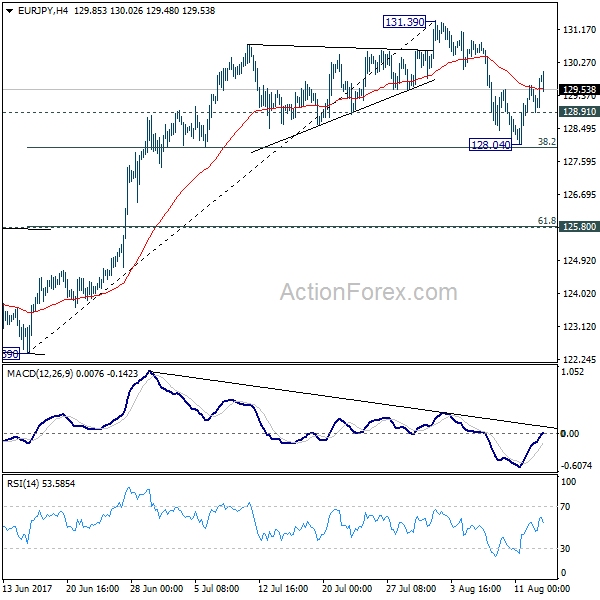

Daily Pivots: (S1) 125.76; (P) 126.18; (R1) 126.39; More….

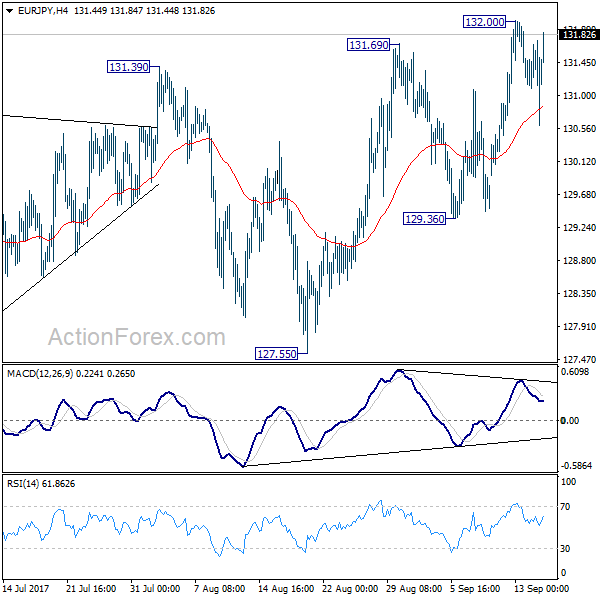

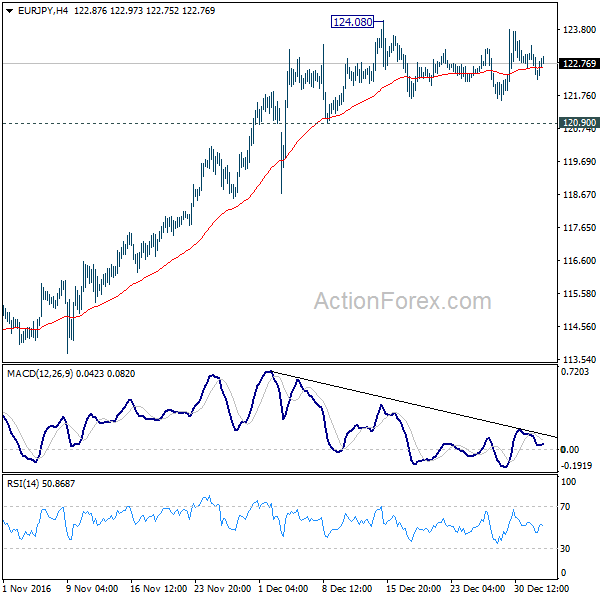

Intraday bias in EUR/JPY remains neutral as consolidation from 126.74 is extending. Further rise is mildly in favor as long as 125.13 resistance turned support holds. On the upside, decisive break of 127.07 will resume whole rise from 114.42. Next target will be 128.67 medium term fibonacci level. On the downside, however, break of 125.13 resistance turned support will turn bias to the downside, to extend the consolidation from 127.07 with another falling leg.

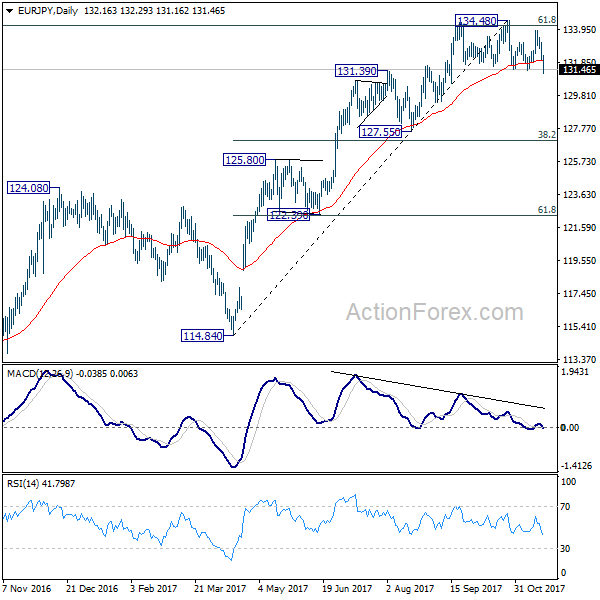

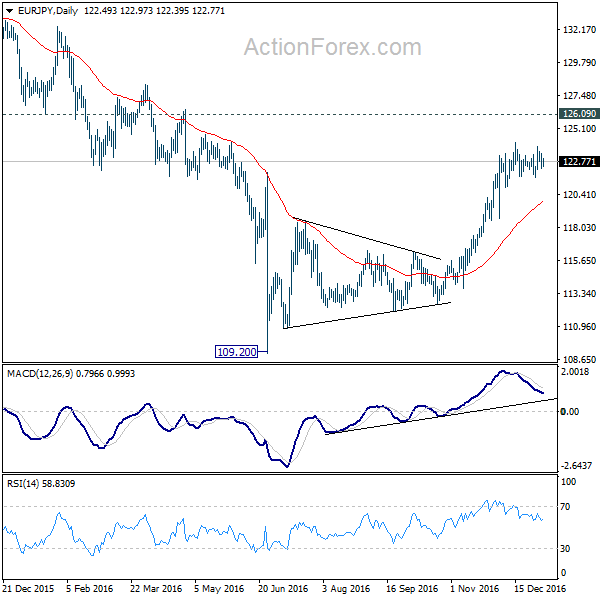

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 119.31 support holds. Break of 127.07 will target 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67 next. Sustained trading above there will target 137.49 next. However, firm break of 119.31 will argue that the rise from 114.42 has completed and turn focus back to this low.