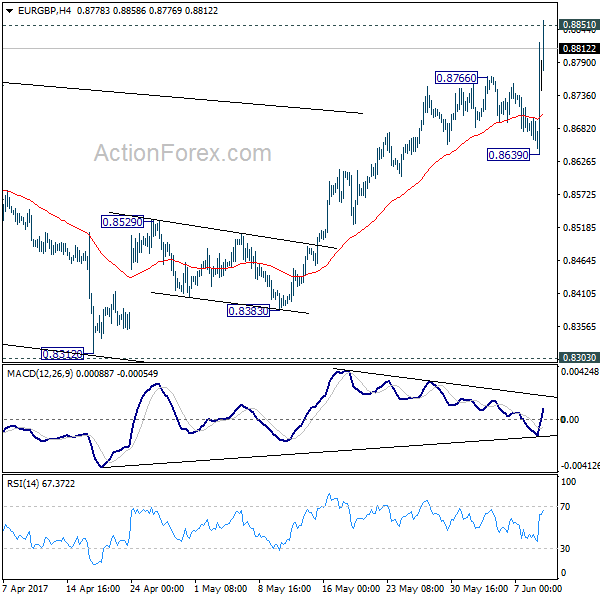

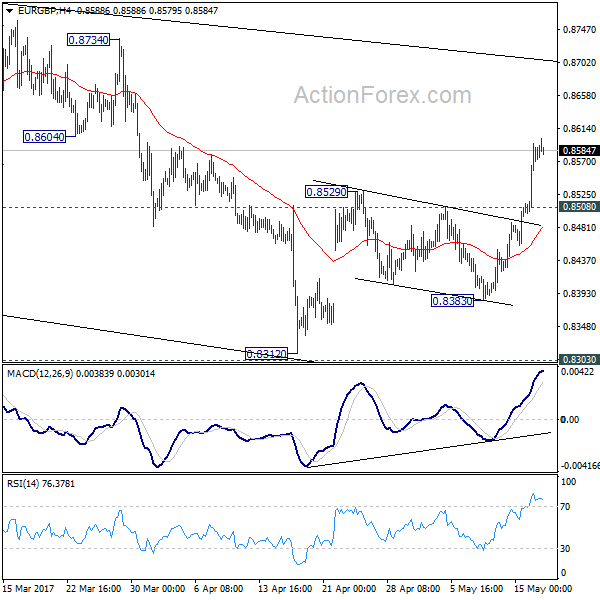

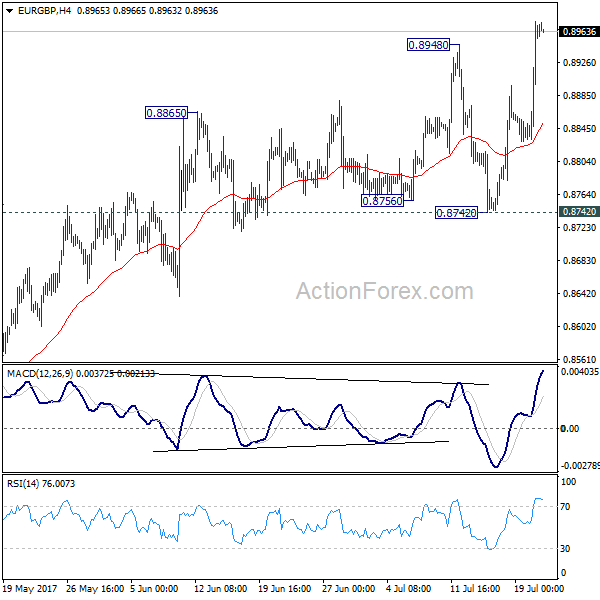

Daily Pivots: (S1) 0.8738; (P) 0.8752; (R1) 0.8761; More….

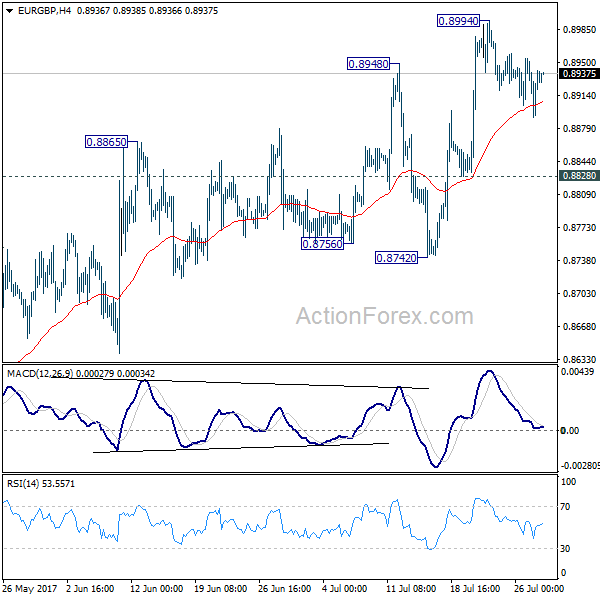

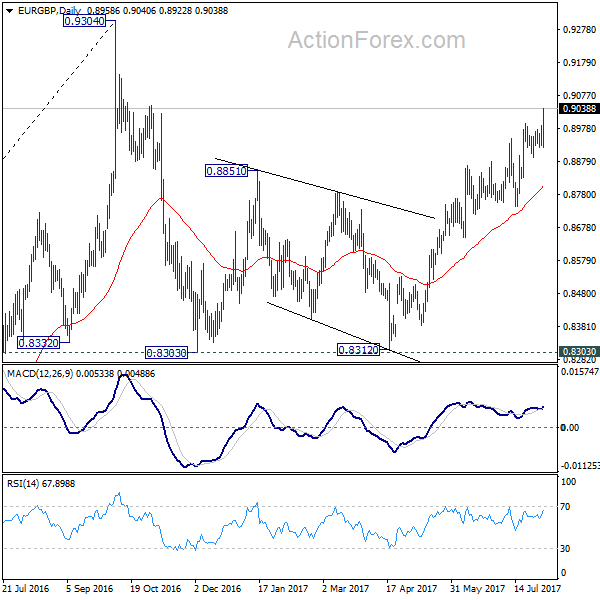

Further rally is expected in EUR/GBP as long as 0.8648 support holds. Current rise from 0.8491 should target 61.8% projection of 0.8491 to 0.8752 from 0.8648 at 0.8809. On the downside, break of 0.8687 support will indicate short term topping, and turn bias back to the downside.

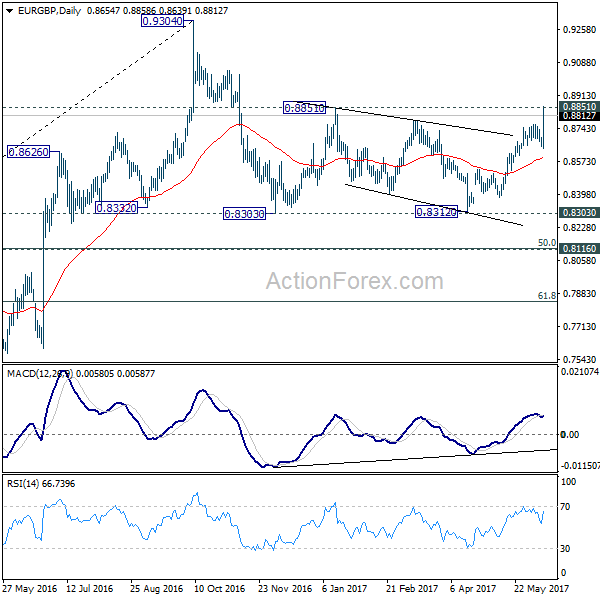

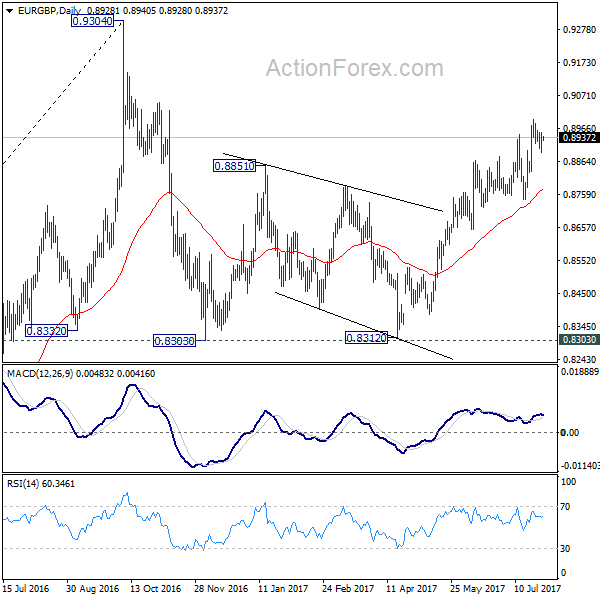

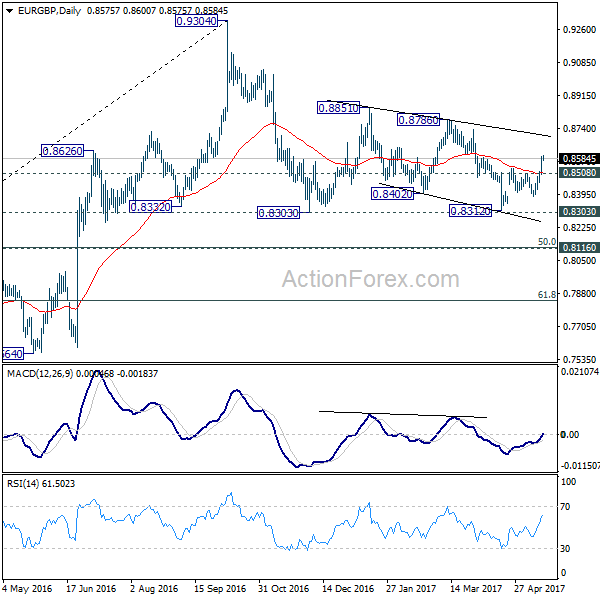

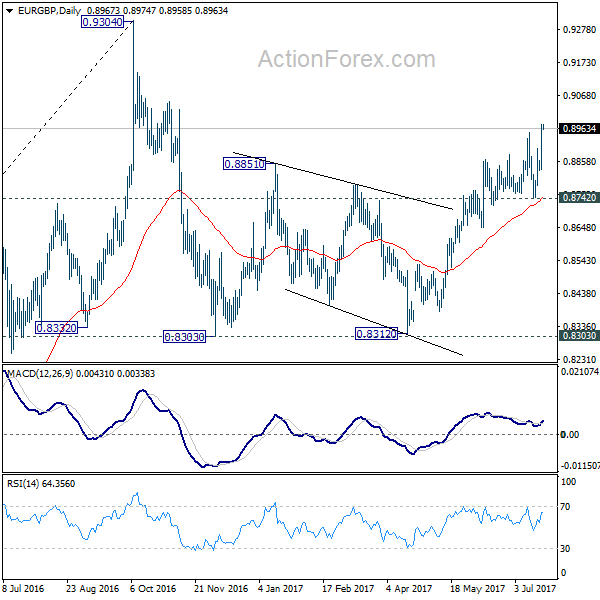

In the bigger picture, down trend from 0.9267 (2022 high) should have completed completed with three down to to 0.8491. Rise from 0.8491 is seen as another leg inside that pattern from 0.9499 (2020 high). Further rally should be seen to 0.8977 resistance and above. This will remain the favored case as long as 0.8648 support holds.