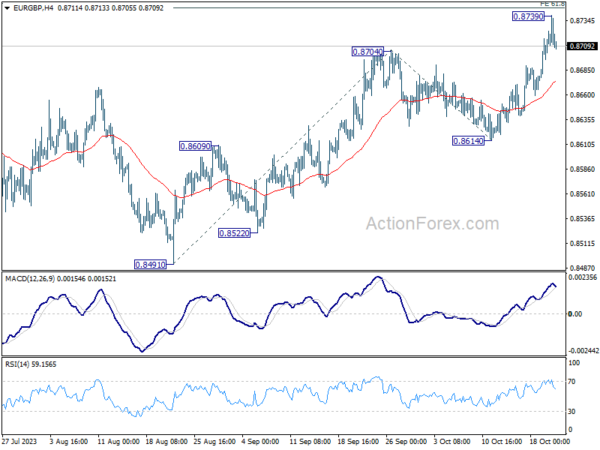

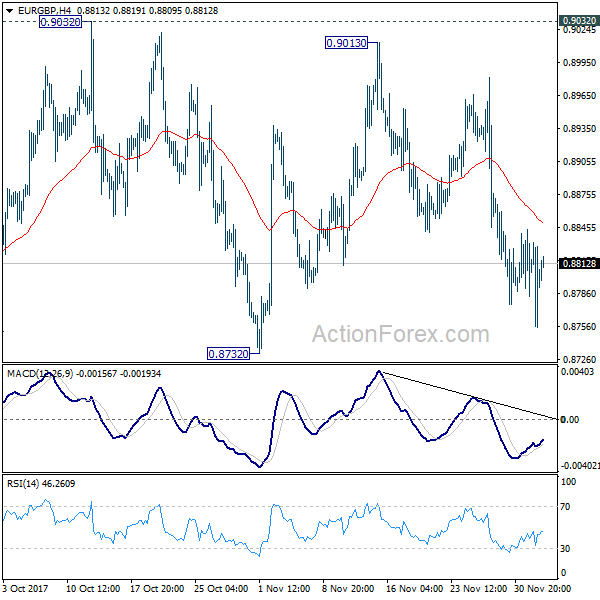

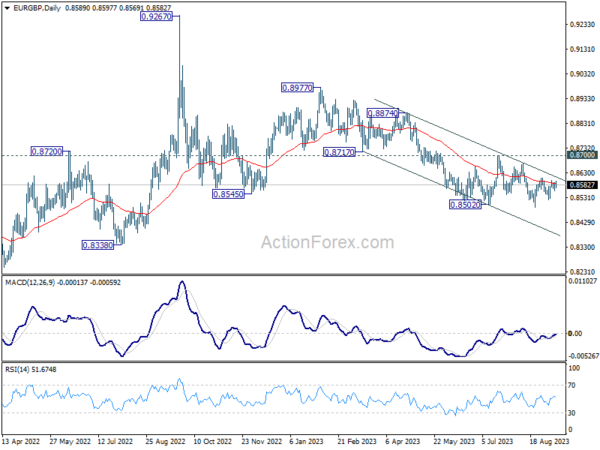

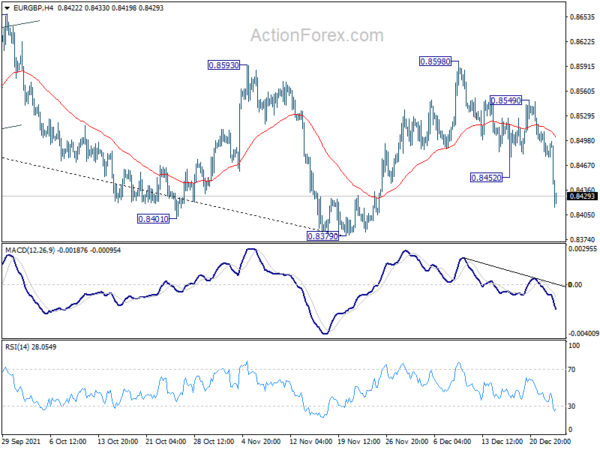

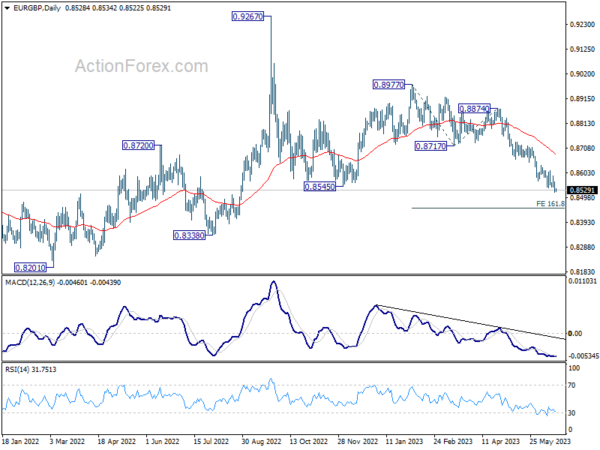

Daily Pivots: (S1) 0.8790; (P) 0.8829; (R1) 0.8854; More…

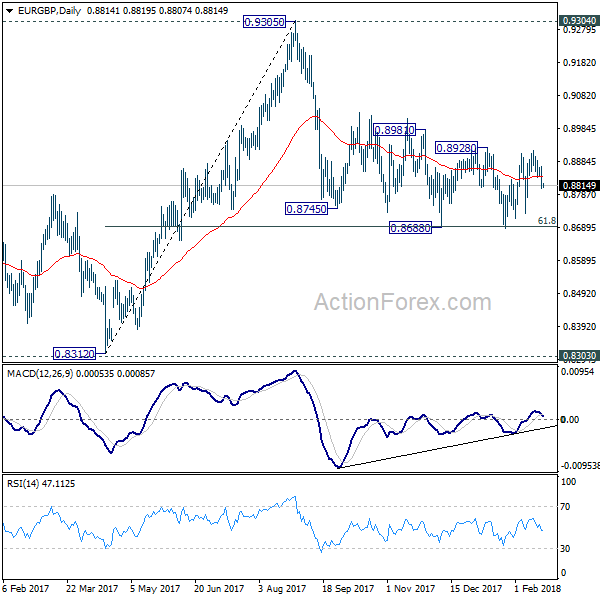

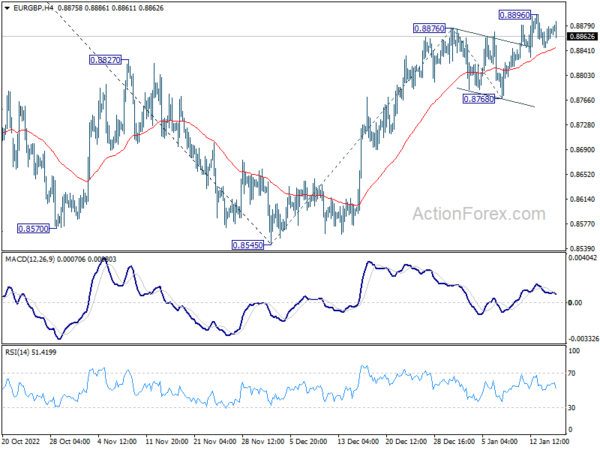

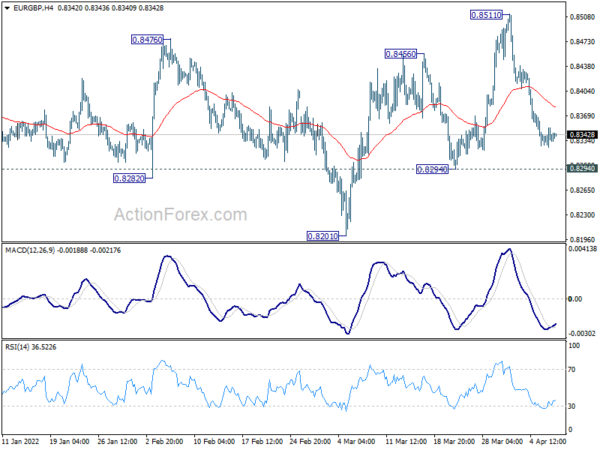

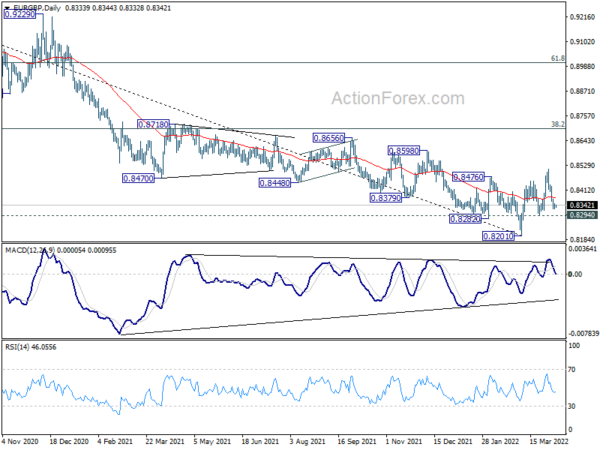

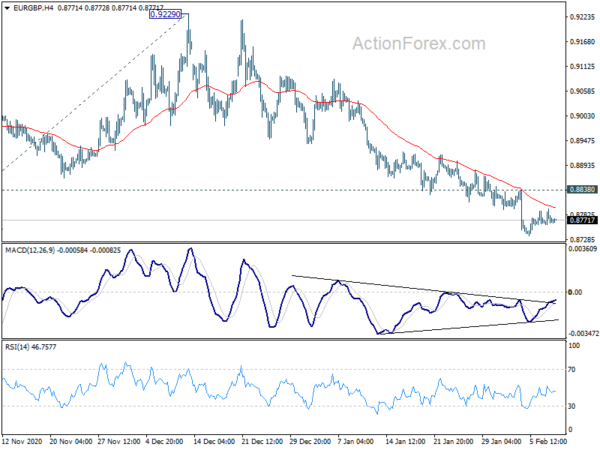

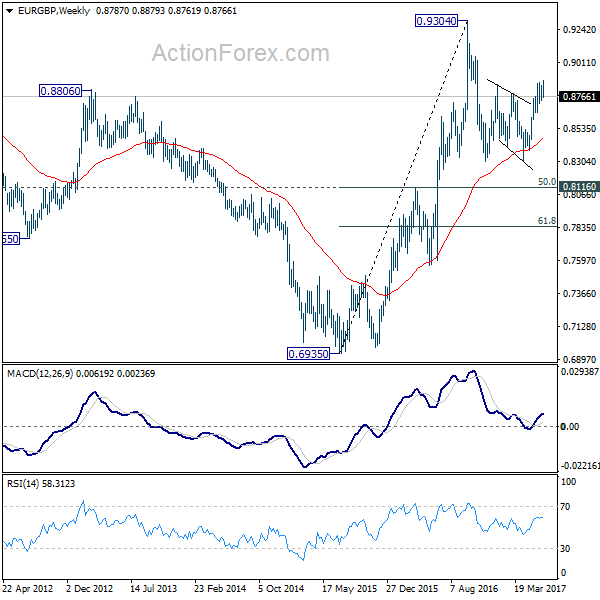

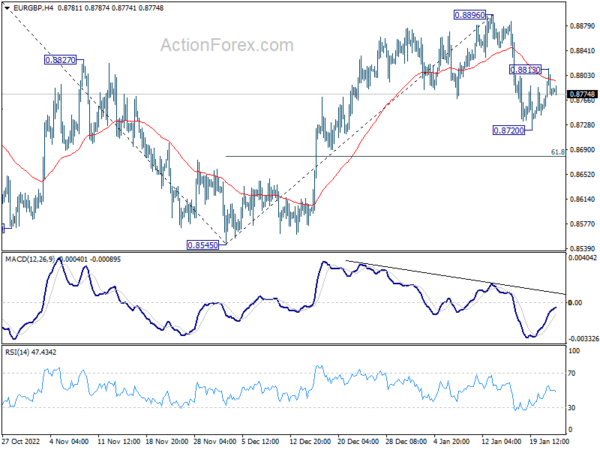

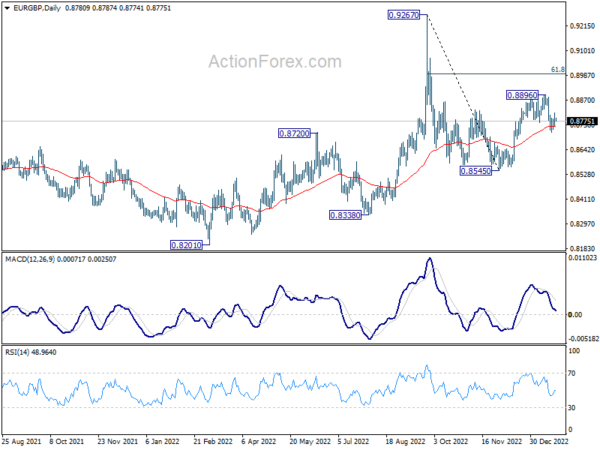

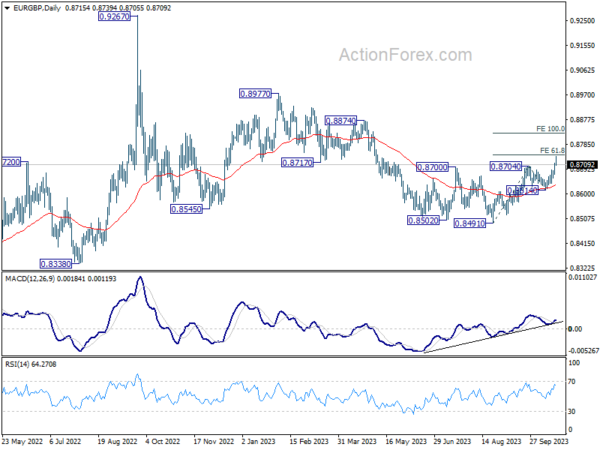

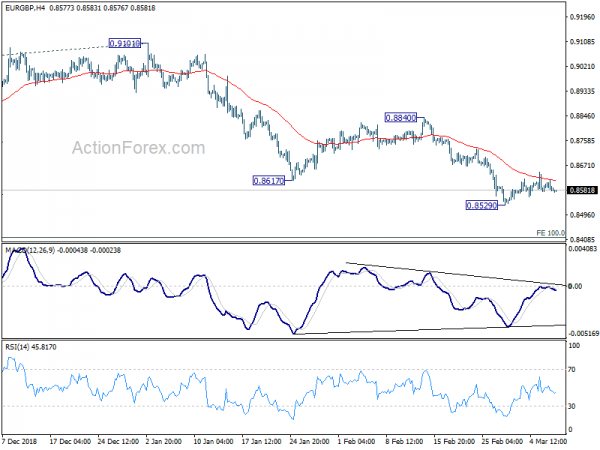

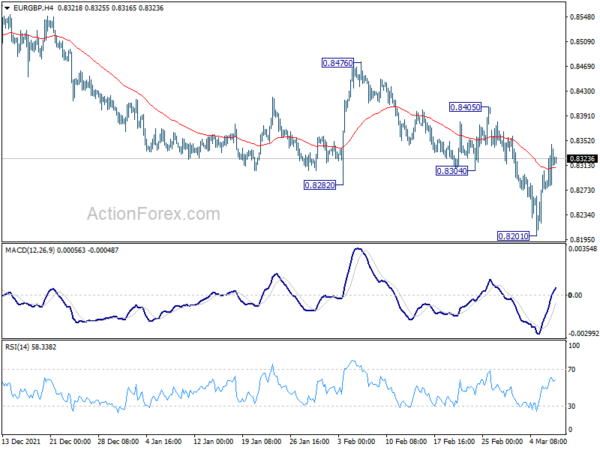

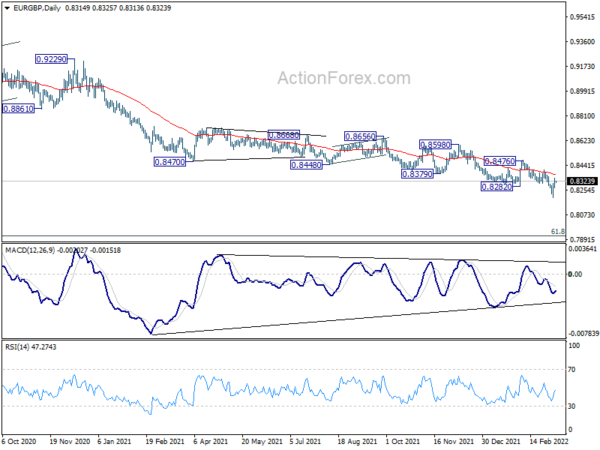

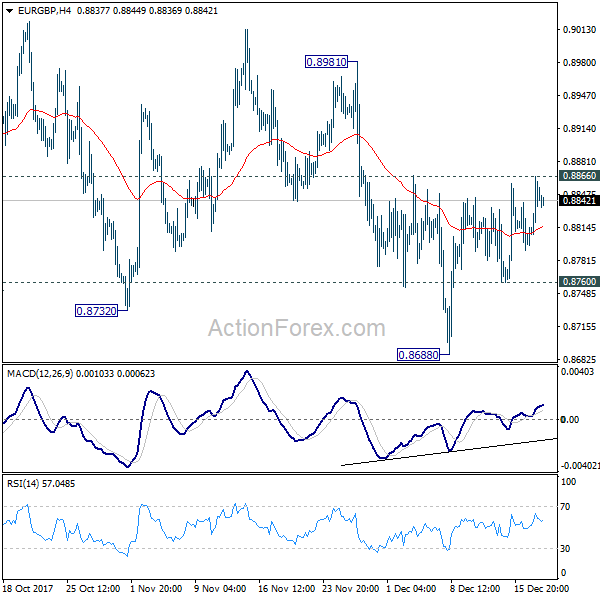

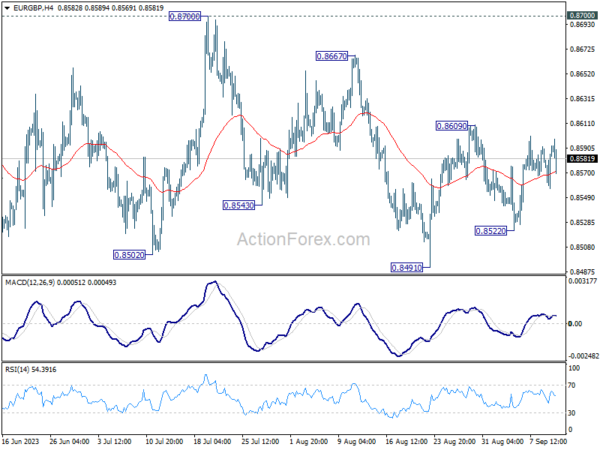

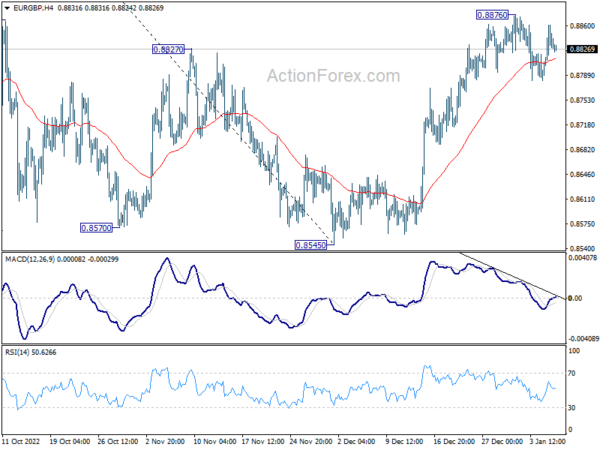

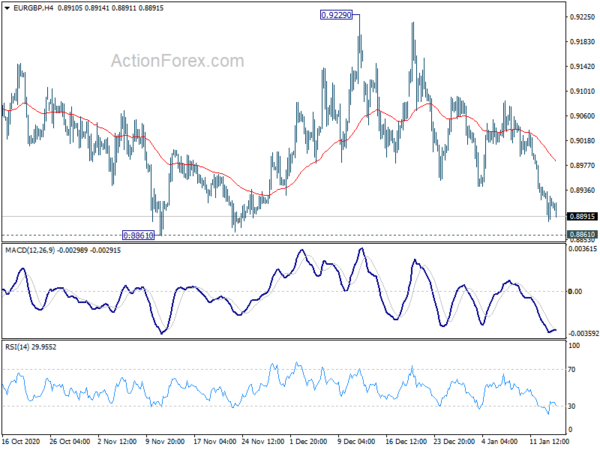

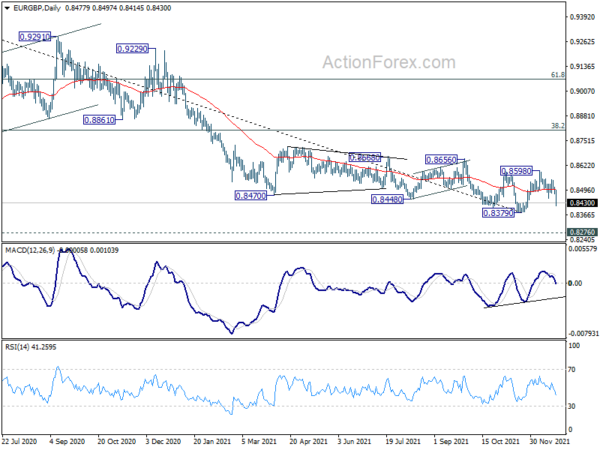

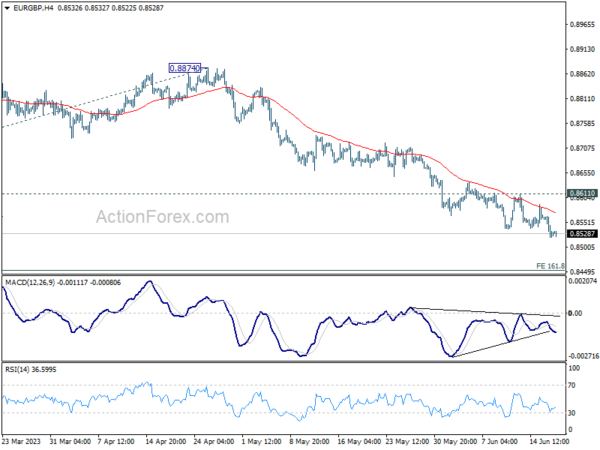

EUR/GBP’s sideway trading continues inside 0.8686/8928. Intraday bias remains neutral and deeper fall is mildly in favor with 0.8928 resistance intact. On the downside, firm break of 0.8686 will resume whole decline from 0.9305. As 61.8% retracement of 0.8312 to 0.9305 should then be taken out too, deeper decline would be seen to retest 0.8303/8312 support zone. Nonetheless, on the upside, break of 0.8928 will indicate near term reversal and turn outlook bullish for 0.9304 resistance.

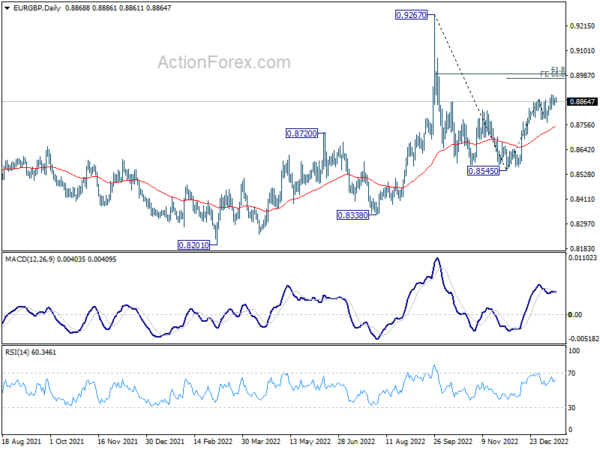

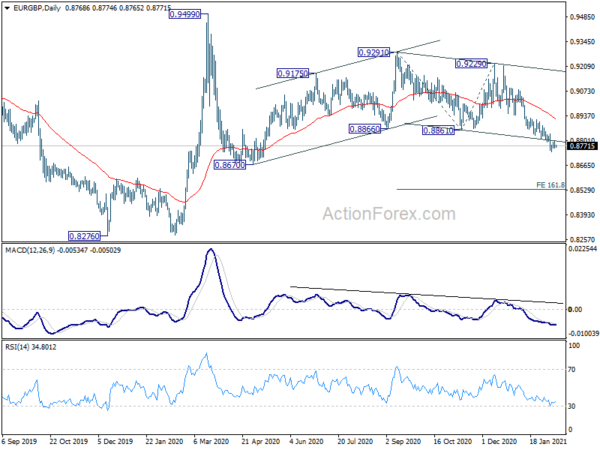

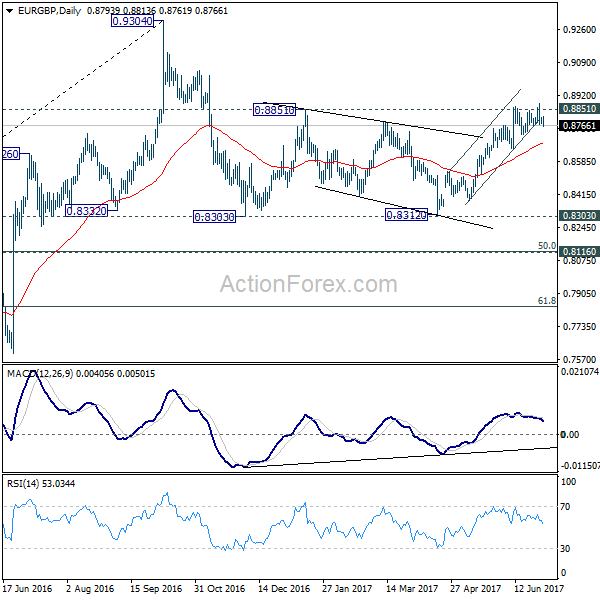

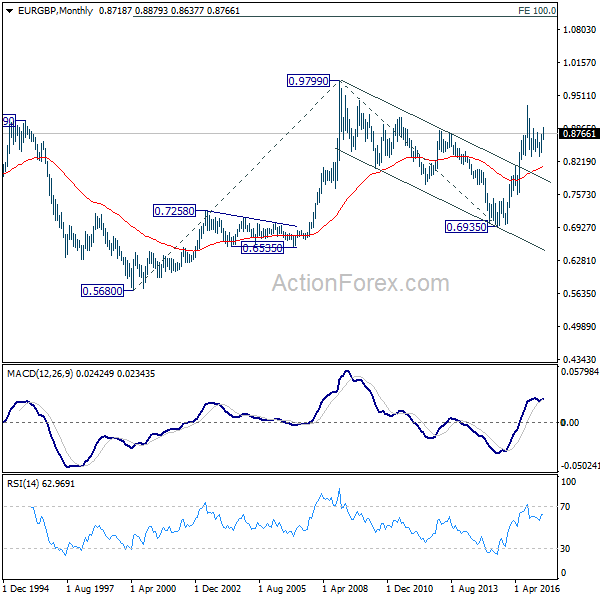

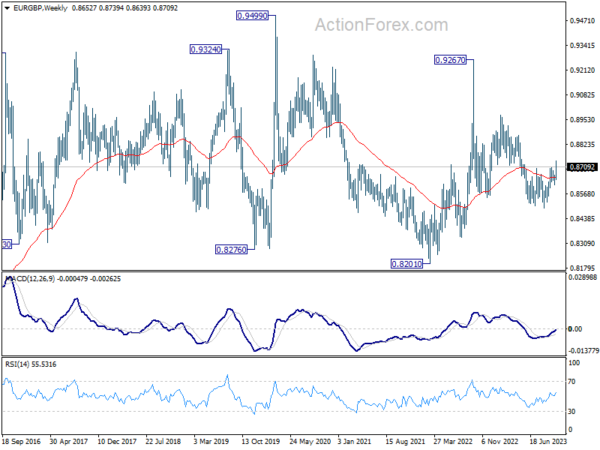

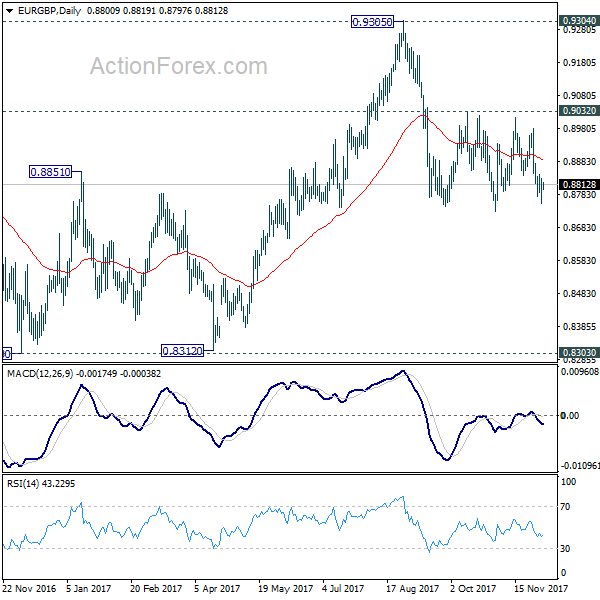

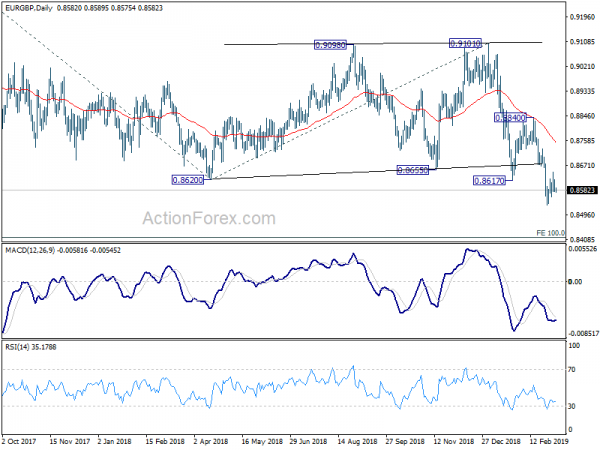

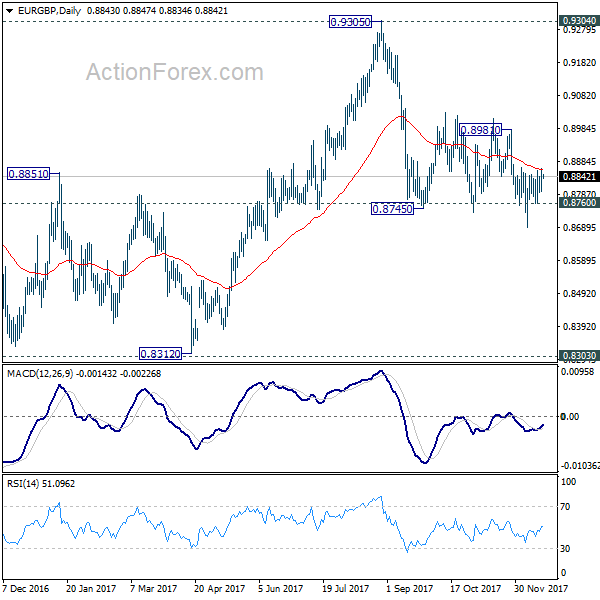

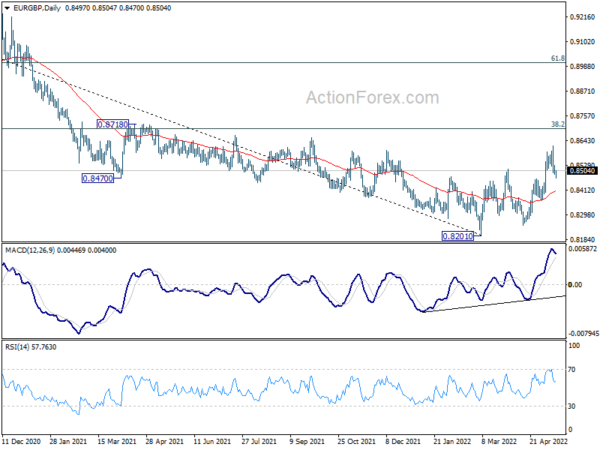

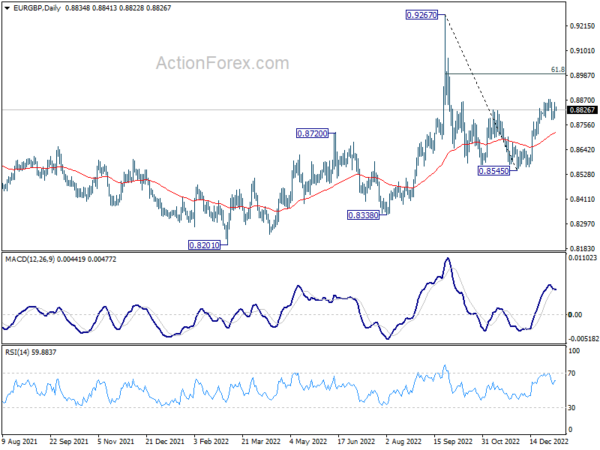

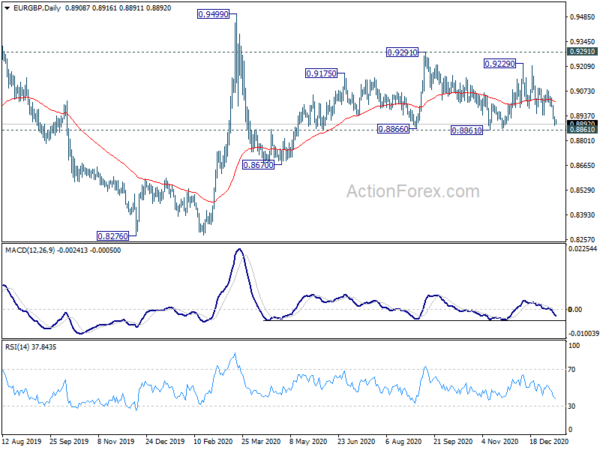

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of deeper fall. And in that case, EUR/GBP could have a retest on 0.8303. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.