EURJPY Outlook

EUR/JPY Weekly Outlook

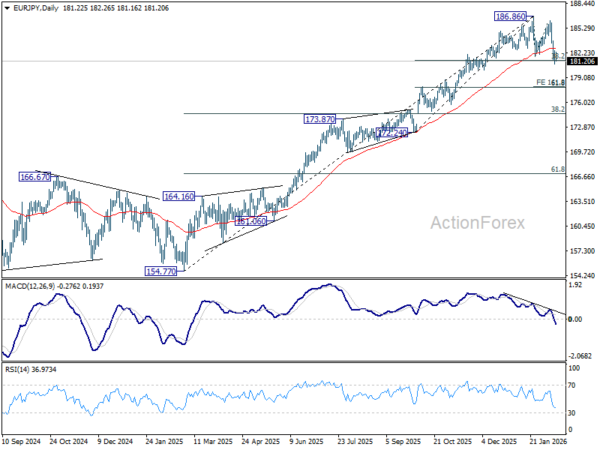

EUR/JPY fell sharply last week but the declined stalled after hitting 38.2% retracement of 172.24 to 186.86 at 181.27. Initial bias is neutral this week first. On the downside, sustained break of 181.27 will argue that fall from 186.86 is correcting whole up trend from 154.77. Next near term target will be 161.8% projection of 186.86 to 181.76 from 186.22 at 177.96. Nevertheless, strong rebound from current level, followed by break of 182.99 minor resistance will retain near term bullishness, and bring retest of 186.86 high first.

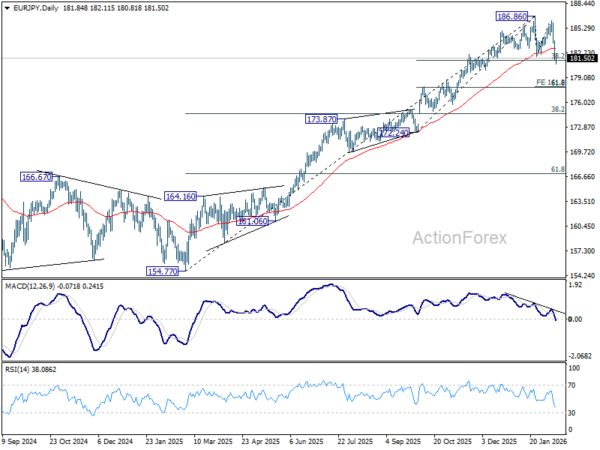

In the bigger picture, considering bearish divergence condition in D MACD and break of 55 D EMA (now at 182.67), a medium term top could be formed at 186.86 already. Deeper correction would be seen but downside should be contained by 38.2% retracement of 154.77 to 186.86 at 174.60 to bring rebound. Meanwhile, firm break of 186.86 will resume larger up trend to 78.6% projection of 124.37 to 175.41 from 154.77 at 194.88 next.

In the long term picture, up trend from 94.11 (2021 low) is in progress. Next target is 138.2% projection of 94.11 to 149.76 (2014 high) from 114.42 (2020 low) at 191.32. This will remain the favored case as long as 154.77 support holds.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 180.57; (P) 181.56; (R1) 182.30; More...

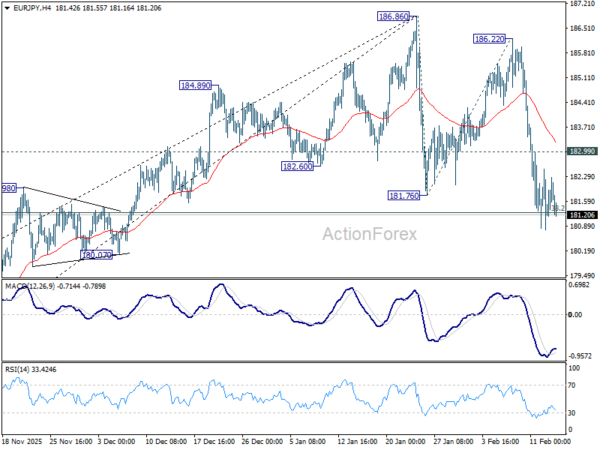

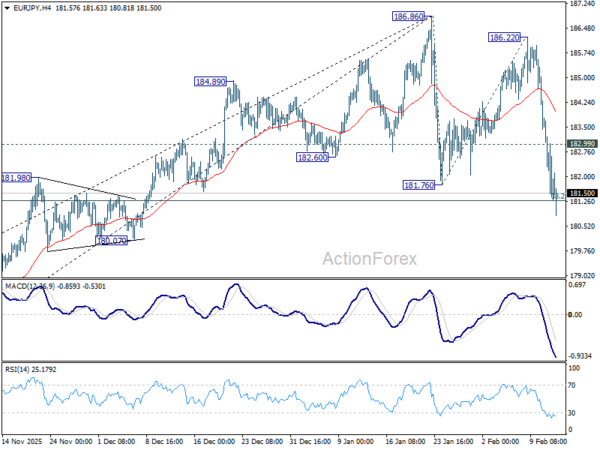

Immediate focus stays on 38.2% retracement of 172.24 to 186.86 at 181.27 in EUR/JPY. Decisive break there will argue that fall from 186.86 is correcting whole up trend from 154.77. Next near term target will be 161.8% projection of 186.86 to 181.76 from 186.22 at 177.96. Nevertheless, strong rebound from current level, followed by break of 182.99 minor resistance will retain near term bullishness, and bring retest of 186.86 high first.

In the bigger picture, up trend from 114.42 (2020 low) is in progress. Upside momentum has been diminishing as seen in bearish divergence condition in D MACD. But there is no clear sign of topping yet. On resumption, next target is 78.6% projection of 124.37 to 175.41 from 154.77 at 194.88 next. Meanwhile, outlook will stay bullish as long as 55 W EMA (now at 174.22) holds, even in case of deep pullback.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 180.91; (P) 182.36; (R1) 183.39; More...

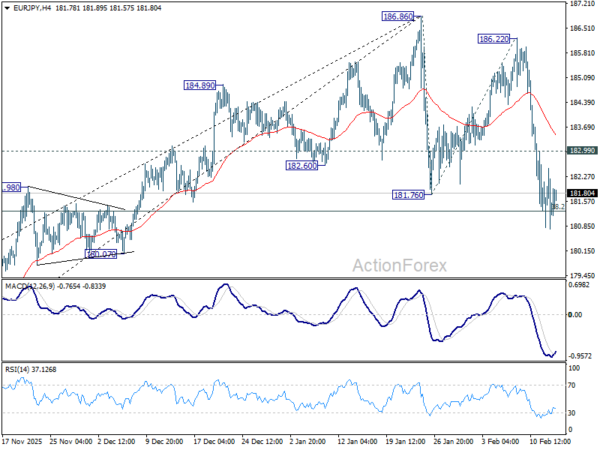

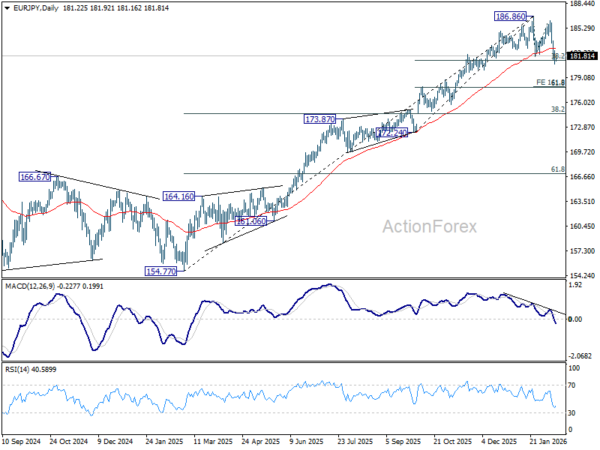

Immediate focus is now on 38.2% retracement of 172.24 to 186.86 at 181.27 as EUR/JPY's fall accelerated lower. Decisive break there will argue that fall from 186.86 is correcting whole up trend from 154.77. Next near term target will be 161.8% projection of 186.86 to 181.76 from 186.22 at 177.96. Nevertheless, strong rebound from current level, followed by break of 182.99 minor resistance will retain near term bullishness, and bring retest of 186.86 high first.

In the bigger picture, up trend from 114.42 (2020 low) is in progress. Upside momentum has been diminishing as seen in bearish divergence condition in D MACD. But there is no clear sign of topping yet. On resumption, next target is 78.6% projection of 124.37 to 175.41 from 154.77 at 194.88 next. Meanwhile, outlook will stay bullish as long as 55 W EMA (now at 174.22) holds, even in case of deep pullback.