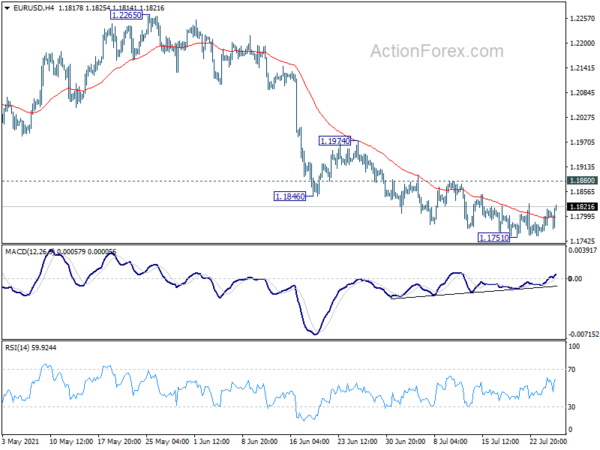

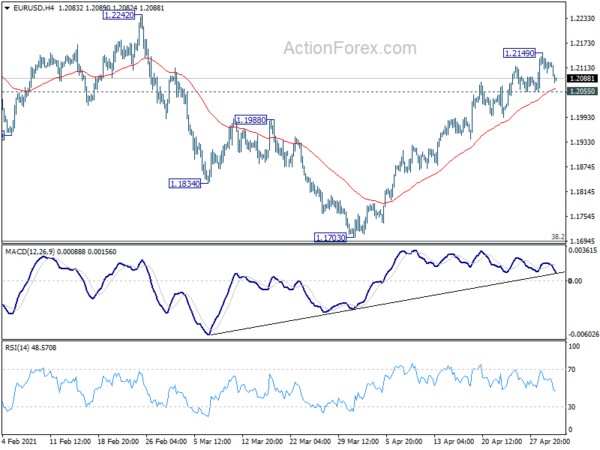

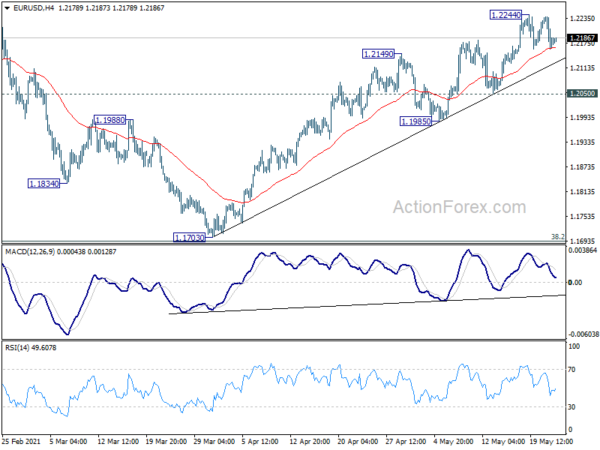

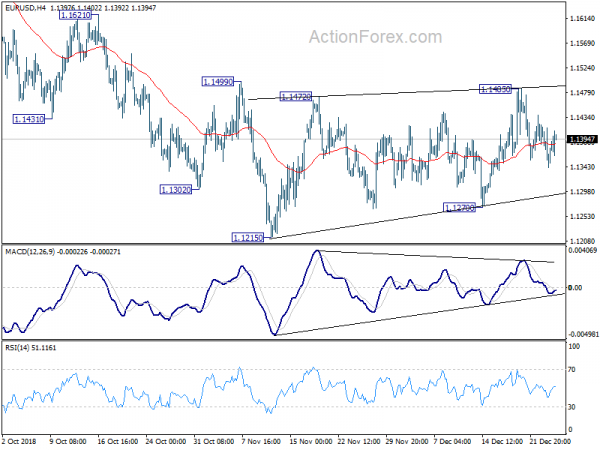

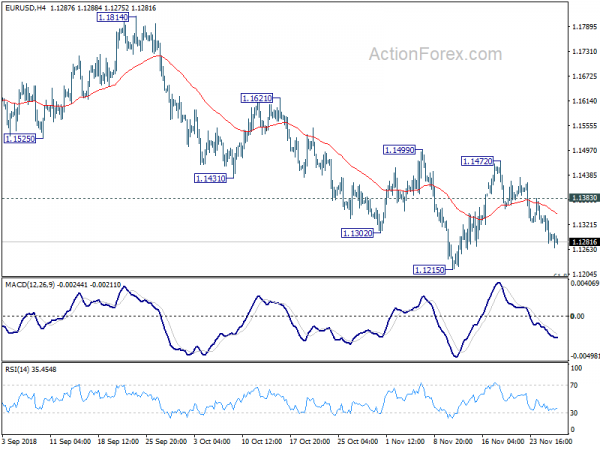

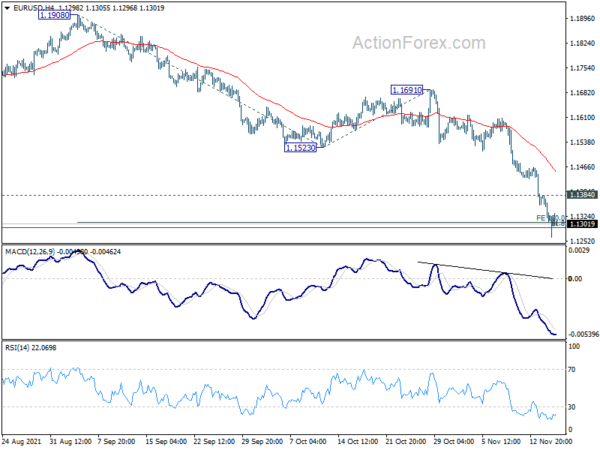

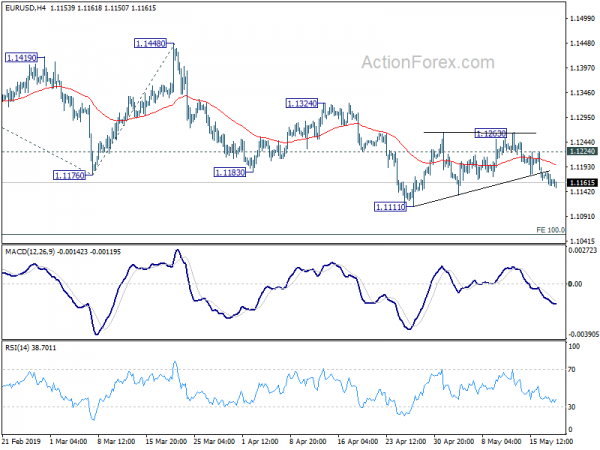

Daily Pivots: (S1) 1.1772; (P) 1.1795; (R1) 1.1825; More…

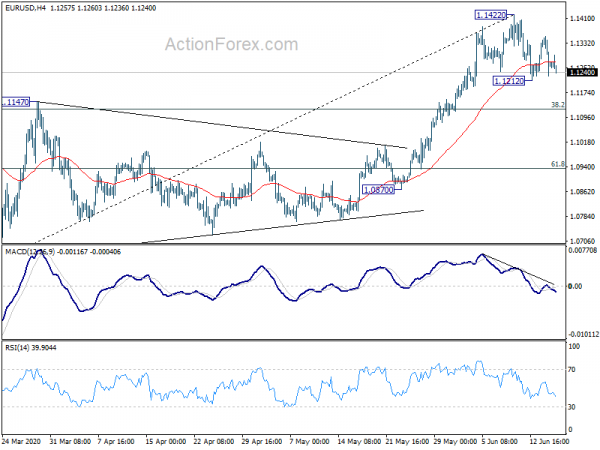

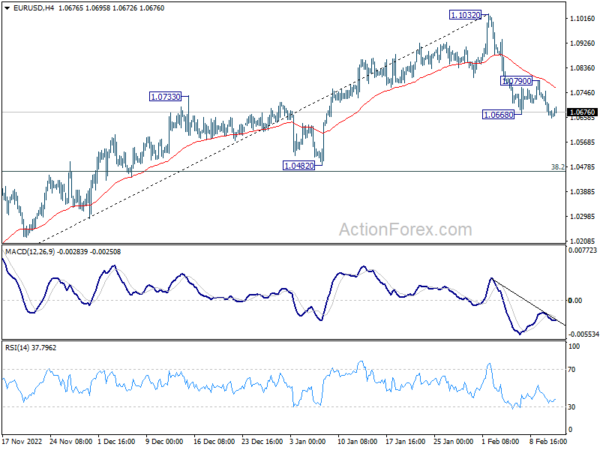

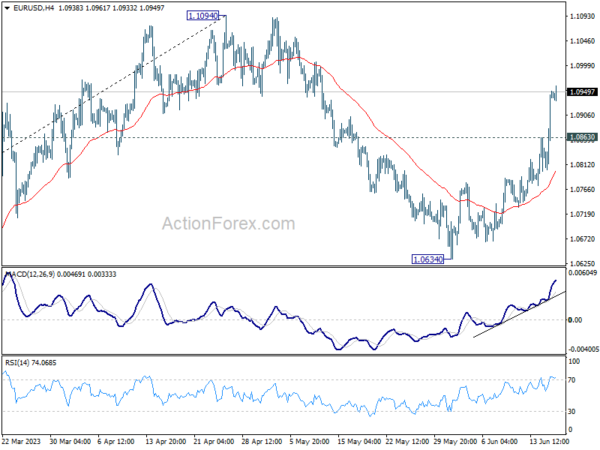

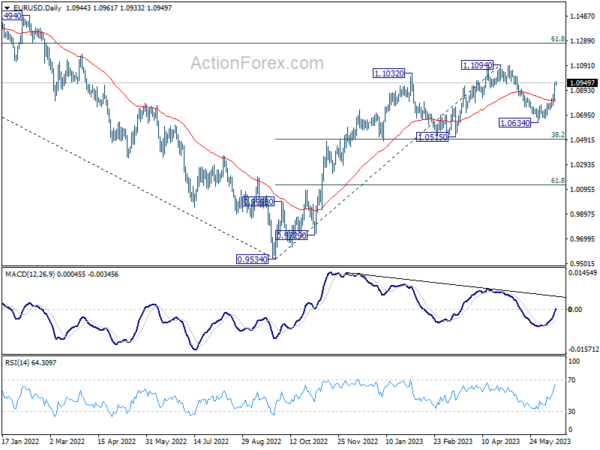

EUR/USD is still bounded in range above 1.1751 and intraday bias remains neutral. On the downside, break of 1.1751 will resume the fall from 1.2265, as the third leg of correction from 1.2348, to 1.1703 support. However, on the upside, break of 1.1880 resistance will indicate short term bottoming and turn bias back to the upside, for stronger rebound to 1.1974 resistance first.

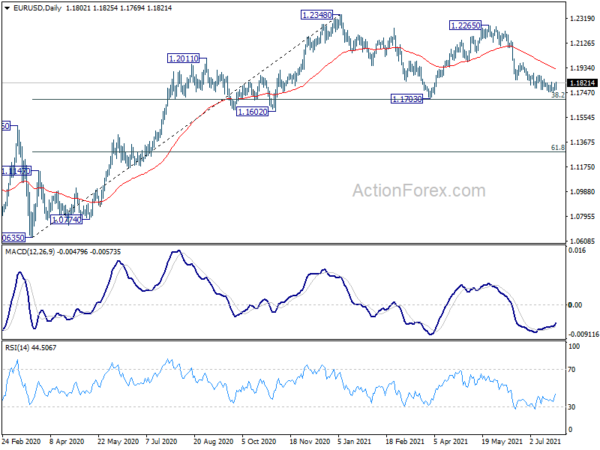

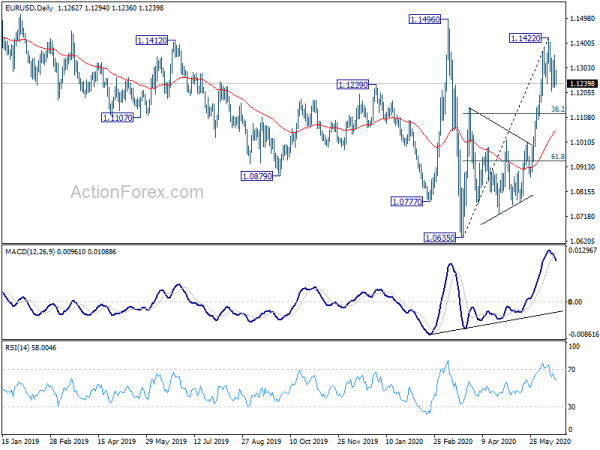

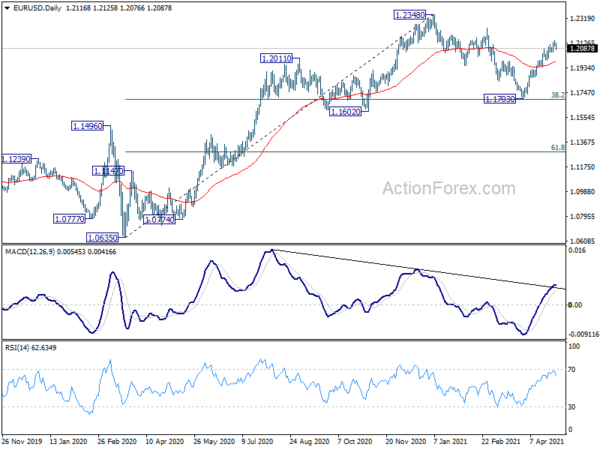

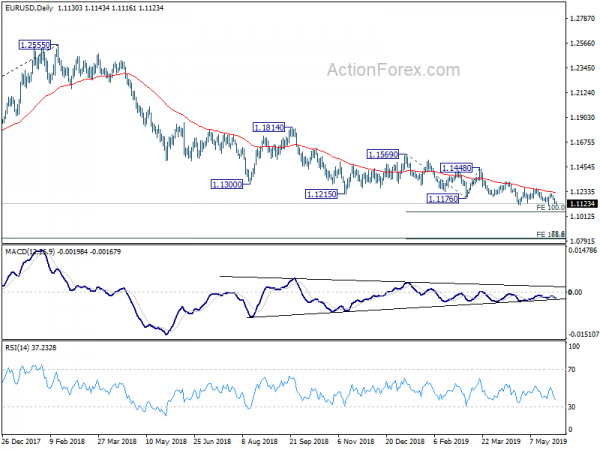

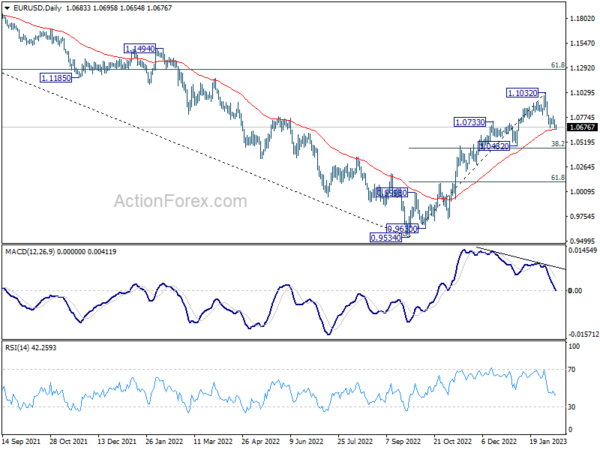

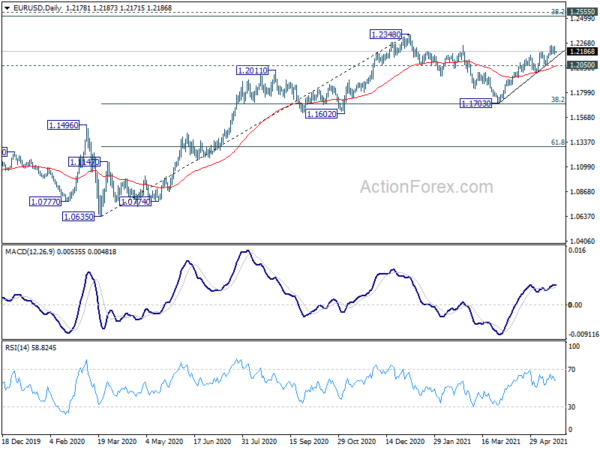

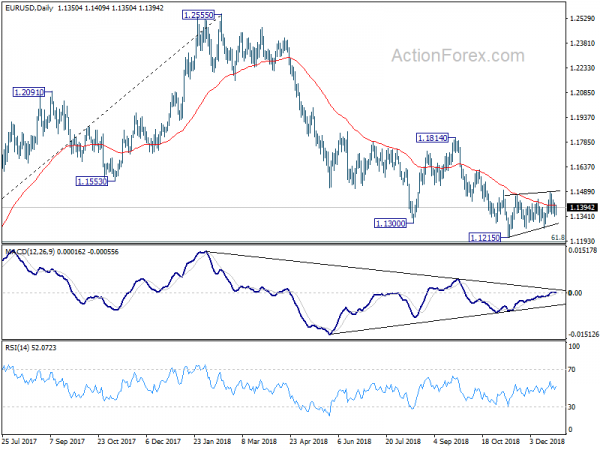

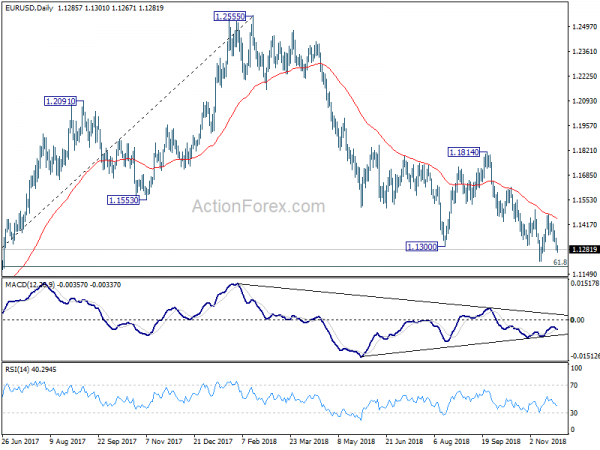

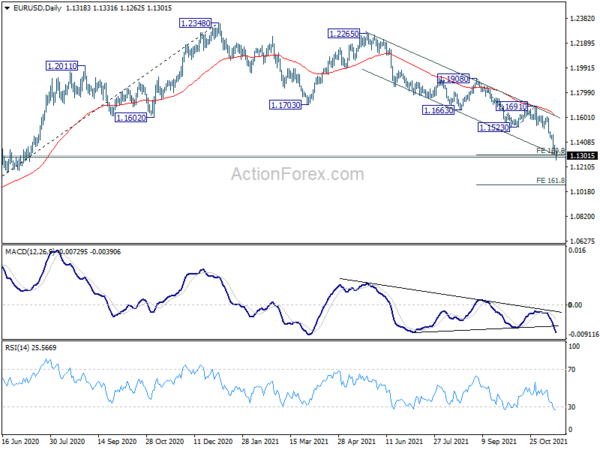

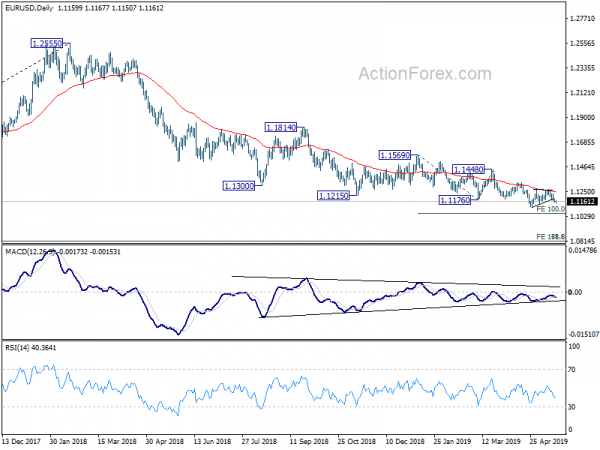

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.