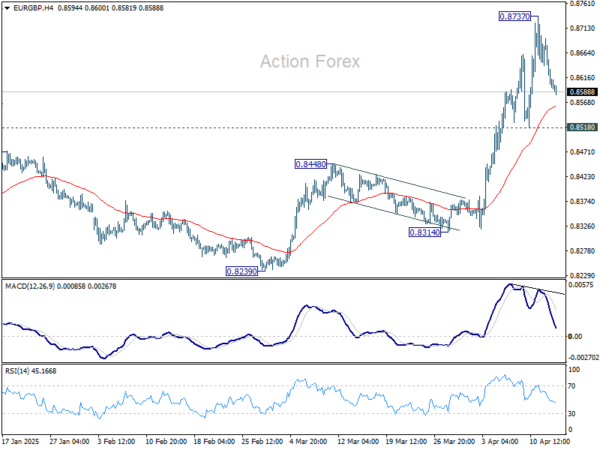

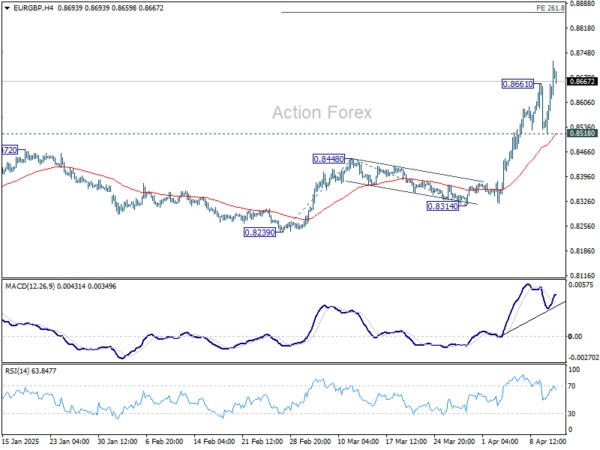

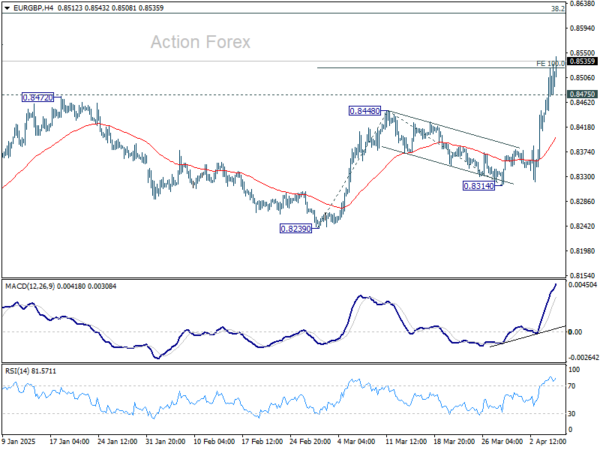

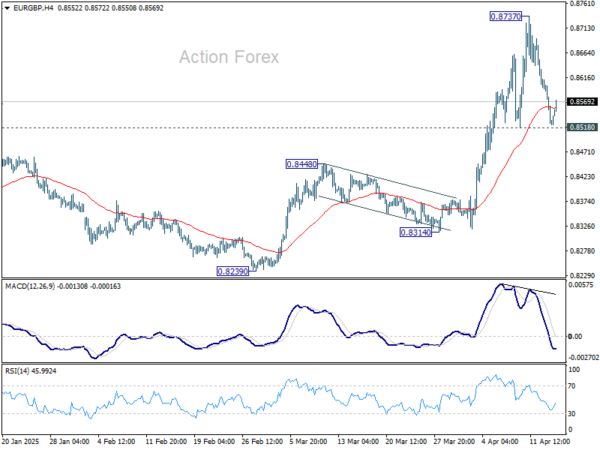

Daily Pivots: (S1) 0.8553; (P) 0.8584; (R1) 0.8640; More…

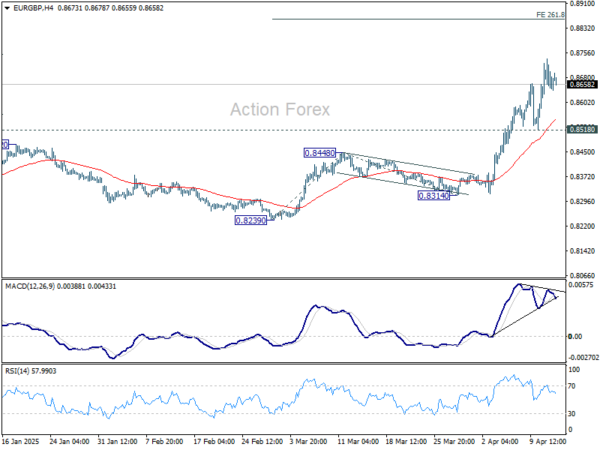

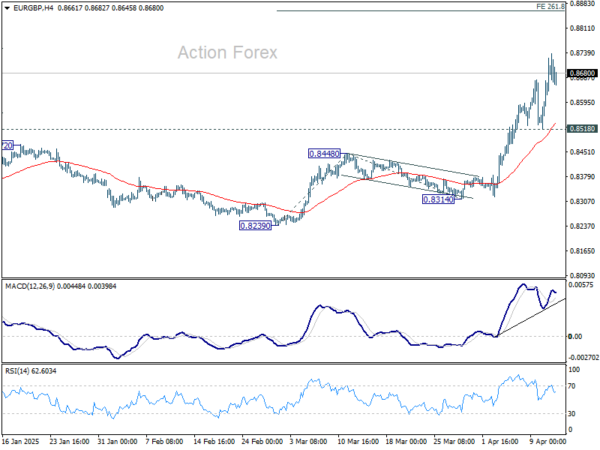

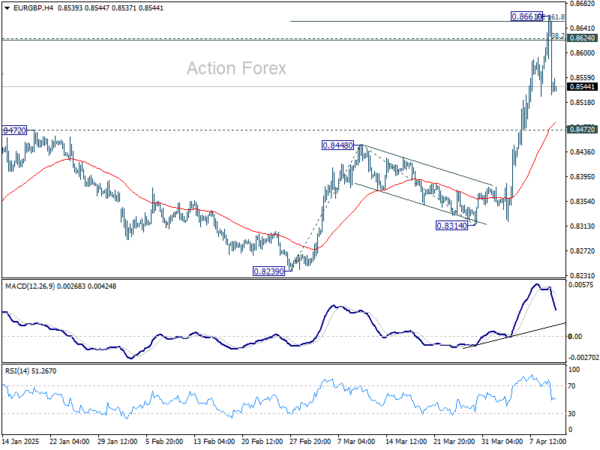

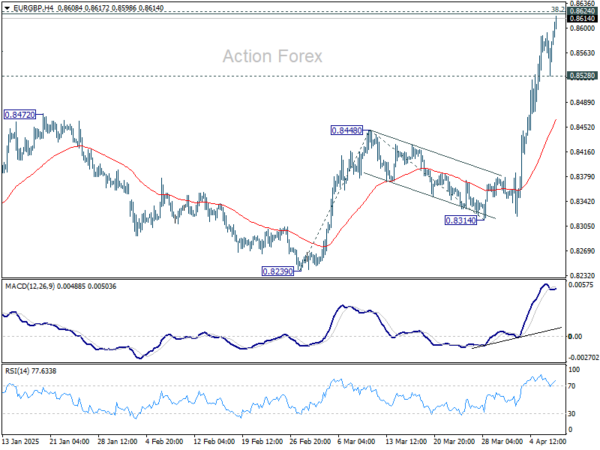

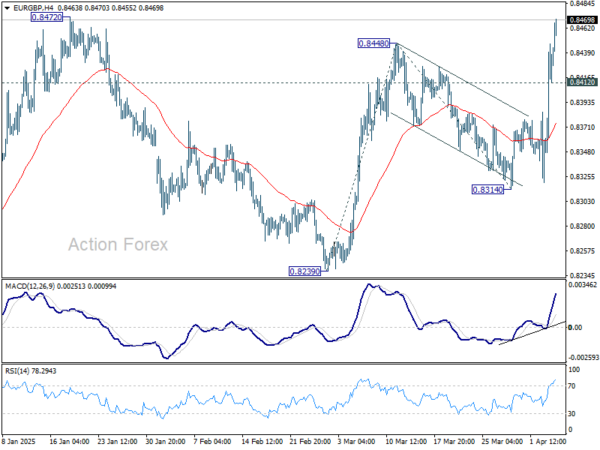

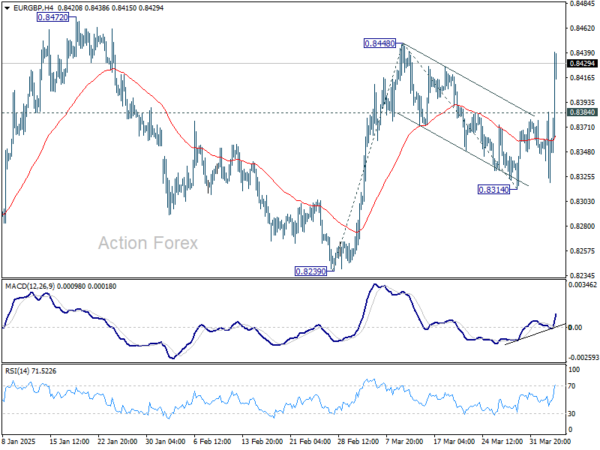

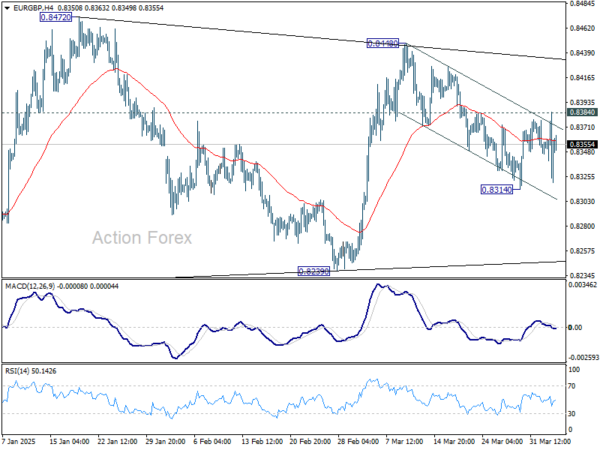

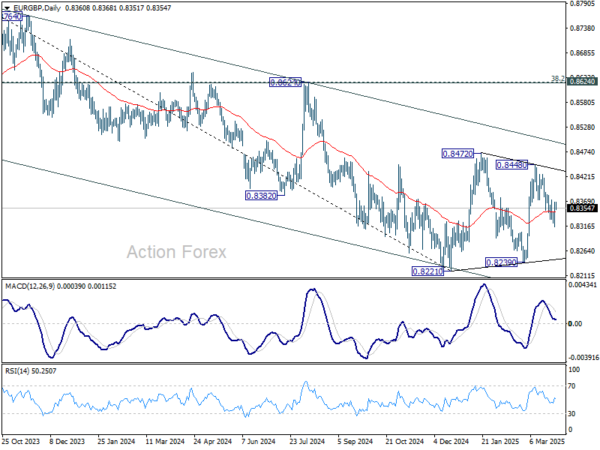

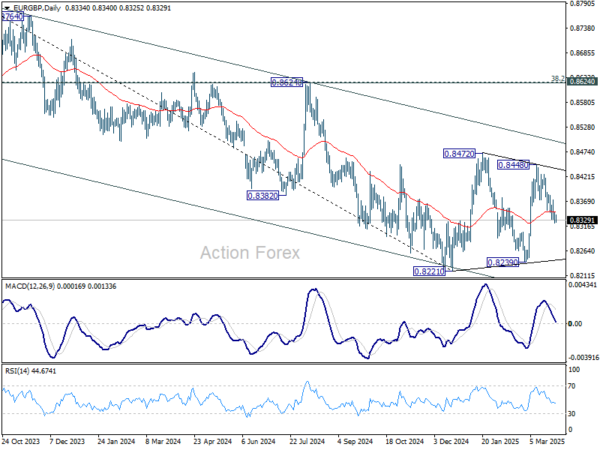

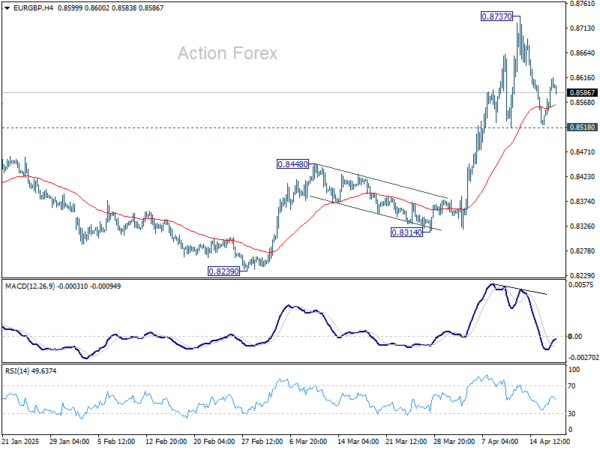

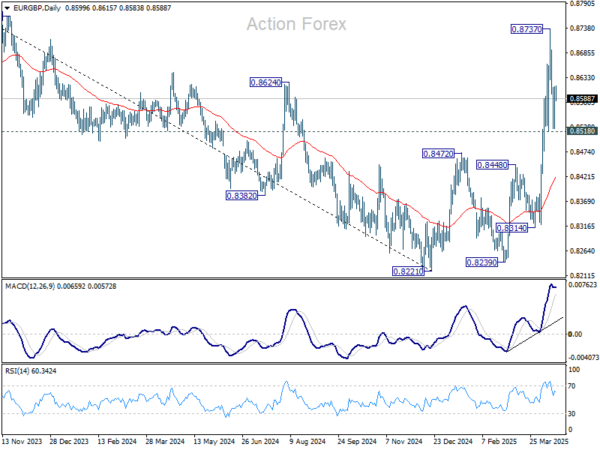

Intraday bias in EUR/GBP remains neutral for the moment. Consolidations from 0.8737 could extend but further rise is still expected as long as 0.8518 support holds. On the upside, break of 0.8737 will resume the larger rally from 0.8221.

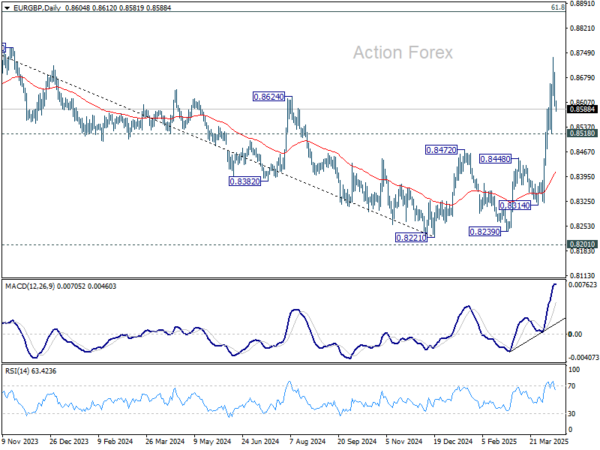

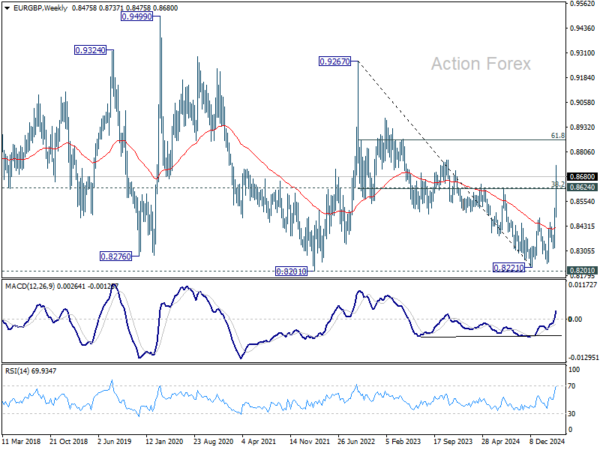

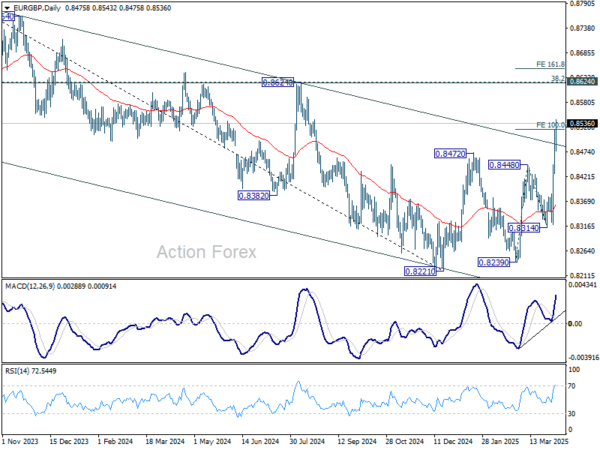

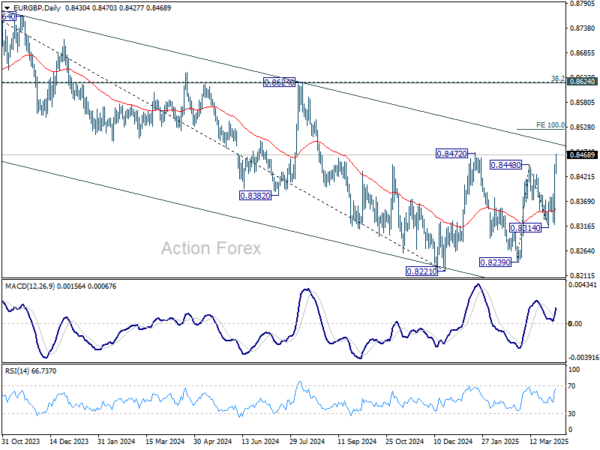

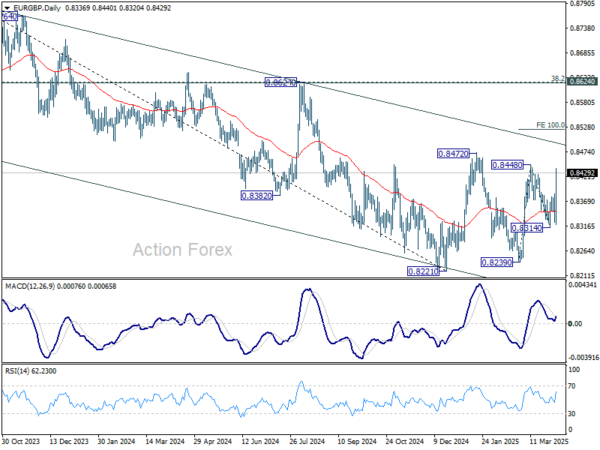

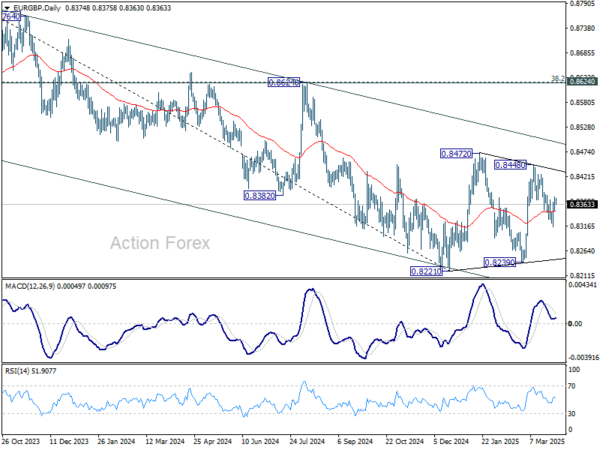

In the bigger picture, down trend from 0.9267 (2022 high) should have completed at 0.8221, just ahead of 0.9201 key support (2024 low). Rise from 0.8221 is likely reversing the whole fall. Further rise should be seen to 61.8% retracement of 0.9267 to 0.8221 at 0.8867 next. This will now remain the favored case as long as 0.8472 resistance turned support holds.

Sell

Sell