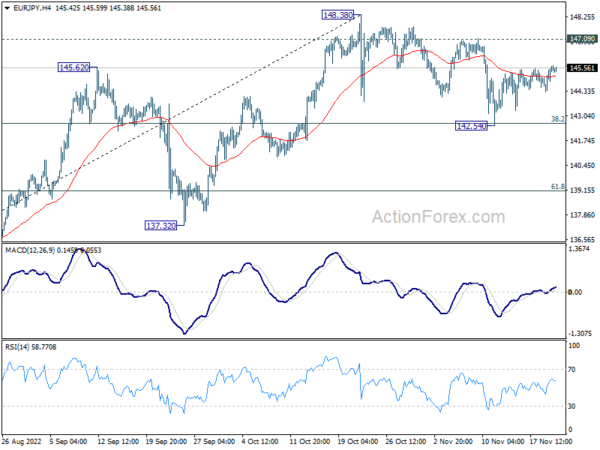

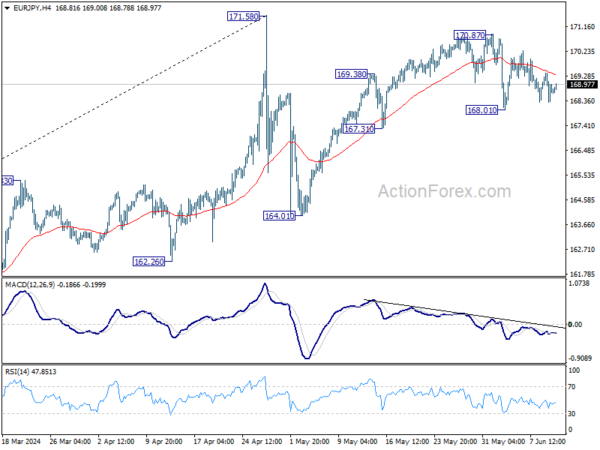

Daily Pivots: (S1) 144.69; (P) 145.17; (R1) 146.00; More….

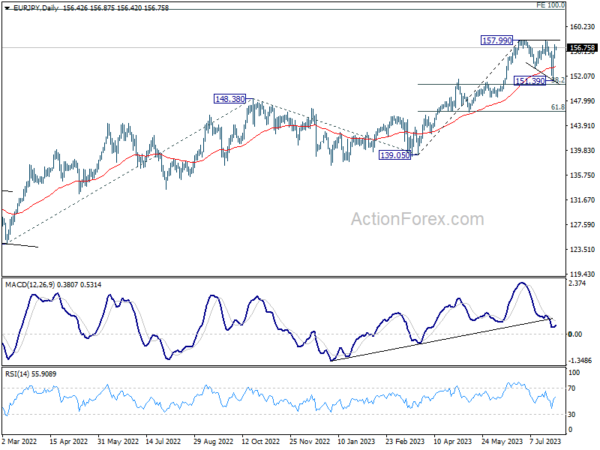

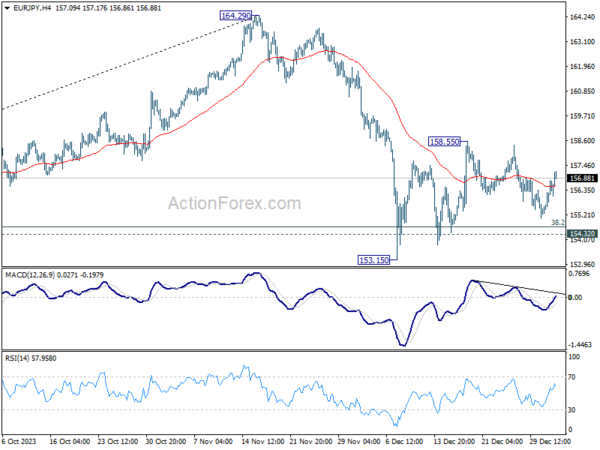

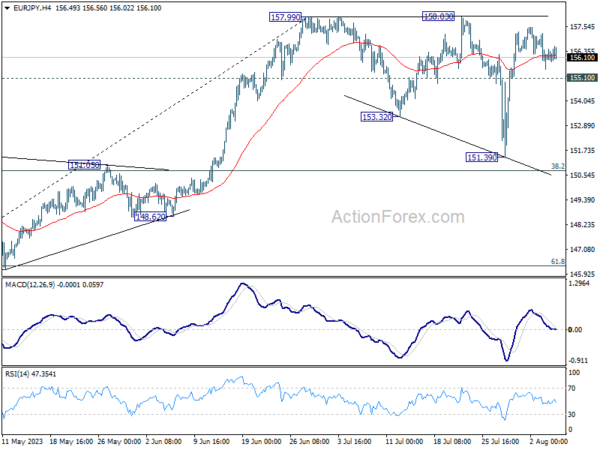

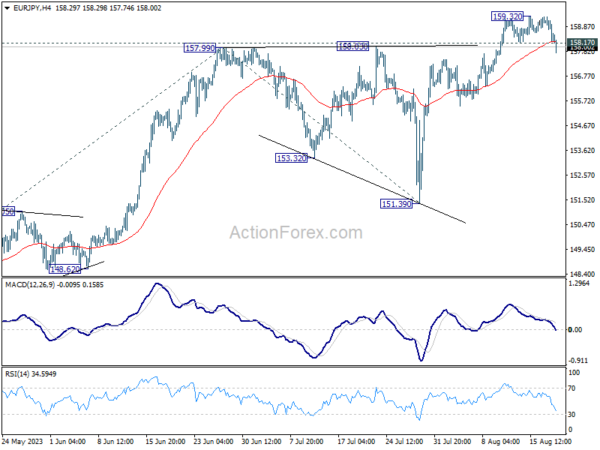

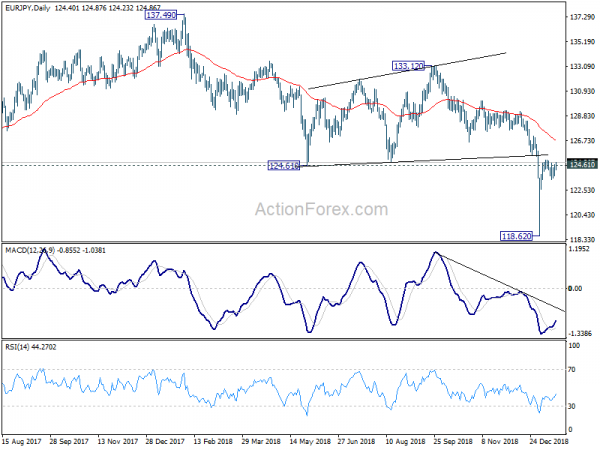

Intraday bias in EUR/JPY stays neutral and outlook is unchanged. Correction from 148.38 might have completed at 142.54. Break of 147.09 resistance will indicate that larger up trend is ready to resume through 148.38 high. However, on the downside, sustained break of 142.65 will bring deeper fall to 61.8% retracement at 139.11 and possibly below.

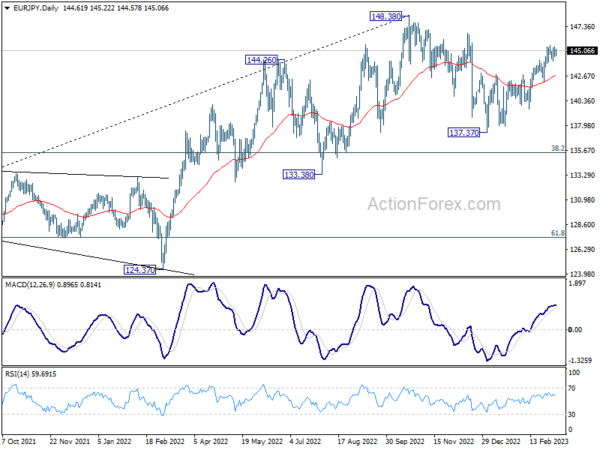

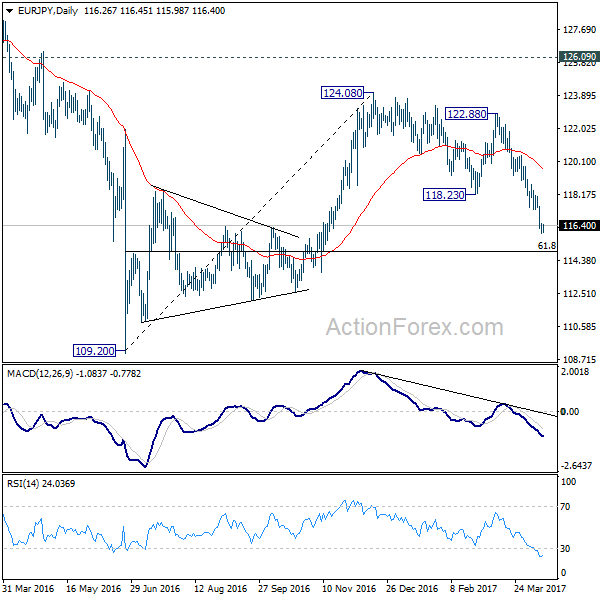

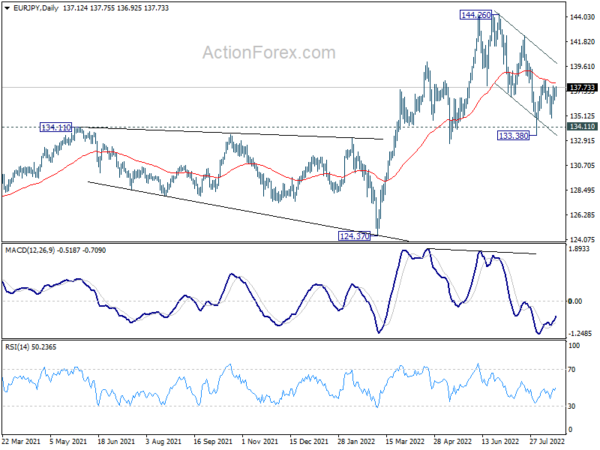

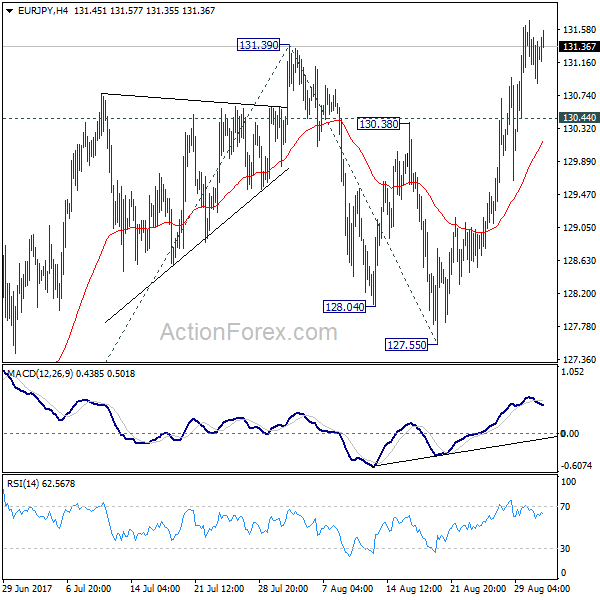

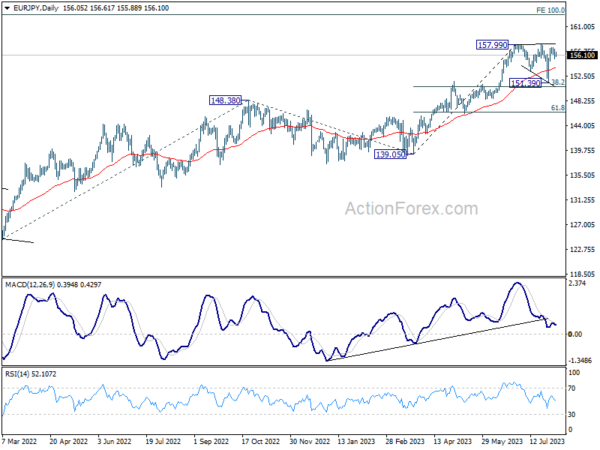

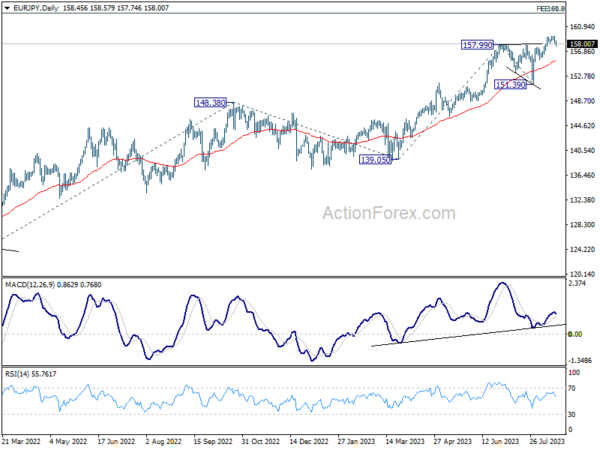

In the bigger picture, there is no clear sign of medium term topping yet. Up trend from 114.42 (2020 low) could still resume through 148.38 to 149.76 (2014 high). However, break of 137.32 support argue that a medium term correction has already started to correct the whole up trend from 114.42.