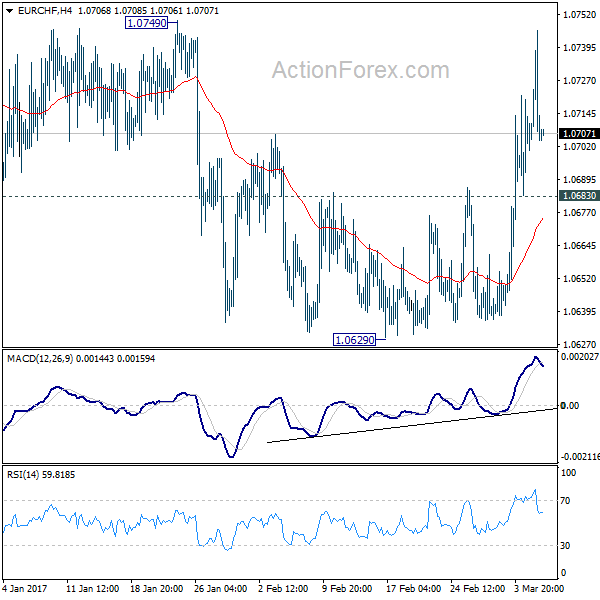

Daily Pivots: (S1) 1.0690; (P) 1.0718; (R1) 1.0733; More…

With 1.0683 minor support intact, further rise is expected in EUR/CHF. As noted before, a short term bottom is likely in place at 1.0629 on bullish convergence condition in 4 hour MACD. Current development raised the chance of larger trend reversal after defending 1.0620 key support level. Decisive break of 1.0749 should affirm this bullish case and target 1.0897. On the downside, though, below 1.0683 minor support will turn bias back to the downside for 1.0629 instead.

In the bigger picture, the decline from 1.1198 is seen as a corrective move. There is no confirmation of completion yet. Sustained trading below 38.2% retracement of 0.9771 to 1.1198 at 1.0653 will target 50% retracement at 1.0485. However, strong rebound from 1.0620 and break of 1.0897 resistance will indicate trend reversal and turn outlook bullish.