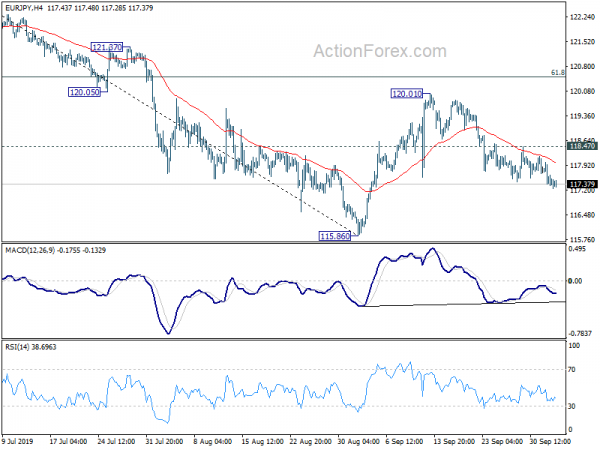

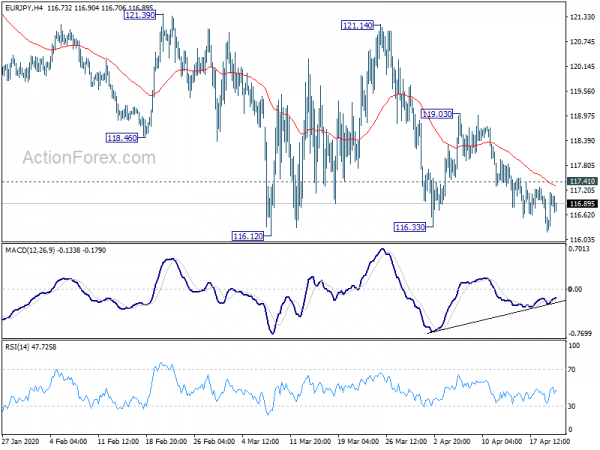

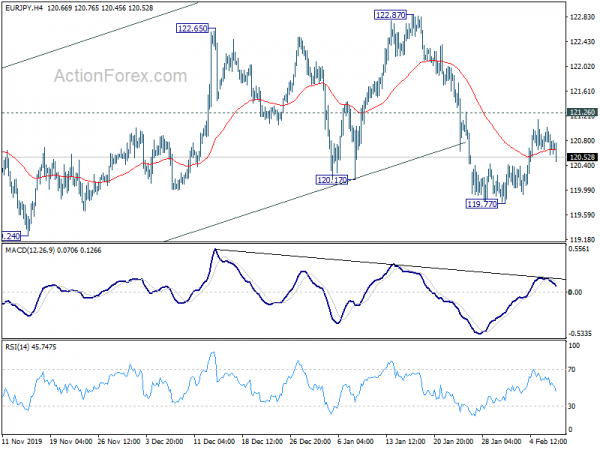

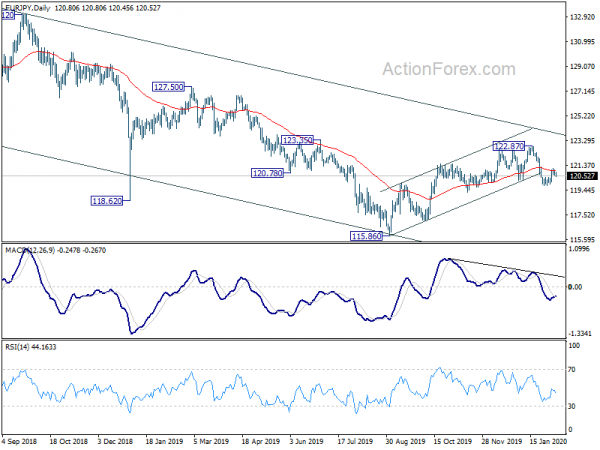

Daily Pivots: (S1) 117.19; (P) 117.60; (R1) 117.86; More….

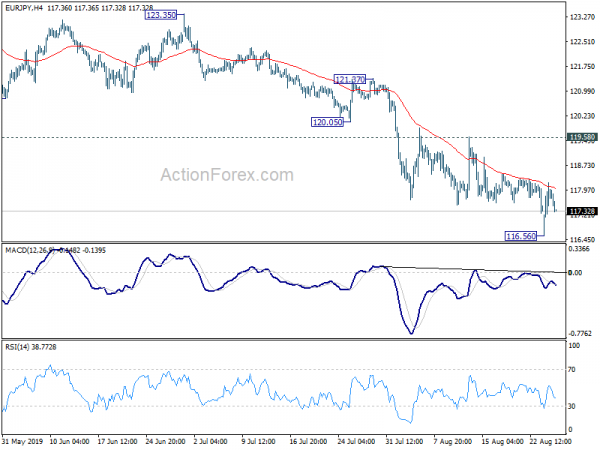

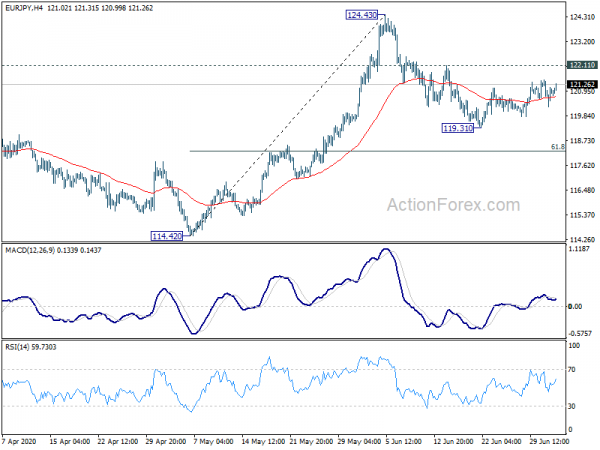

Intraday bias in EUR/JPY remains mildly on the downside for the moment. rebound from 115.86 should have completed at 120.01. Deeper fall should be seen to retest 115.86 first. On the upside, above 118.47 minor resistance will turn bias back to the upside for 120.01 resistance instead.

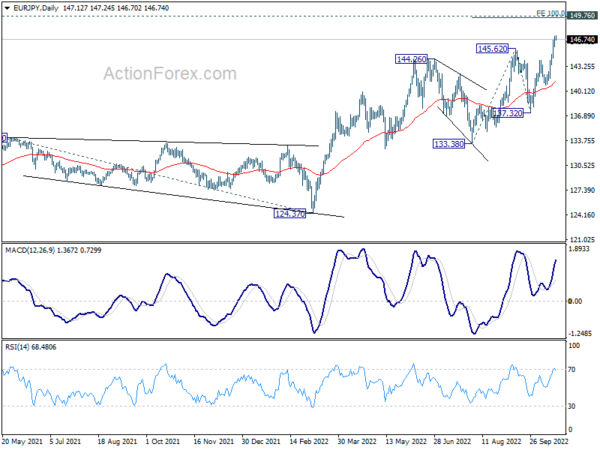

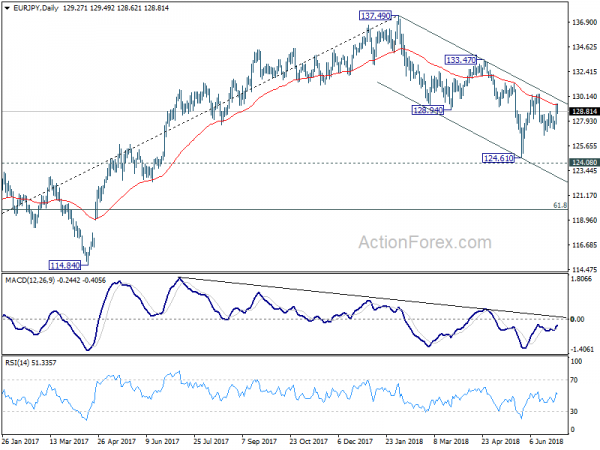

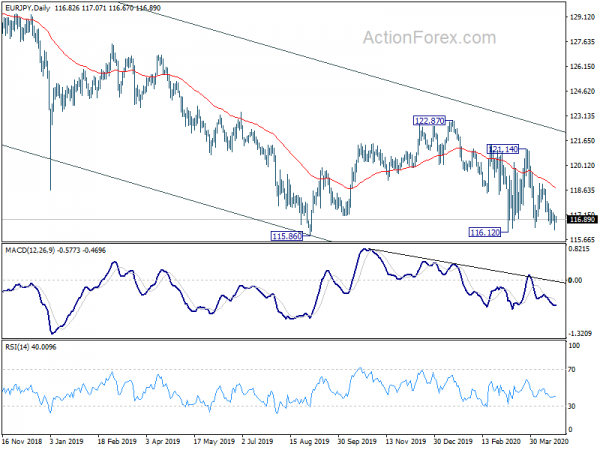

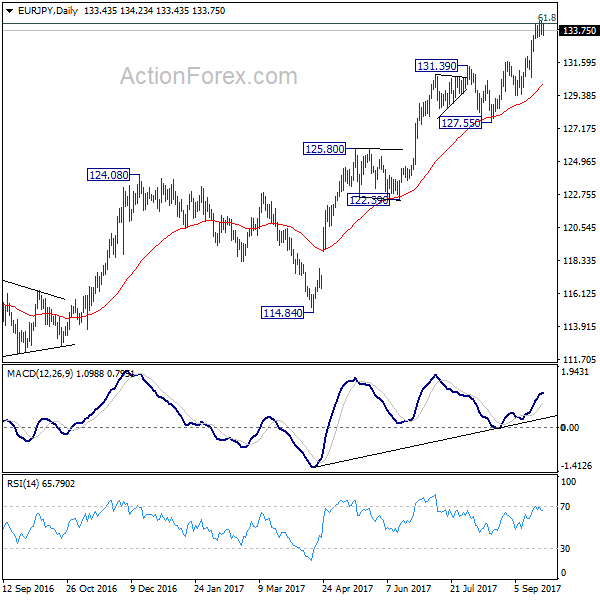

In the bigger picture, as long as 120.78 support turned resistance holds, down trend from 137.49 (2018 high) should still be in progress. Break of 115.86 will target 109.48 (2016 low) and below. However, sustained break of 120.78 will be the first indication of medium term reversal. Further rise would then be seen to 127.50 resistance for confirmation.