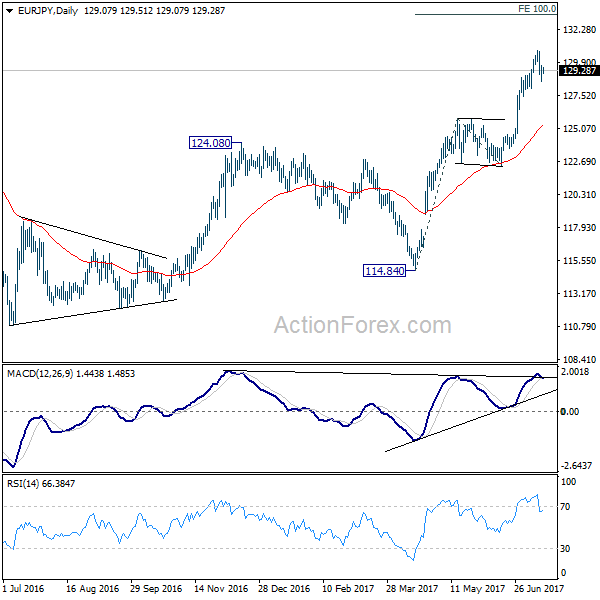

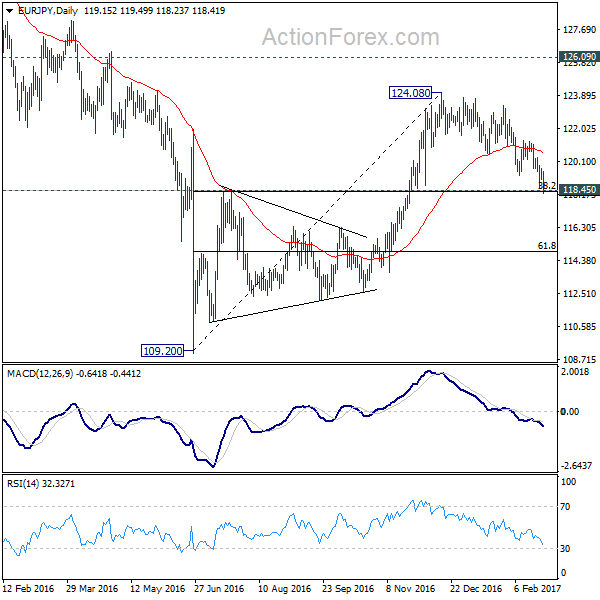

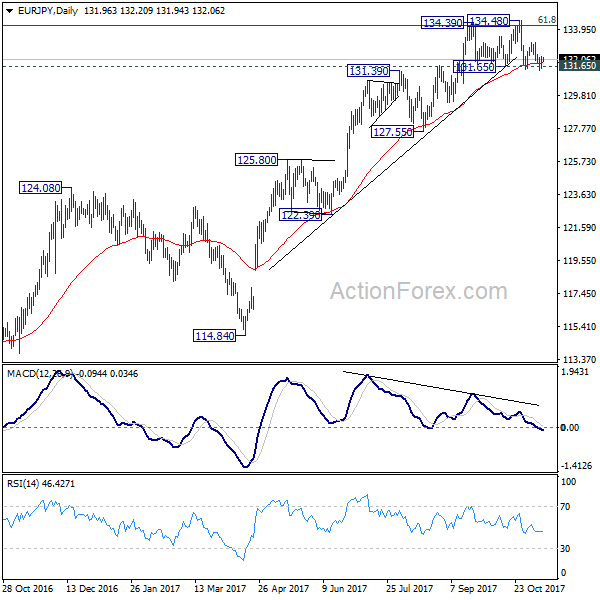

EUR/JPY edged lower to 114.84 last week but drew support from 114.88 fibonacci level and recovered. Upside of recovery is limited below 118.23 support turned resistance so far. Thus, the bearish outlook is maintained. That is, rebound from 109.20 has completed at 124.08. Fall from 124.08 would resume to retest 109.20 low.

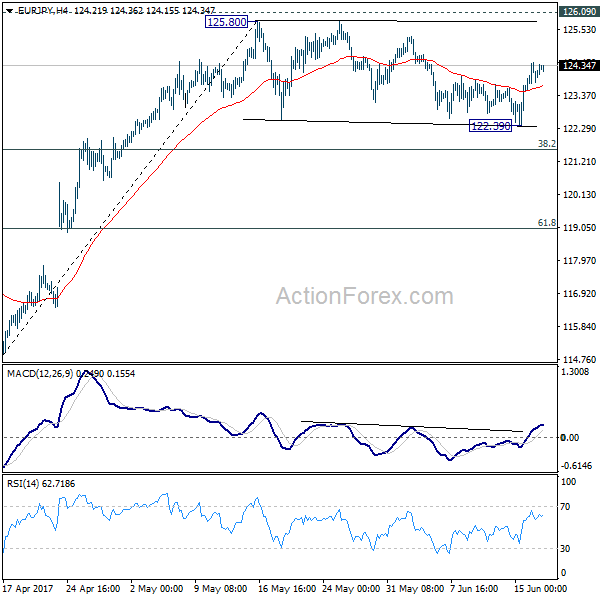

Initial bias in EUR/JPY remains neutral this week for consolidation above 114.84. Upside of recovery should be limited by 118.23 support turned resistance and bring another fall. Sustained break of 61.8% retracement of 109.20 to 124.08 at 114.88 will extend the decline from 124.08 to retest 109.20 low. However, firm break of 118.23 will indicate near term reversal and target 122.88 resistance instead.

In the bigger picture, medium term corrective rise from 109.20 should have completed at 124.08, ahead of 126.09 support turned resistance. Medium term down trend from 149.76 could be resuming. Break of 109.20 will target 94.11 low. In any case, break of 126.09 is needed needed to confirm medium term reversal. Otherwise, outlook will remain bearish in case of another rebound.

In the long term picture, medium term decline from 149.76 is seen as part of a long term sideway pattern from 88.96. Such decline is still in progress and could target 94.11 low. At this point, we’d look for loss of downside momentum above 94.11 to signal bottoming and reversal. This bearish view will hold as long as 126.09 resistance holds.