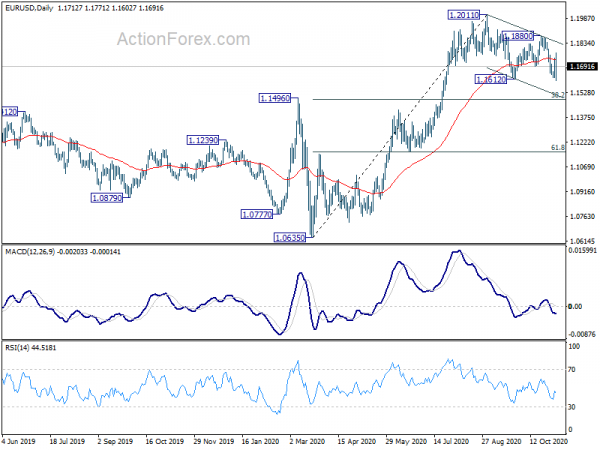

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.