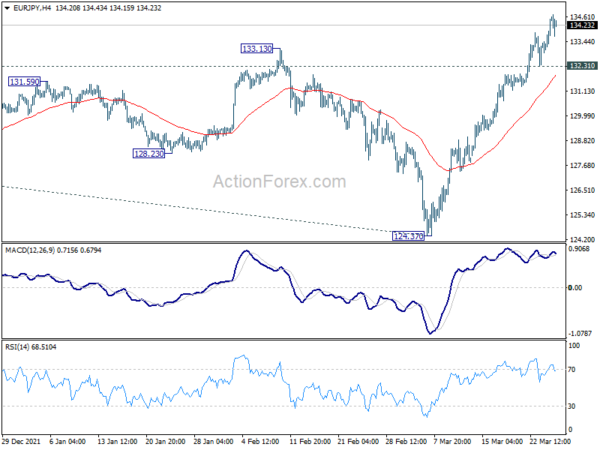

Daily Pivots: (S1) 133.47; (P) 134.04; (R1) 135.14; More….

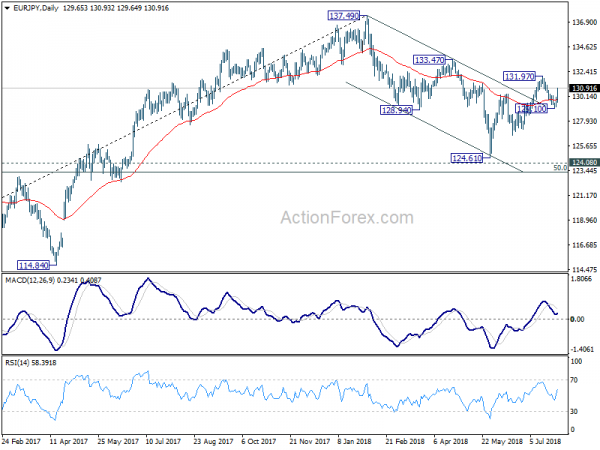

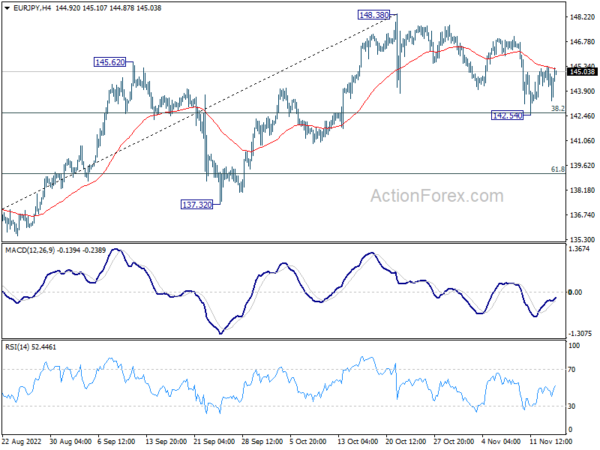

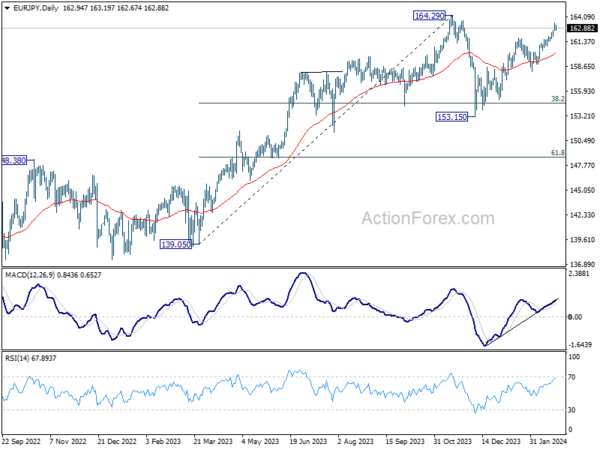

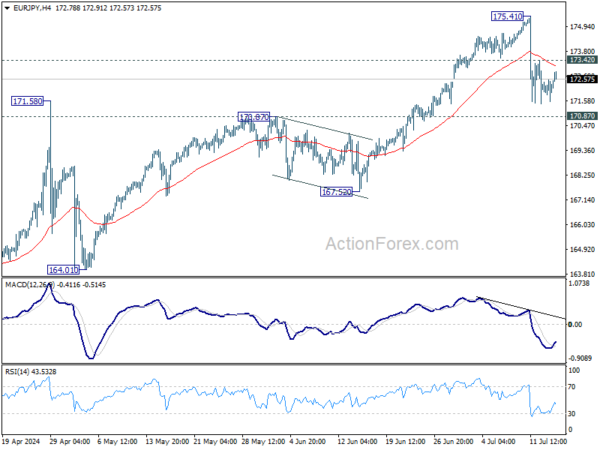

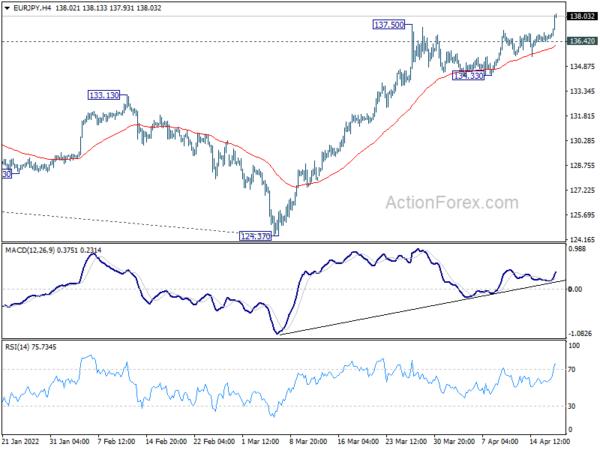

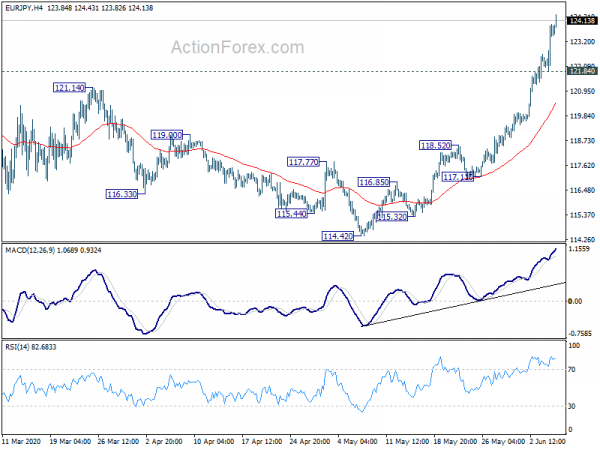

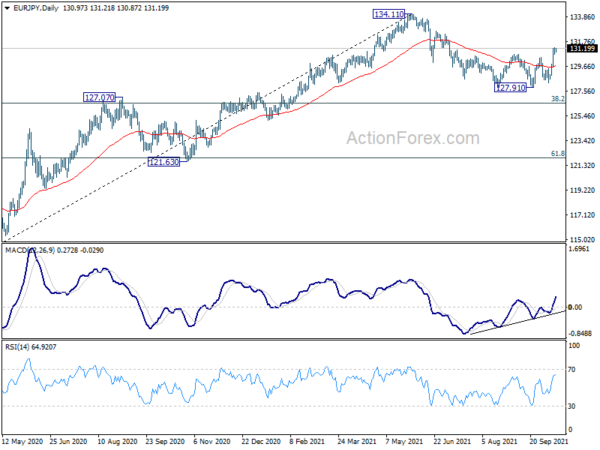

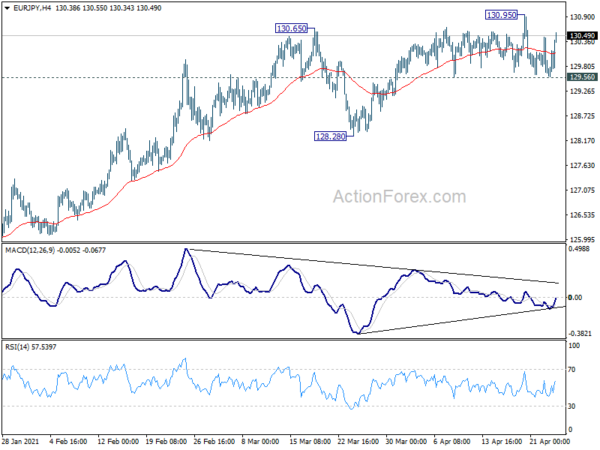

Intraday bias sin EUR/JPY remains on the upside for the moment. Sustained trading above 134.11 high will confirm resumption of larger up trend next target will be 136.53 medium term projection level. On the downside, though, break of 132.31 minor support will delay the bullish case and turn bias neutral first.

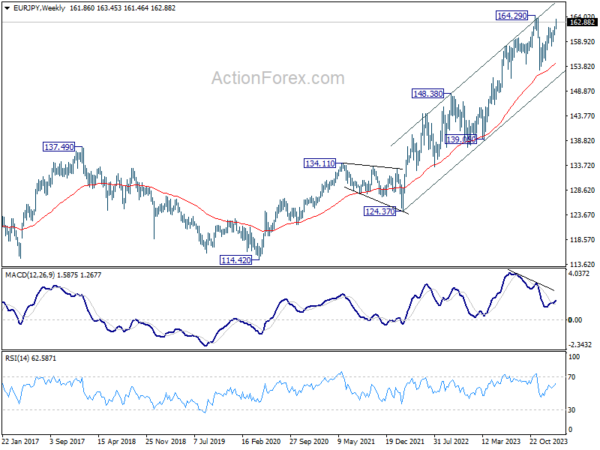

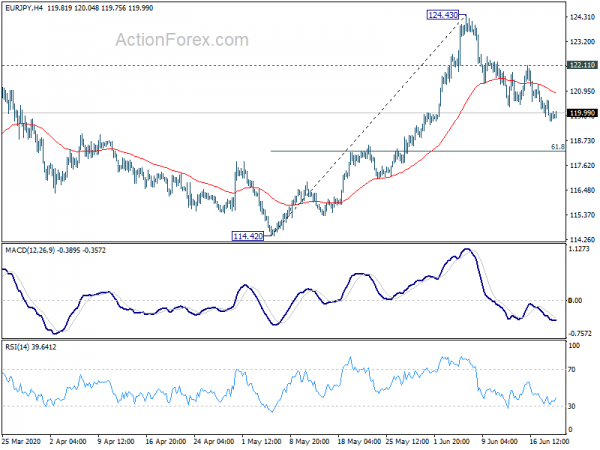

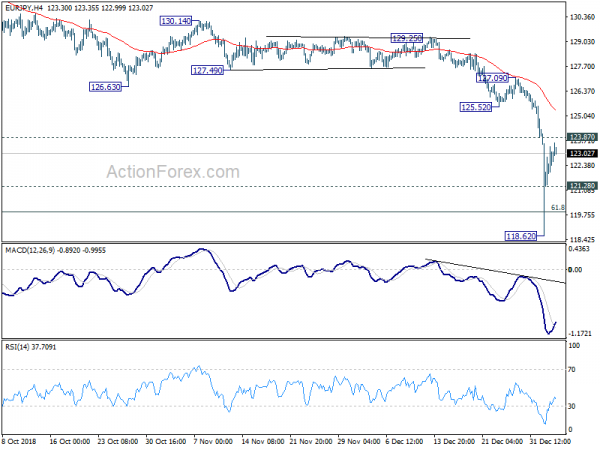

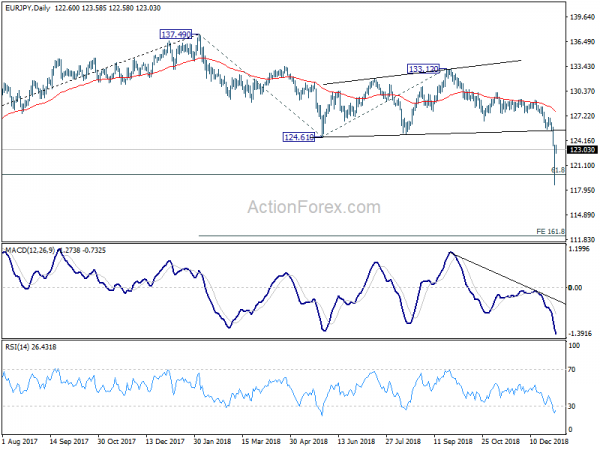

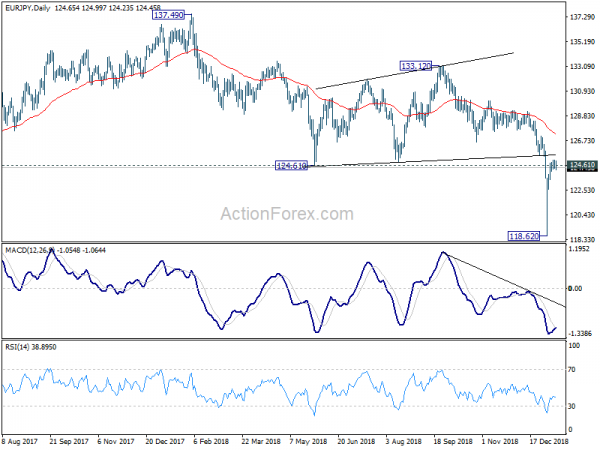

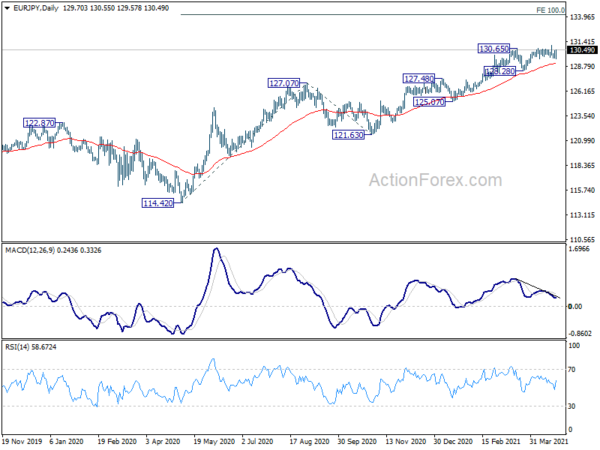

In the bigger picture, current development suggests that corrective pattern from 134.11 has completed at 124.37 already. Firm break of 134.11 will resume the up trend from 114.42 (2020 low). Next target is 61.8% projection of 114.42 to 134.11 from 124.37 at 136.53, and then 137.49 (2018 high). This will now remain the favored case as long as 124.37 support holds.