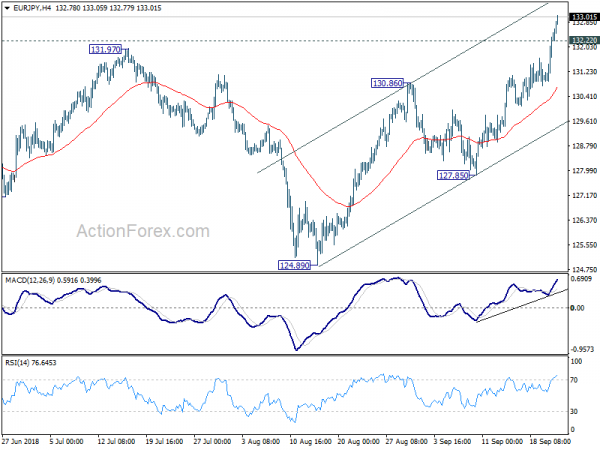

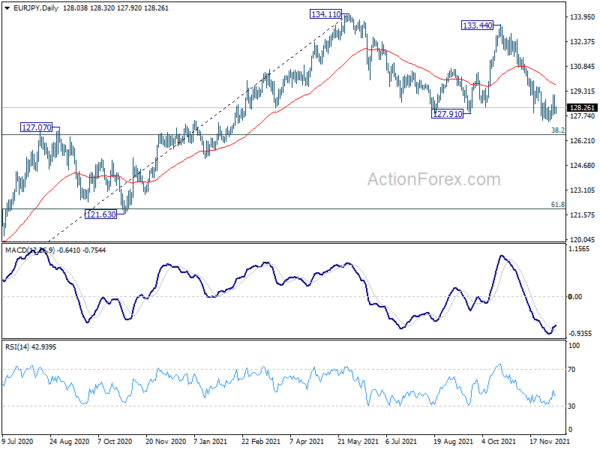

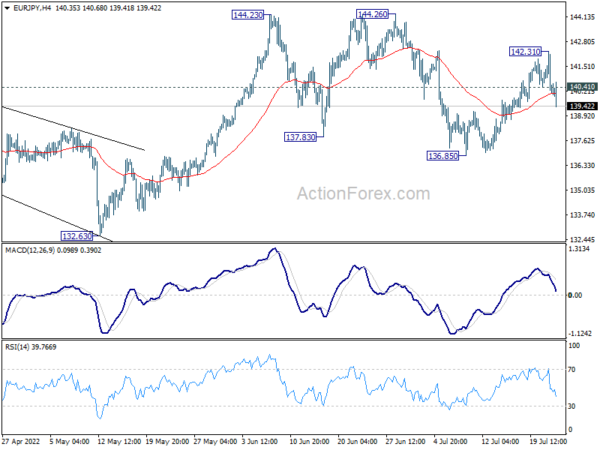

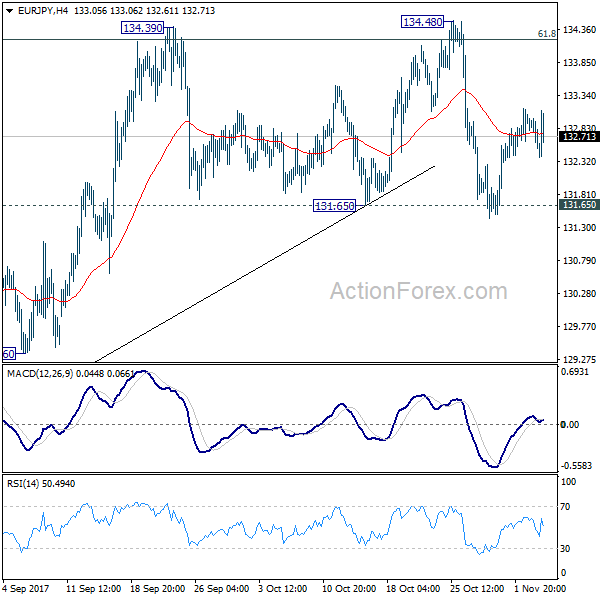

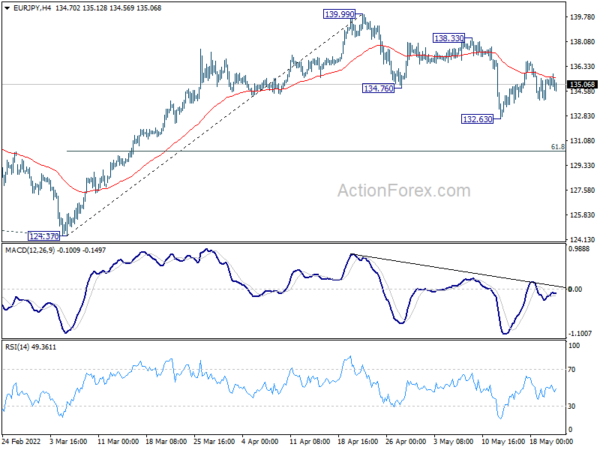

Daily Pivots: (S1) 131.45; (P) 131.98; (R1) 133.04; More….

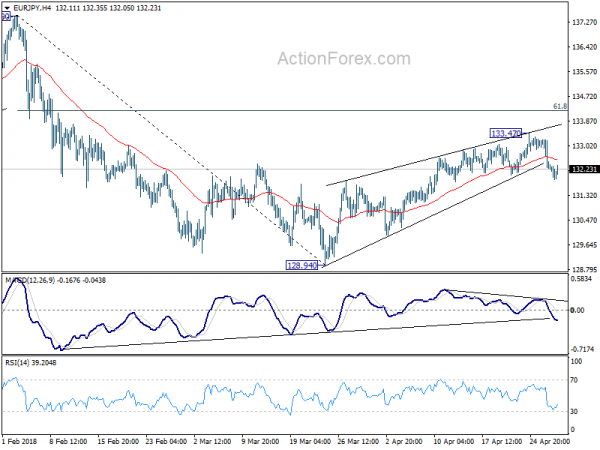

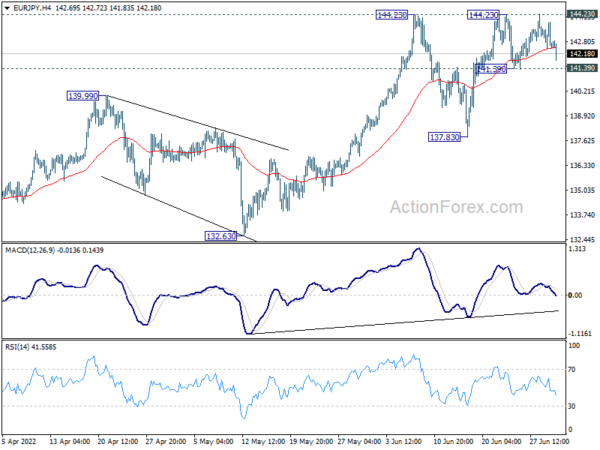

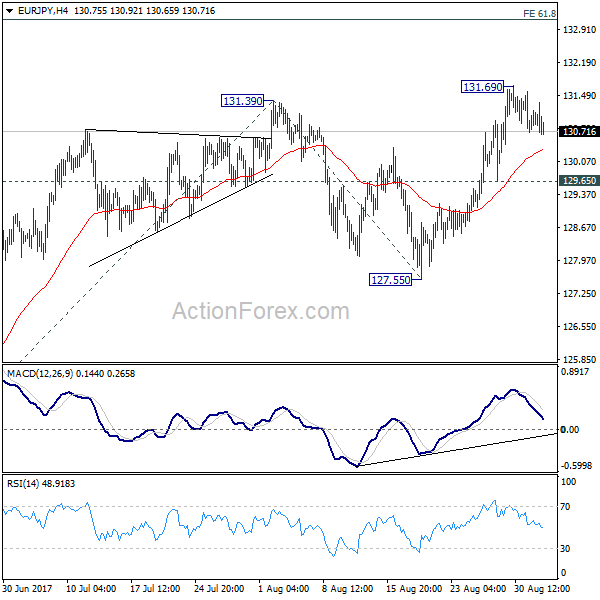

EUR/JPY’s rally extends to as high as 133.05 so far today and intraday bias stays on the upside. Break of key fibonacci resistance at 132.56 should confirmed that correction from 137.49 has completed. Further rally should be seen to retest this high. On the downside, below 132.22 minor support will turn intraday bias neutral to bring consolidation. But downside should be contained by 130.86 resistance turned support to bring another rally.

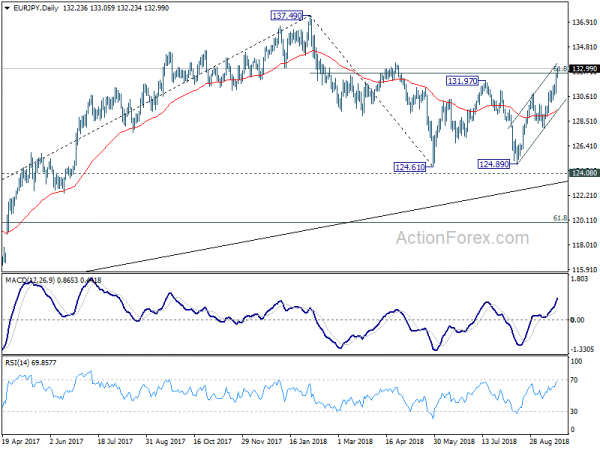

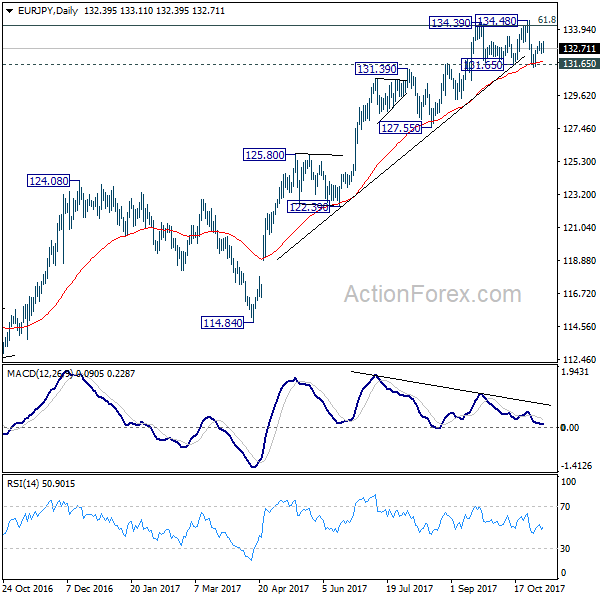

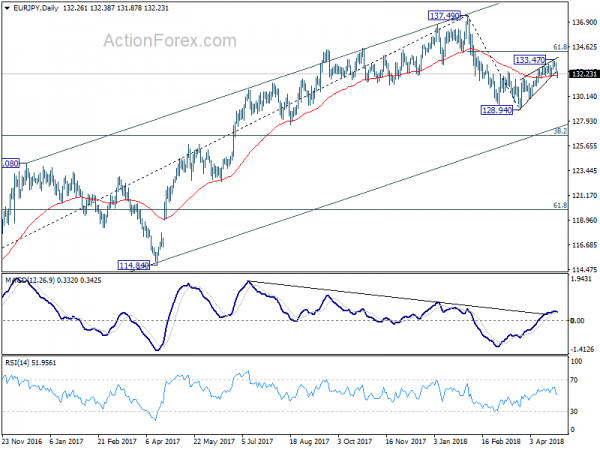

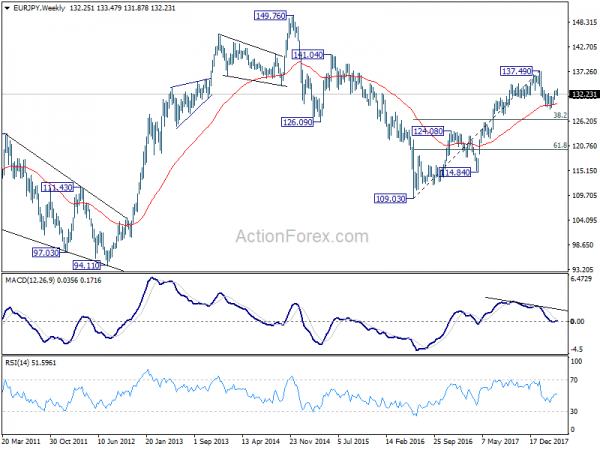

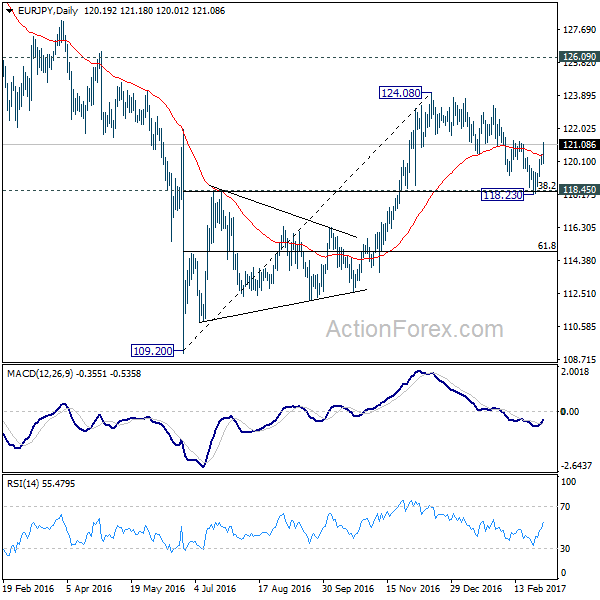

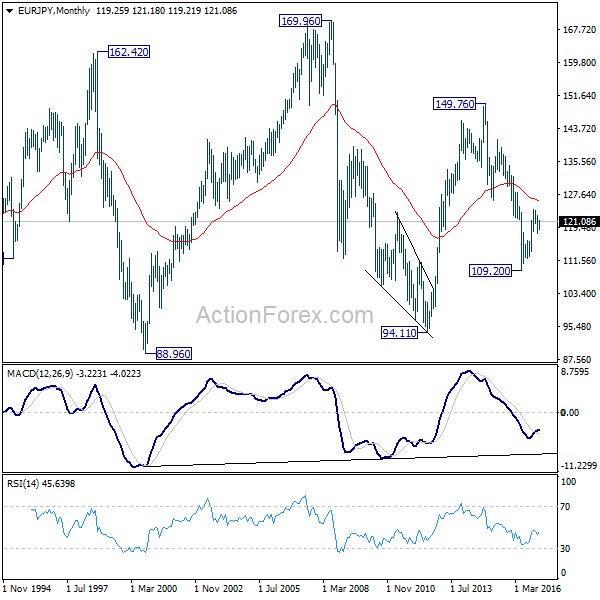

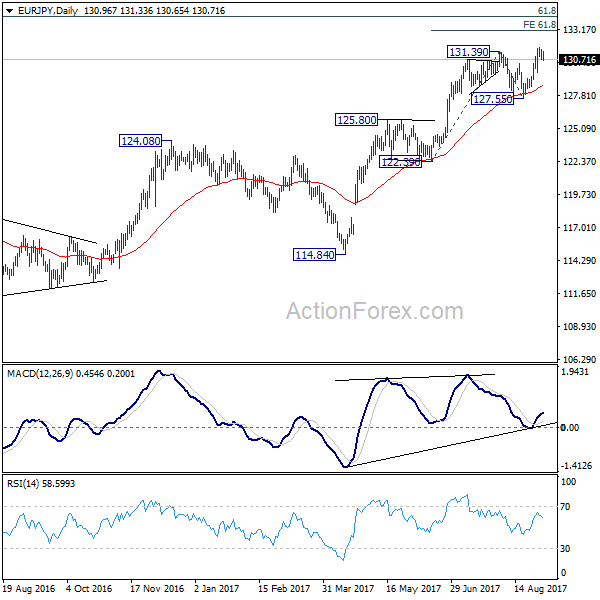

In the bigger picture, current development suggests that EUR/JPY has defended key support level of 124.08 key resistance turned support. And, the larger up trend from 109.03 (2016 low) is still in progress. Firm break of 137.49 will target 141.04/149.76 resistance zone next. This will now be the preferred case as long as 127.85 near term support holds.