Daily Pivots: (S1) 146.51; (P) 146.85; (R1) 147.48; More….

Intraday bias in EUR/JPY remains on the upside despite some loss of upside momentum. Current rally should target 100% projection of 133.38 to 145.62 from 137.32 at 149.56, which is close to 149.76 long term resistance. On the downside, below 145.80 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

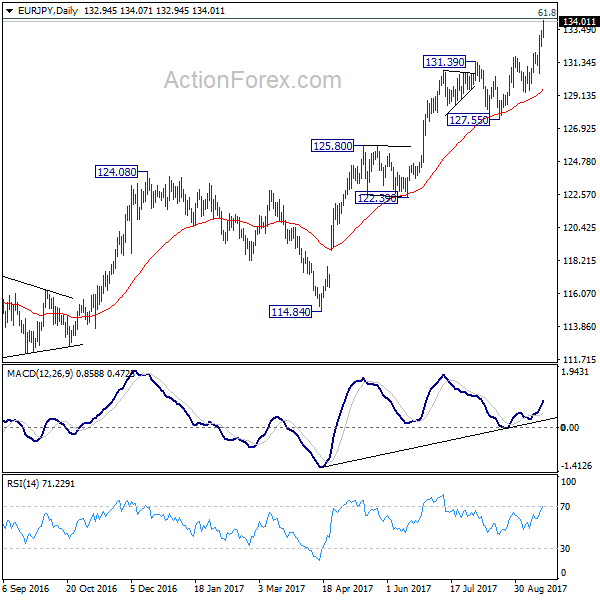

In the bigger picture, the up trend from 114.42 (2020 low) is still in progress for 149.75 (2014 high). Decisive break there will pave the way to 161.8% projection of 114.42 to 134.11 from 124.37 at 156.22. This will now remain the favored case as long as 137.32 support holds.