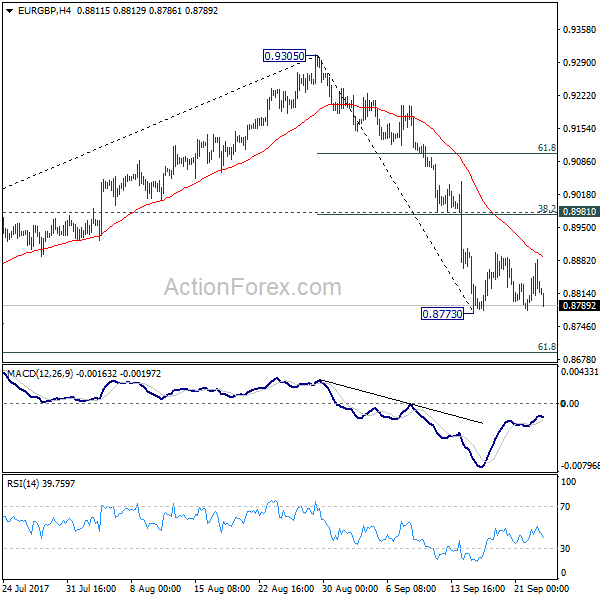

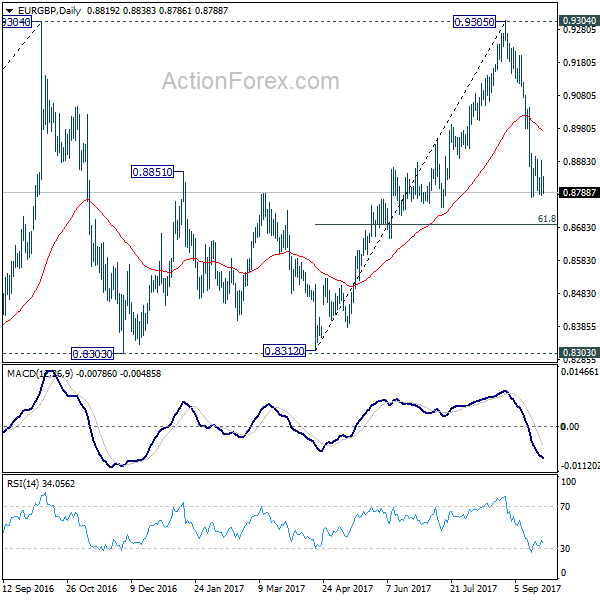

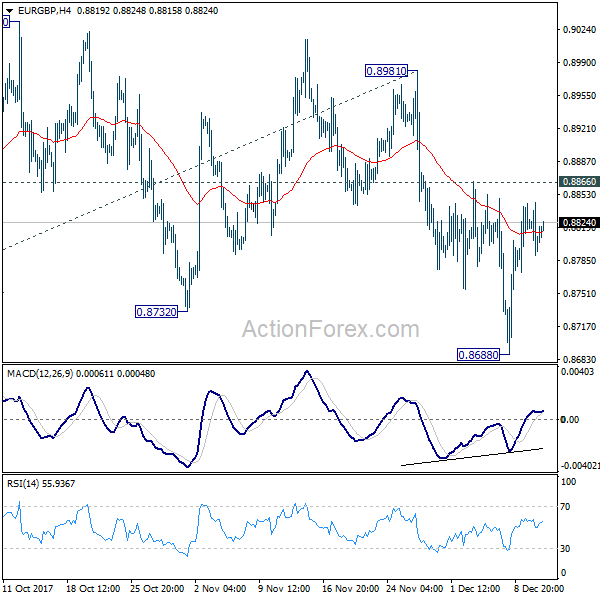

Daily Pivots: (S1) 0.8864; (P) 0.8884; (R1) 0.8918; More…

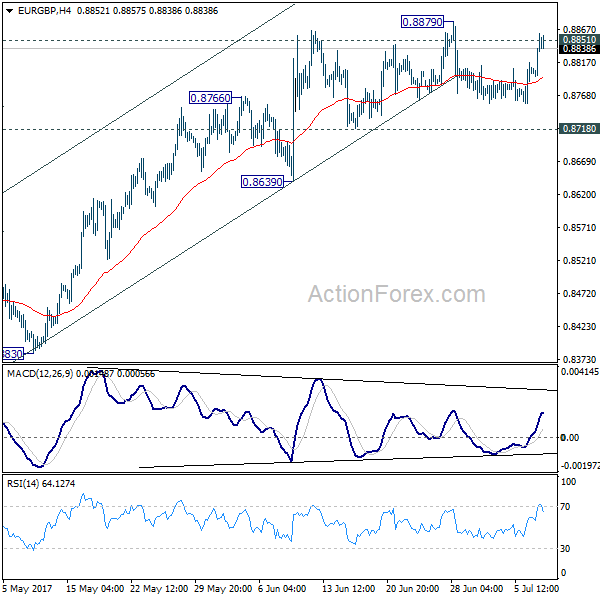

Intraday bias in EUR/GBP remains neutral as consolidation form 0.8902 is in progress. Another fall cannot be ruled out but downside should be contained well above 0.8681 resistance turned support to bring rally resumption. On the upside, break of 0.8902 will turn bias back to the upside and target 0.9101 key resistance next.

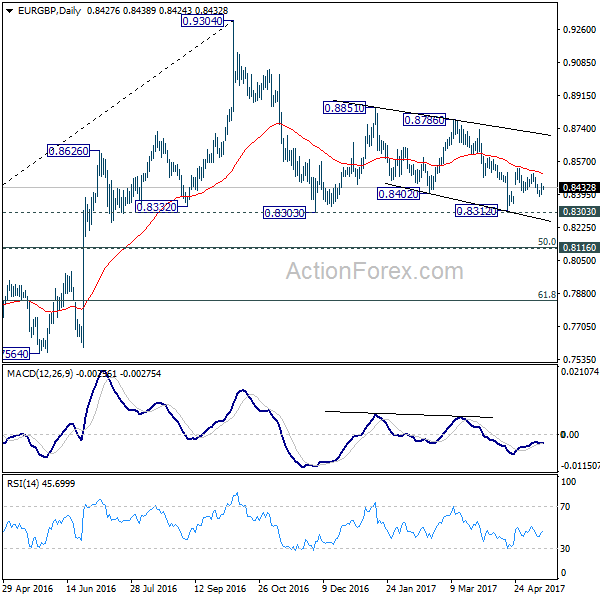

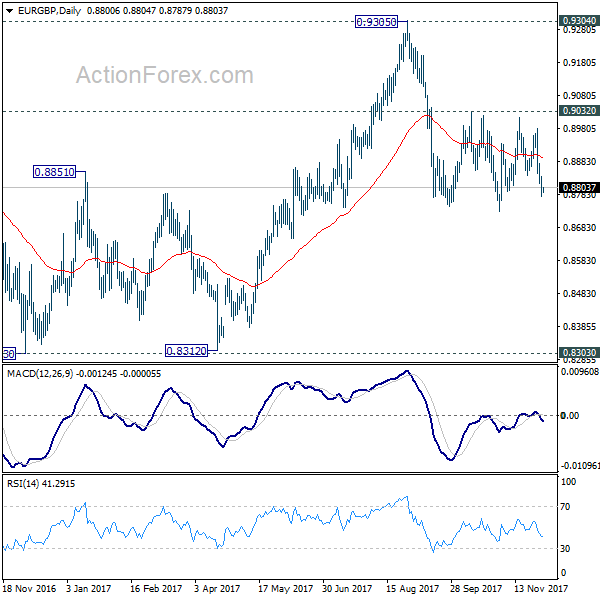

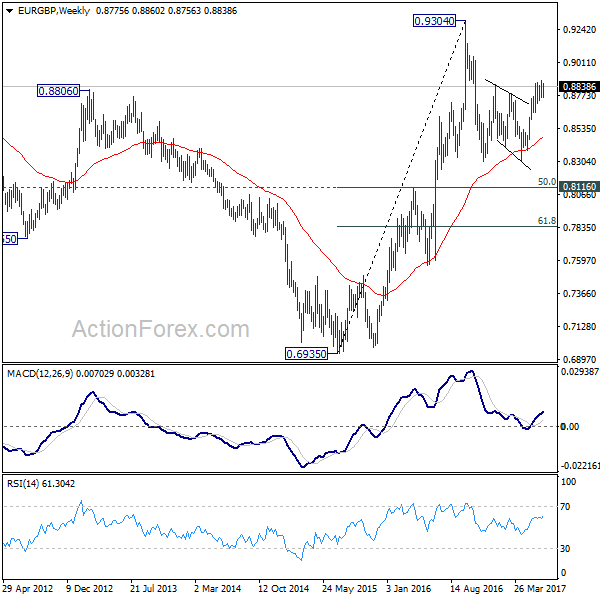

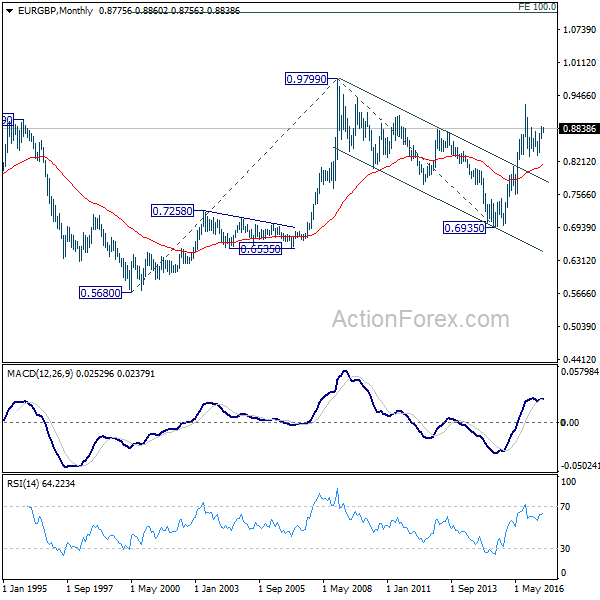

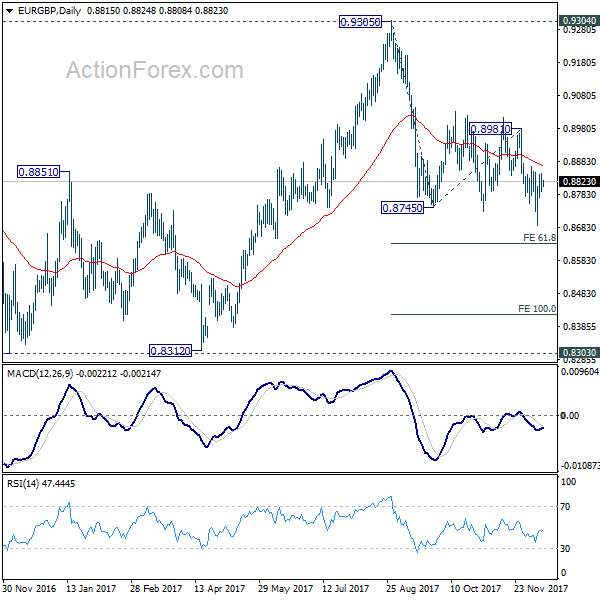

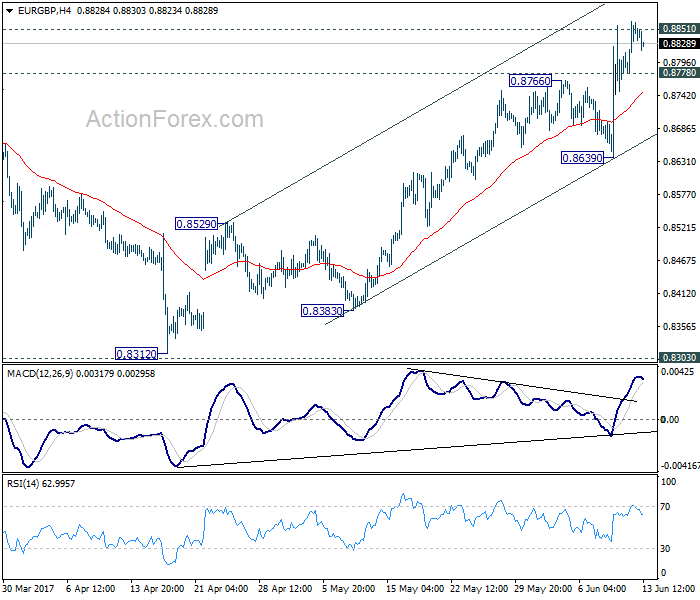

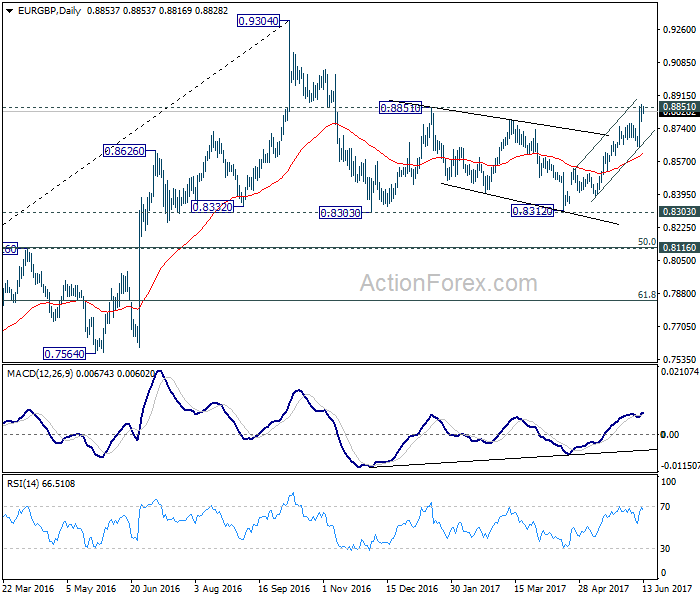

In the bigger picture, medium term decline from 0.9305 (2017 high) is seen as a corrective move. No change in this view. Current development argues that it might have completed with three waves down to 0.8472, just ahead of 38.2% retracement of 0.6935 (2015 low) to 0.9306 at 0.8400, after hitting 55 month EMA (now at 0.8526). Decisive break of 0.9101 resistance will confirm this bullish case. Nevertheless, as EUR/GBP is still staying inside long term falling channel, correction from 0.9305 could still extend to 0.8400 fibonacci level before completion, if upside is rejected by 0.9101.