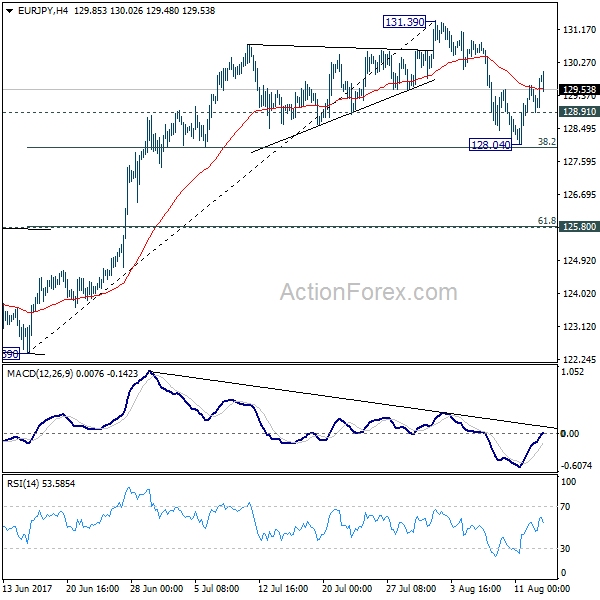

Daily Pivots: (S1) 119.45; (P) 119.88; (R1) 120.13; More….

EUR/JPY’s decline from 122.87 is in progress and hits as low as 118.86 so far. Intraday bias remains on the downside for 100% projection of 122.87 to 119.77 from 121.15 at 118.05 next. On the upside, above 119.55 minor resistance will turn intraday bias neutral first. But recovery should be limited well below 121.15 resistance to bring fall resumption.

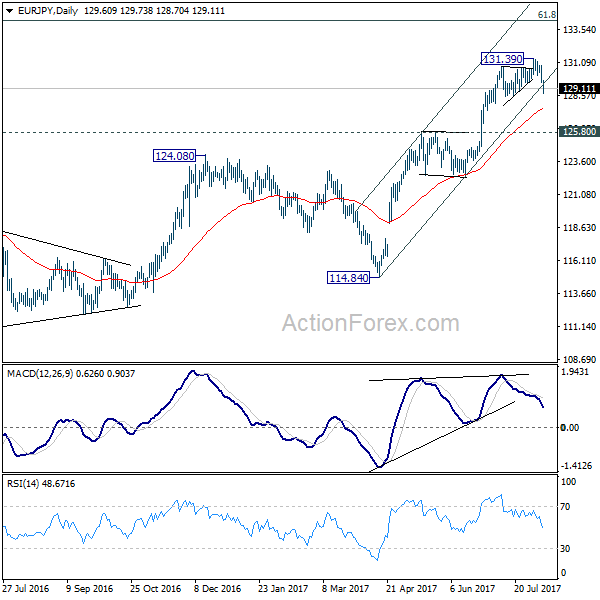

In the bigger picture, EUR/JPY is still staying in the falling channel established since 137.49 (2018 high). Thus, outlook remains bearish. Rise from 115.86 is seen as a corrective rise, which might have completed. Firm break of 115.86 will resume the down trend to 114.84 support next.