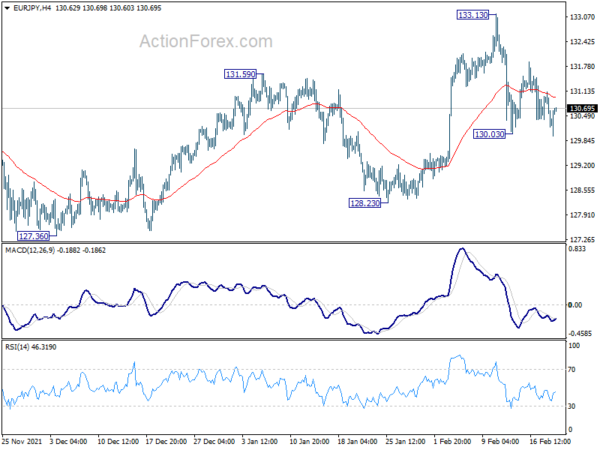

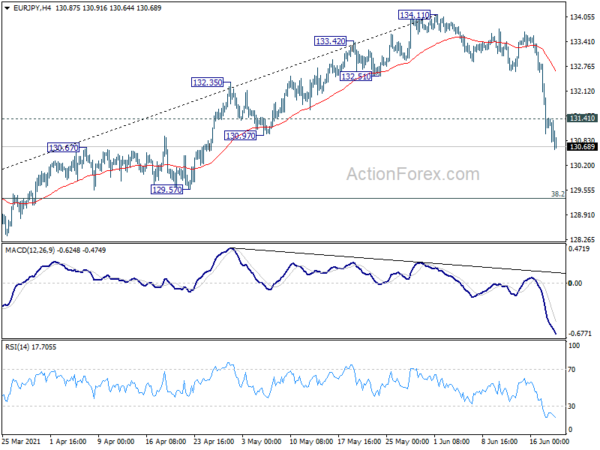

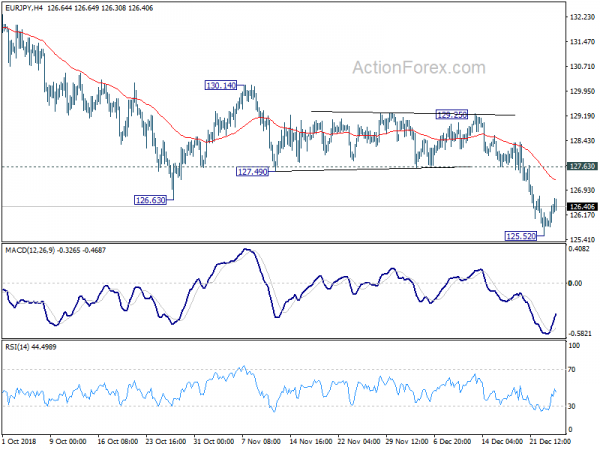

Daily Pivots: (S1) 129.95; (P) 130.54; (R1) 130.86; More….

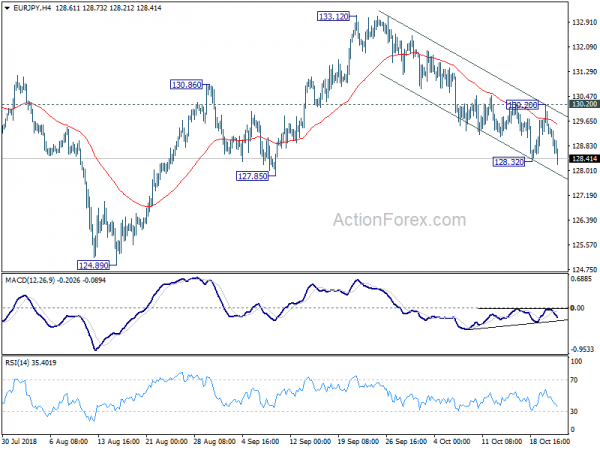

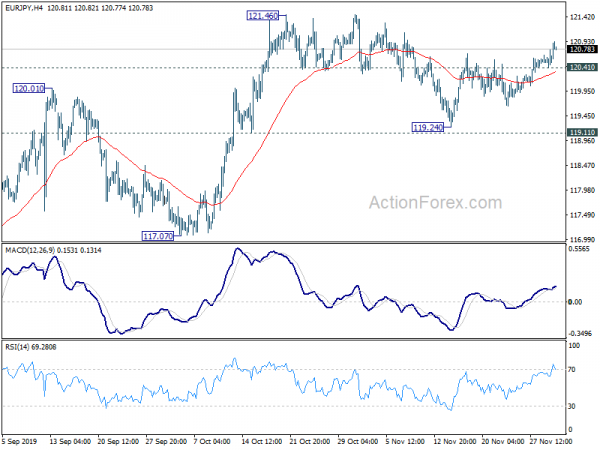

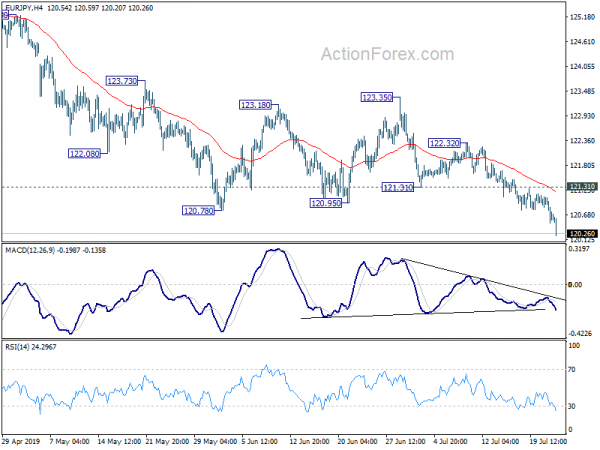

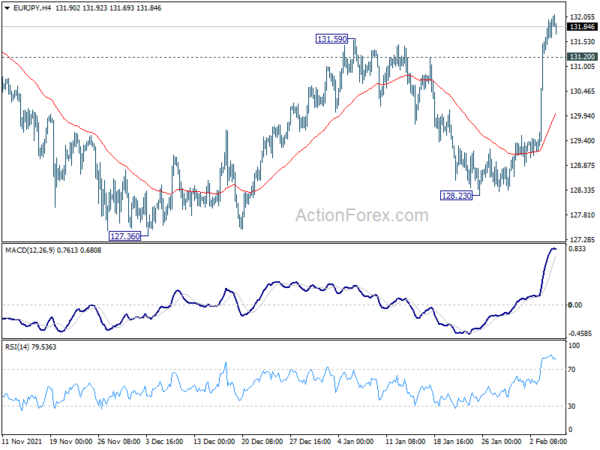

Intraday bias in EUR/JPY remains neutral first. Corrective pattern from 134.11 is seen as extending with another falling leg. Break of 130.03 will bring deeper fall to 128.23 support first. Break will target 127.36 support and below. On the upside, however, break of 133.13 will bring retest of 134.11 high.

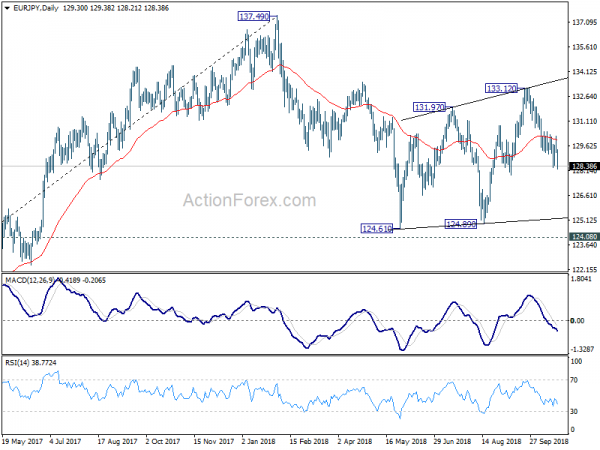

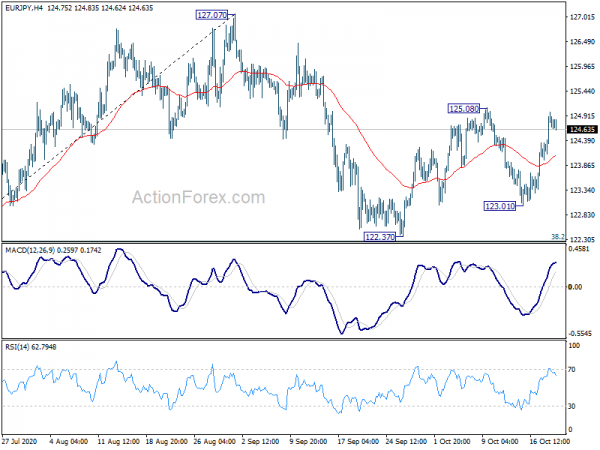

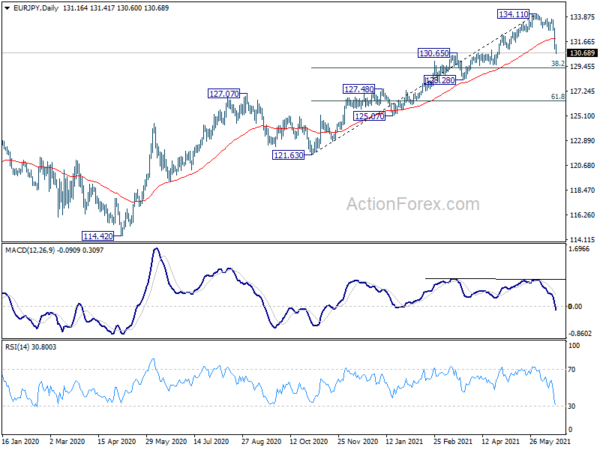

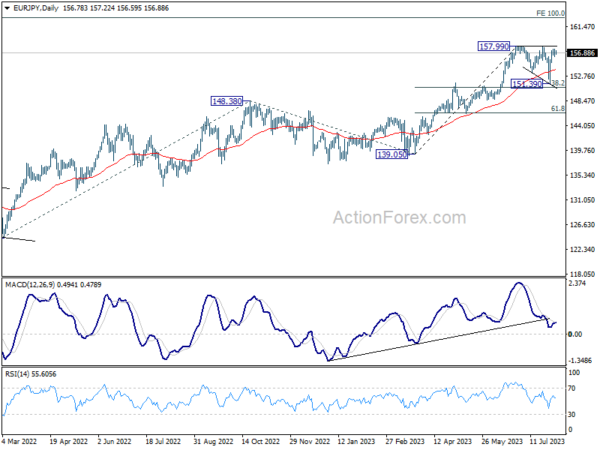

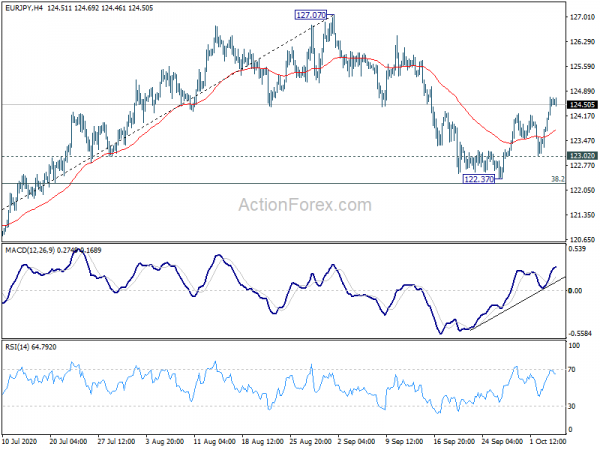

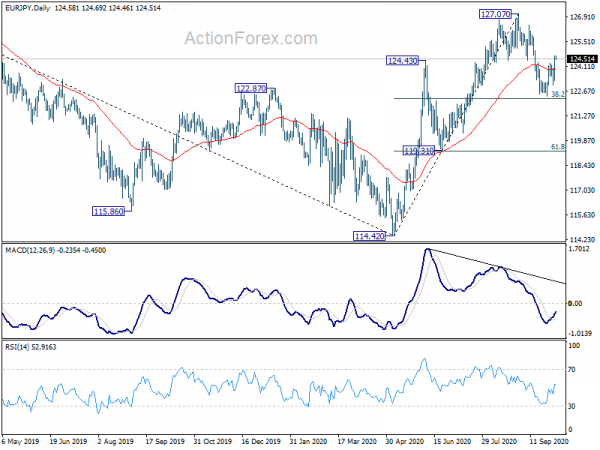

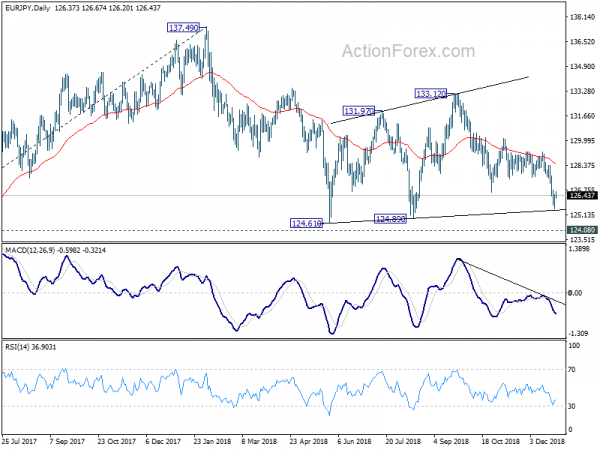

In the bigger picture, price actions from 134.11 are currently seen as a consolidation pattern only. As long as 38.2% retracement of 114.42 (2020 low) to 134.11 at 126.58 holds, up trend from 114.42 is still in favor to continue. Break of 134.11 will target long term resistance at 137.49 (2018 high). However, sustained break of 126.58 will raise the chance of bearish reversal. In this case, deeper decline would be seen to 61.8% retracement at 121.94, and possibly below.