Daily Pivots: (S1) 1.0521; (P) 1.0548; (R1) 1.0570; More…

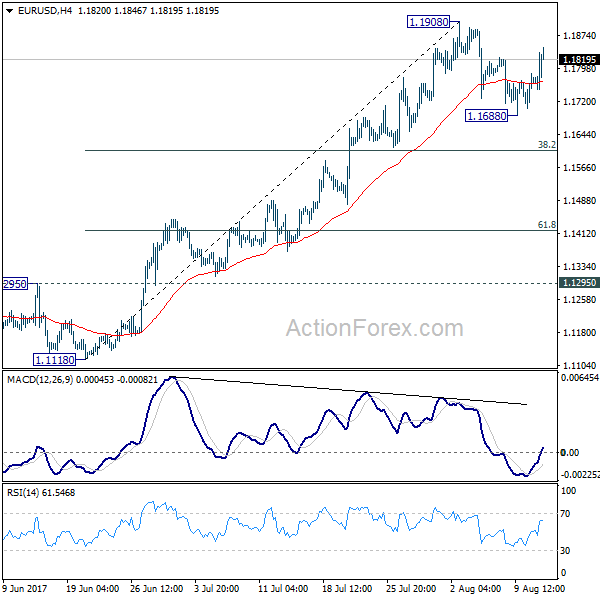

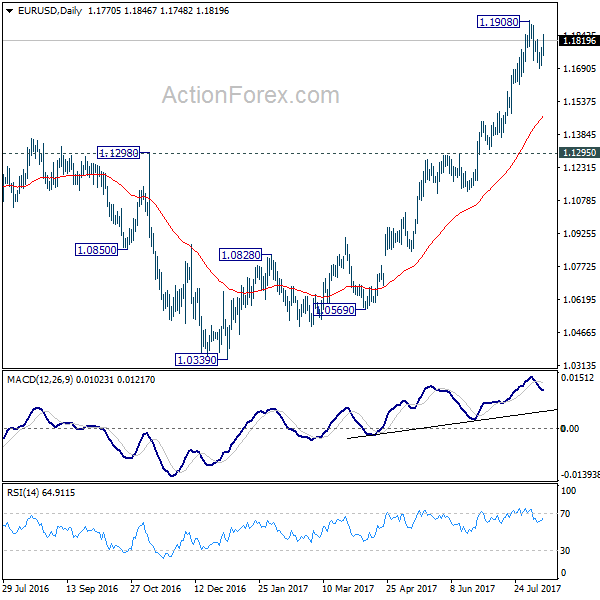

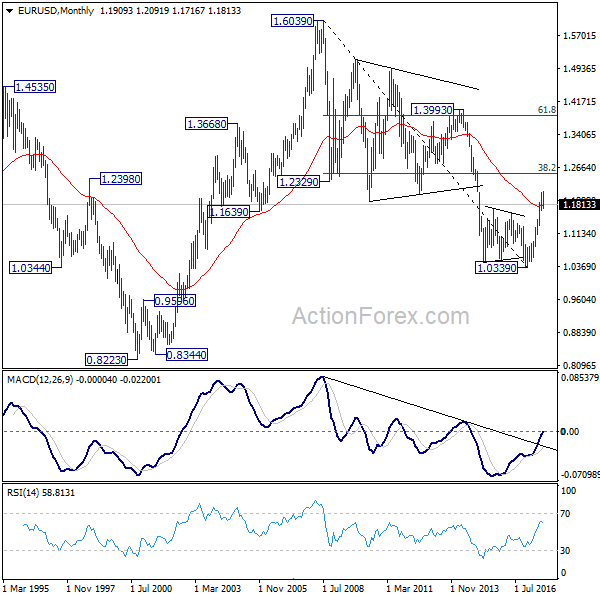

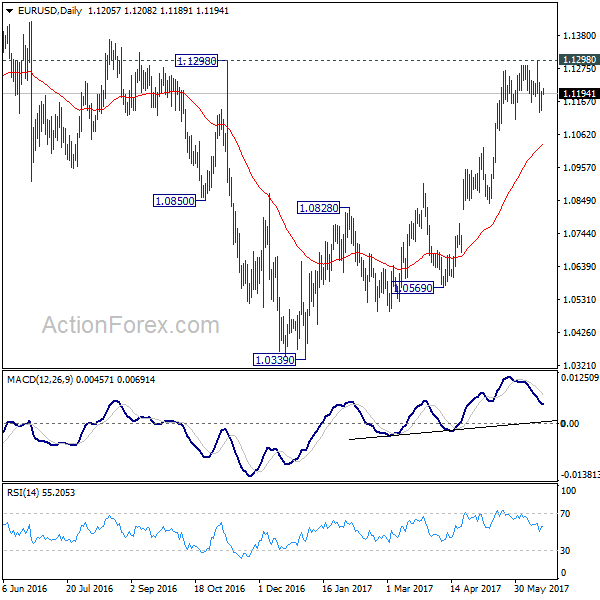

Intraday bias in EUR/USD stays on the downside at this point. Fall from 1.1032 is in progress for 38.2% retracement of 0.9534 to 1.1032 at 1.0463. Strong support could be seen there to bring reversal. But break of 1.0693 resistance is needed to indicate short term bottoming first. Meanwhile, sustained break of 1.0463 will carry larger bearish implications.

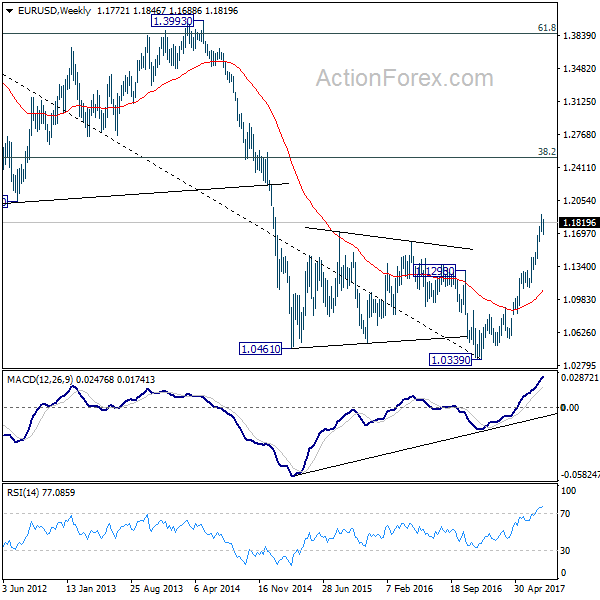

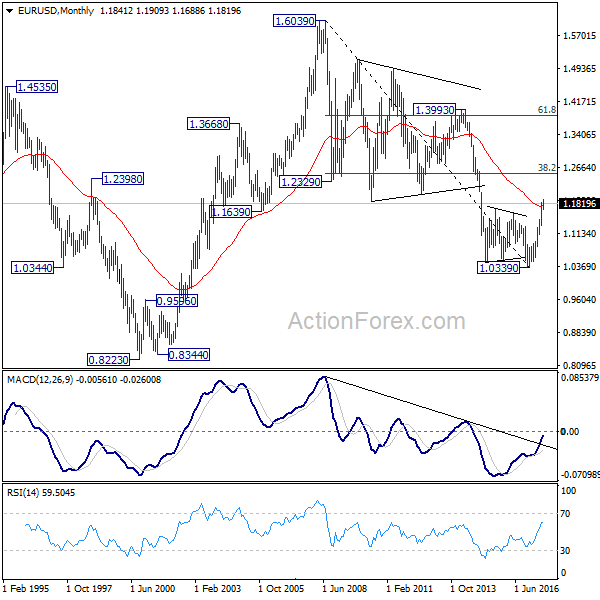

In the bigger picture, as long as 1.0482 support holds, rise from 0.9534 (2022 low) should continue to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. However, sustained break of 1.0482 will bring deeper fall to 61.8% retracement of 0.9534 to 1.1032 at 1.0106, even as a corrective pull back.