Daily Pivots: (S1) 0.8421; (P) 0.8444; (R1) 0.8457; More….

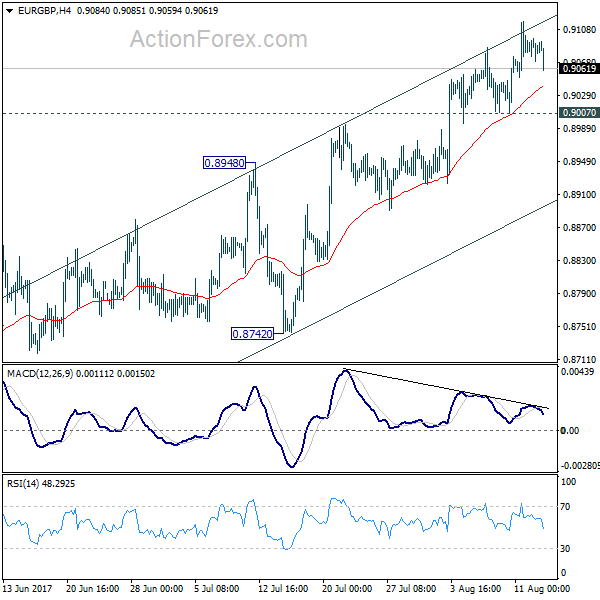

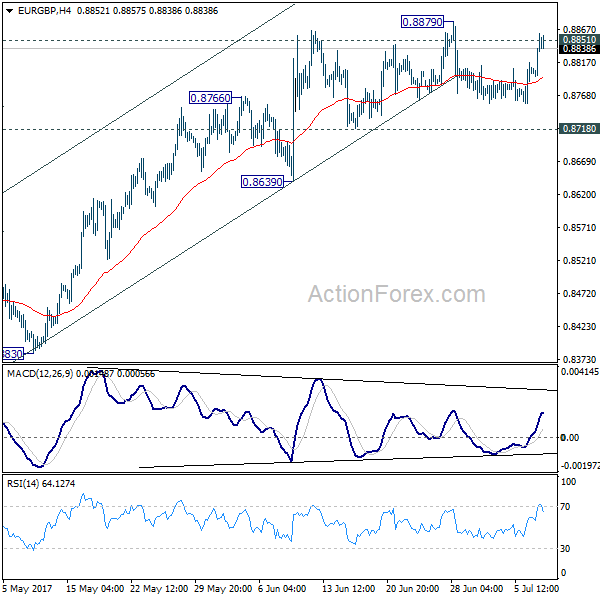

EUR/GBP’s fall from 0.8624 is still in progress, and intraday bias stays on the downside for retesting 0.8382 low. Strong support could be seen from there to bring rebound on first attempt. Above 0.8474 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 55 D EMA (now at 0.8492) holds. Firm break of 0.8382 will confirm larger down trend resumption.

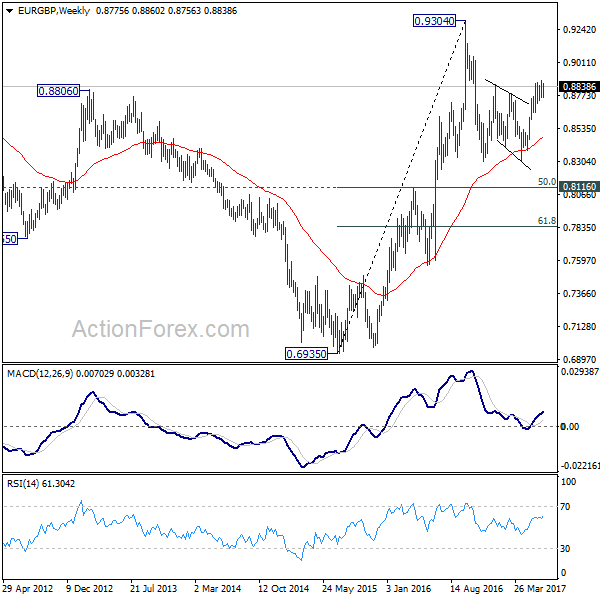

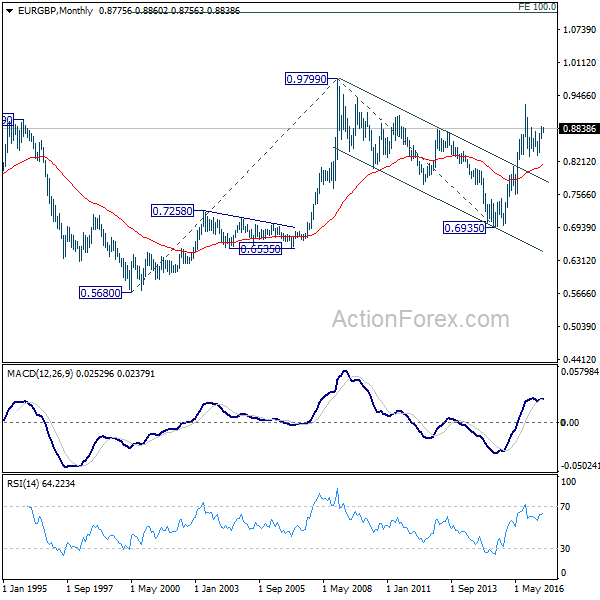

In the bigger picture, while the rebound from 0.8382 is strong, there is no confirmation of trend reversal yet. As long as 0.8643 resistance holds, down trend from 0.9267 could still resume through 0.8382 at a later stage towards 0.8201 (2022 low). However, firm break of 0.8643 will indicate that such down trend has completed, and turn outlook bullish for 0.8764 resistance next.