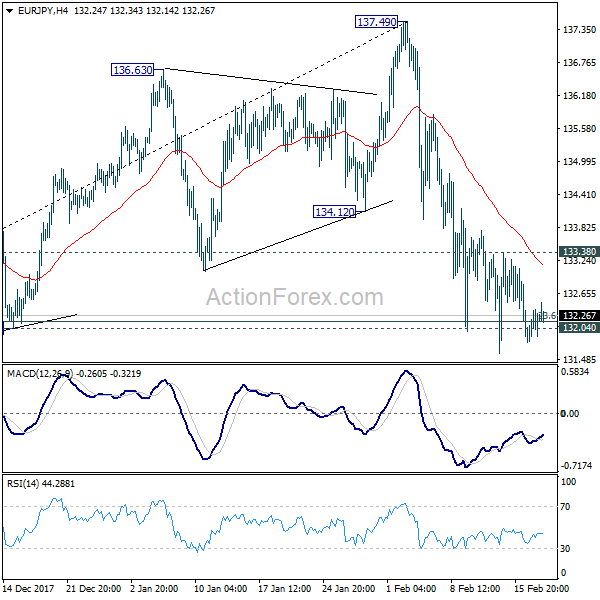

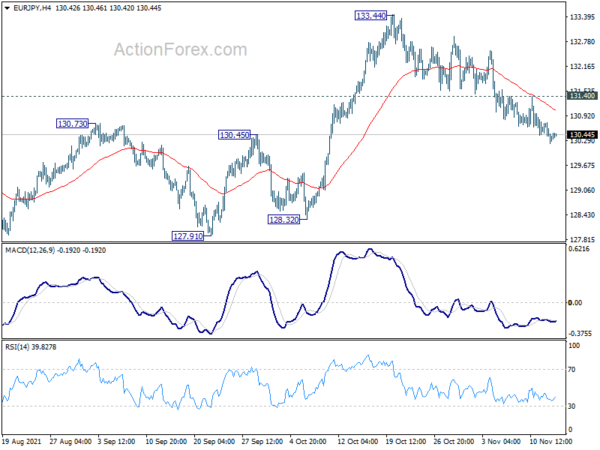

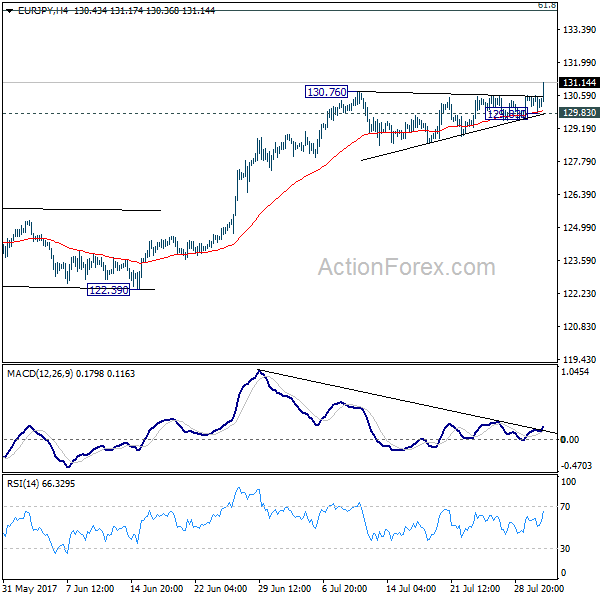

Daily Pivots: (S1) 131.89; (P) 132.13; (R1) 132.46; More….

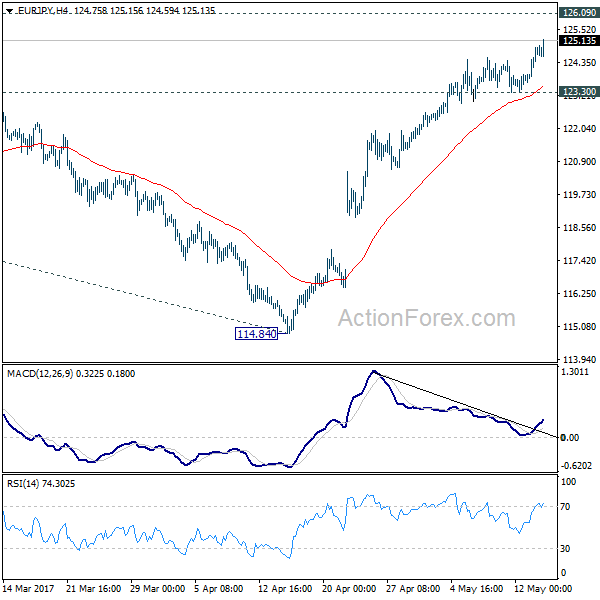

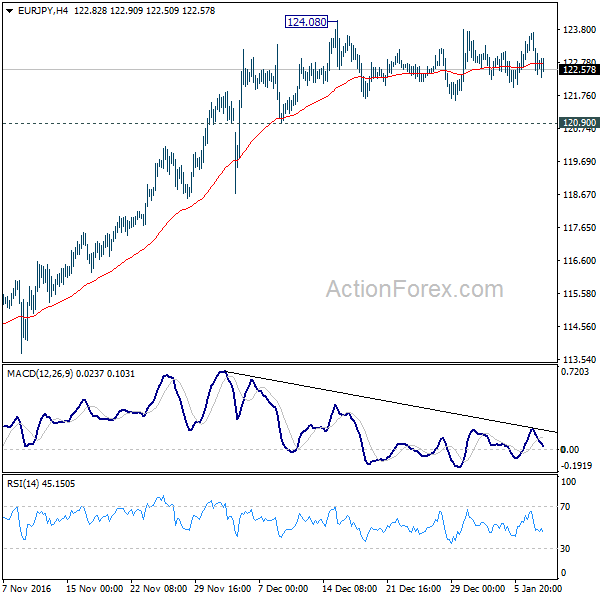

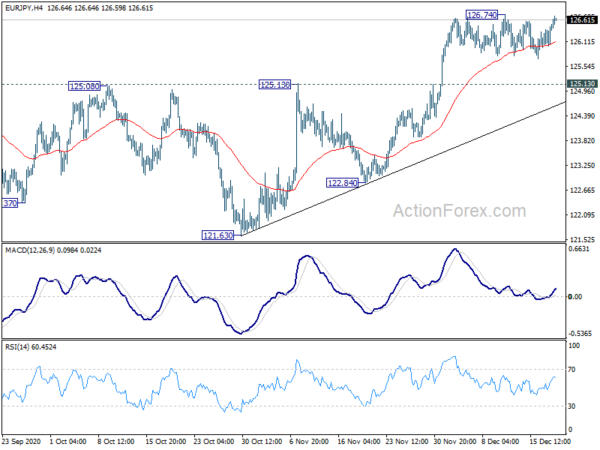

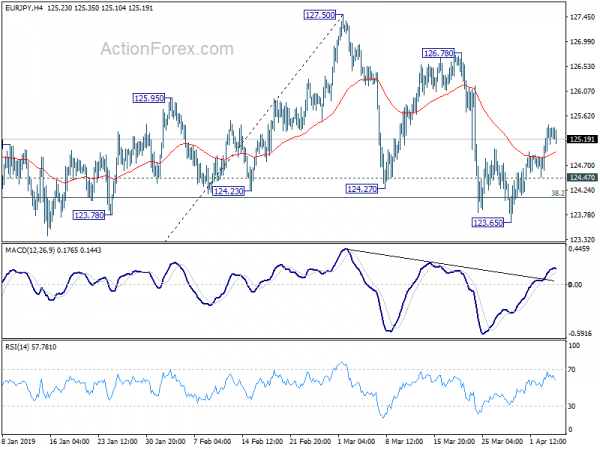

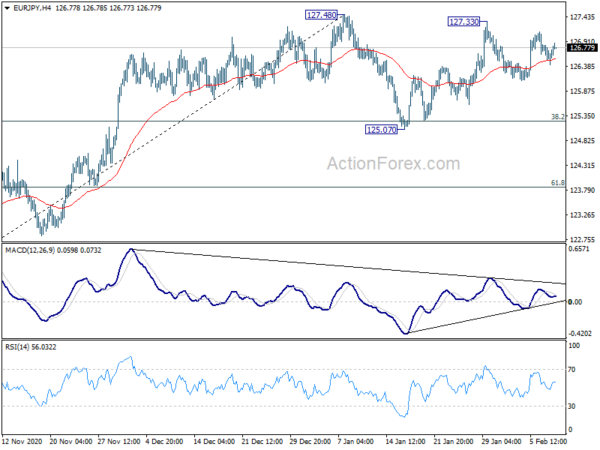

Near term outlook remains bearish with 133.38 resistance intact. Sustained trading below 132.04 cluster support (23.6% retracement of 114.84 to 137.49 at 132.14) will indicate larger trend reversal on bearish divergence condition in daily MACD. In such case, deeper decline would be seen for 38.2% retracement at 128.38 first. However, rebound from 132.04 will retain near term bullishness. Break of 133.38 minor resistance will turn bias back to the upside for 137.49 again.

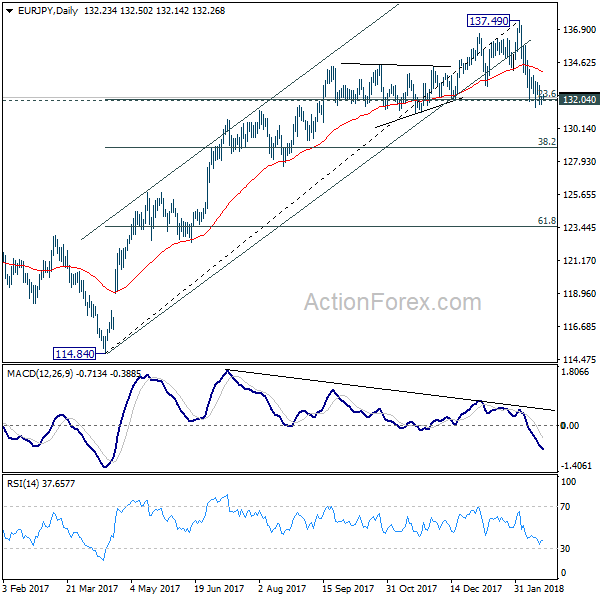

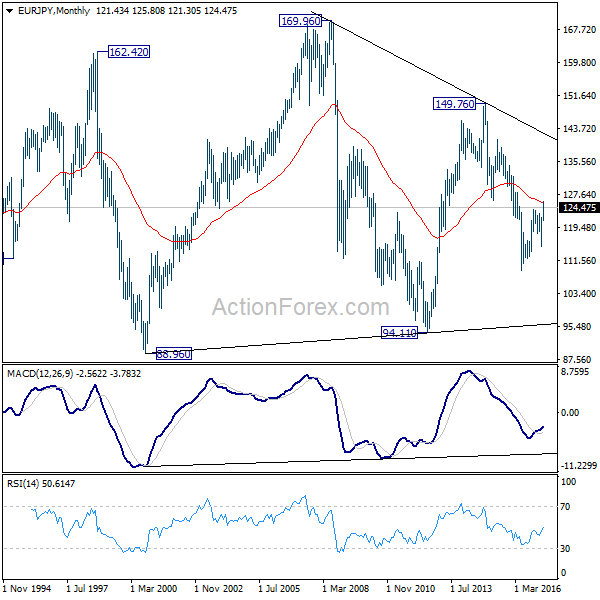

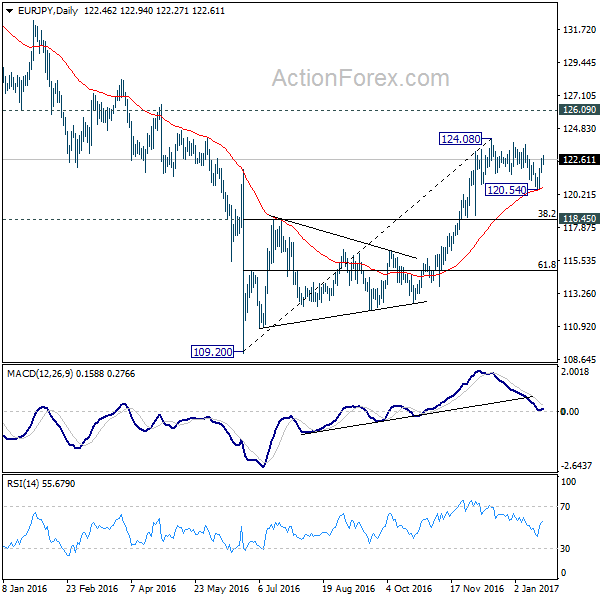

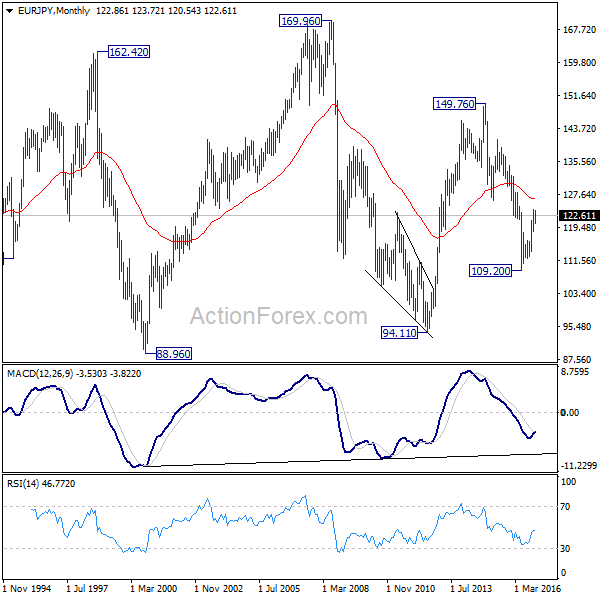

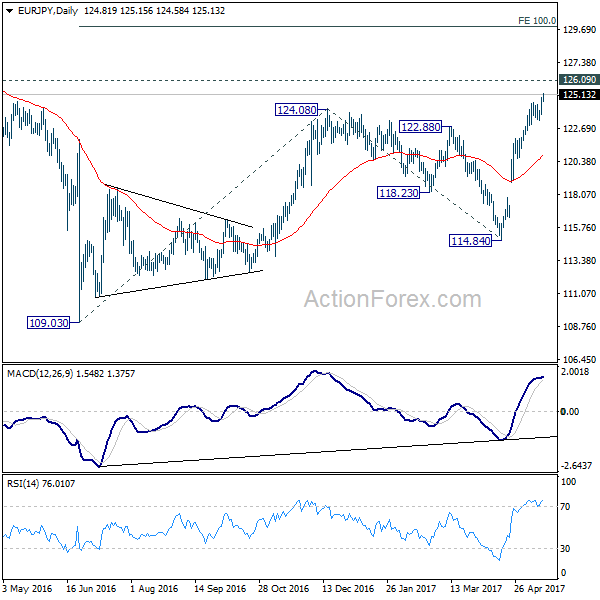

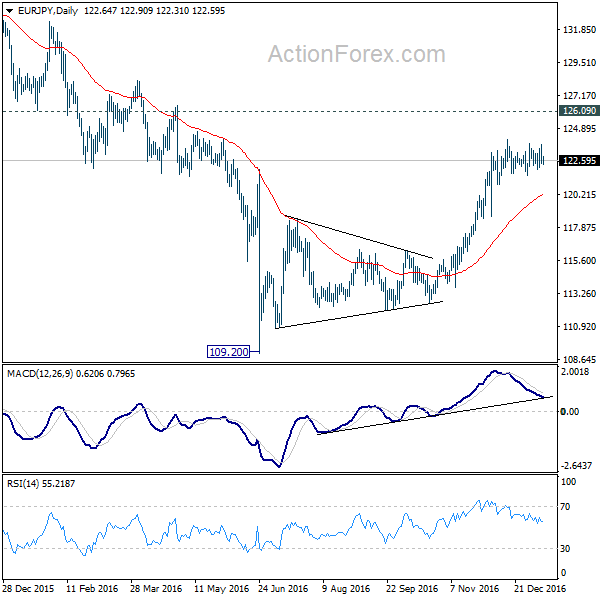

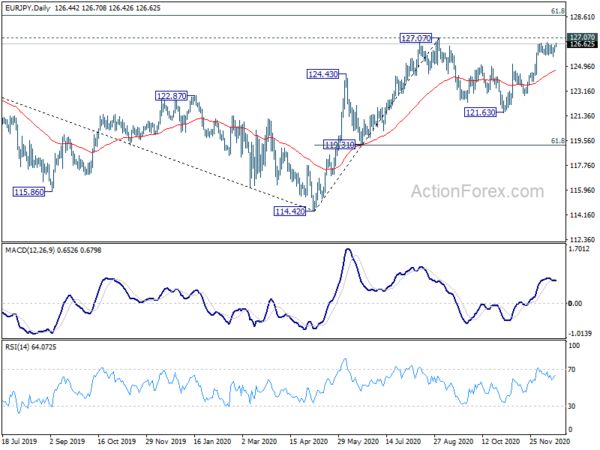

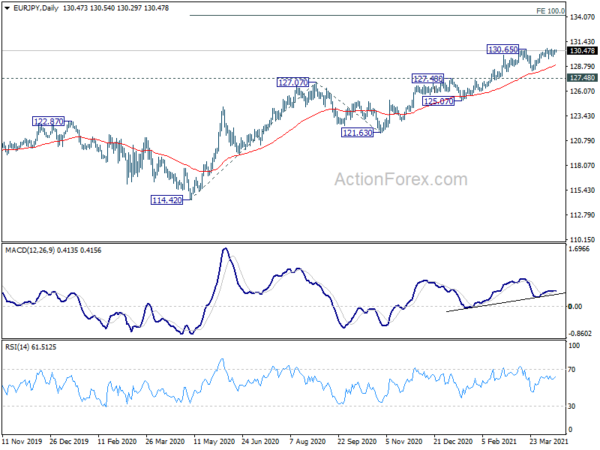

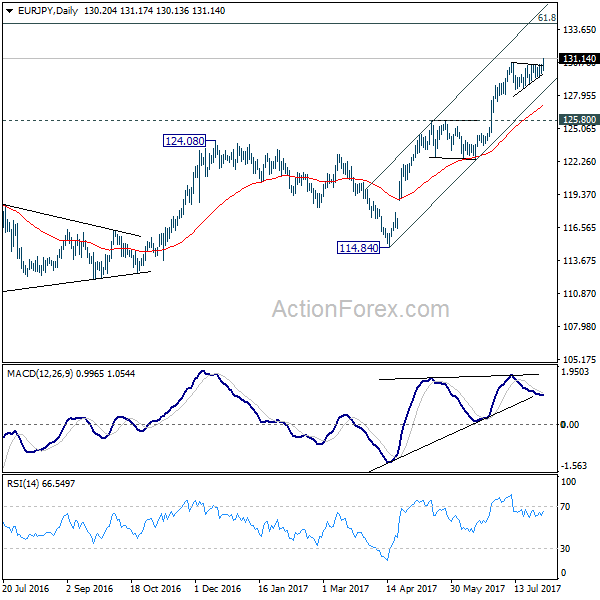

In the bigger picture, bearish divergence condition in weekly MACD indicates loss of medium term upside momentum. Sustained break of 132.04 will be the early sign of long term reversal and should bring deeper fall back to retest 124.08 key support level. Meanwhile, break of 137.49 will resume the up trend from 109.03 to 141.04/149.76 resistance zone.