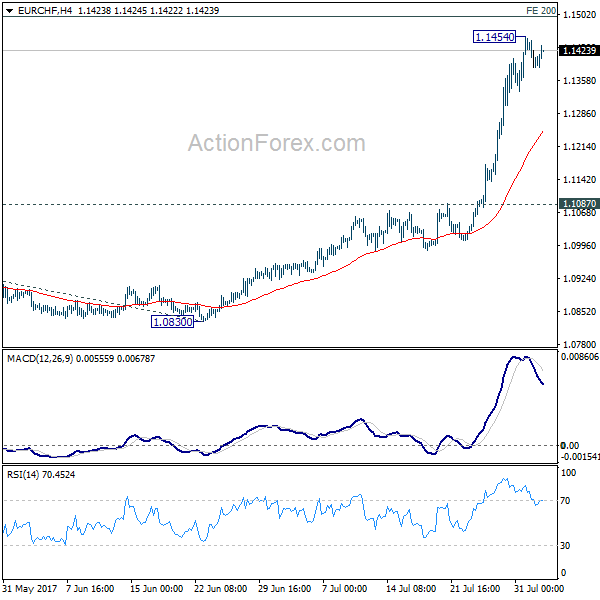

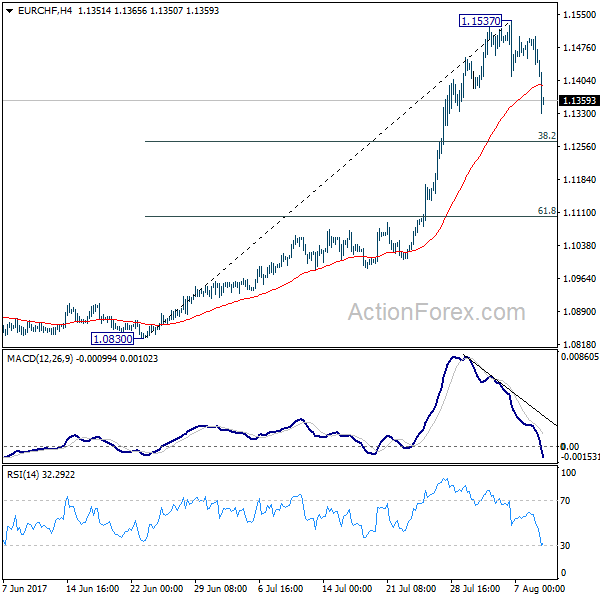

Daily Pivots: (S1) 1.0632; (P) 1.0666; (R1) 1.0685; More…

EUR/CHF drops notably but stays above 1.0635 temporary low. Intraday bias remains neutral first. Overall, near term outlook will remain bearish as long as 1.0749 resistance holds and deeper decline is expected. Decisive break of 1.0620 key support level will confirm resumption of whole fall from 1.1198. In that case, next downside target will be 1.0485 fibonacci level. Break of 1.0749 will raise the chance of medium term reversal and turn focus back to 1.0897 key resistance.

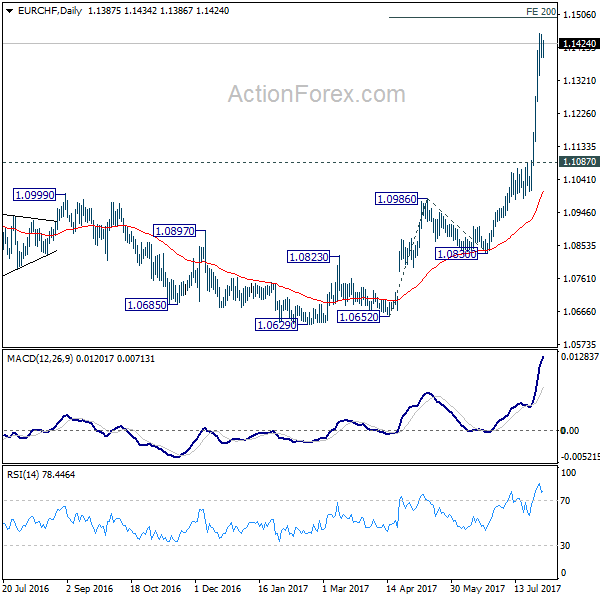

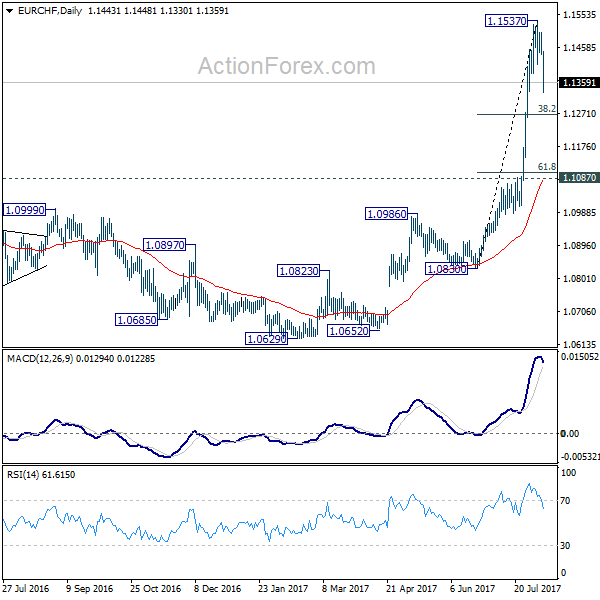

In the bigger picture, the decline from 1.1198 is seen as a corrective move. Such correction is still in progress. Sustained trading below 38.2% retracement of 0.9771 to 1.1198 at 1.0653 will target 50% retracement at 1.0485. On the upside, break of 1.0897 resistance is needed to confirm completion of such fall. Otherwise, outlook will stay bearish.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box