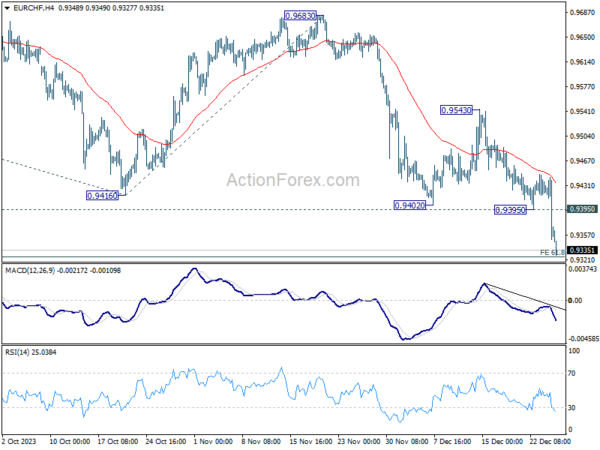

Daily Pivots: (S1) 0.9428; (P) 0.9443; (R1) 0.9467; More…

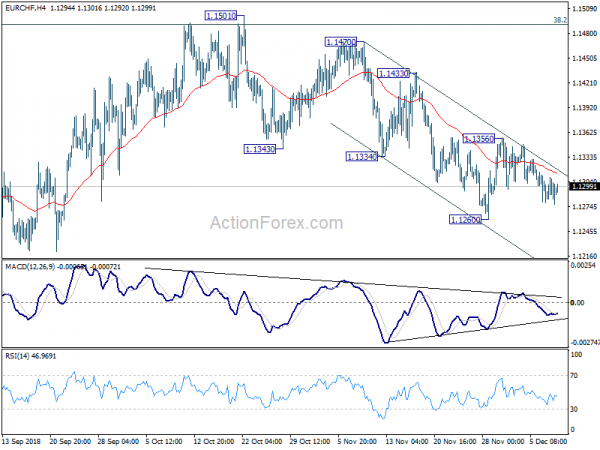

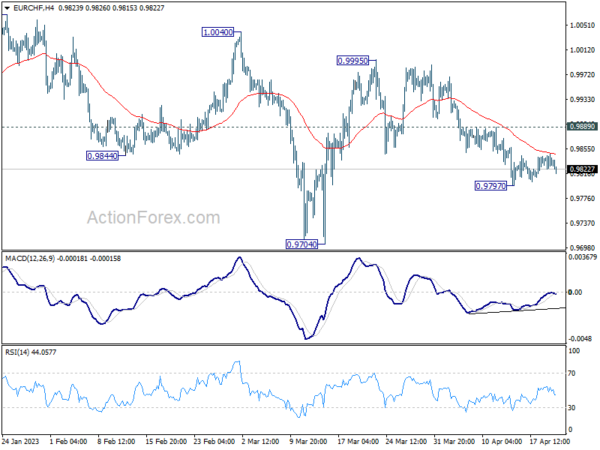

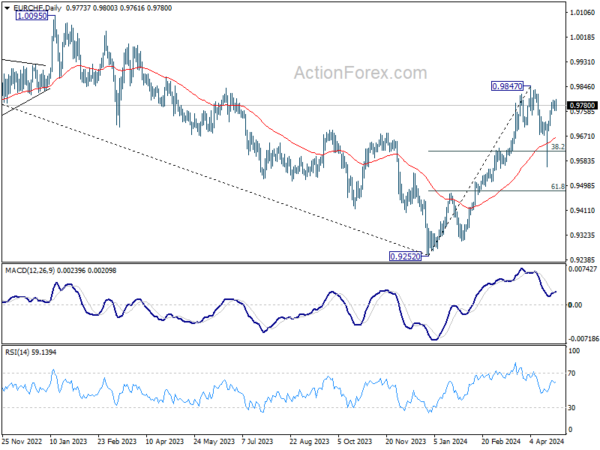

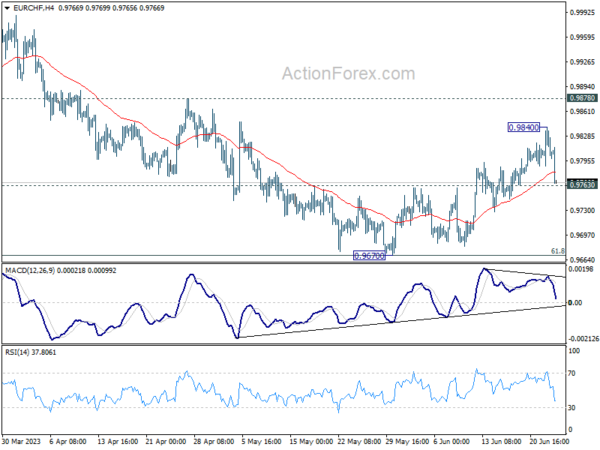

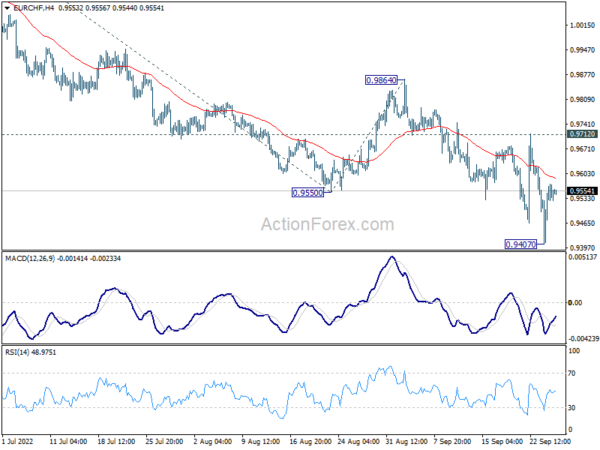

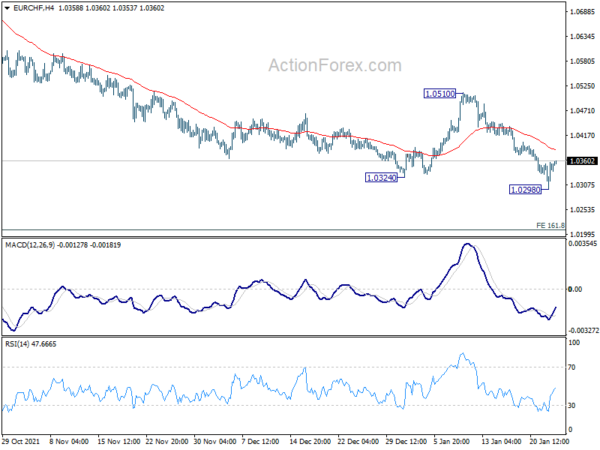

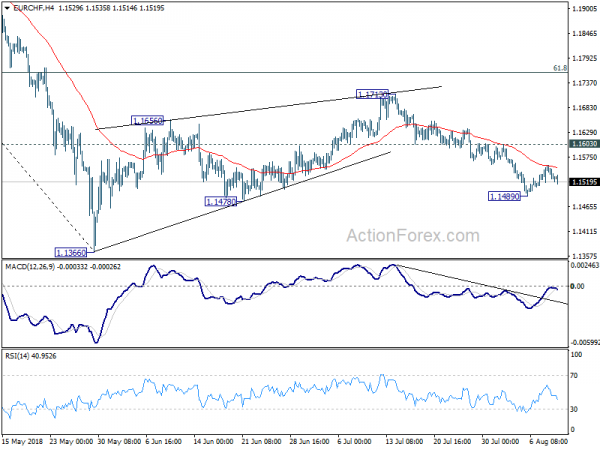

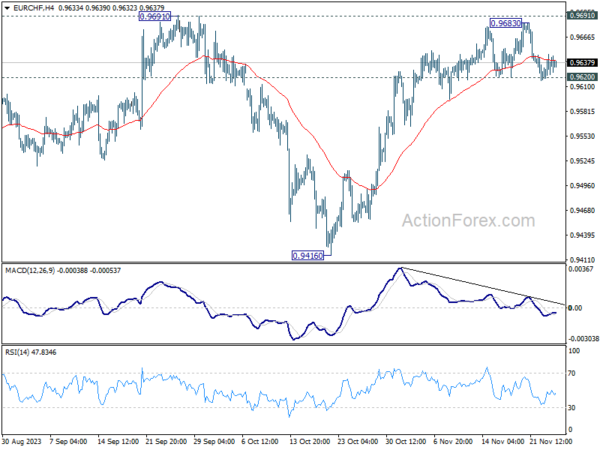

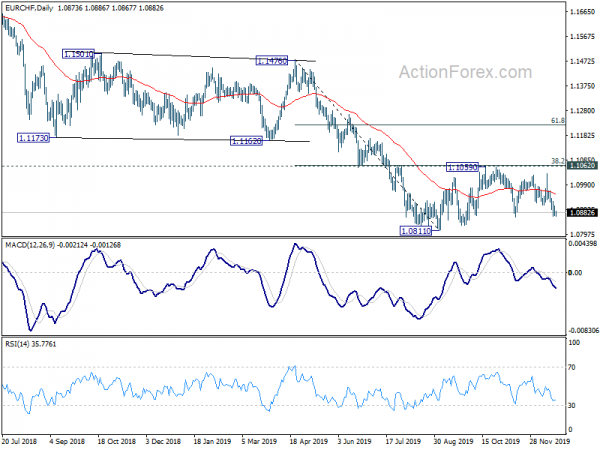

Intraday bias in EUR/CHF remains neutral for some more consolidations. But outlook stays bearish as long as 0.9532 resistance holds. On the downside, decisive break of 0.9407 medium term bottom will confirm resumption of larger down trend. Next near term target will be 100% projection of 0.9840 to 0.9520 from 0.9691 at 0.9499, and then 161.8% projection at 0.9179.

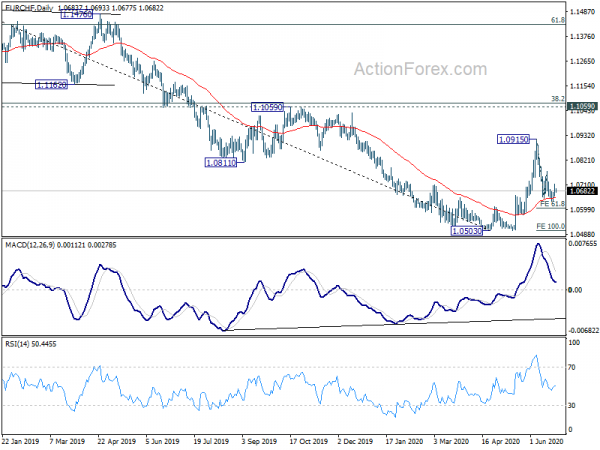

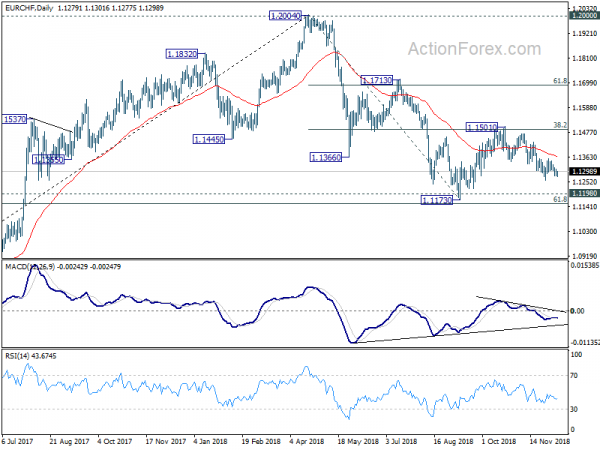

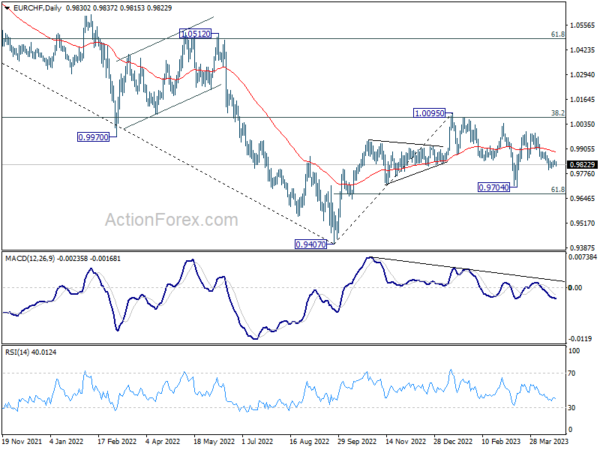

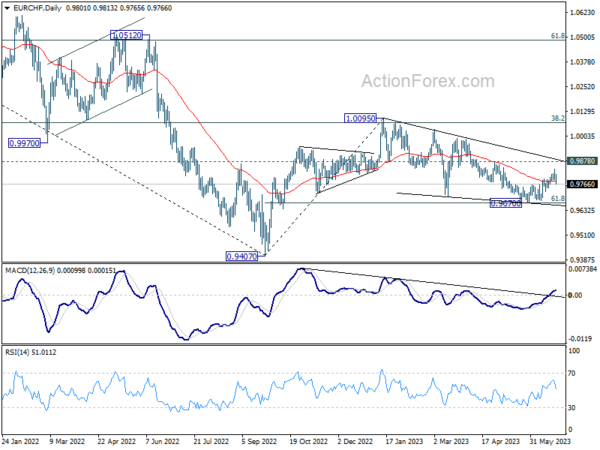

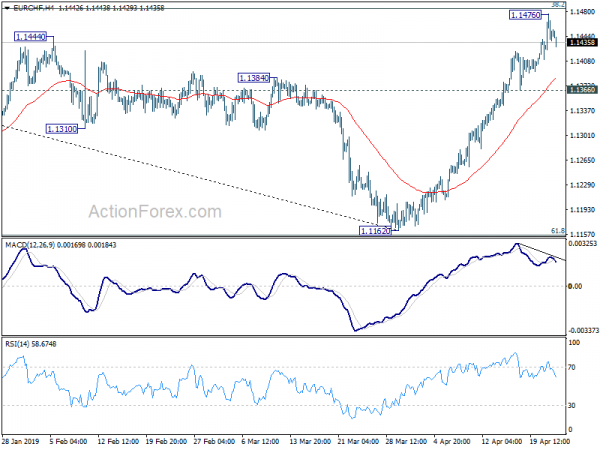

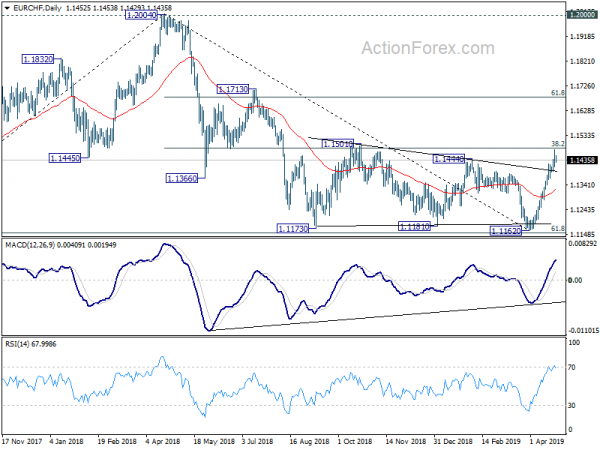

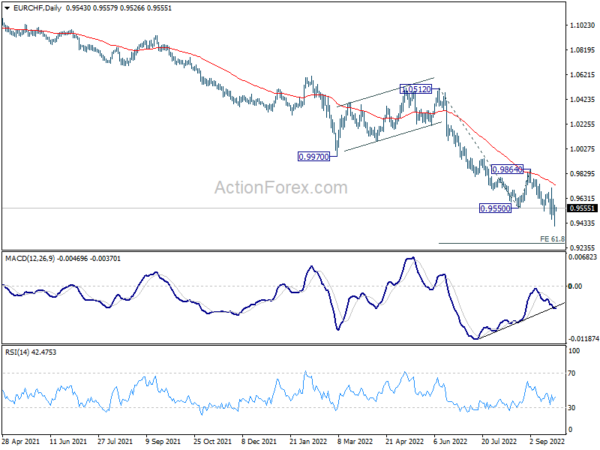

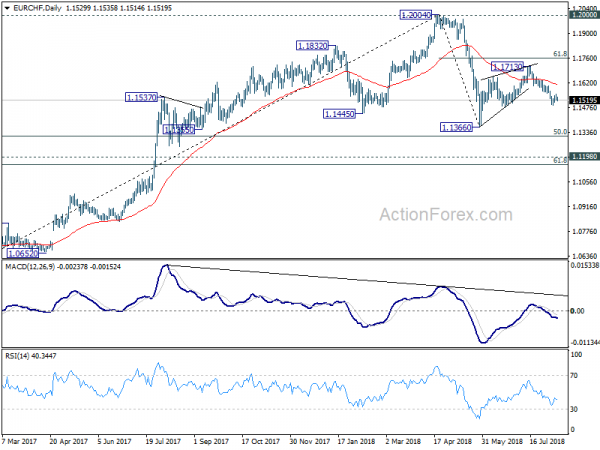

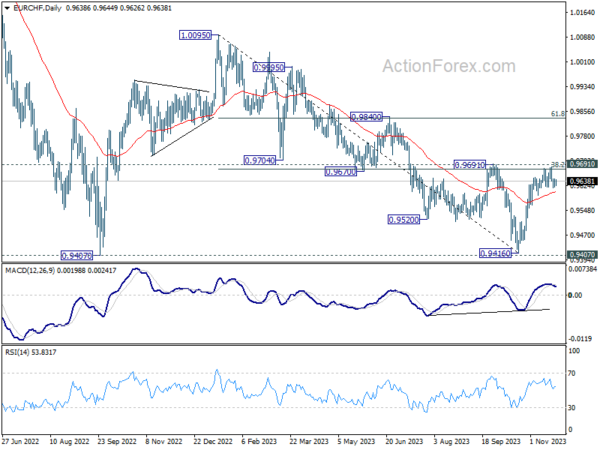

In the bigger picture, down trend from 1.2004 (2018 high) is still in progress. Decisive break of 0.9407 will confirm resumption, and target 61.8% projection of 1.1149 to 0.9407 from 1.0095 at 0.9018. On the upside, break of 0.9691 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish.