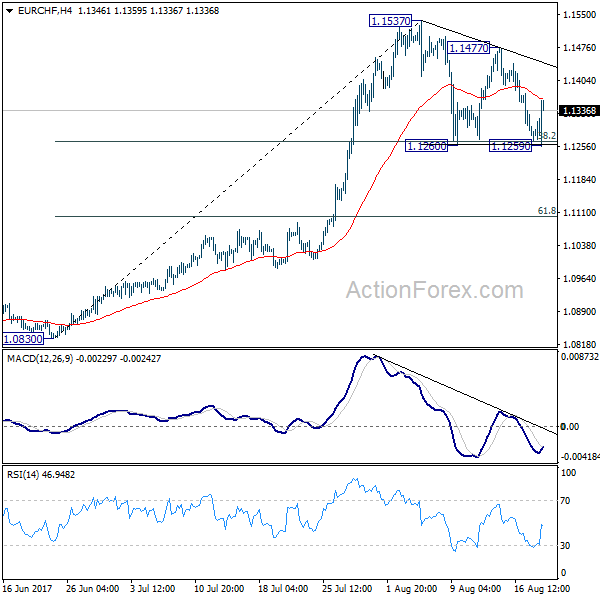

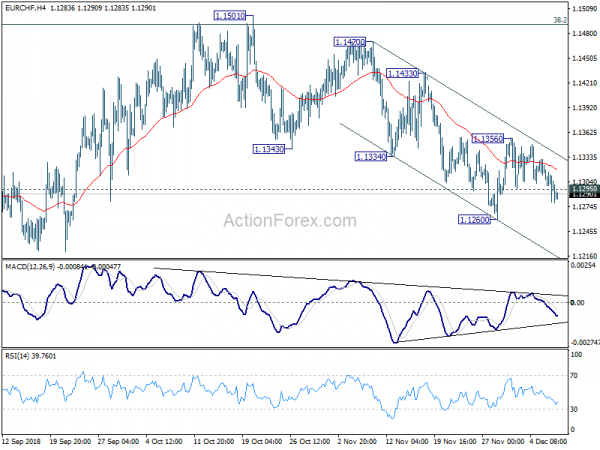

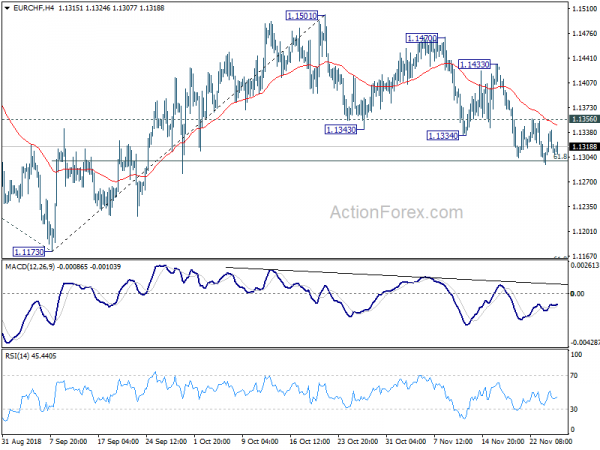

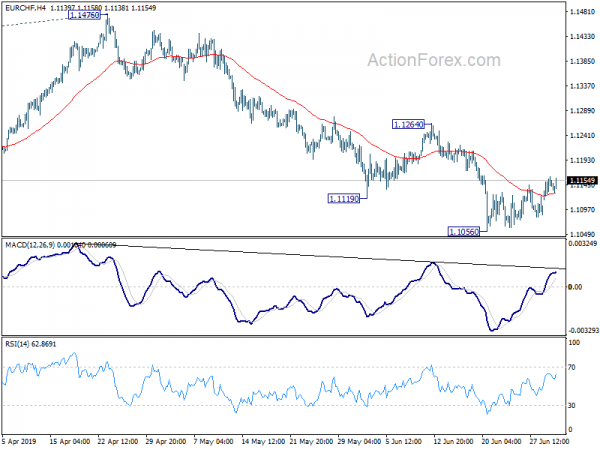

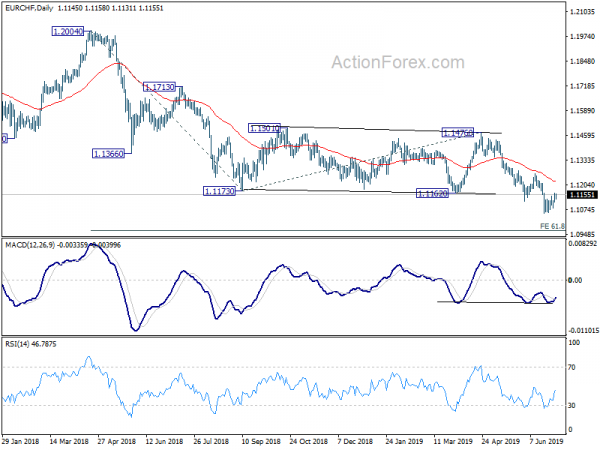

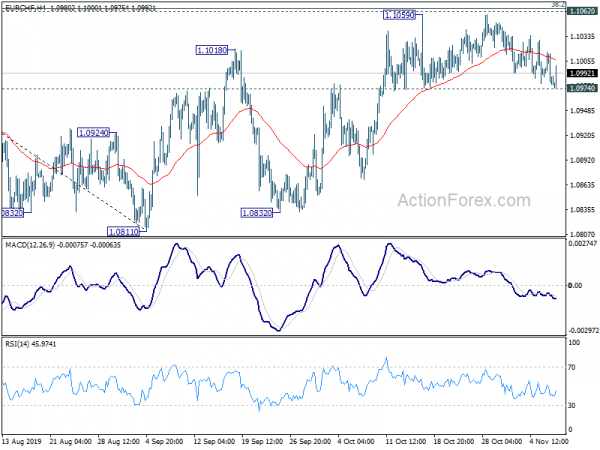

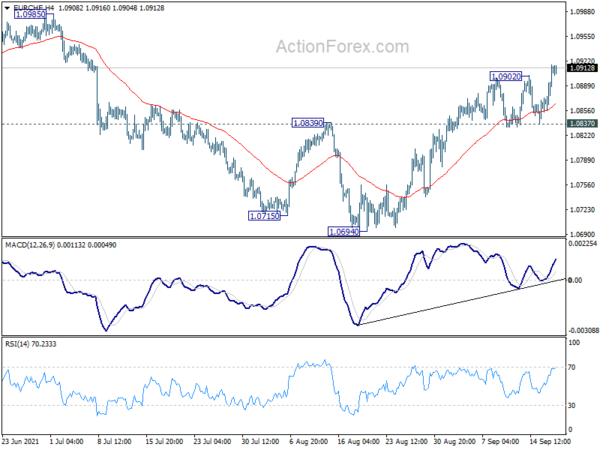

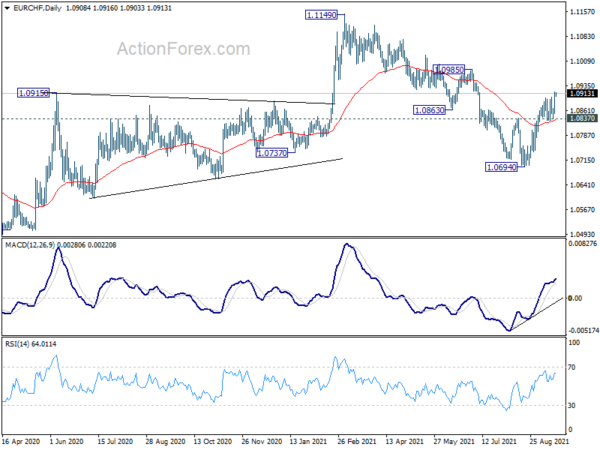

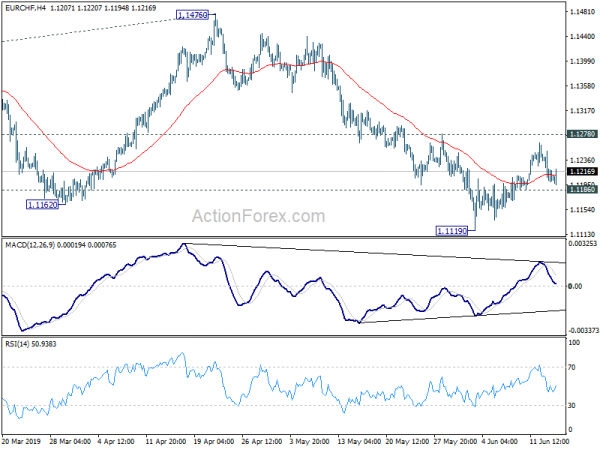

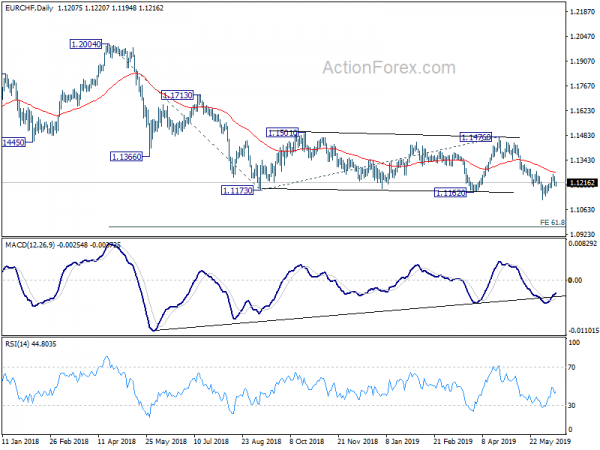

EUR/CHF’s consolidation from 1.1537 extended with another fall last week. But so far it’s still holding on to 38.2% retracement of 1.0830 to 1.1537 at 1.1267. Initial bias remains neutral this week first. On the upside, break of 1.1477 resistance will argue that the consolidation from 1.1537 has completed and larger rise is resuming. However, firm break of 1.1267 will extend the correction to 61.8% retracement at 1.1100 before completion.

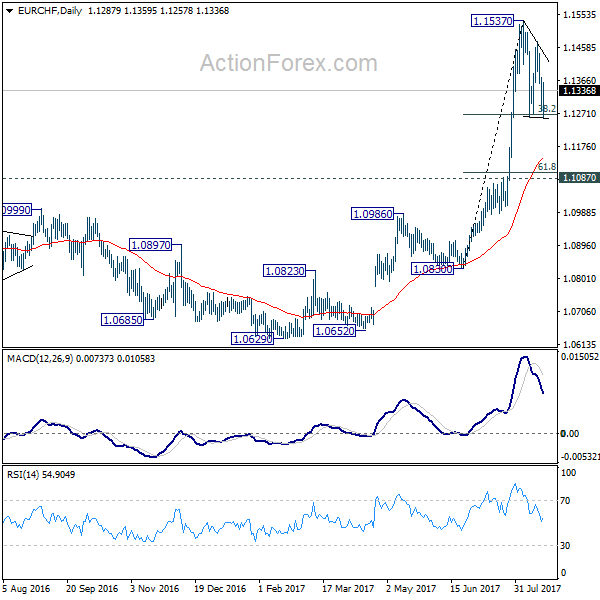

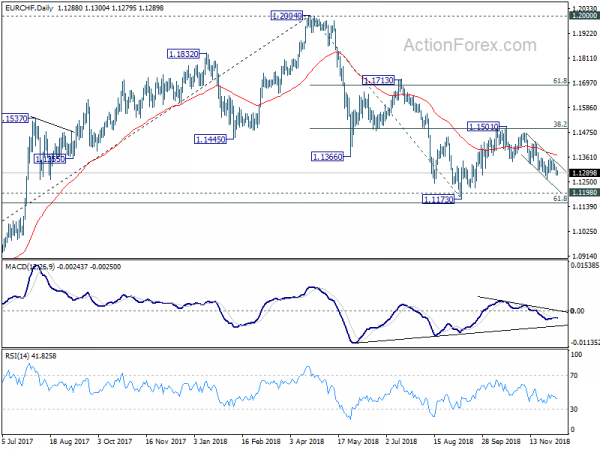

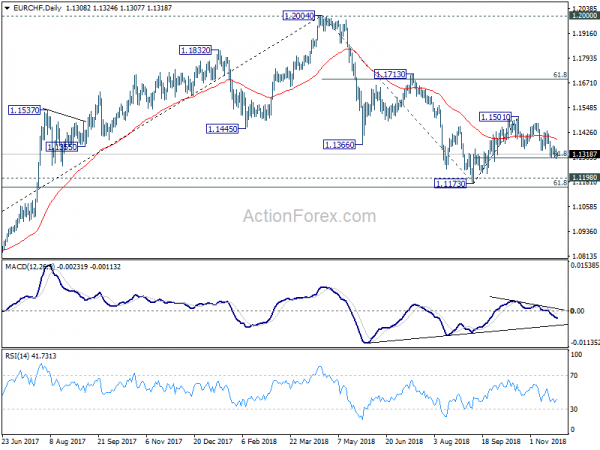

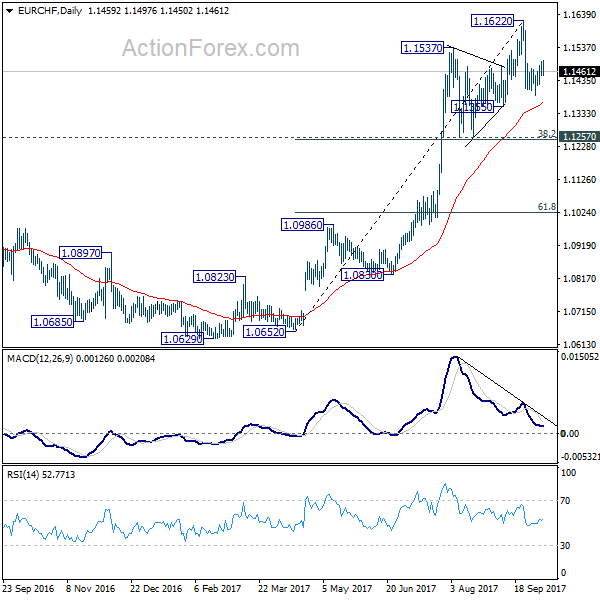

In the bigger picture, firm break of 1.1198 key resistance confirms resumption of the long term rise from SNB spike low back in 2015. In this case, EUR/CHF would eventually head back to prior SNB imposed floor at 1.2000. For now, this will be the favored case as long as 1.1087 resistance turned support holds.