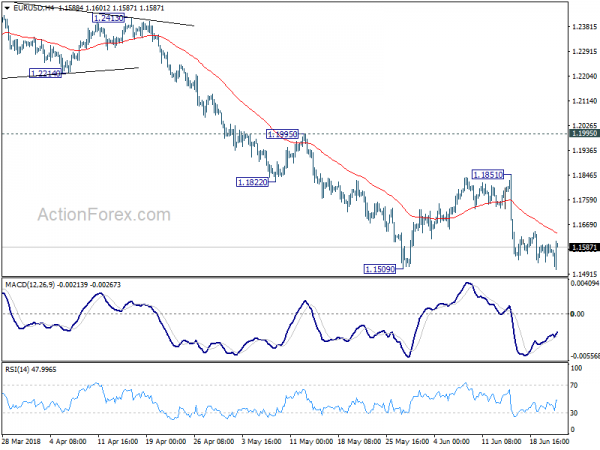

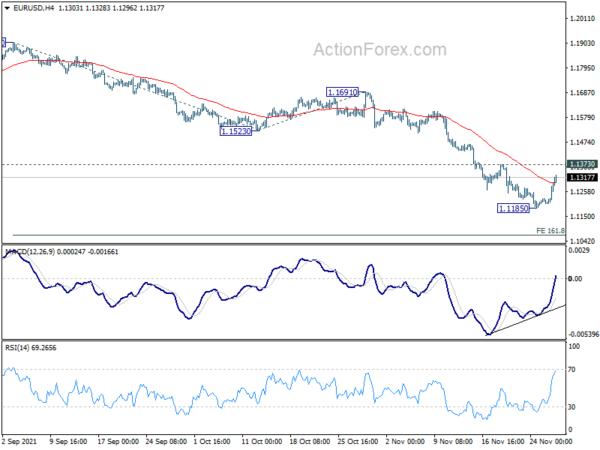

Daily Pivots: (S1) 1.1541; (P) 1.1572 (R1) 1.1606; More…..

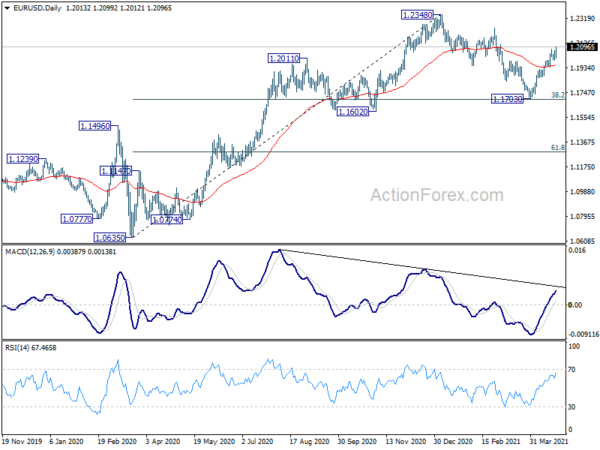

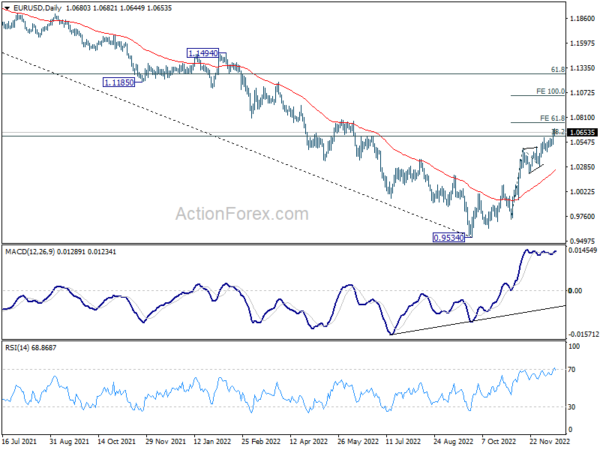

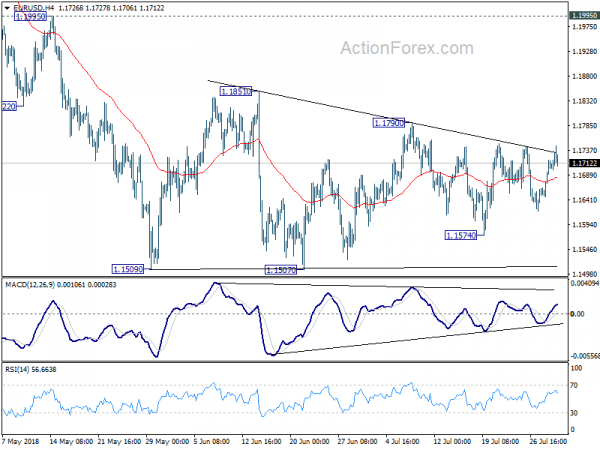

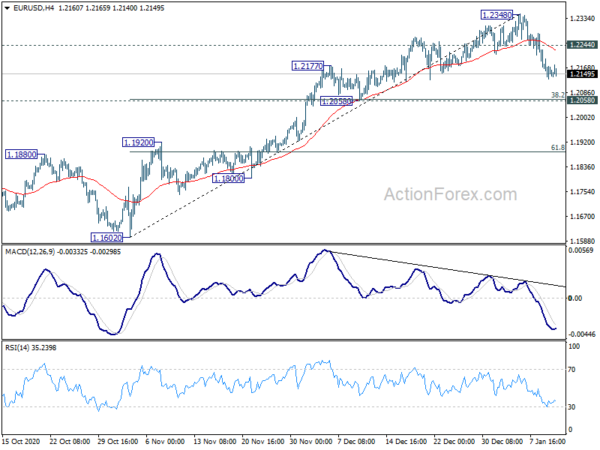

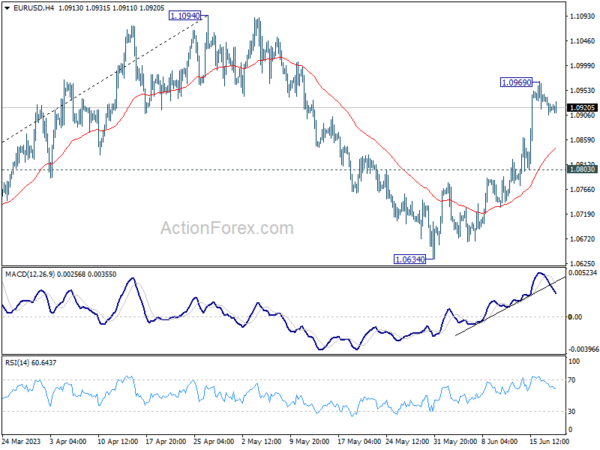

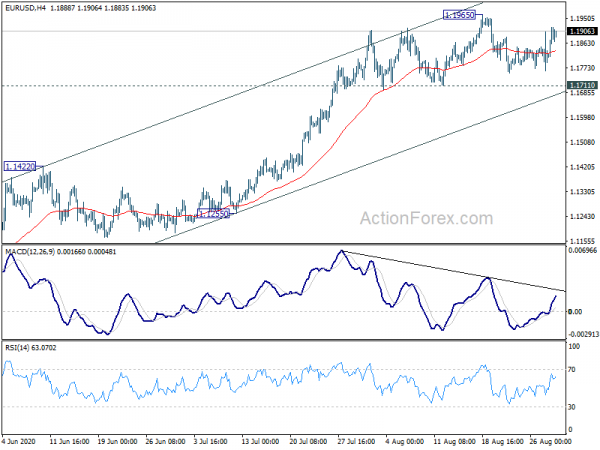

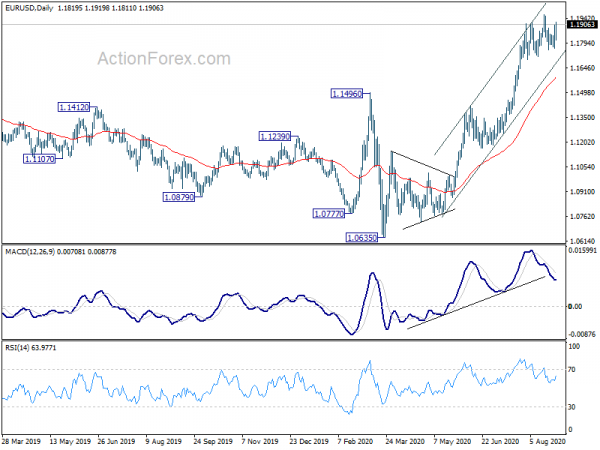

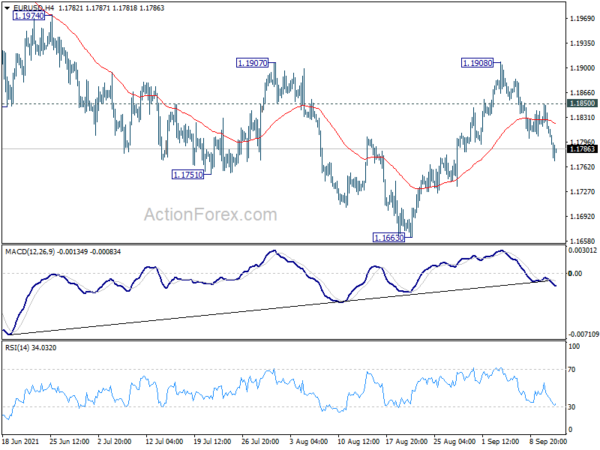

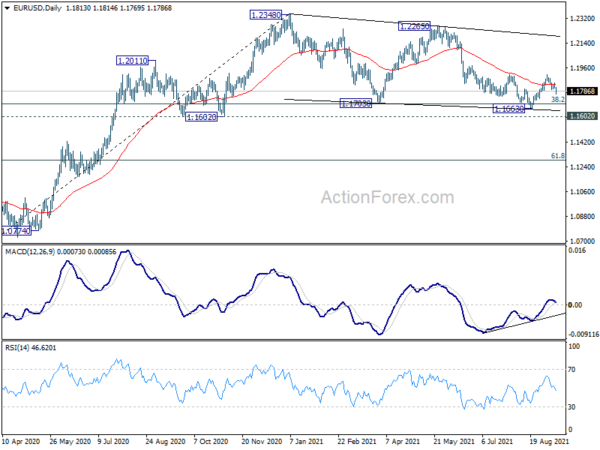

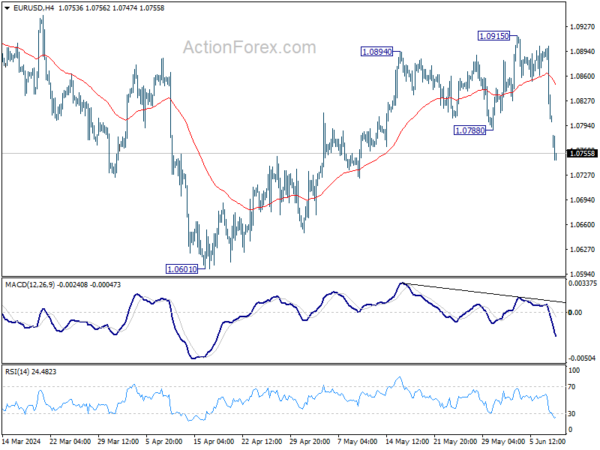

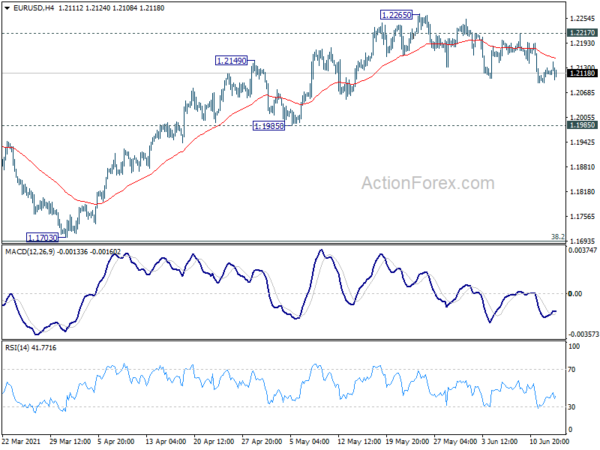

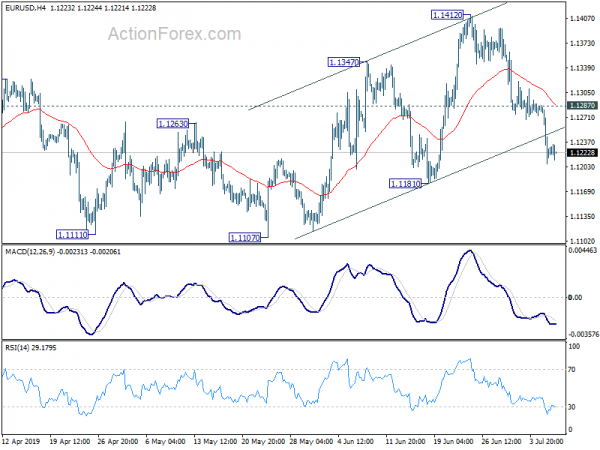

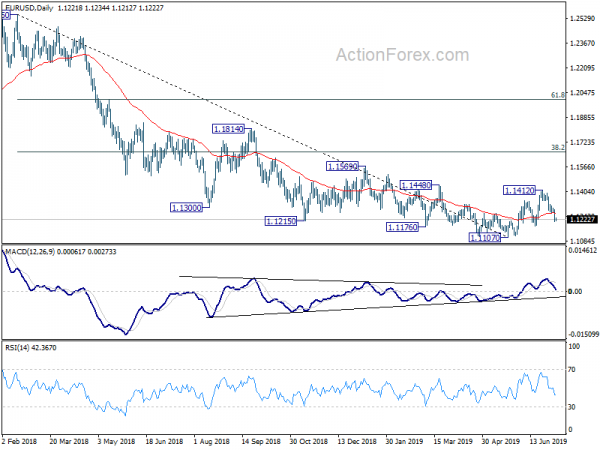

EUR/USD quickly recovers after breaching 1.1509 to 1.1507 and intraday bias remains neutral first. More consolidation could be seen and another recovery cannot be ruled out. But upside should be limited below 1.1851 resistance to bring fall resumption. Firm break of 1.1509 will resume larger decline from 1.2555 through 50% retracement of 1.0339 to 1.2555 at 1.1447 to 61.8% retracement at 1.1186.

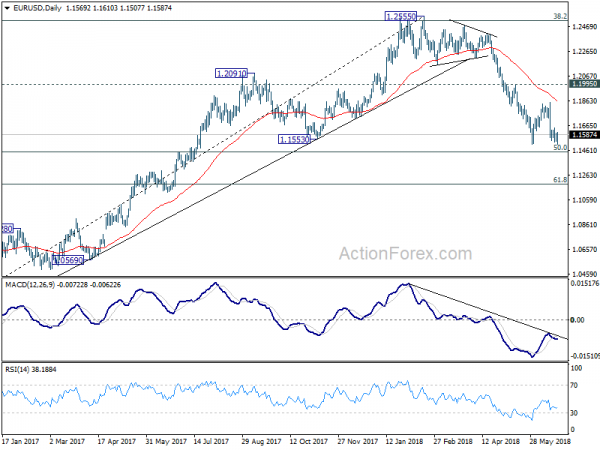

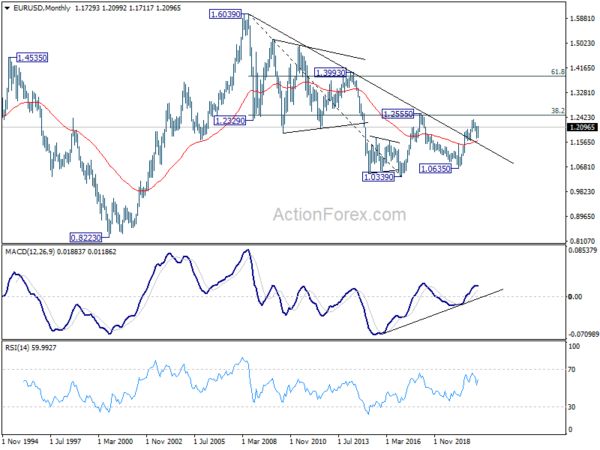

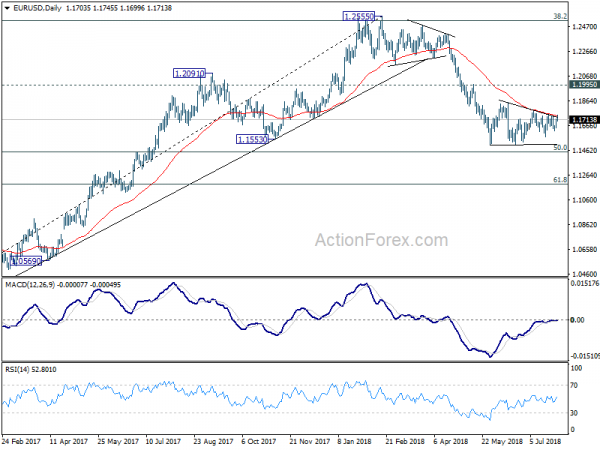

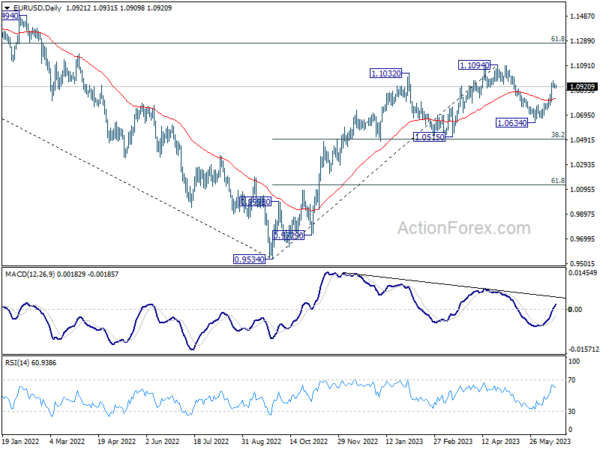

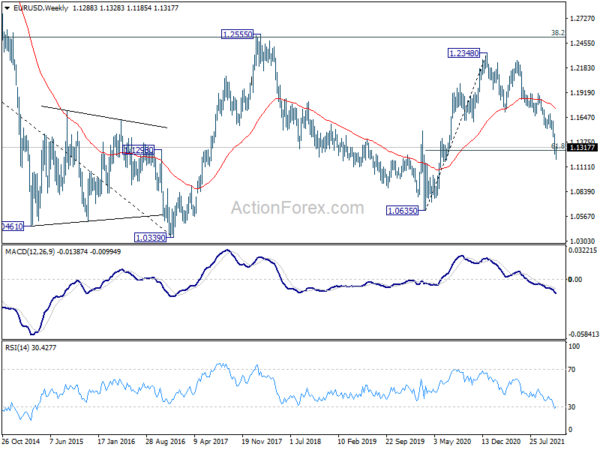

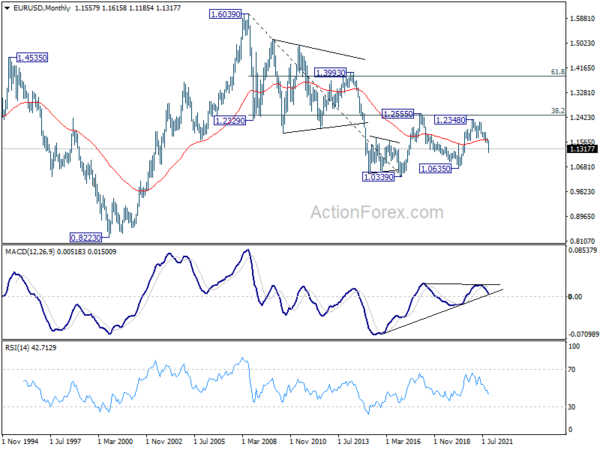

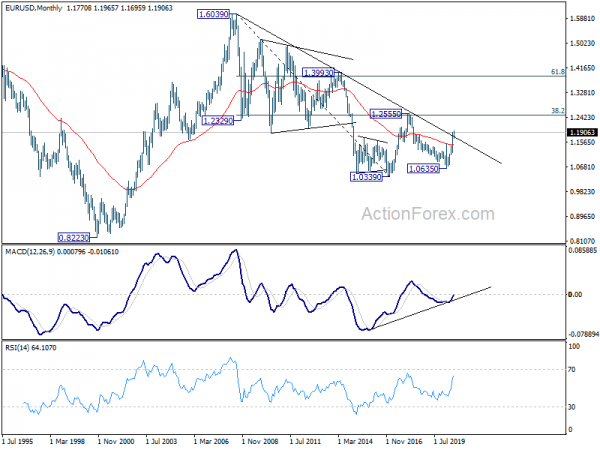

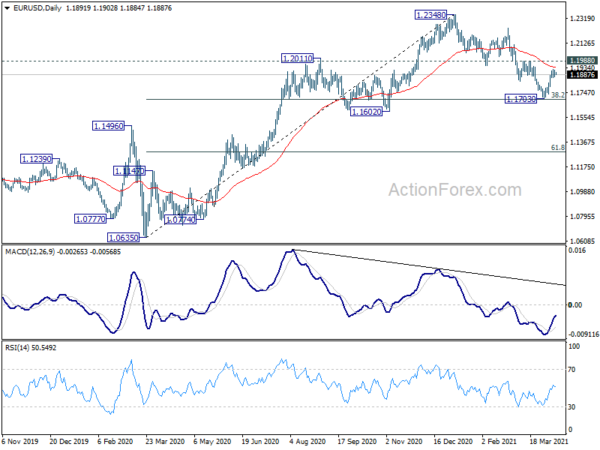

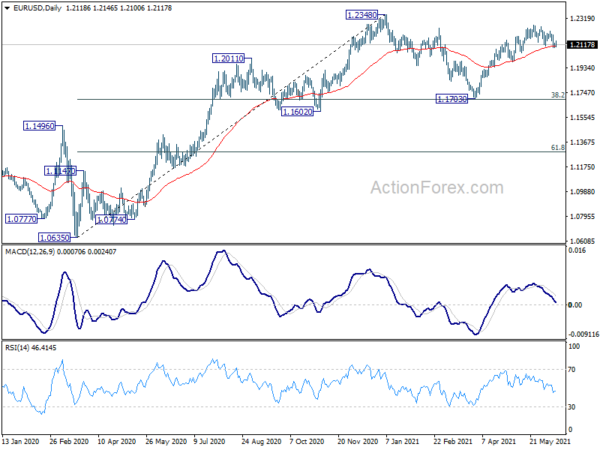

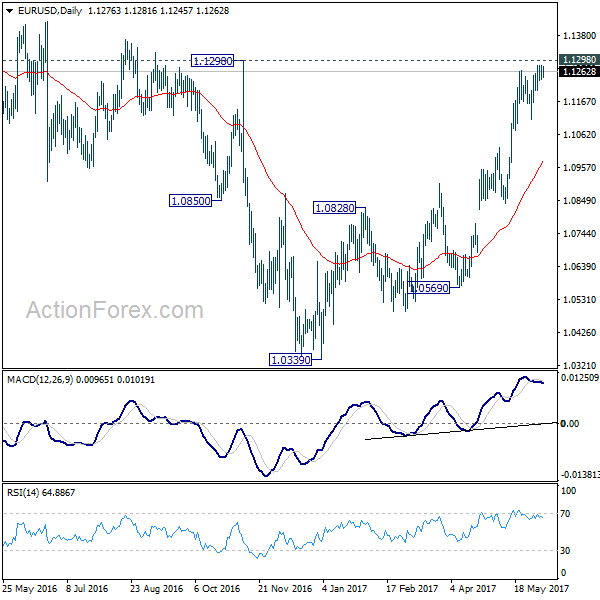

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.