Daily Pivots: (S1) 121.32; (P) 121.58; (R1) 121.75; More….

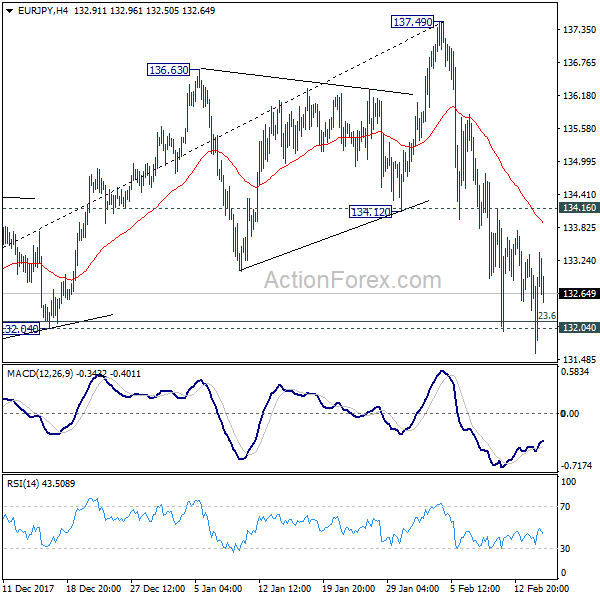

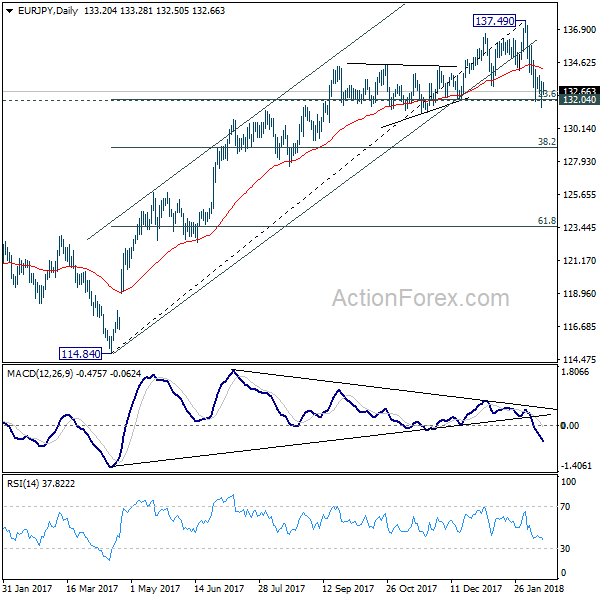

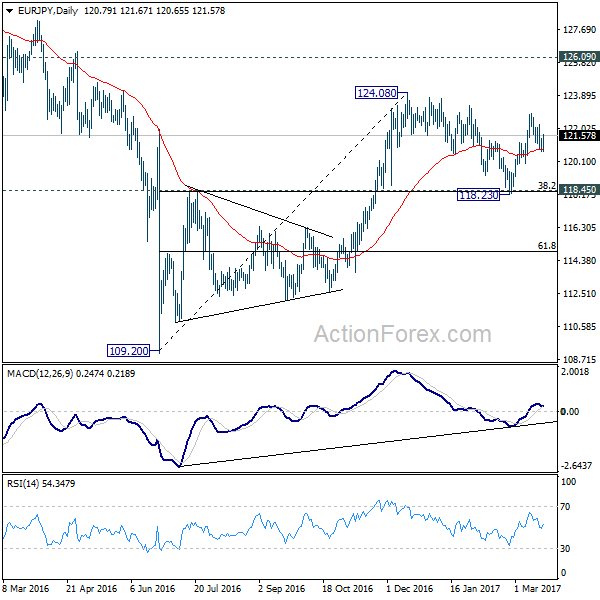

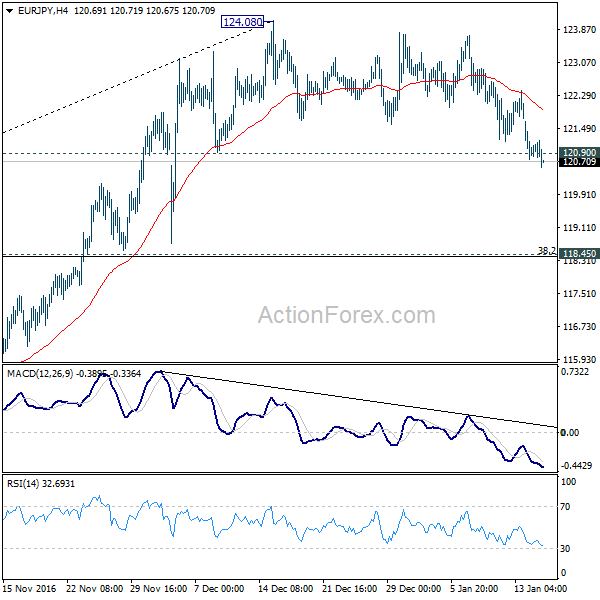

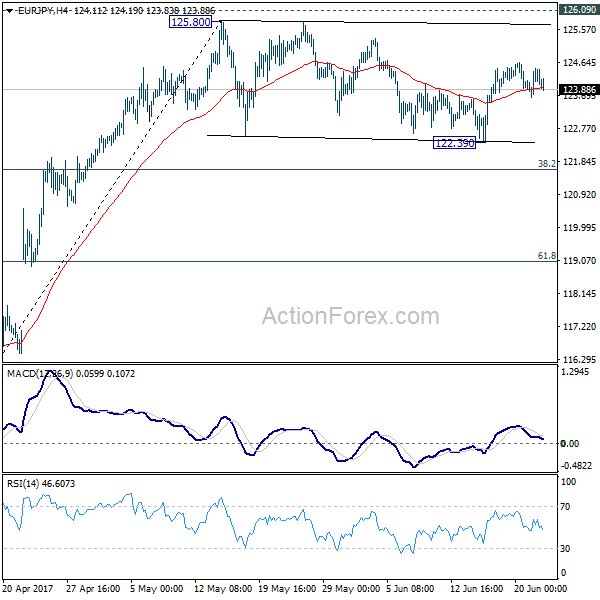

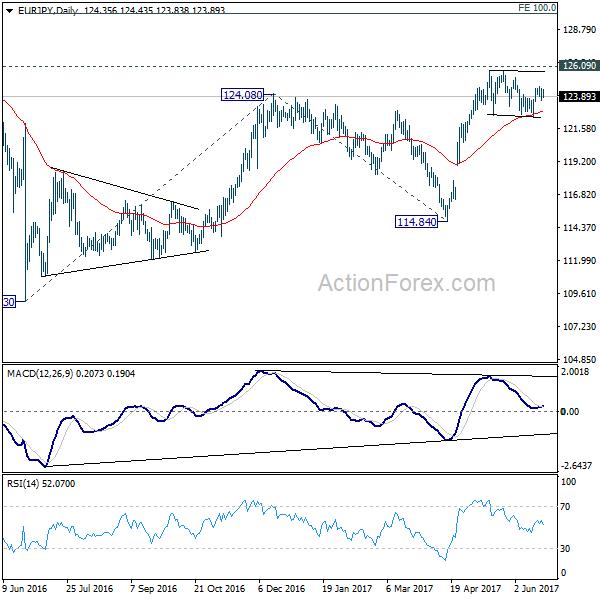

No change in EUR/JPY’s outlook and intraday bias remains neutral first. We’re still favoring the case that consolidation from 120.78 has completed with three waves to 123.35. Below 121.31 will target retest of 120.78 first. Break will resume fall from 127.50 to 118.62 low. In case of another rise as consolidation from 120.78 extends, upside should be limited by 123.73 resistance to bring fall resumption eventually.

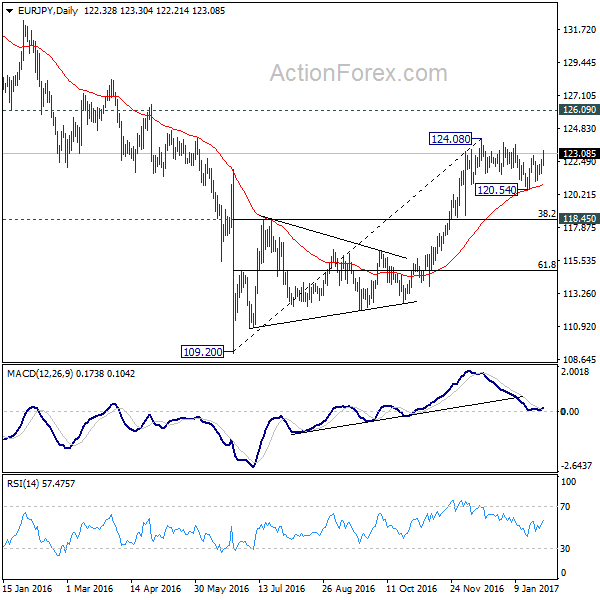

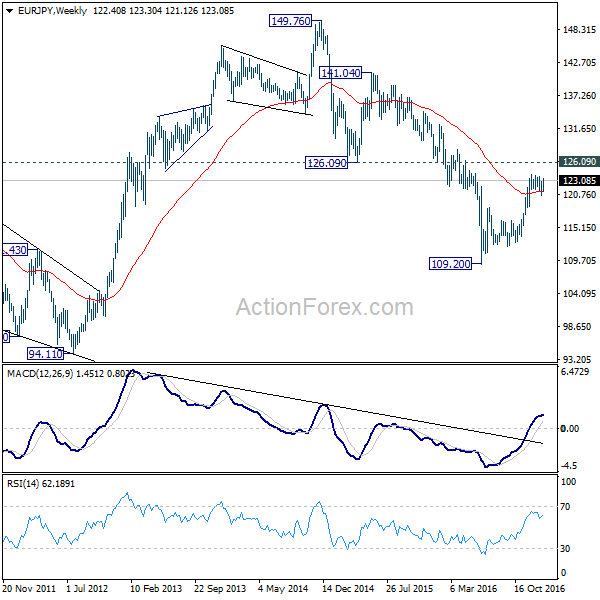

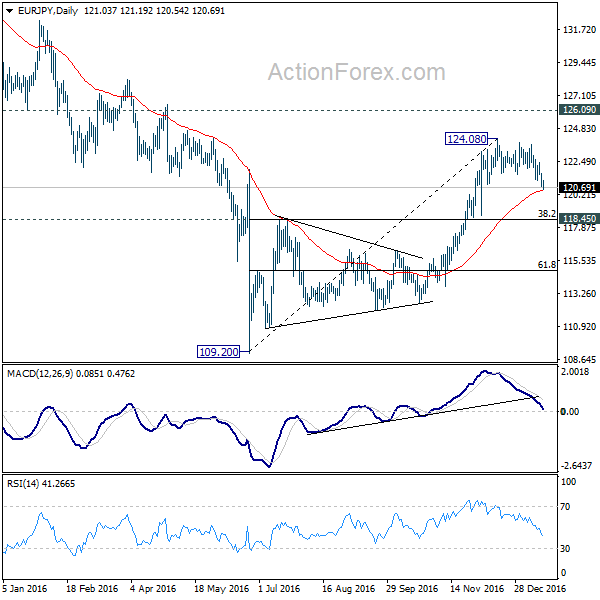

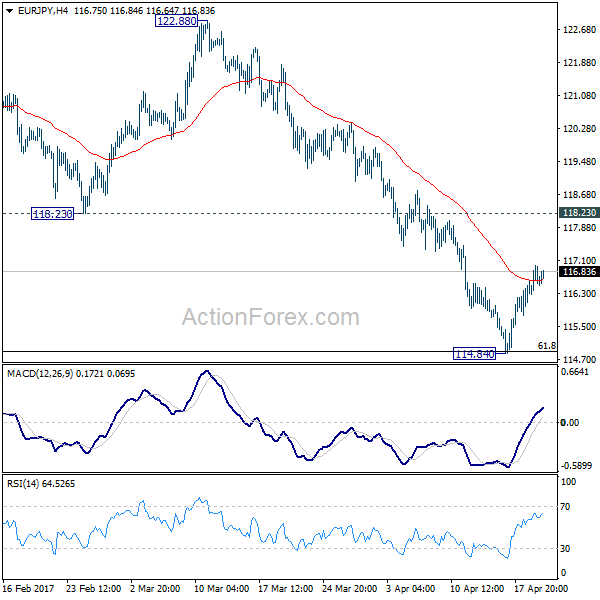

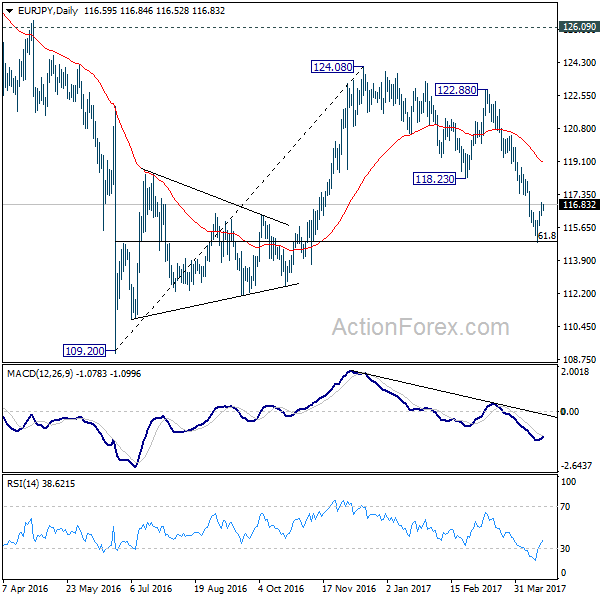

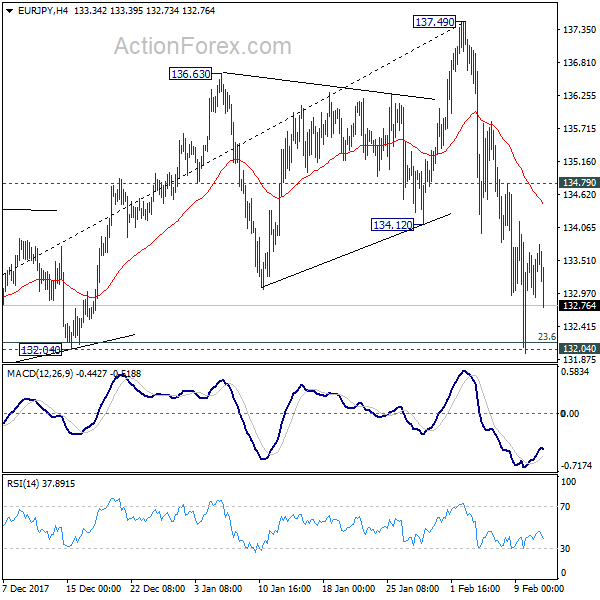

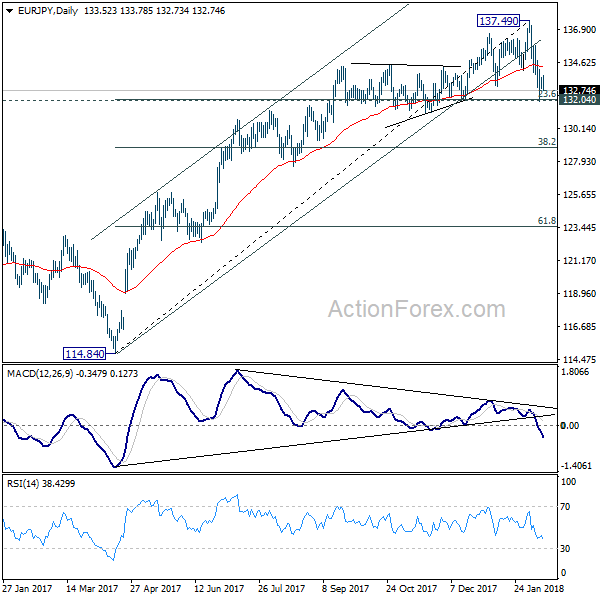

In the bigger picture, down trend from 137.49 is still in progress with the cross staying inside long term falling channel. Break of 118.62 will extend the fall to 109.48 (2016 low). On the upside, break of 127.50 resistance is needed to be the first sign of medium term reversal. Otherwise, outlook will remain bearish in case of strong rebound.