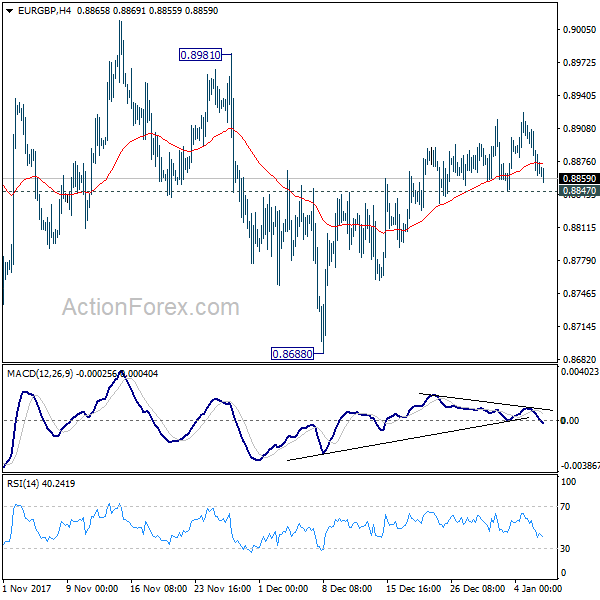

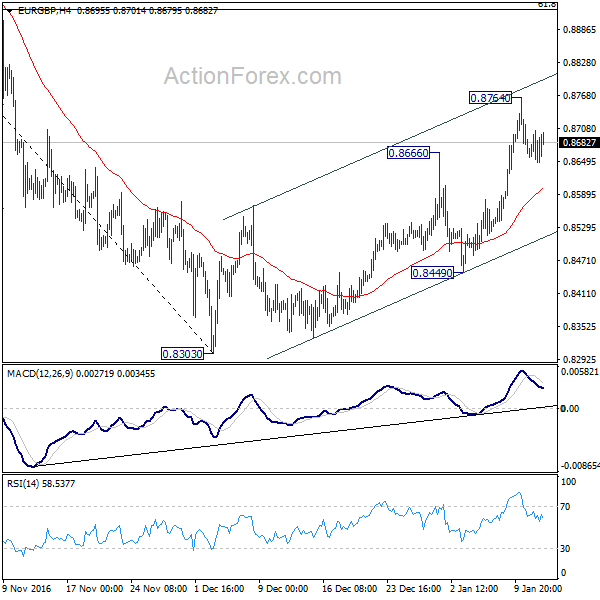

Daily Pivots: (S1) 0.8314; (P) 0.8342; (R1) 0.8360; More…

Intraday bias in EUR/GBP remains neutral for the moment. On the downside, below 0.8294 will resume the fall from 0.8456 to retest 0.8201 low. Firm break there will resume larger down trend. On the upside, however, break of 0.8456 will resume the rebound from 0.8201 to 0.8476 structural resistance.

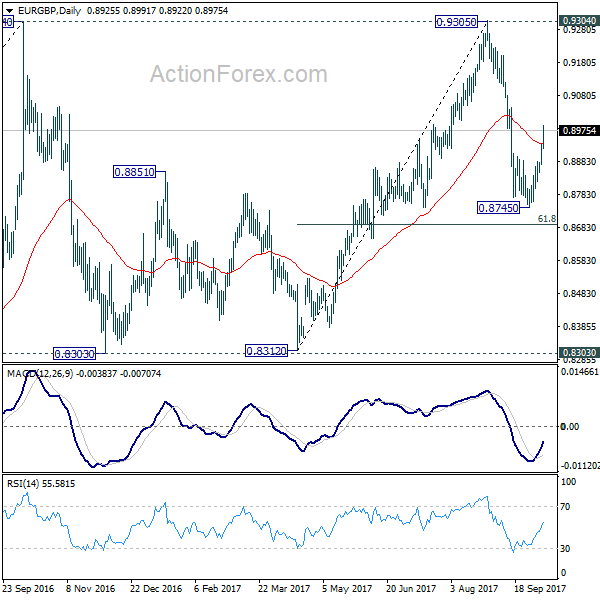

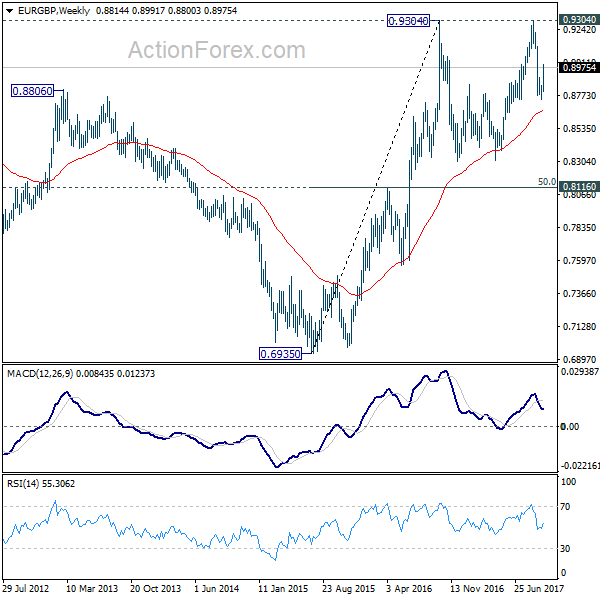

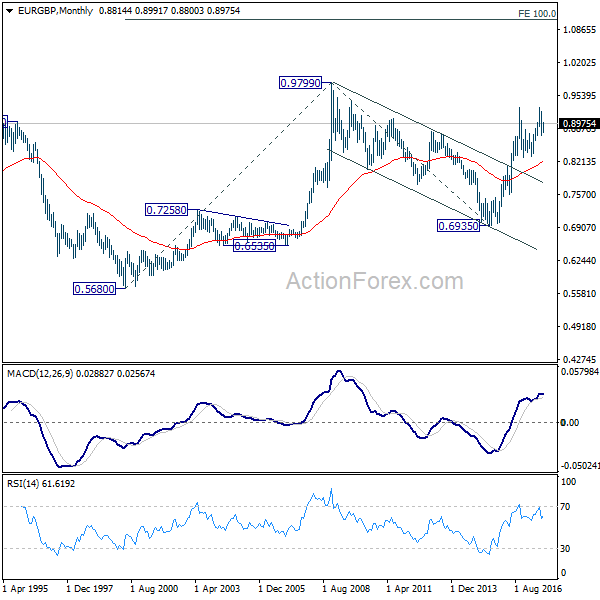

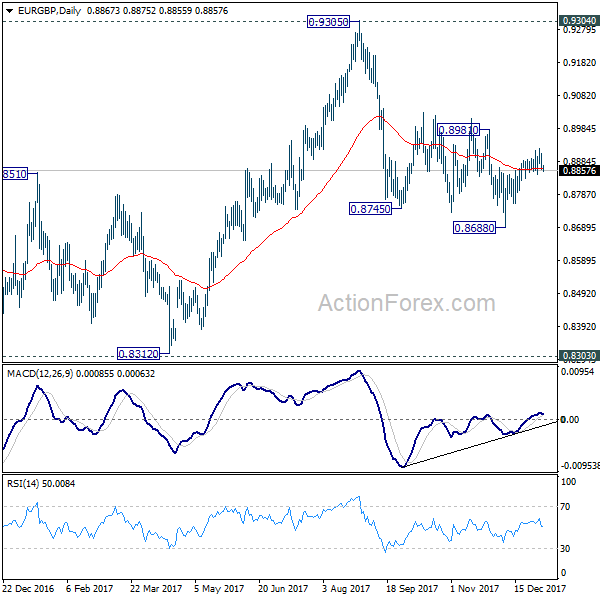

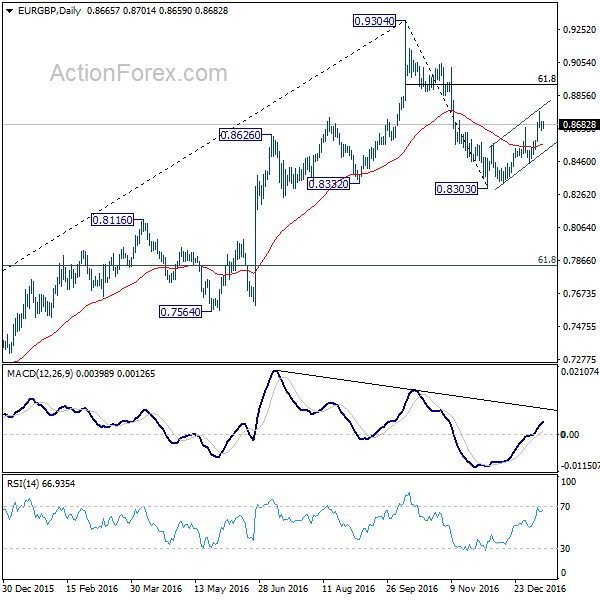

In the bigger picture, the down trend from 0.9499 is expected to continue as long as 0.8476 resistance holds. Sustained trading below 0.8276 support will argue that the whole up trend from 0.6935 (2015 low) has reversed. Deeper fall should be seen to 61.8% retracement of 0.6935 to 0.9499 at 0.7917 next. However, firm break of 0.8476 will indicate medium term bottoming at least. Focus will be back on 55 week EMA (now at 0.8523) for more evidence of bullish reversal.