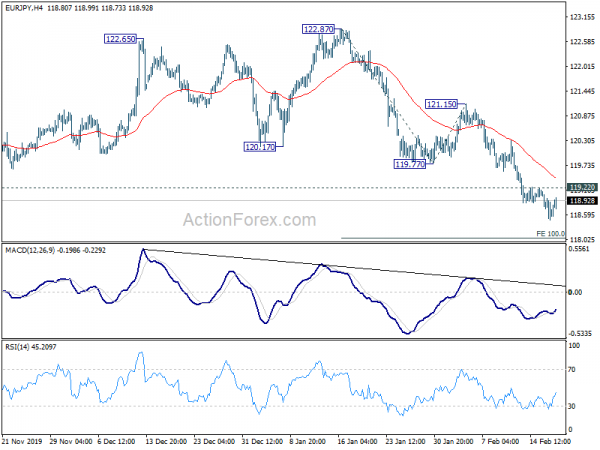

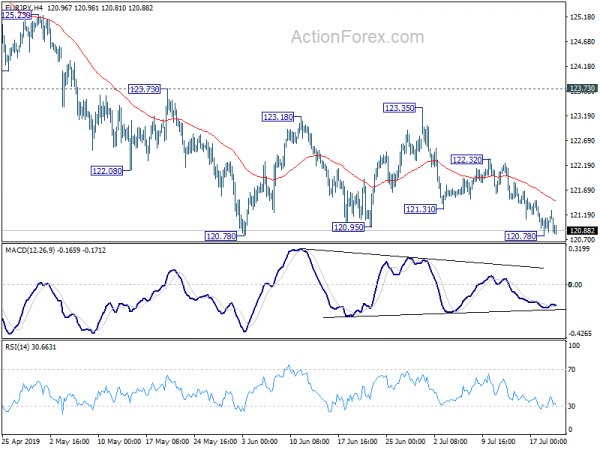

Daily Pivots: (S1) 118.35; (P) 118.71; (R1) 118.95; More….

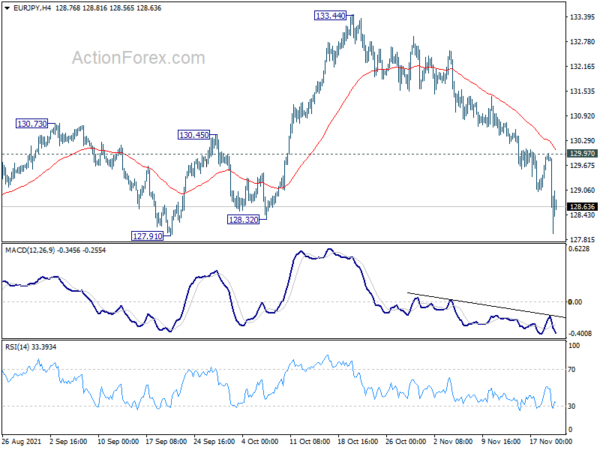

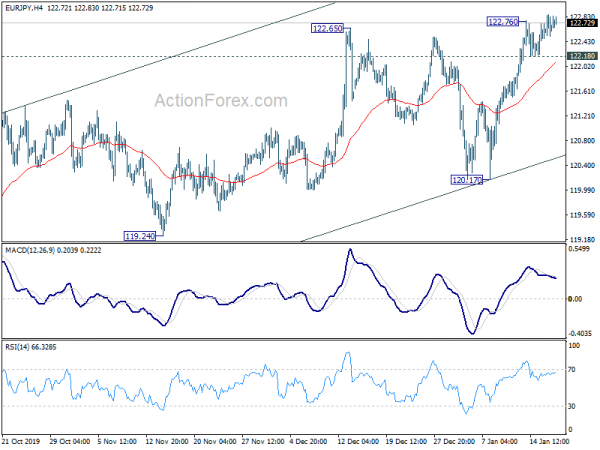

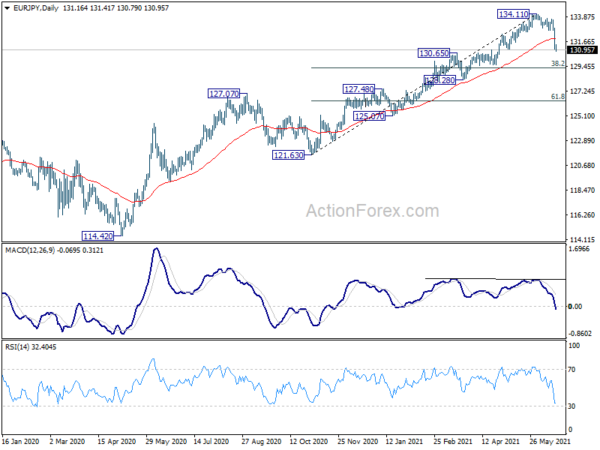

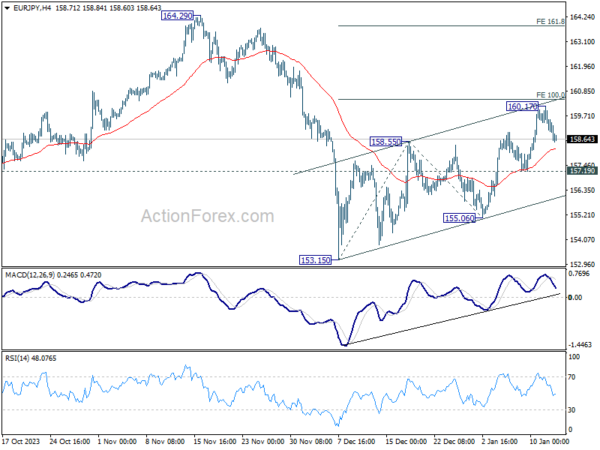

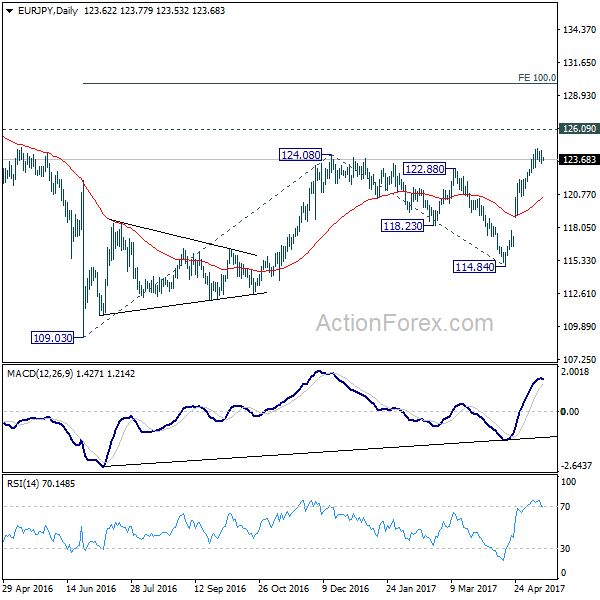

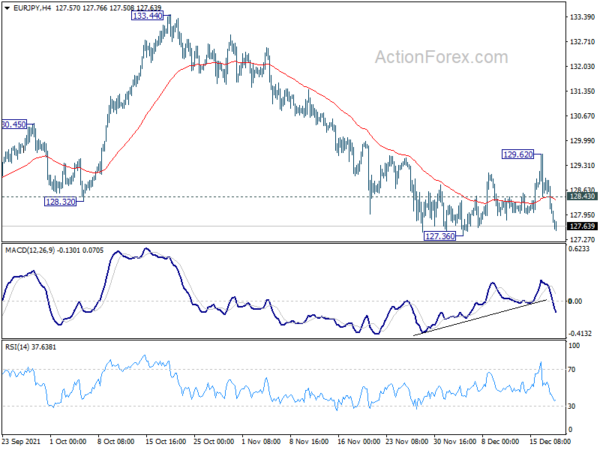

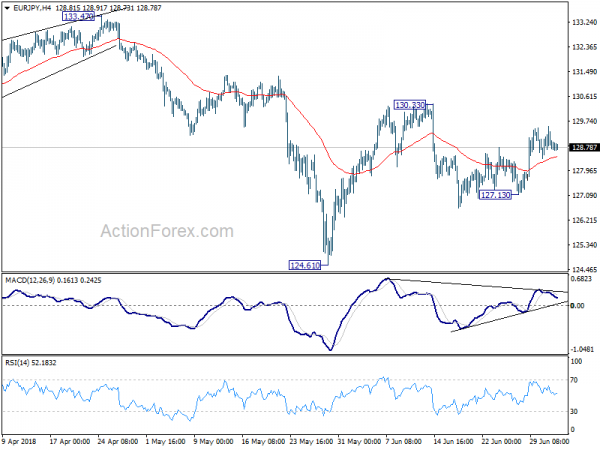

Intraday bias in EUR/JPY stays on the downside with 109.22 minor resistance intact. Current fall from 122.87 should target 100% projection of 122.87 to 119.77 from 121.15 at 118.05 next. On the upside, above 119.22 minor resistance will turn intraday bias neutral first. But recovery should be limited well below 121.15 resistance to bring fall resumption.

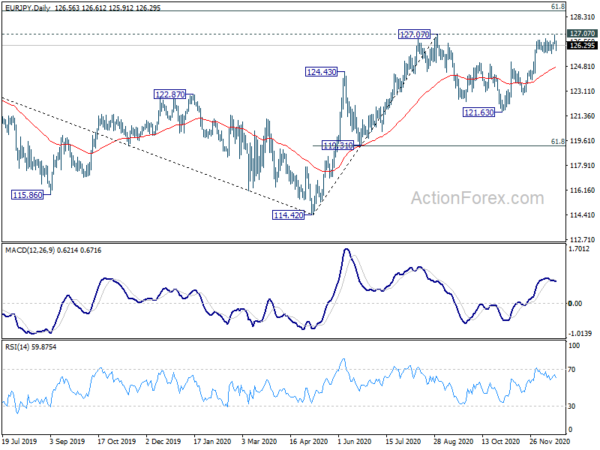

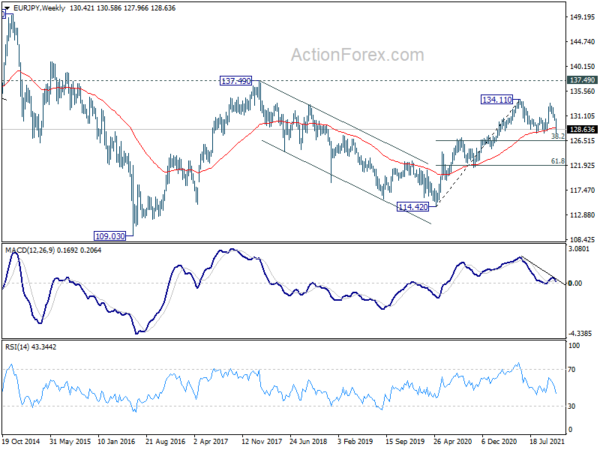

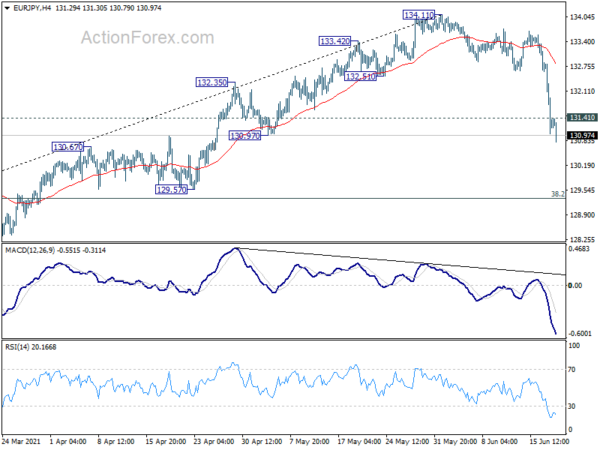

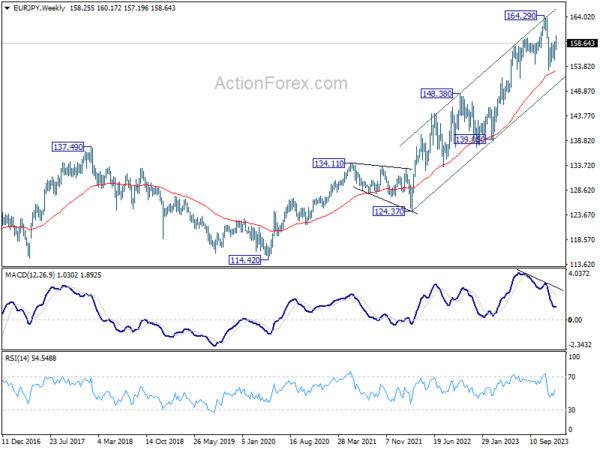

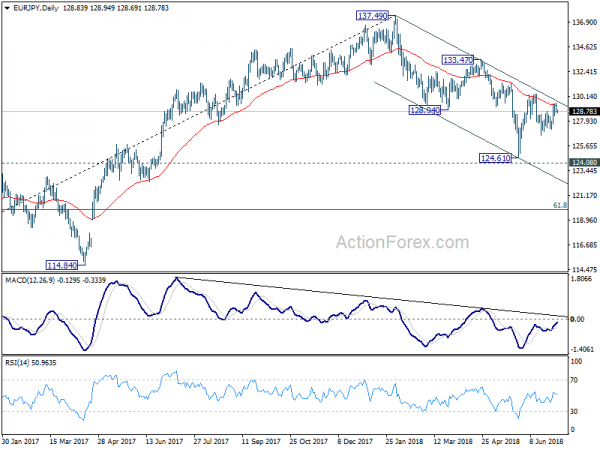

In the bigger picture, outlook remains bearish as the cross is staying well inside falling channel established since 137.49 (2018 high). It was also just rejected by 55 week EMA. Break of 115.86 will extend the down trend from 137.49 (2018 high) to 114.84 support next.