Daily Pivots: (S1) 0.8582; (P) 0.8600; (R1) 0.8615; More…

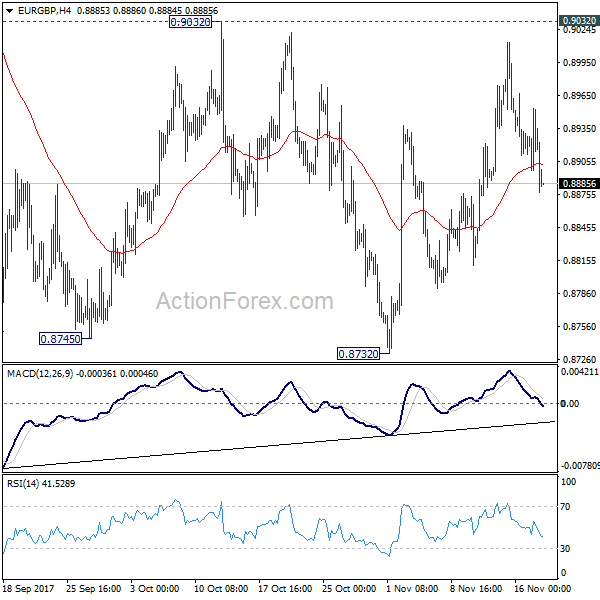

Intraday bias in EUR/GBP remains neutral at this point. On the downside, below 0.8559 will target a test on 0.8470 low. On the upside, though, break of 0.8718 will resume the rebound from 0.8470 to 38.2% retracement of 0.9291 to 0.8470 at 0.8784.

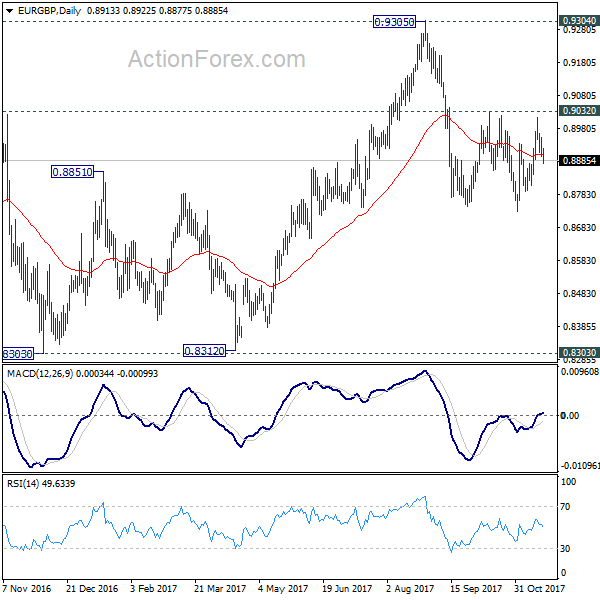

In the bigger picture, we’re seeing the price actions from 0.9499 as developing into a corrective pattern. That is, up trend from 0.6935 (2015 low) would resume at a later stage. This will remain the favored case as long as 0.8276 support holds. However, firm break of 0.8276 support will suggest that rise from 0.6935 has completed and turn medium term outlook bearish.