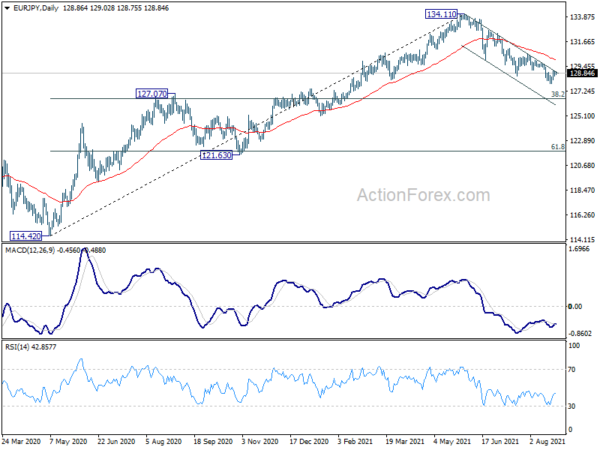

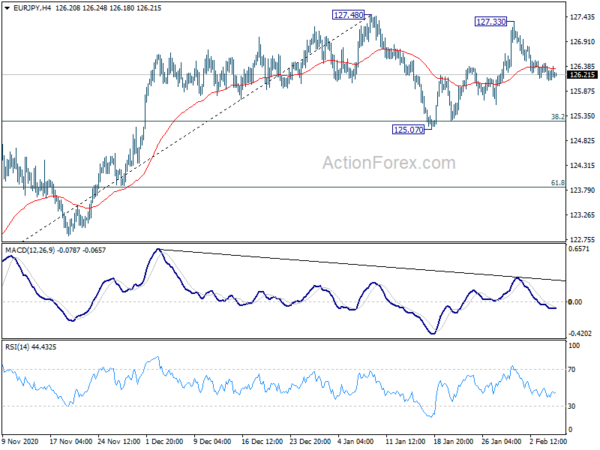

Daily Pivots: (S1) 128.69; (P) 128.87; (R1) 129.13; More….

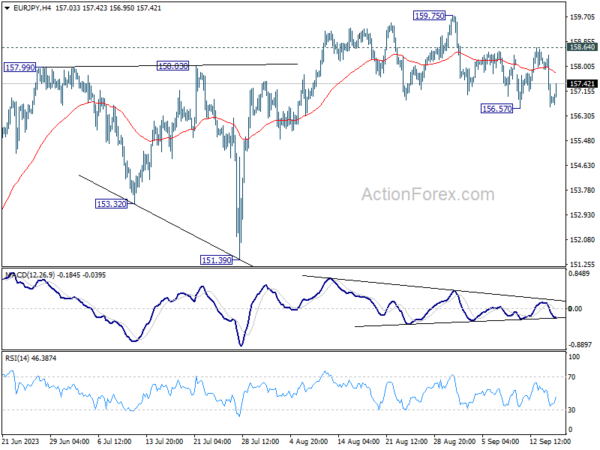

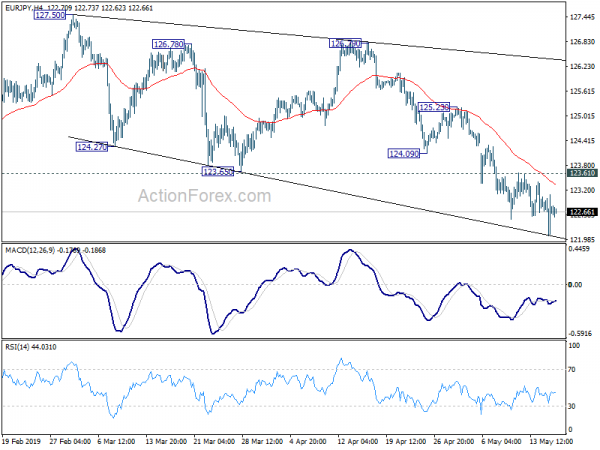

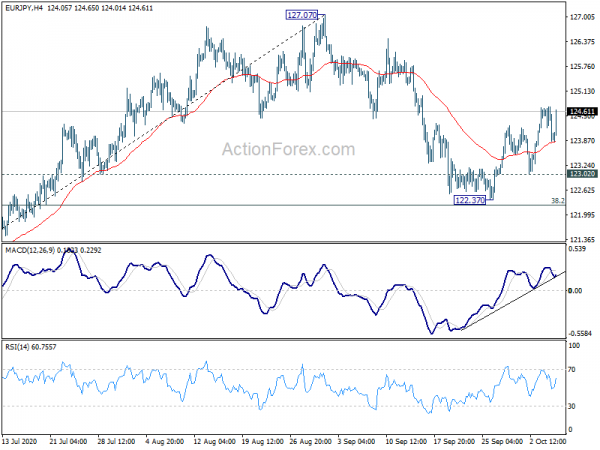

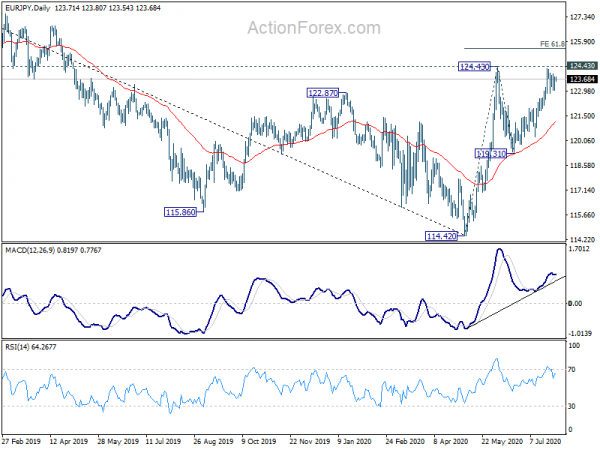

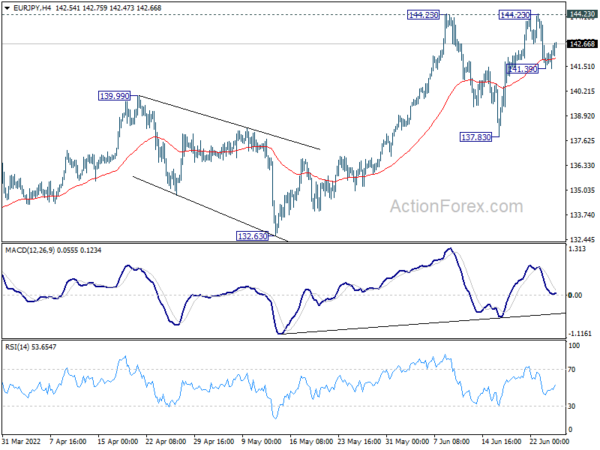

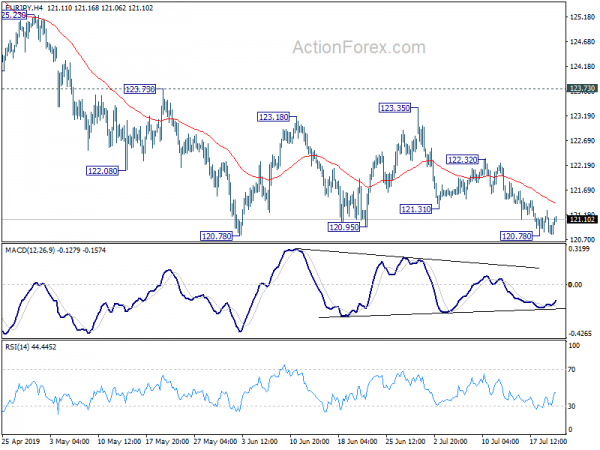

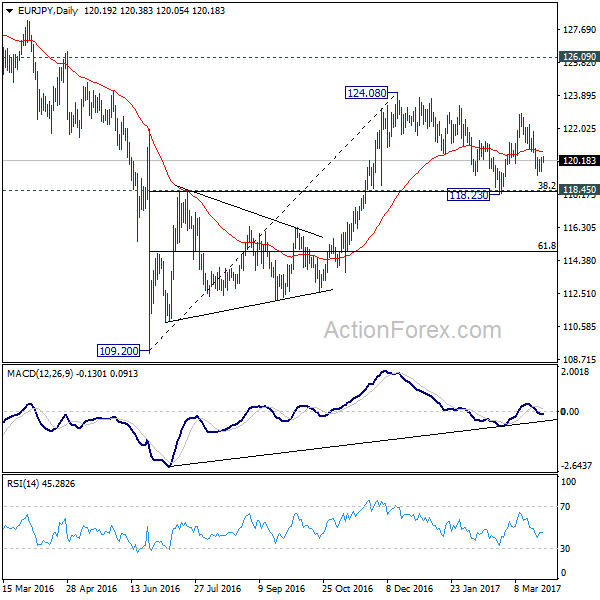

EUR/JPY is staying in consolidation from 127.91 temporary low and intraday bias remains neutral first. Further decline is expected as long as 130.54 resistance holds. On the downside, break of 127.91 will target 127.07 resistance turned support. That is close to 38.2% retracement of 114.42 to 134.11 at 126.58.

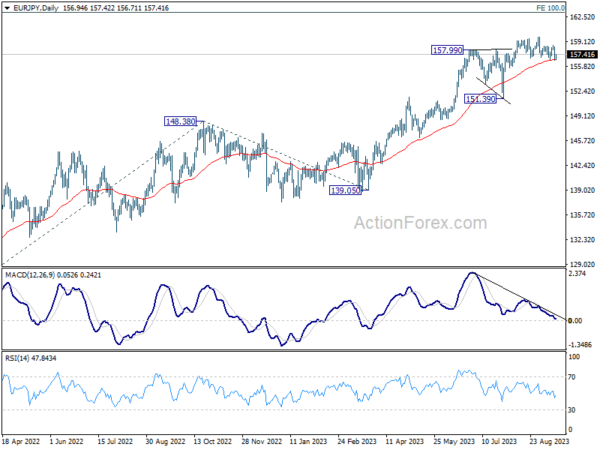

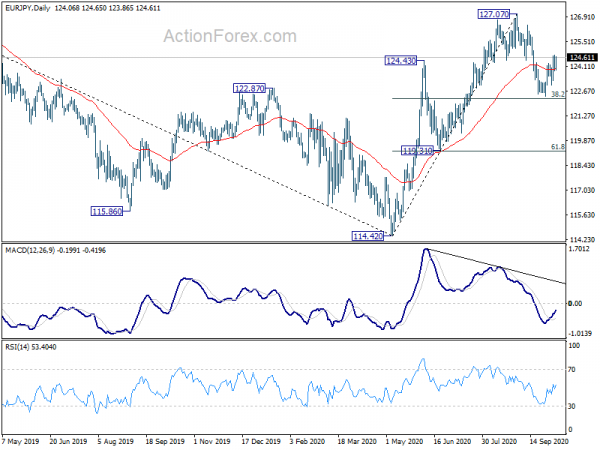

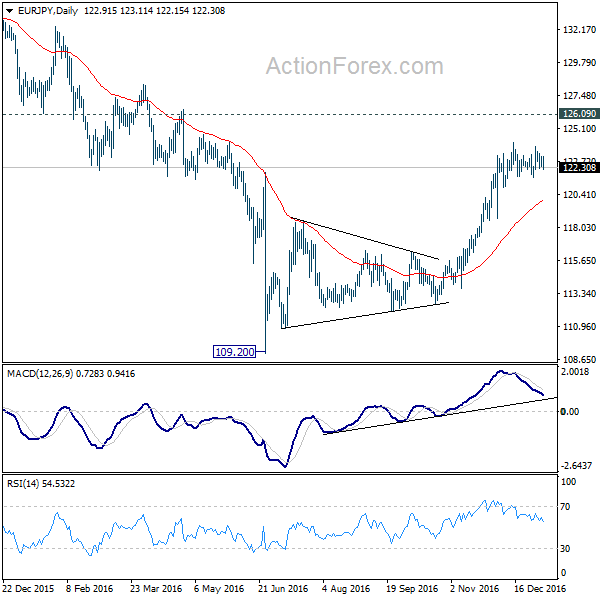

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. As long as 127.07 resistance turned support holds, further rise is still expected to retest 137.49 (2018 high). However, firm break of 127.07 will argue that the medium term trend has reversed, deeper fall would be seen to 61.8% retracement of 114.42 to 134.11 at 121.94.