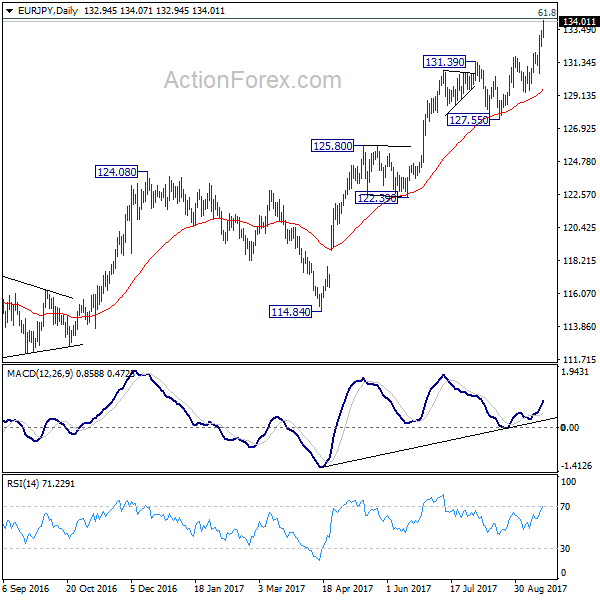

EUR/JPY stayed in consolidation below 129.96 last week and outlook is unchanged. Initial bias stays neutral this week for more consolidations. Still further rally is expected with 127.48 resistance turned support intact. On the upside, above 129.96 will resume the up trend from 121.63 to 100% projection of 121.63 to 127.48 from 125.07 at 130.92 next. However, firm break of 127.48 will turn bias to the downside, for deeper decline to 125.07 support.

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 125.07 support holds. Sustained trading above 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67 will pave the way to 137.49 resistance next.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Another rising leg in progress for 137.49 resistance and above.