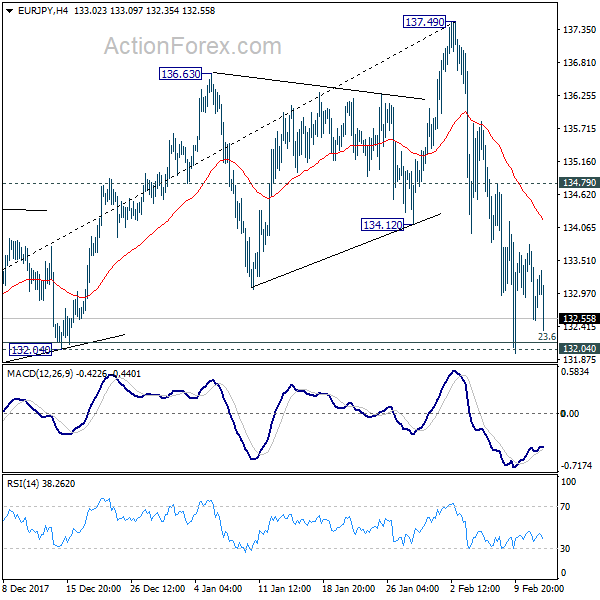

Daily Pivots: (S1) 132.87; (P) 133.10; (R1) 133.29; More….

With 132.03 minor support intact, EUR/JPY’s recovery from 128.94 could extend higher. But after all, it’s seen as a corrective move. Therefore, we expect strong resistance from 61.8% retracement of 137.49 to 128.94 at 134.22 to limit upside. Break of 132.03 will turn bias to the downside for retesting 128.94 low. However, sustained break of 134.22 will turn focus back to 137.49 high instead.

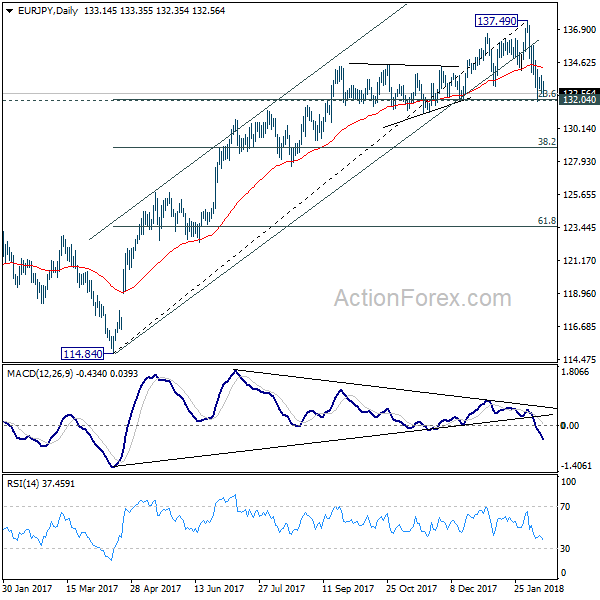

In the bigger picture, price action from 137.49 medium term top are developing into a corrective pattern. Strong support from 55 week EMA (now at 129.91) suggests that the first leg has completed at 128.94 already. Nonetheless, break of 137.49 is needed to confirm resumption of the rise from 109.03 (2016 low). Otherwise, we’d expect more corrective range trading, with risk of another fall to 38.2% retracement of 109.03 to 137.49 at 126.61 before completion.