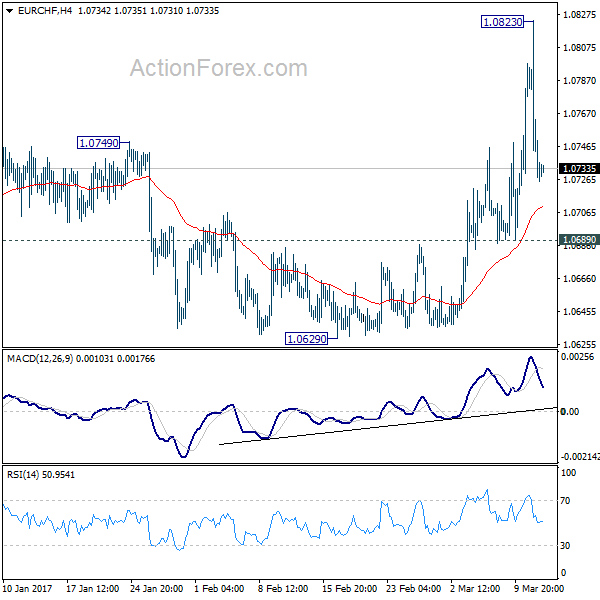

Daily Pivots: (S1) 1.0695; (P) 1.0760; (R1) 1.0793; More…

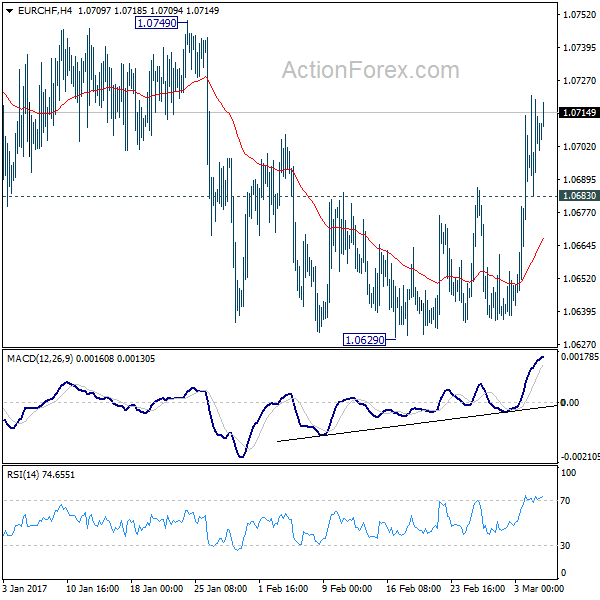

EUR/CHF spiked higher to 1.0823. However, it quickly retreated sharply since then. Intraday bias is turned neutral first. We’re favoring the case of trend reversal, on bullish convergence condition in daily MACD, after defending 1.0620 key support level. That is, correction from 1.1198 could have completed. Above 1.0823 will target 1.0897 resistance next. However, break of 1.0689 support will dampen our view and turn focus back to 1.0629 low again.

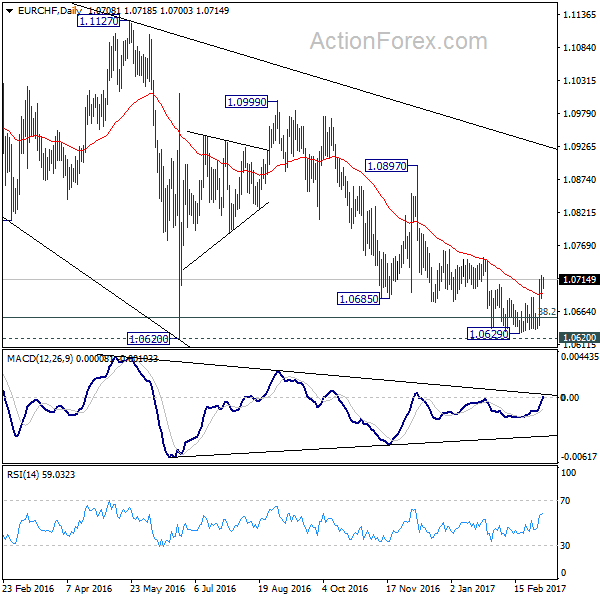

In the bigger picture, the decline from 1.1198 is seen as a corrective move. Decisive break of 1.0897 resistance should confirm that it’s completed. And in that case, larger up trend is resuming for another high above 1.1198. Meanwhile, sustained trading below 38.2% retracement of 0.9771 to 1.1198 at 1.0653 will target 50% retracement at 1.0485.