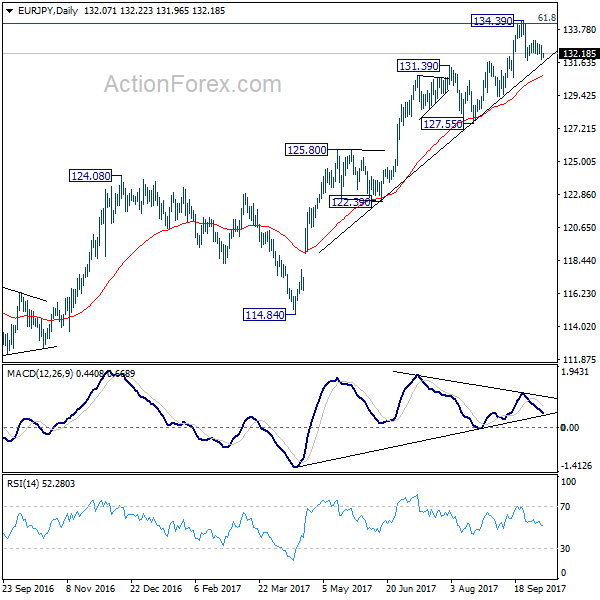

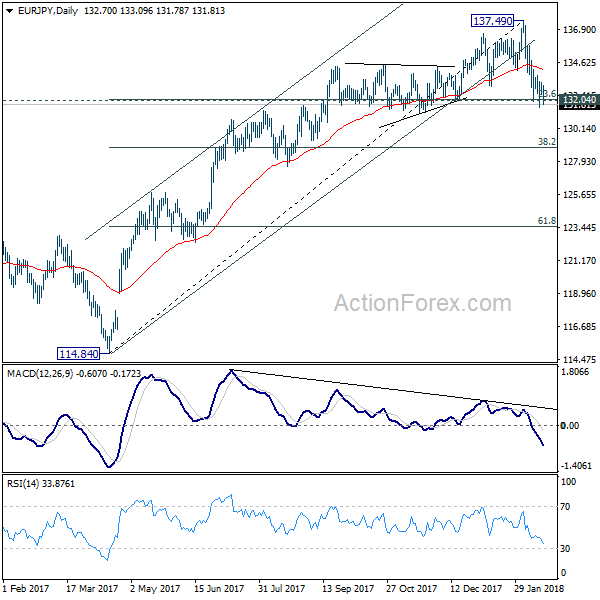

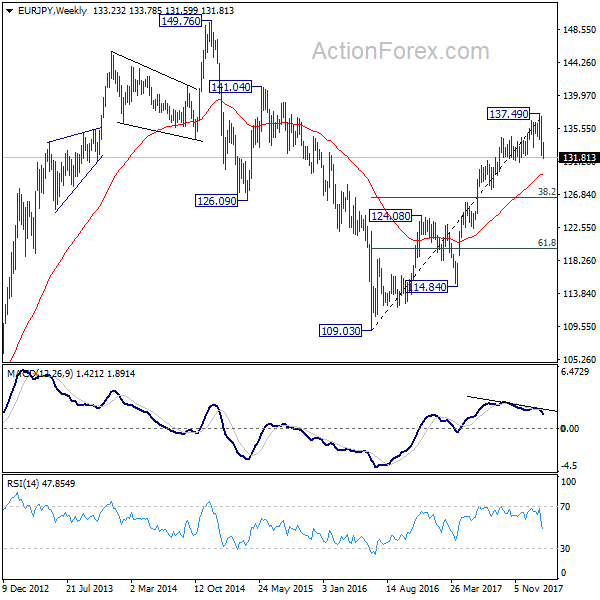

Daily Pivots: (S1) 131.70; (P) 132.24; (R1) 132.63; More…

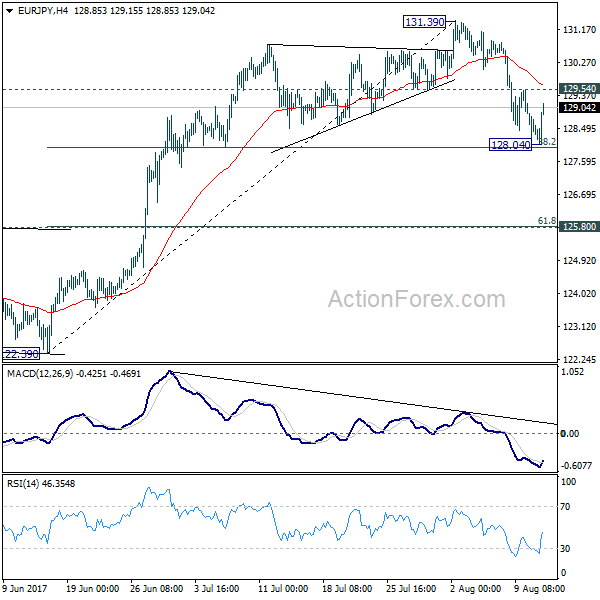

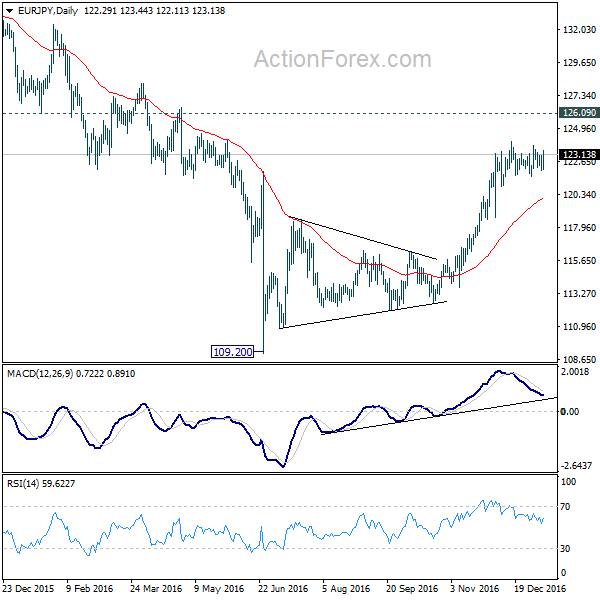

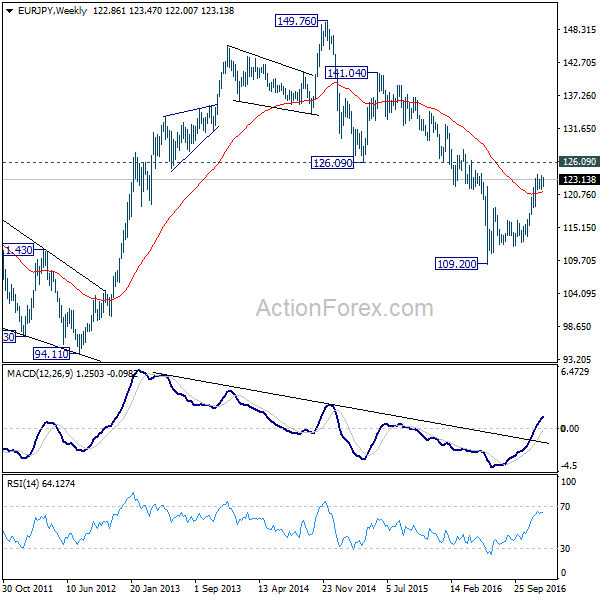

Intraday bias in EUR/JPY remains neutral for consolidative trading below 134.39 high. Near term outlook remains bullish as long as 131.69 holds. Sustained break of 134.20 fibonacci level will extend larger up trend to 141.04 resistance next. However, break of 131.69 will be an early sign of medium term reversal and will target 127.55 key support level instead.

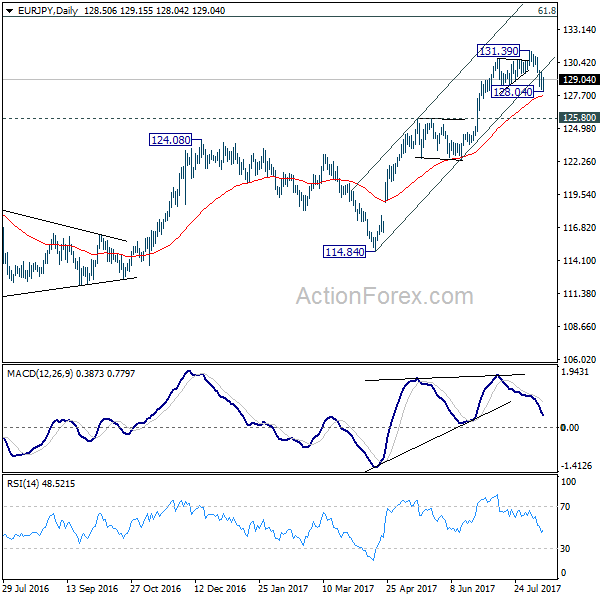

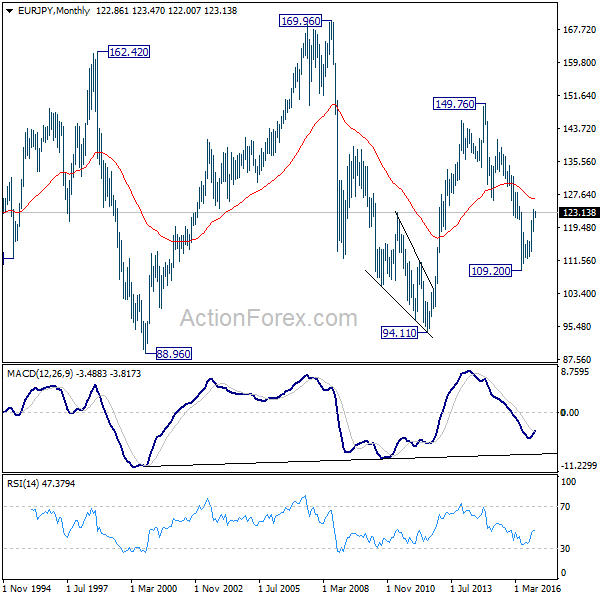

In the bigger picture, current rise from 109.03 is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). 61.8% retracement of 149.76 to 109.03 at 134.20 is already met. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. On the downside, break of 127.55 support is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bullish.