Daily Pivots: (S1) 0.8447; (P) 0.8457; (R1) 0.8468; More…

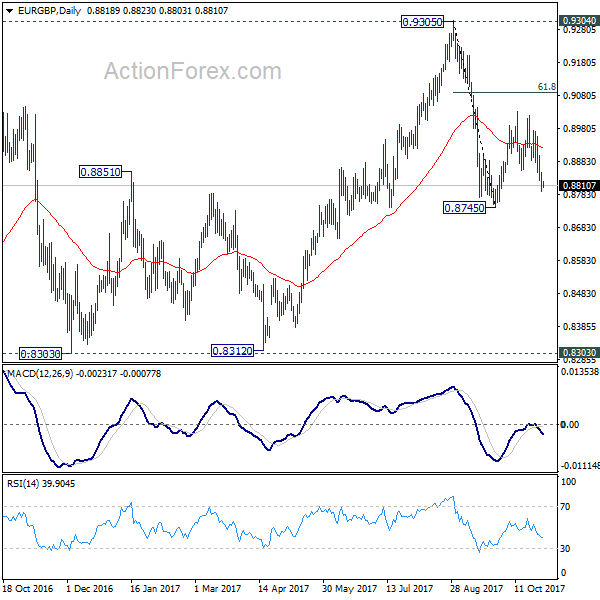

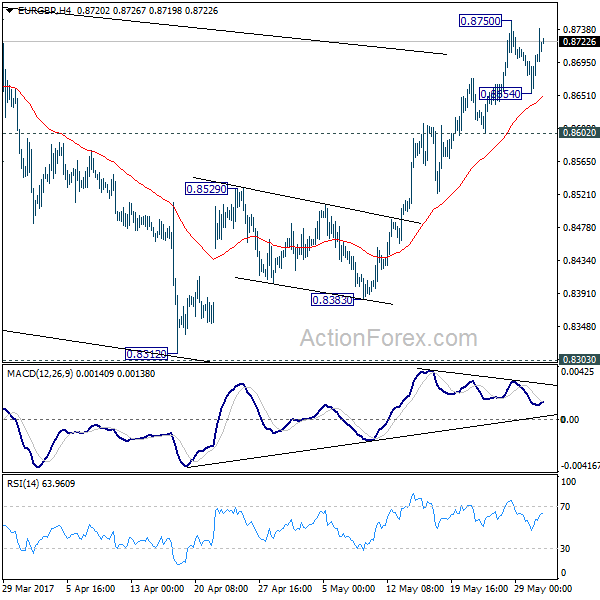

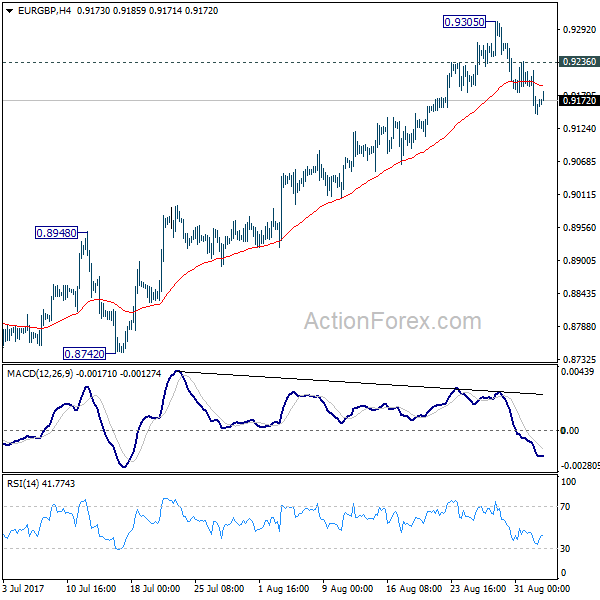

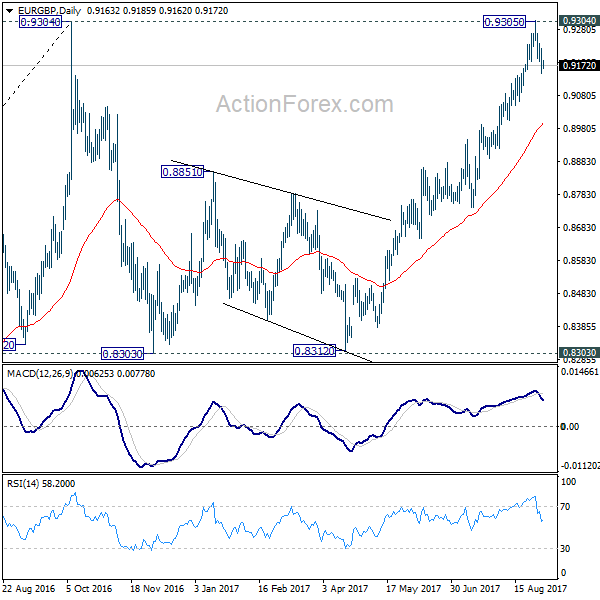

Focus is back on 0.8487 in EUR/GBP/ Break will suggests that corrective rise from 0.8276 is extending with another rising leg. Intraday bias will be turned back to the upside for 0.8595 resistance and above. But upside should be limited by 38.2% retracement of 0.9324 to 0.8276 at 0.8676. On the downside, below 0.8386 will turn bias back to the downside for retesting 0.8276 low.

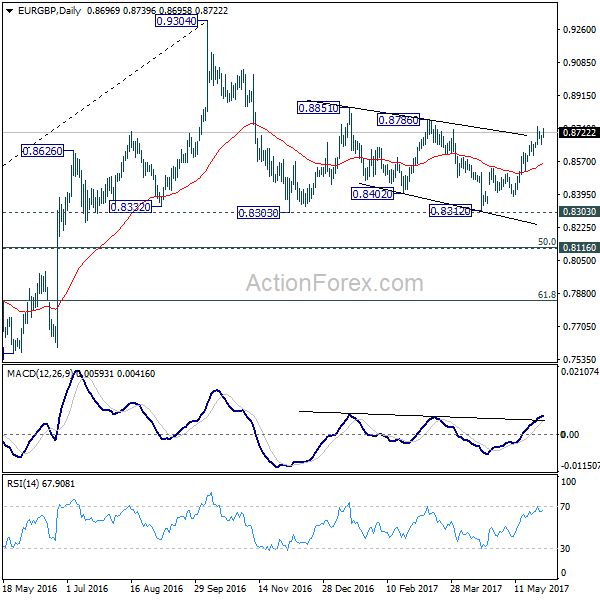

In the bigger picture, decline from 0.9324 medium term top is till in progress. As long as 0.8786 support turned resistance holds, further fall is expected to 61.8% retracement of 0.6935 to 0.9324 at 0.7848. Nevertheless, break of 0.8786 will argue that fall from 0.9324 has completed and turn focus back to this high.