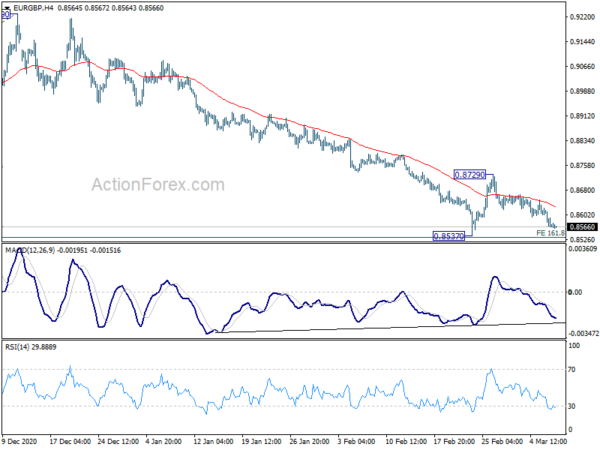

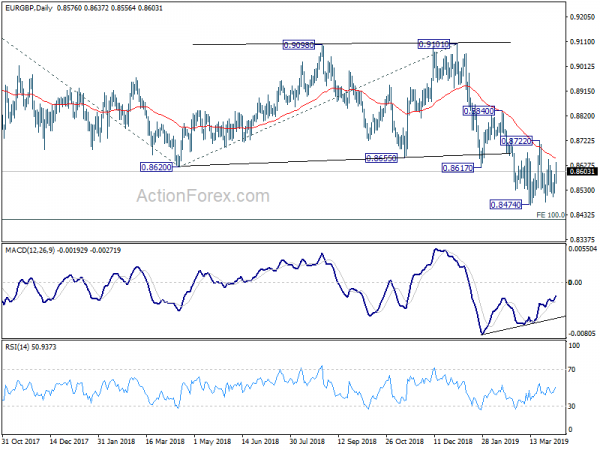

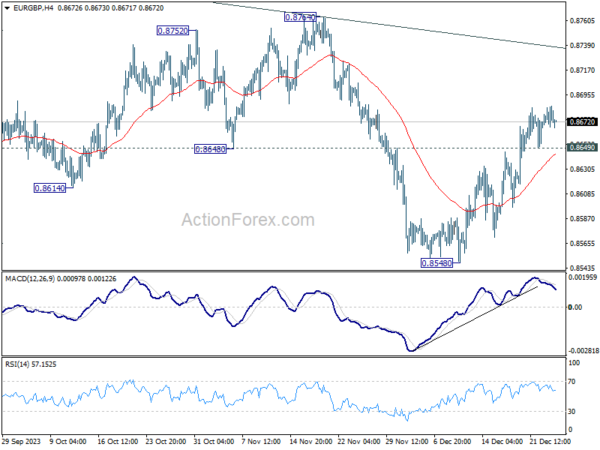

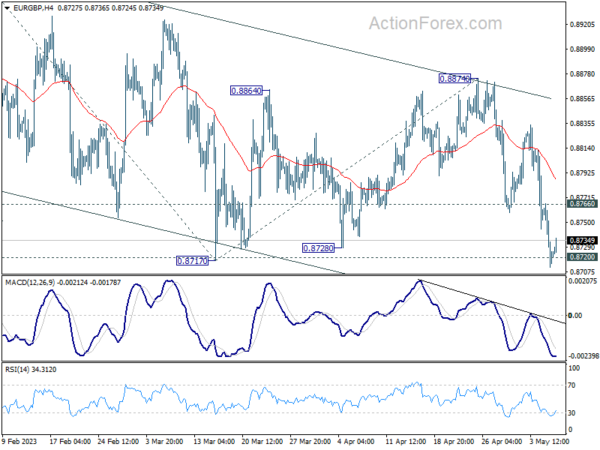

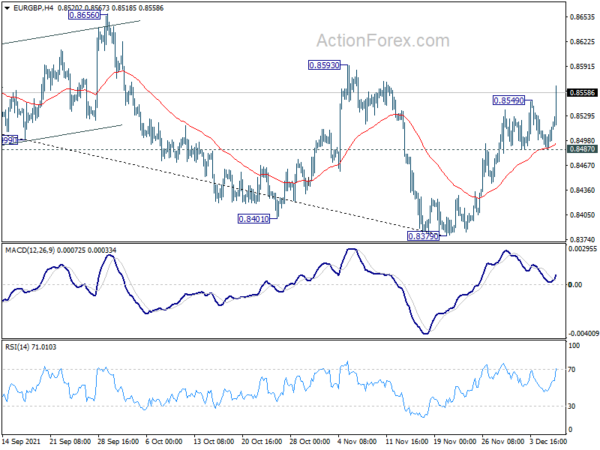

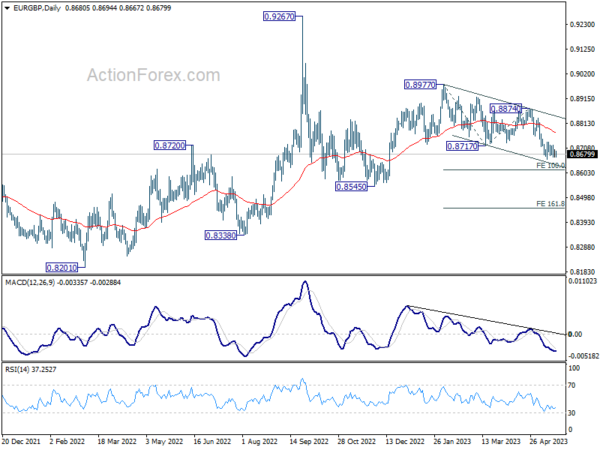

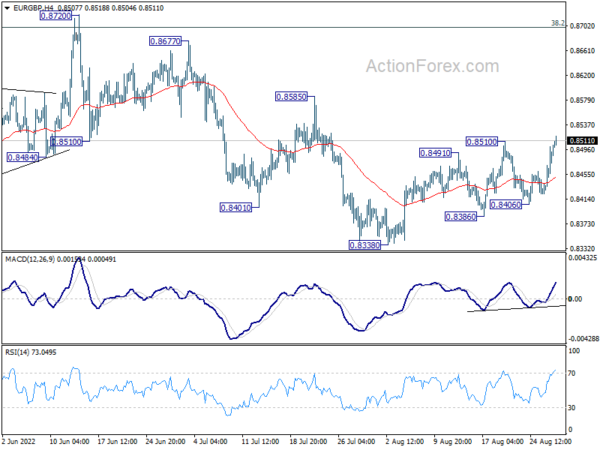

Daily Pivots: (S1) 0.8550; (P) 0.8588; (R1) 0.8609; More…

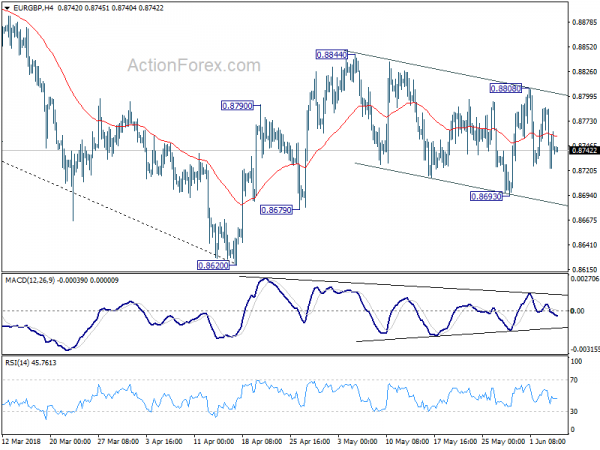

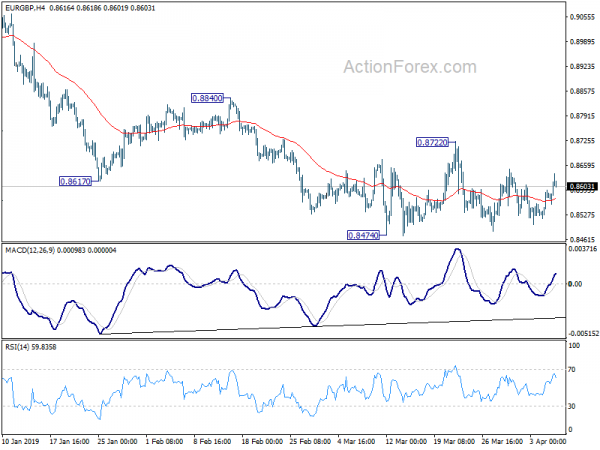

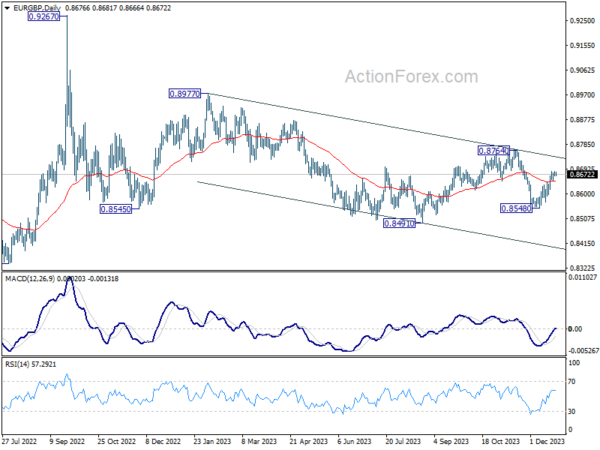

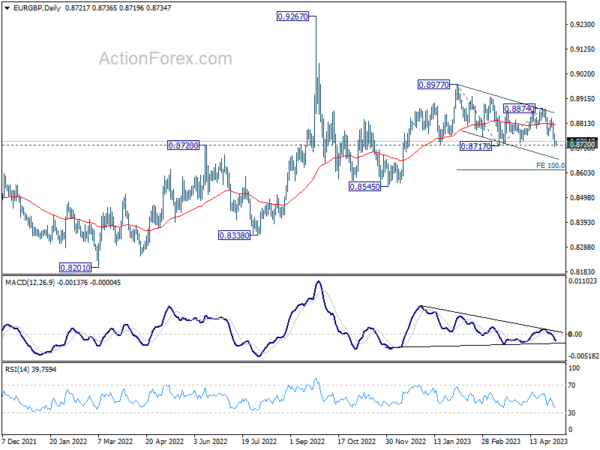

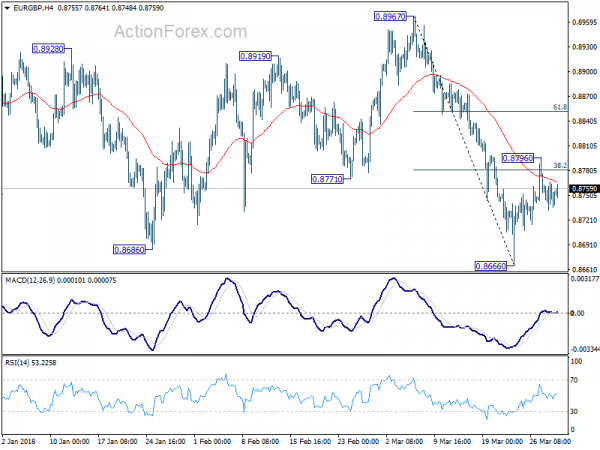

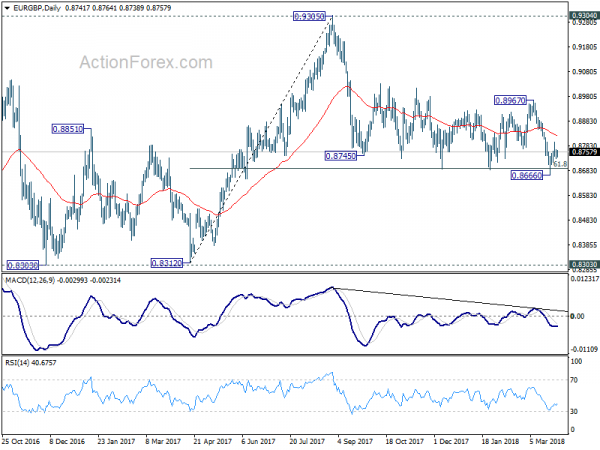

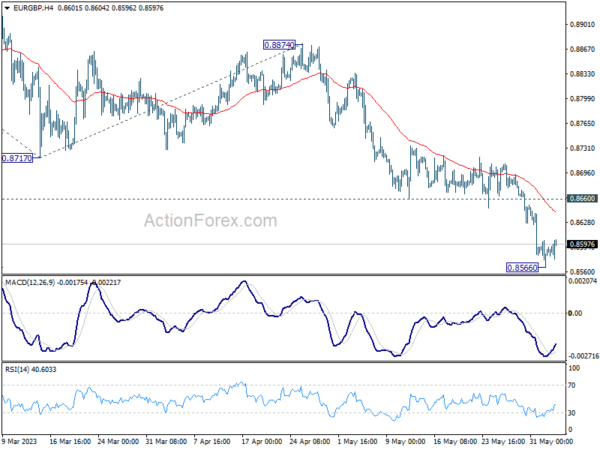

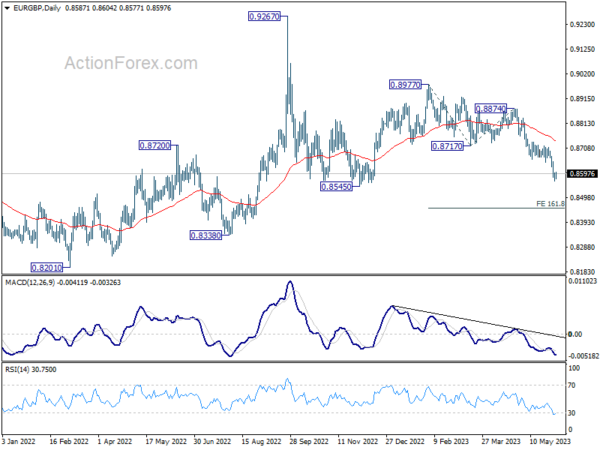

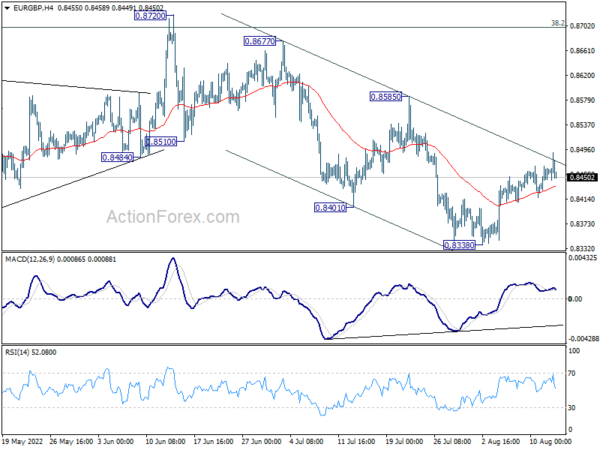

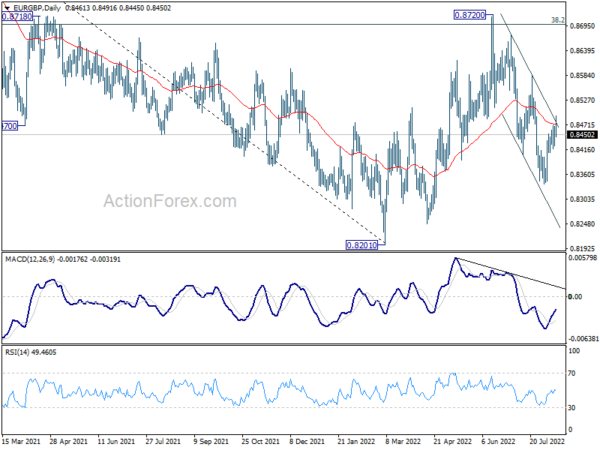

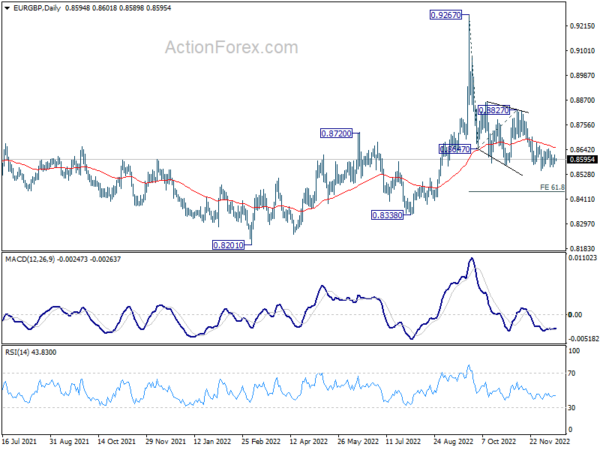

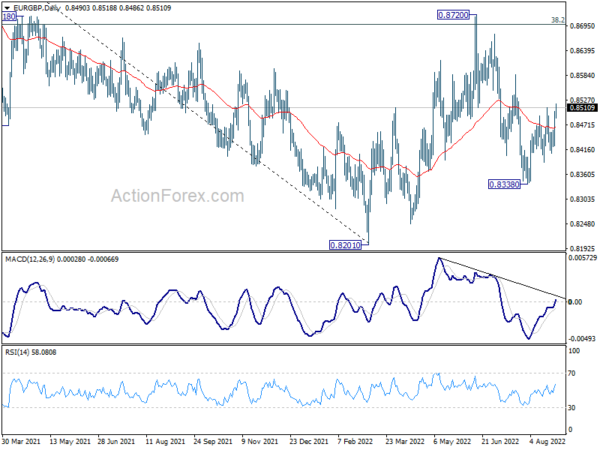

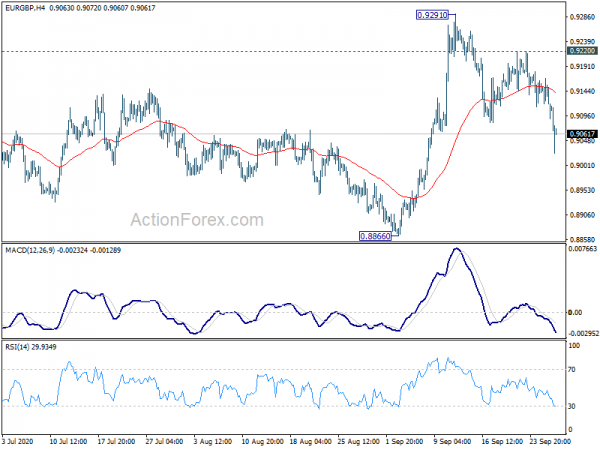

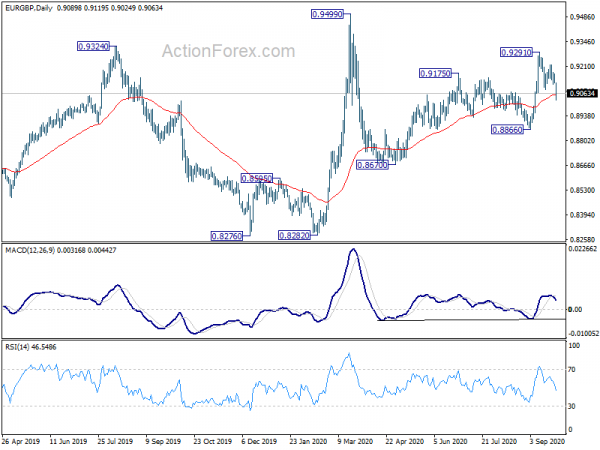

EUR/GBP is staying in range of 0.8537/8729 and intraday bias remains neutral first. On the upside, break of 0.8279 will resume the rebound from 0.8537 and target 55 day EMA (now at 0.8790). However, firm break of 0.8537 will resume the decline towards 0.8276 key support.

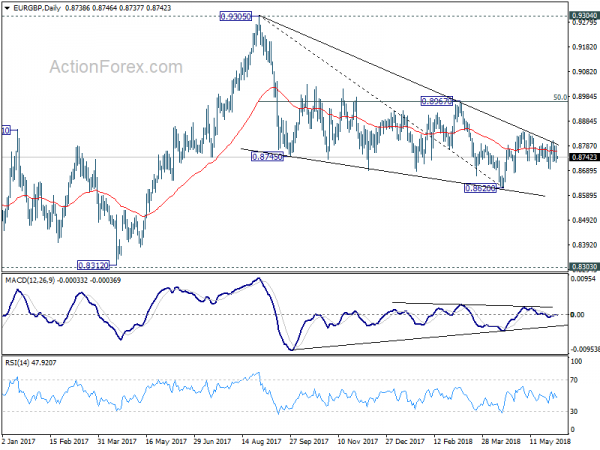

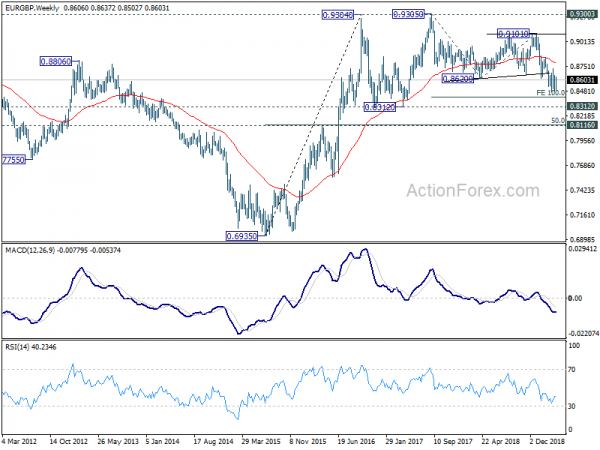

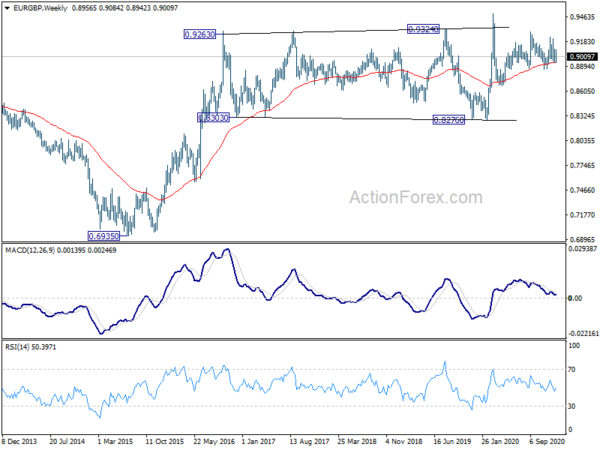

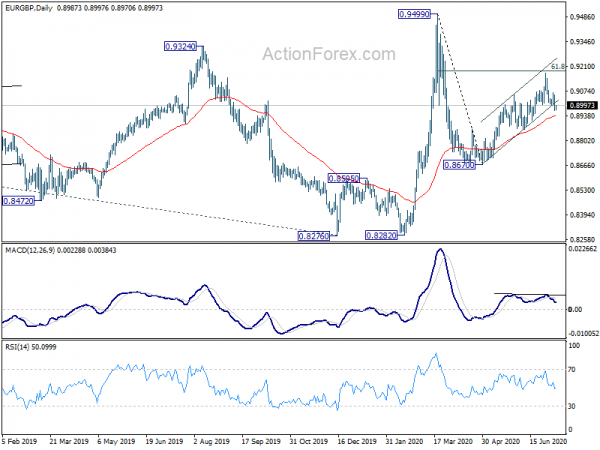

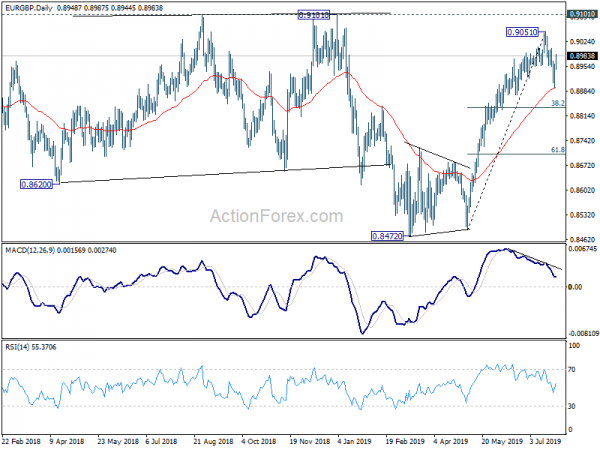

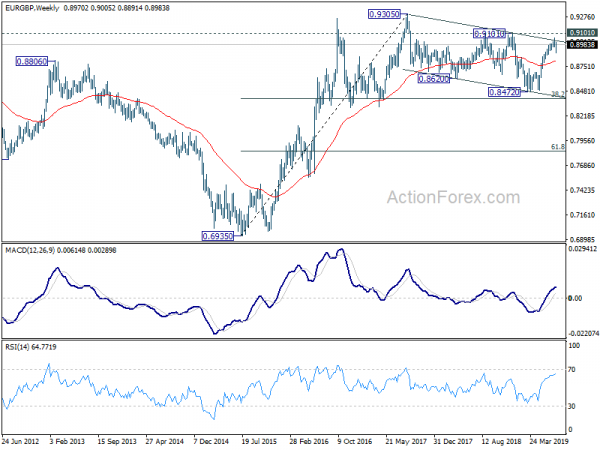

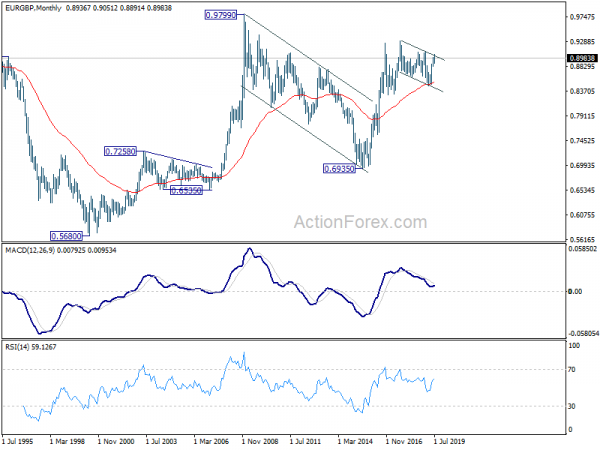

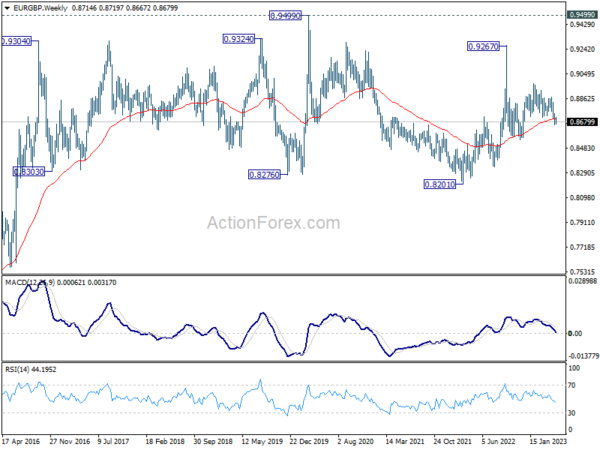

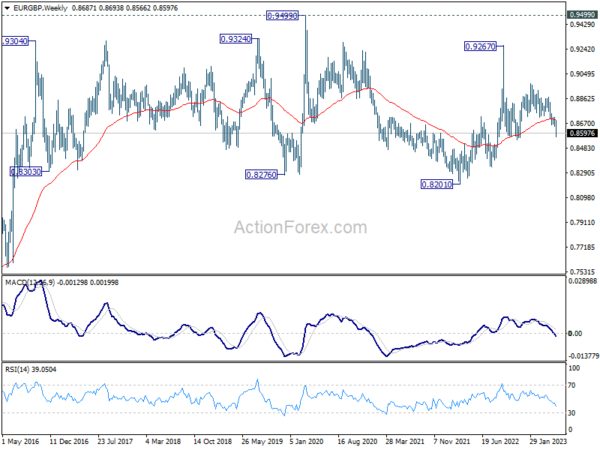

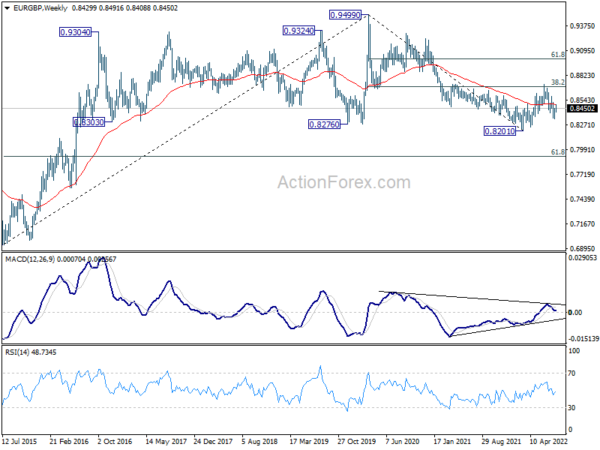

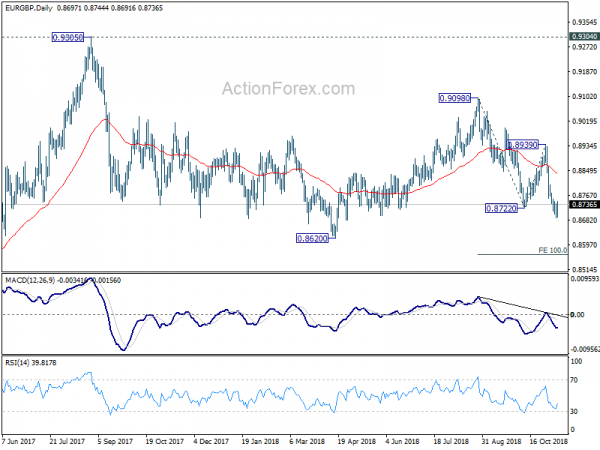

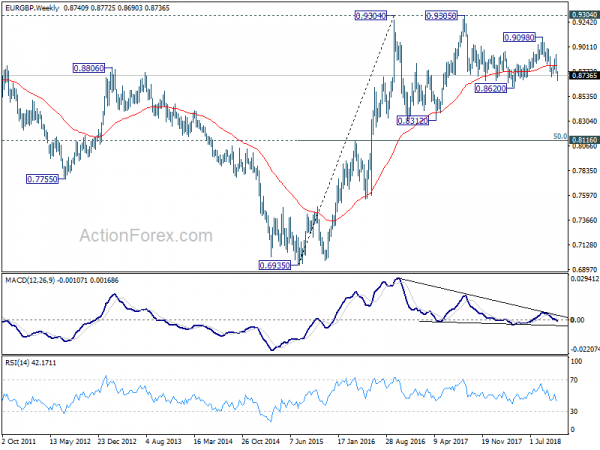

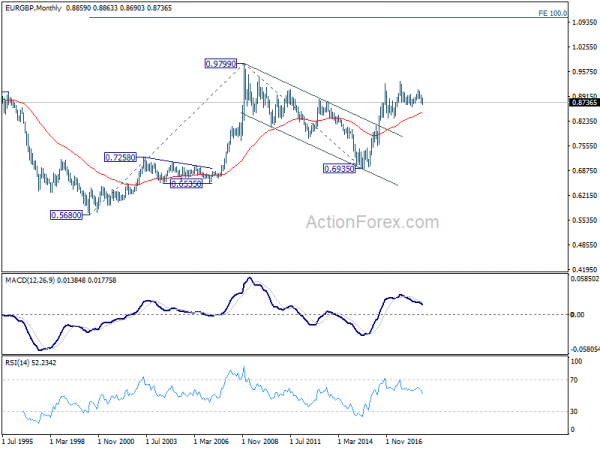

In the bigger picture, we’re seeing the price actions from 0.9499 as developing into a corrective pattern. That is, up trend from 0.6935 (2015 low) would resume at a later stage. This will remain the favored case as long as 0.8276 support holds. However, firm break of 0.8276 support will suggest that rise from 0.6935 has completed and turn outlook bearish.