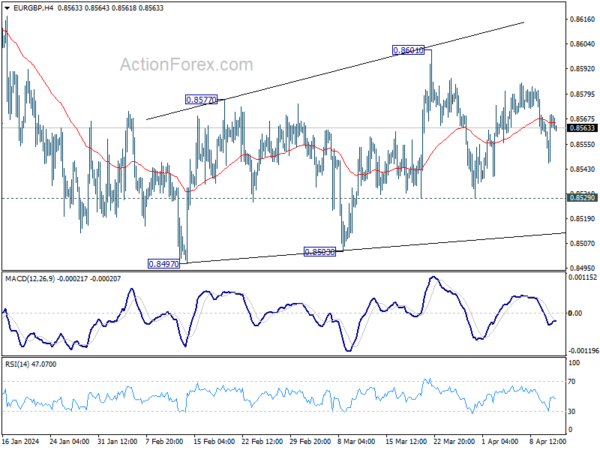

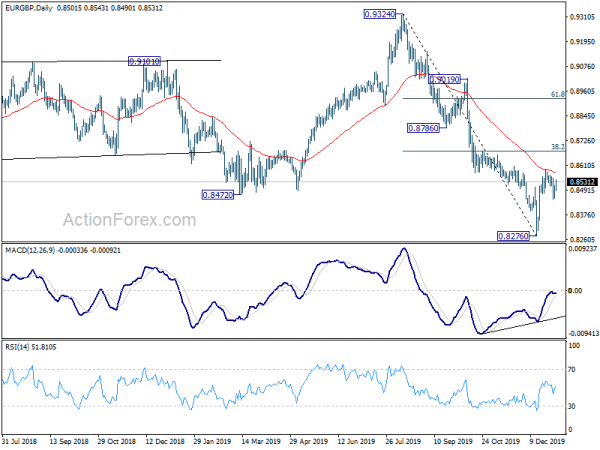

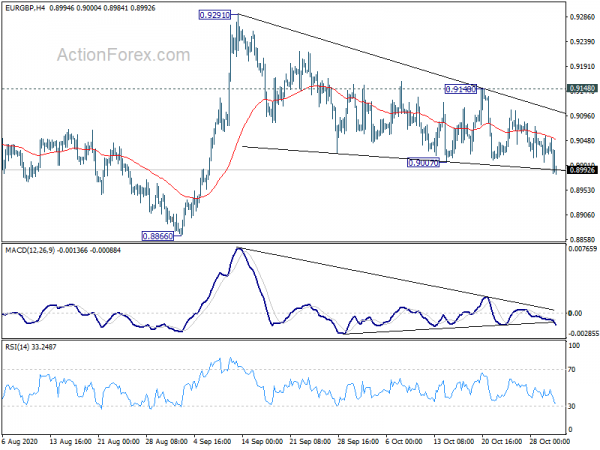

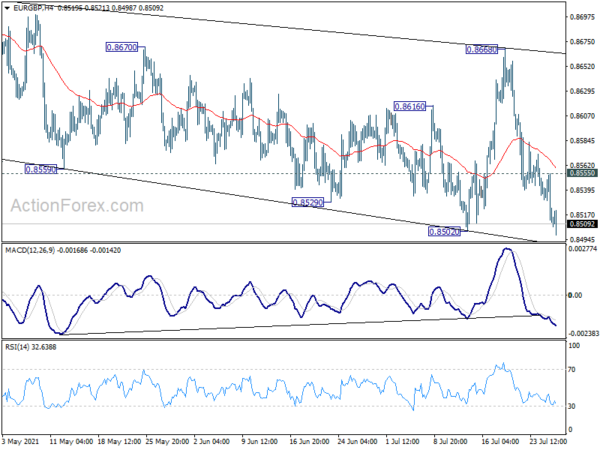

Daily Pivots: (S1) 0.8552; (P) 0.8562; (R1) 0.8576; More…

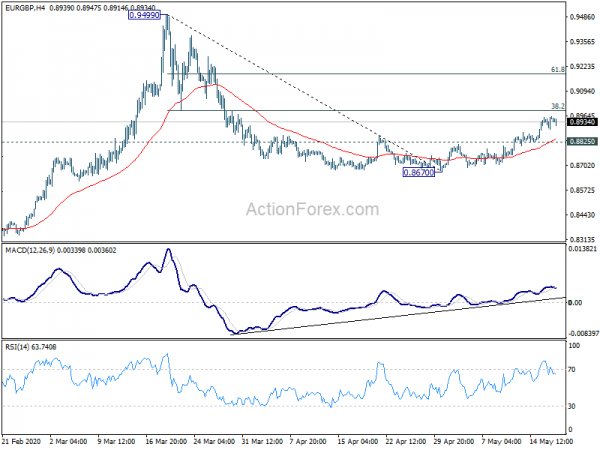

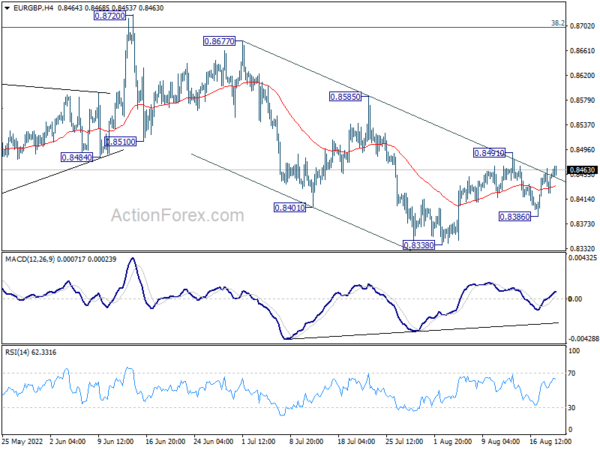

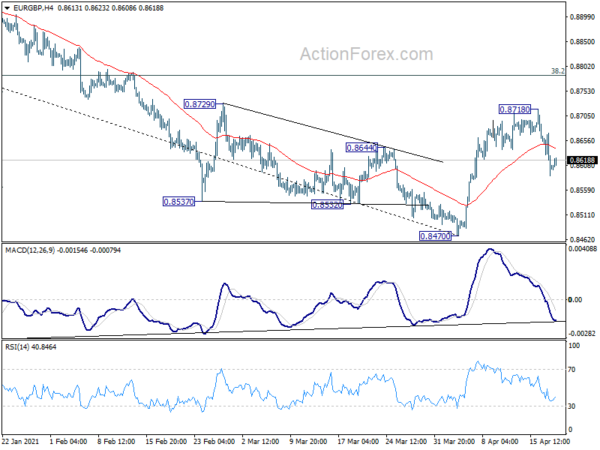

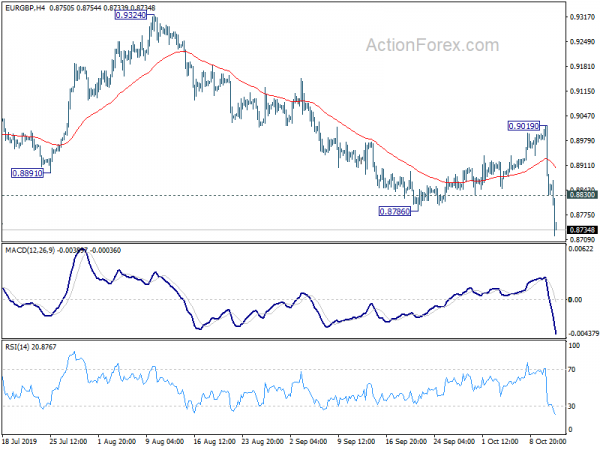

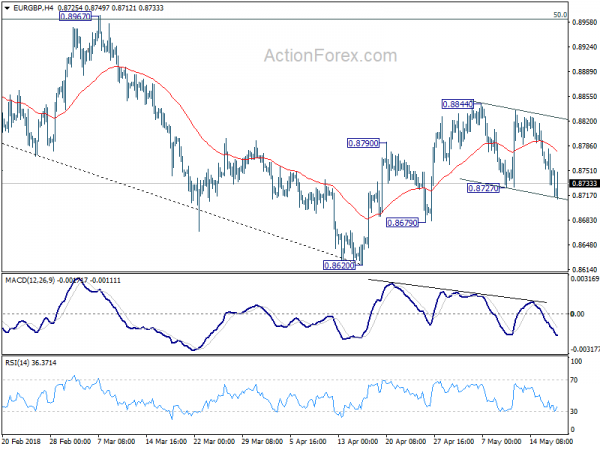

Intraday bias in EUR/GBP remains neutral for the moment, as range trading continues. On the downside, firm break of 0.8529 support will argue that the corrective recovery from 0.8497 has completed at 0.8601. Intraday bias will be back on the downside for retesting 0.8497 low next. On the upside, break of 0.8601 will resume the rebound instead.

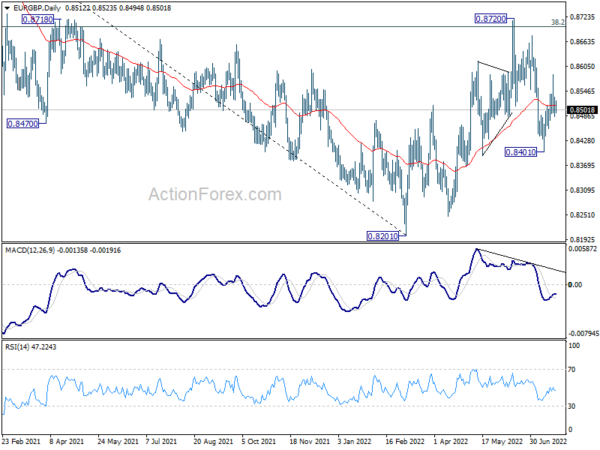

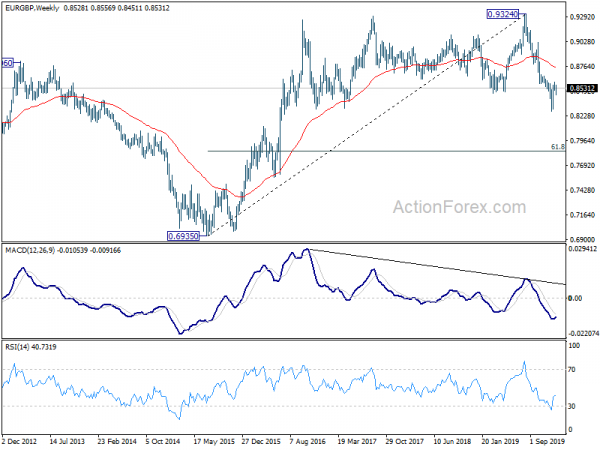

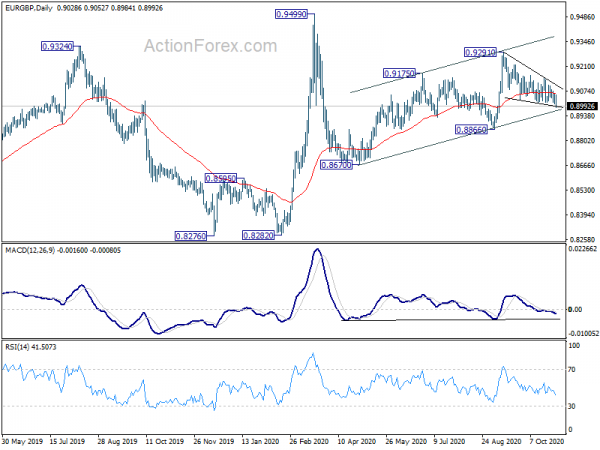

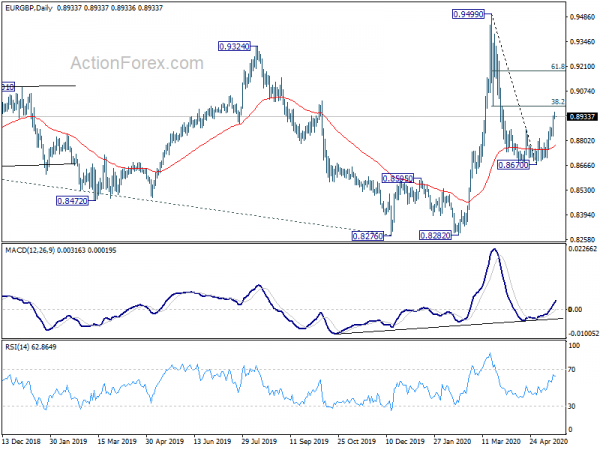

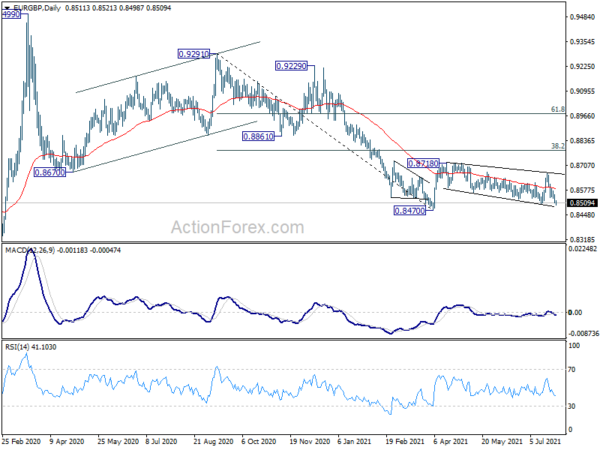

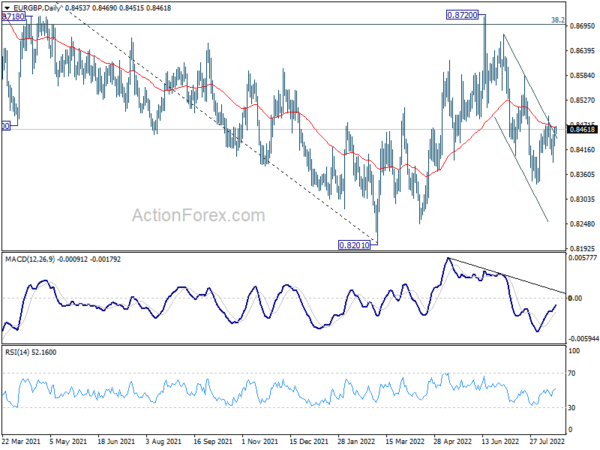

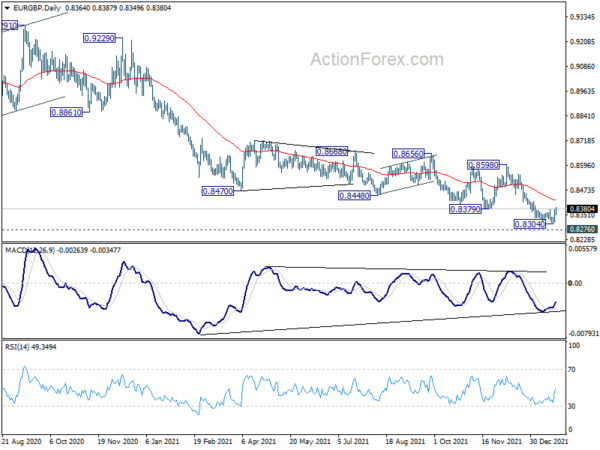

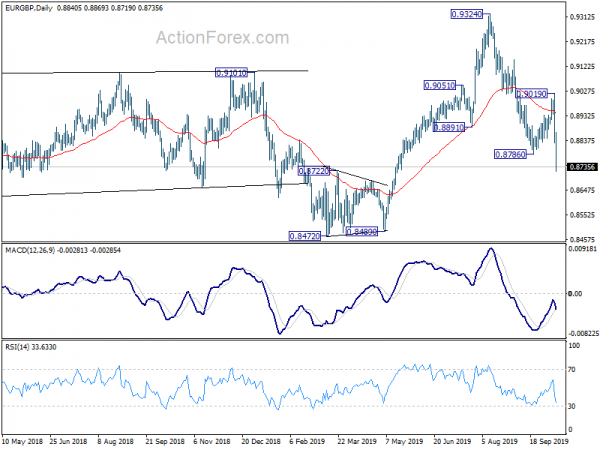

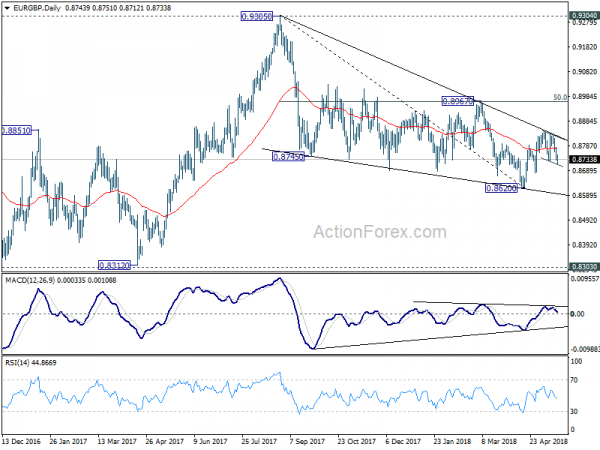

In the bigger picture, there is no clear sign that down trend from 0.9267 has completed, despite loss of downside momentum as seen in D MACD. As long as 0.8713 resistance holds, the down trend will remain in favor to resume through 0.8491 low at la later stage.