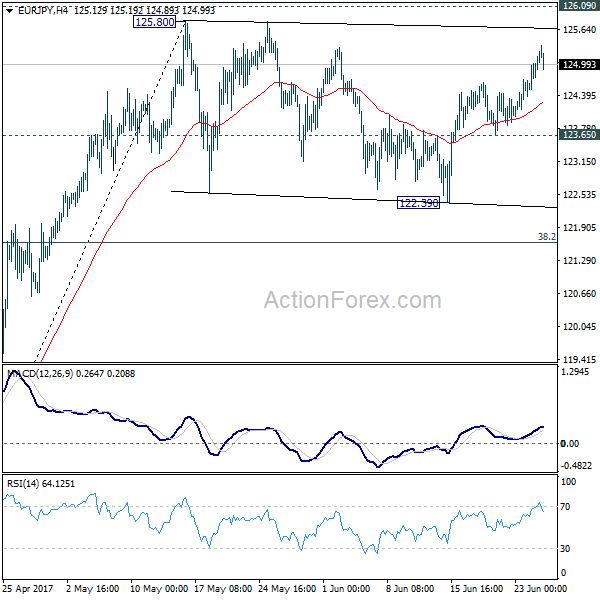

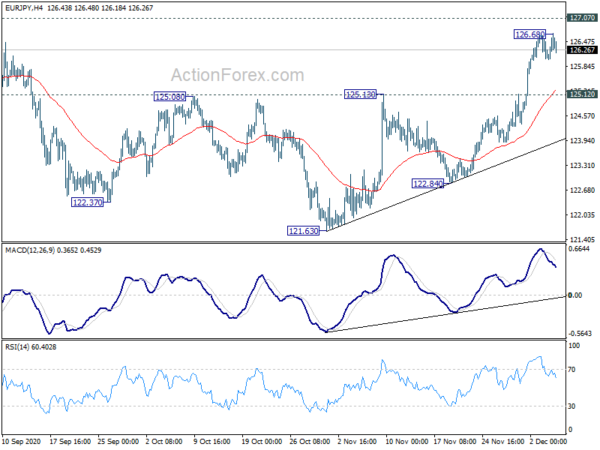

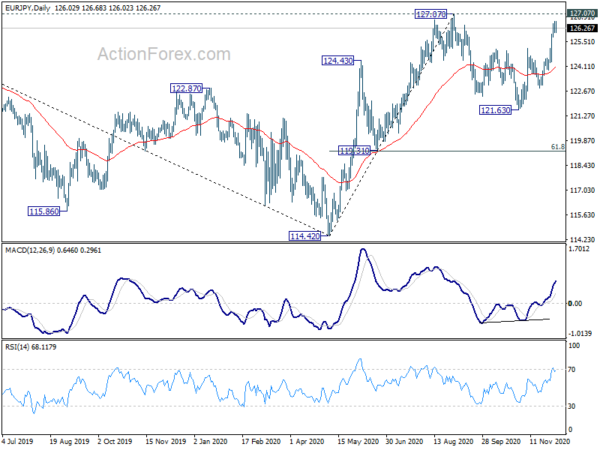

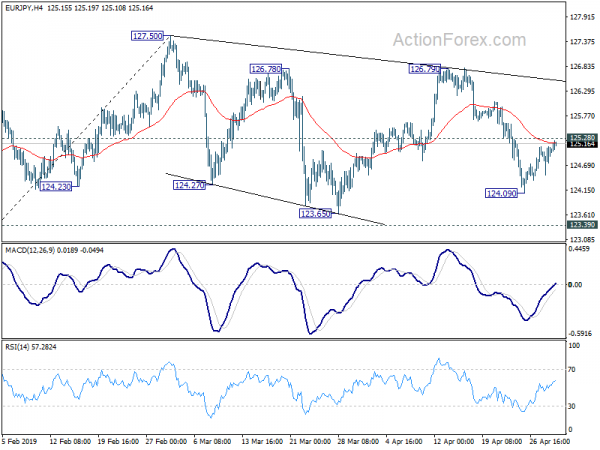

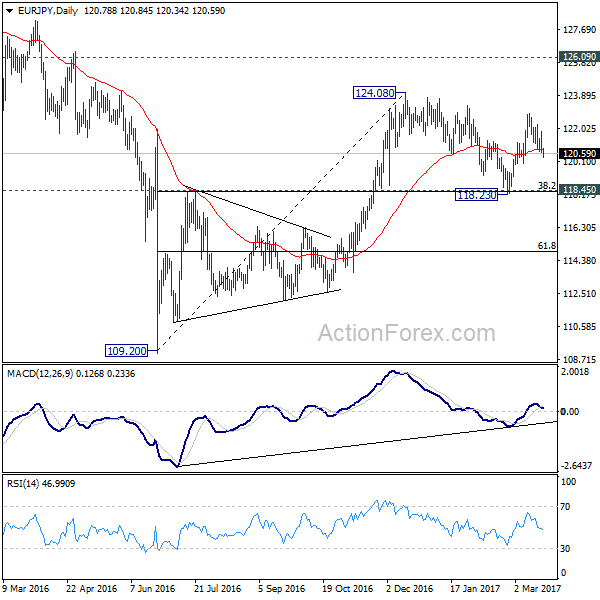

Daily Pivots: (S1) 124.60; (P) 124.87; (R1) 125.34; More…

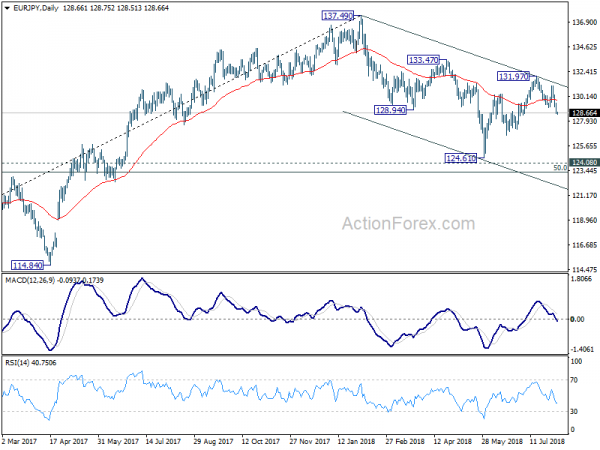

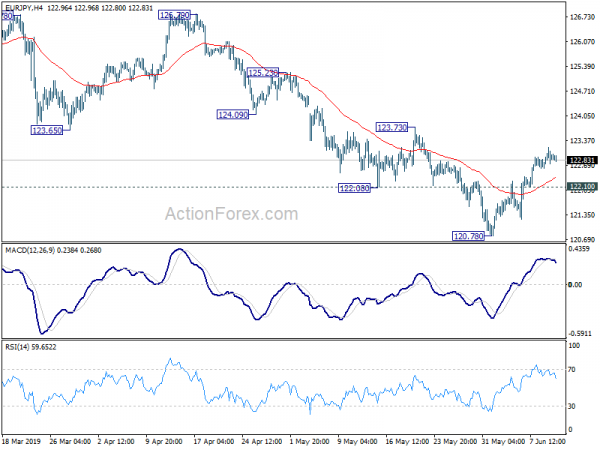

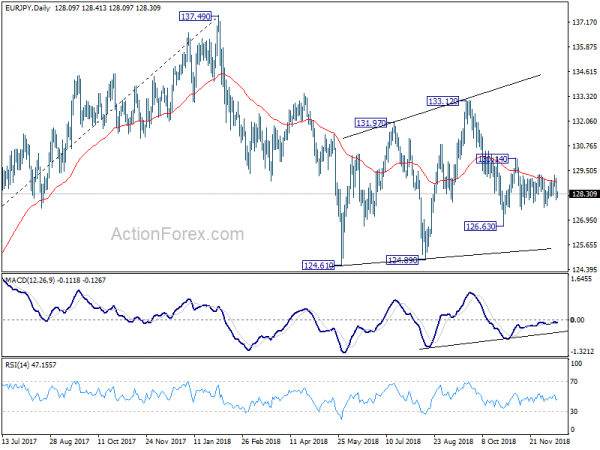

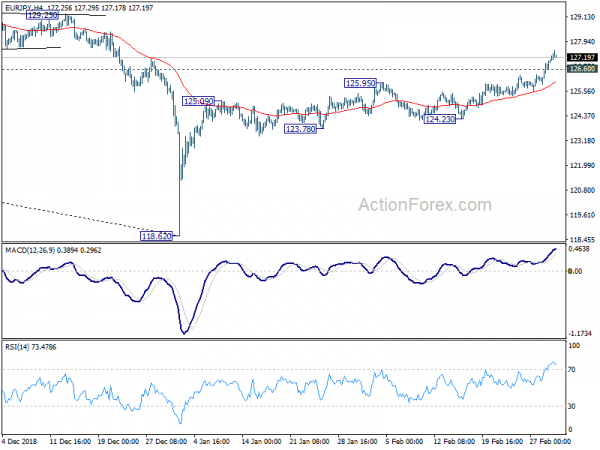

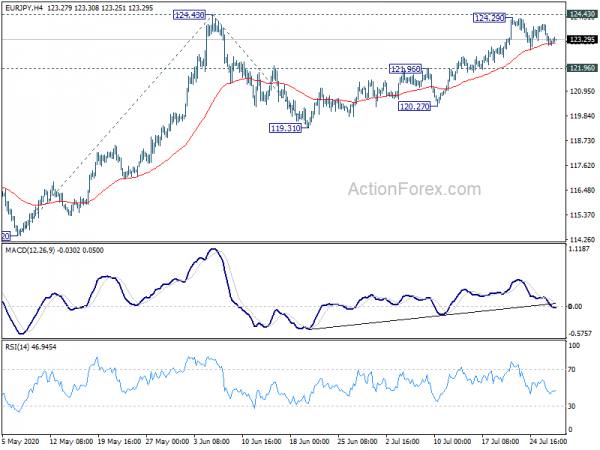

EUR/JPY’s rebound from 122.39 extended further to 125.35 but it’s still limited below 125.80/126.09 resistance zone. Intraday bias stays neutral first. On the upside, decisive break of 125.80/126.09 resistance zone will extend the whole rise from 109.03 to 100% projection of 109.03 to 124.08 from 114.84 at 129.89. On the downside, below 123.65 minor support will extend the consolidation from 125.80 with another falling leg. In that case, downside should be contained by 38.2% retracement of 114.84 to 125.80 at 121.61 to bring rebound and then rise resumption.

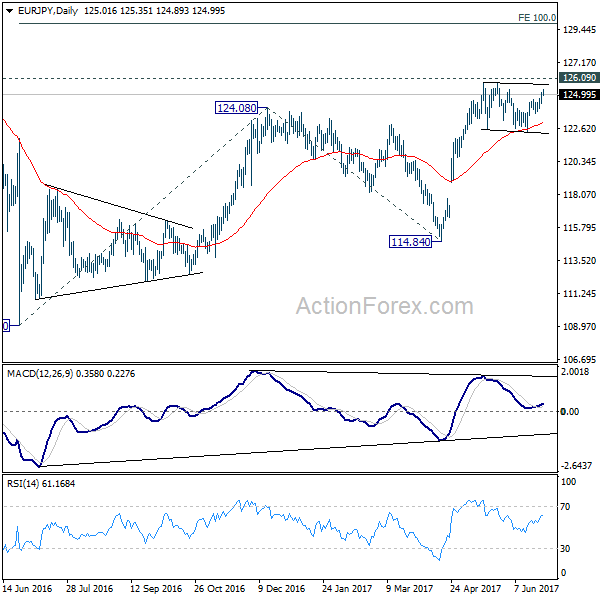

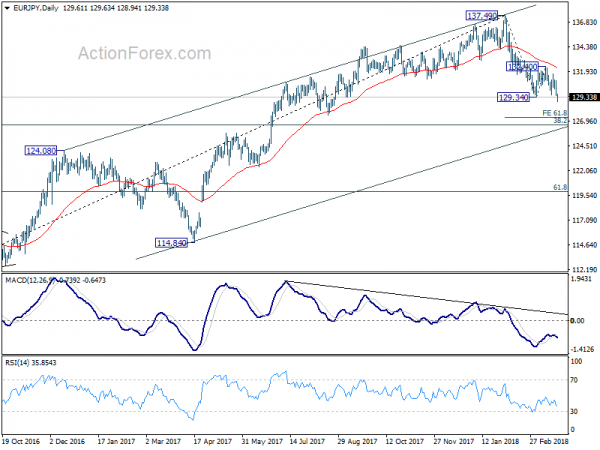

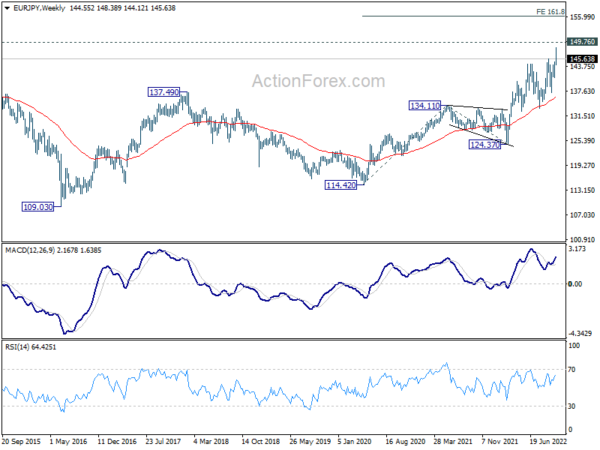

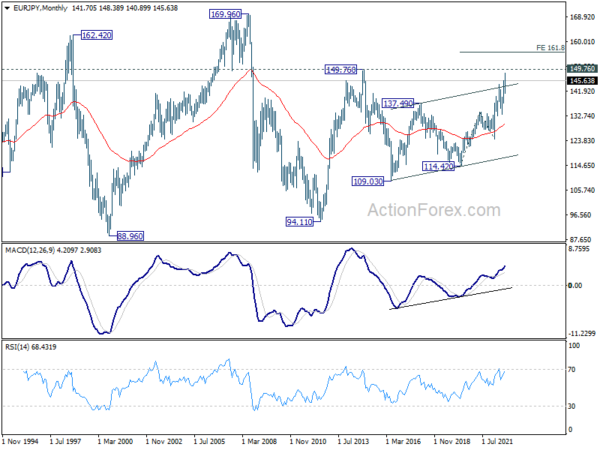

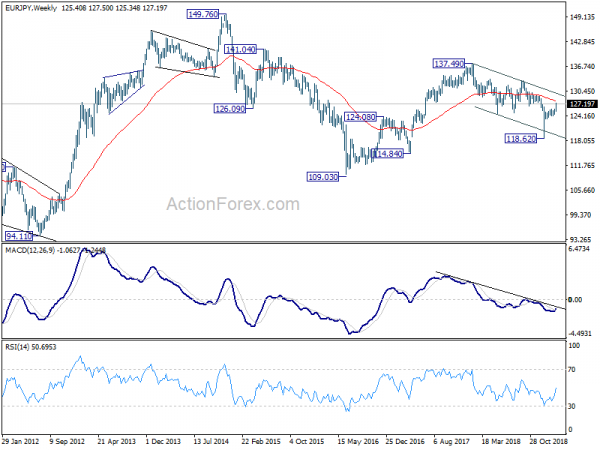

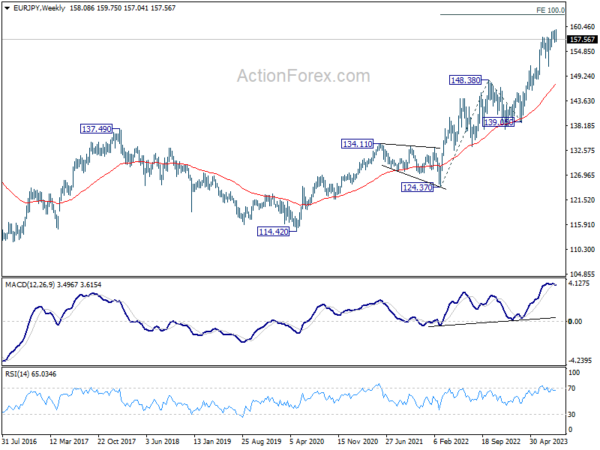

In the bigger picture, focus is staying on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.