Daily Pivots: (S1) 155.96; (P) 156.45; (R1) 157.27; More….

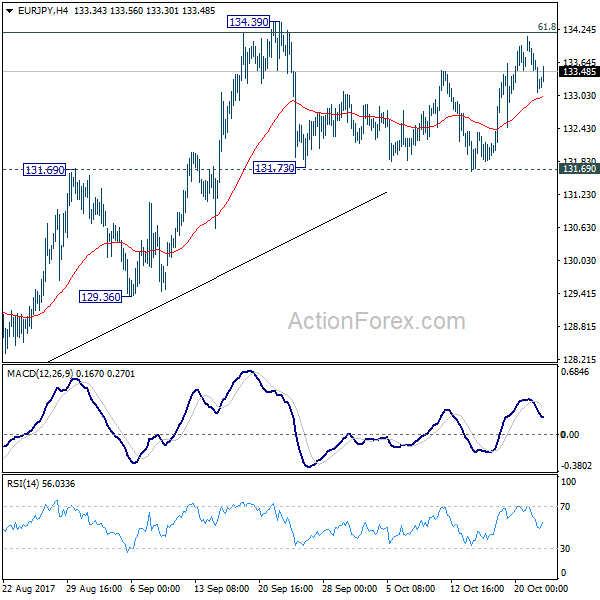

Intraday bias in EUR/JPY is turned neutral first with current retreat. Further rally would remain in favor as long as 154.30 minor support holds. Above 156.92 will resume larger up trend to 100% projection of 139.05 to 151.60 from 146.12 at 158.67. On the downside, break of 154.03 will turn bias back to the downside for deeper pull back.

In the bigger picture, rise from 114.42 (2020 low) is in progress. Next target is 100% projection of 124.37 to 148.38 from 138.81 at 162.82. For now, medium term outlook will remain bullish as long as 148.38 resistance turned support holds, even in case of deep pull back.