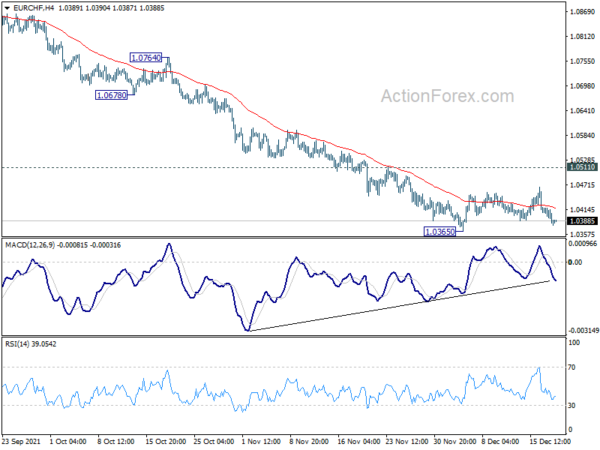

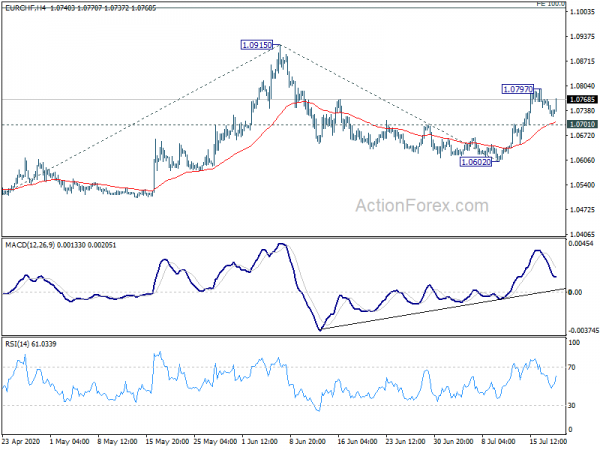

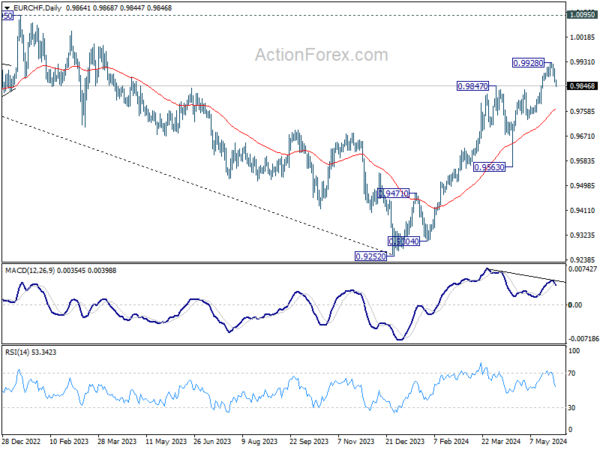

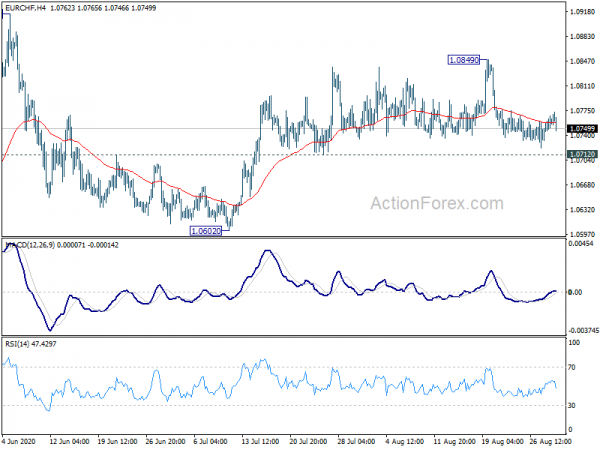

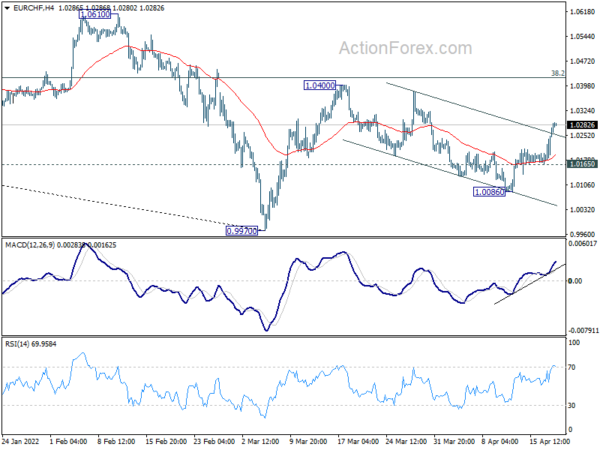

Daily Pivots: (S1) 1.0374; (P) 1.0397; (R1) 1.0409; More….

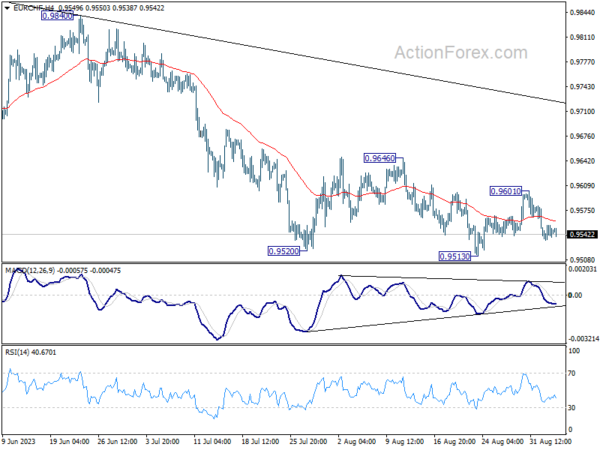

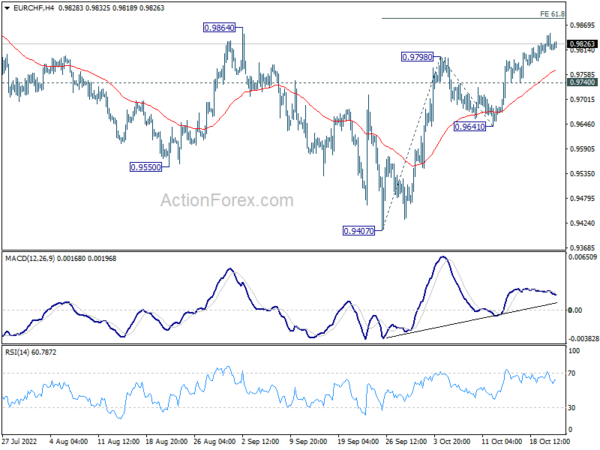

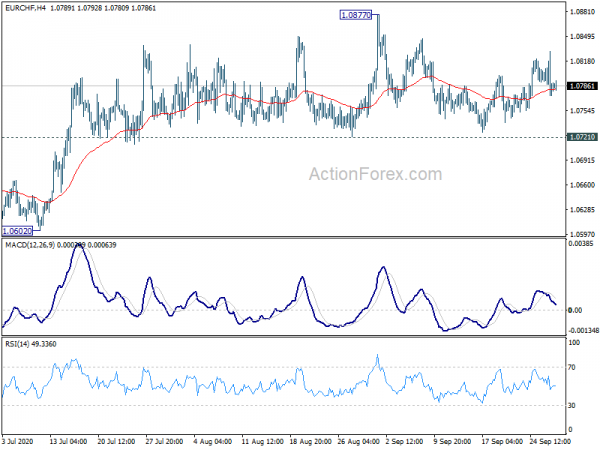

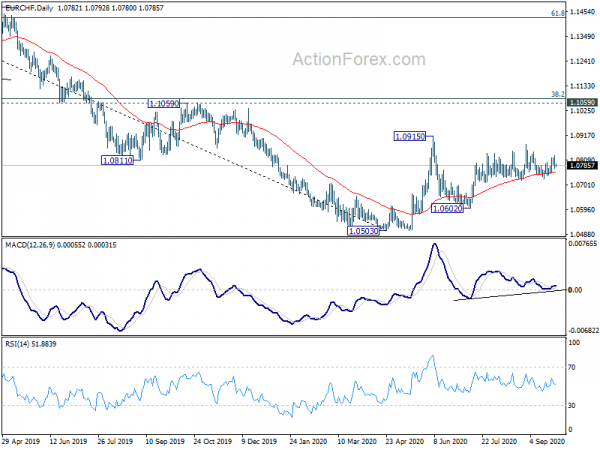

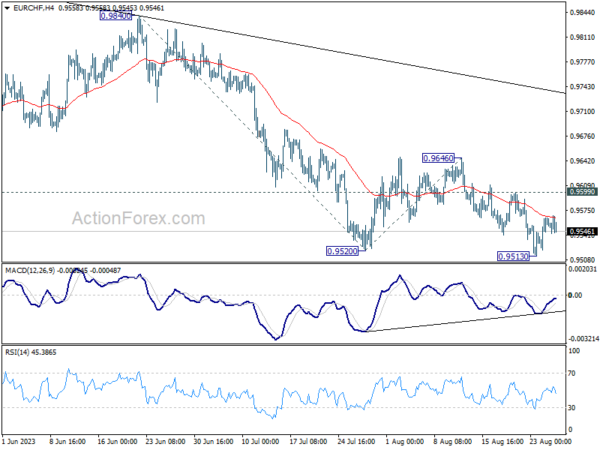

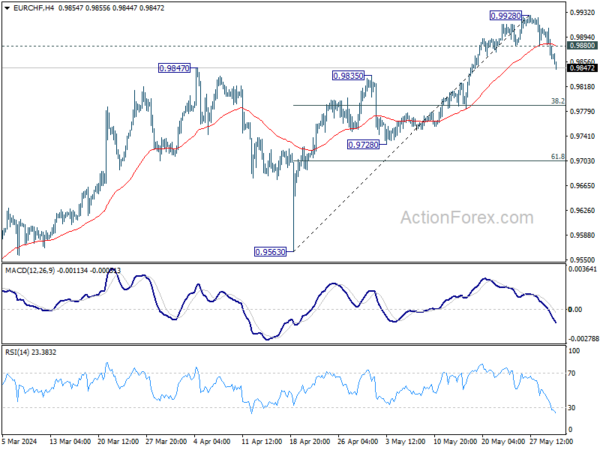

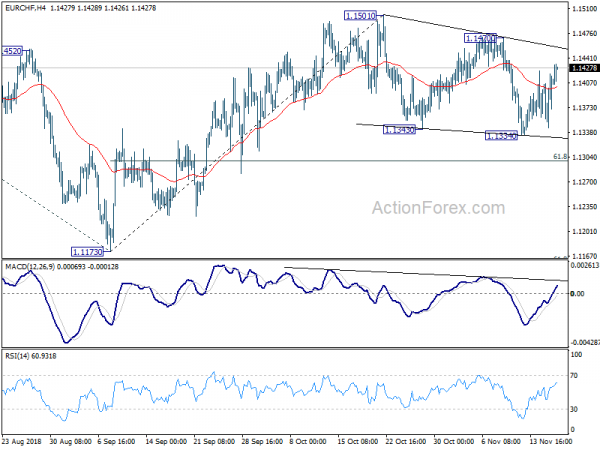

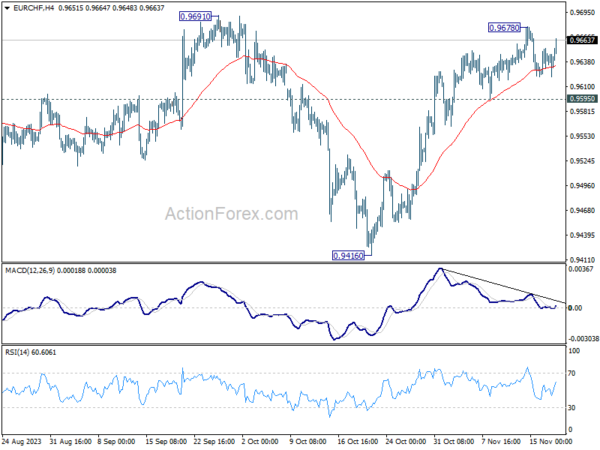

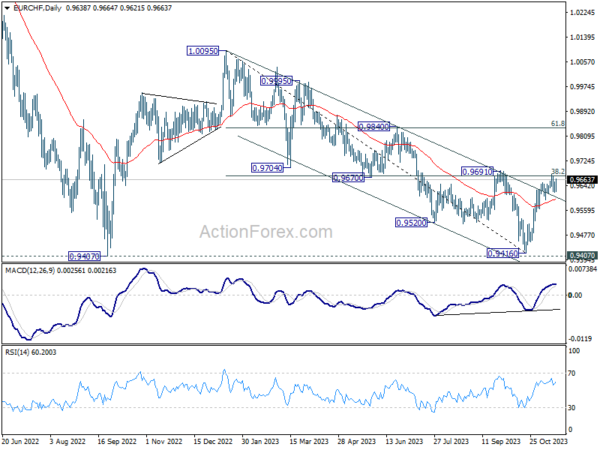

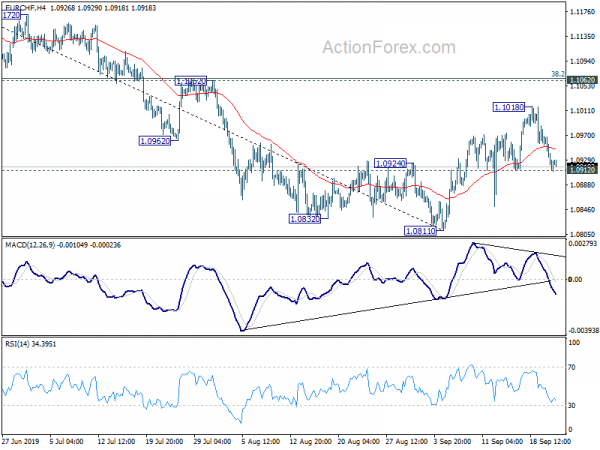

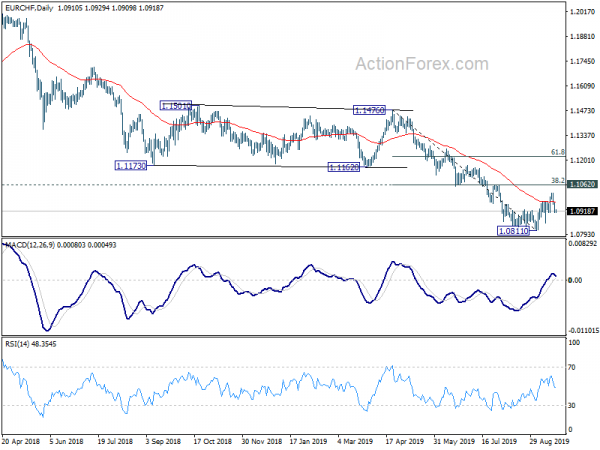

Intraday bias in EUR/CHF remains neutral as consolidation from 1.0365 is still extending. Further decline is expected as long as 1.0511 resistance holds. On the downside, break of 1.0365 will resume larger down trend from 1.1149 to 161.8% projection of 1.1149 to 1.0694 from 1.0936 at 1.0200 next.

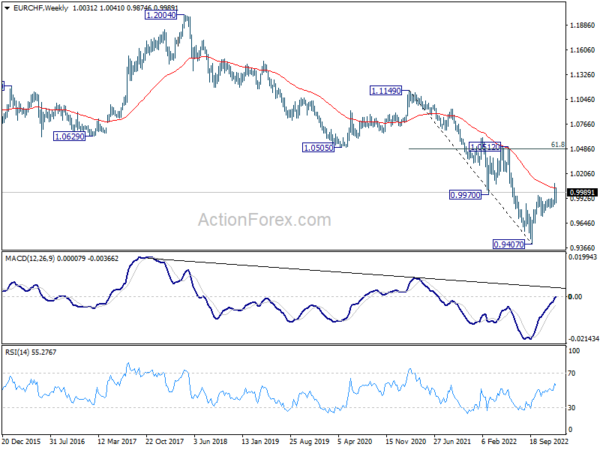

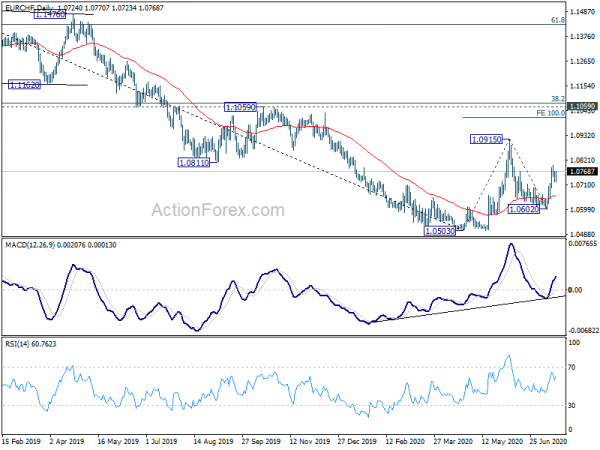

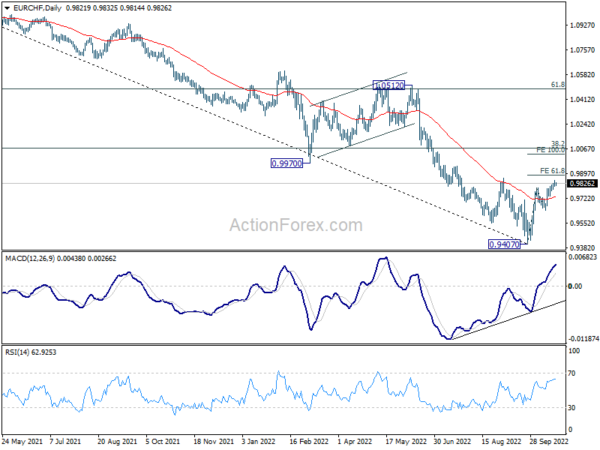

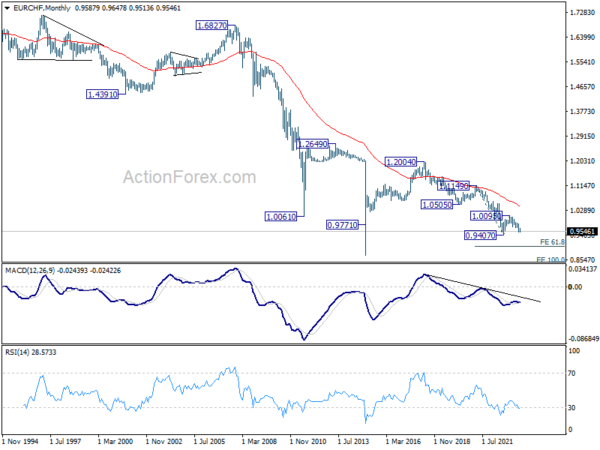

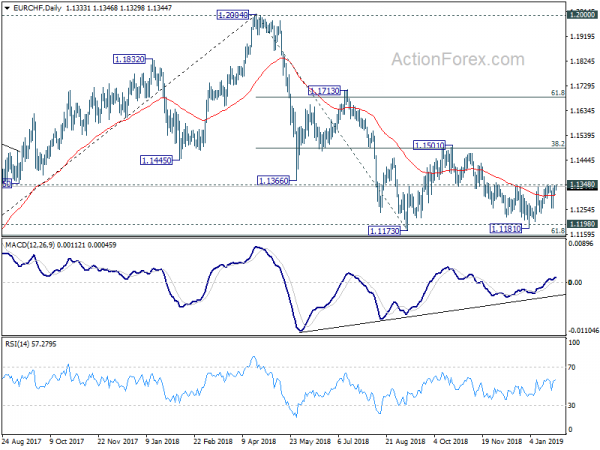

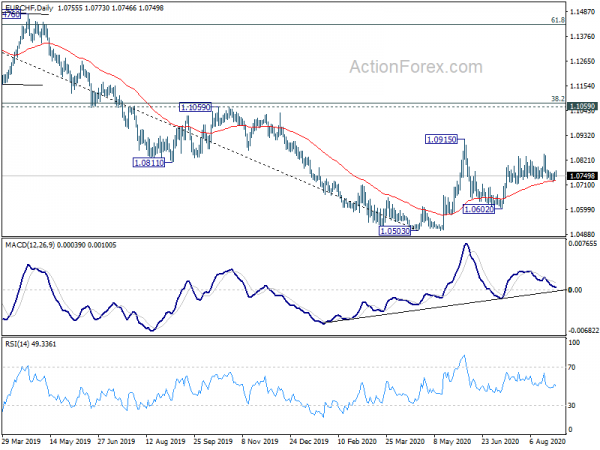

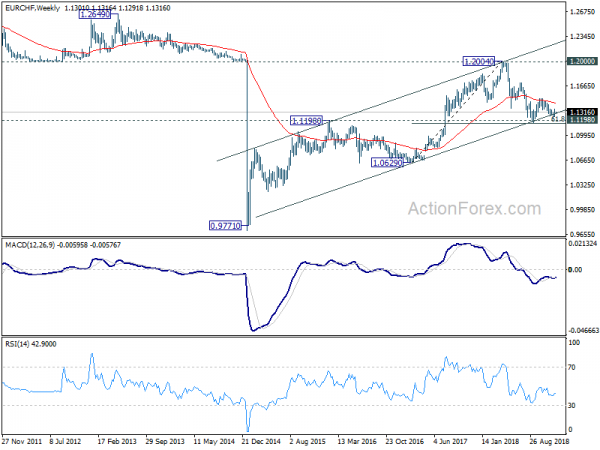

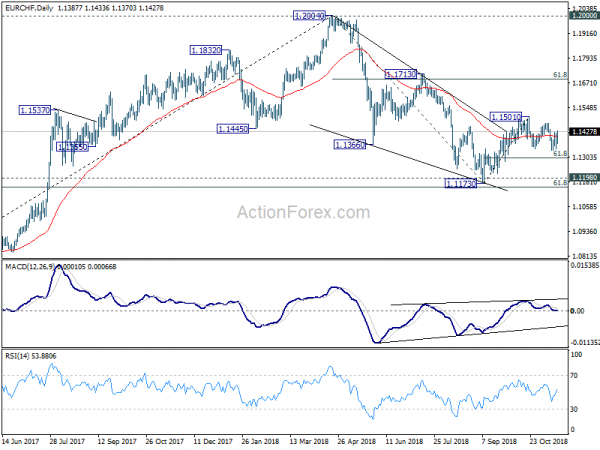

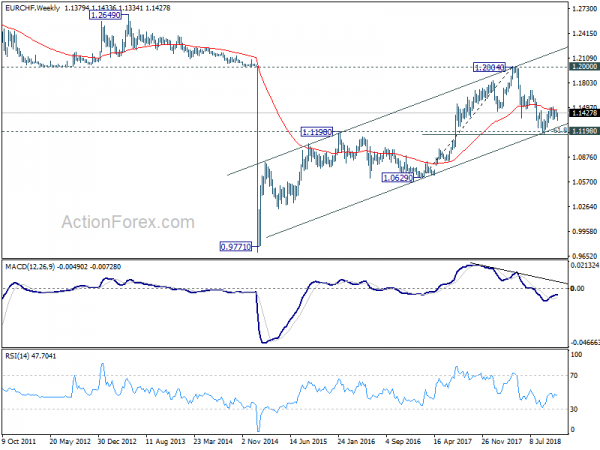

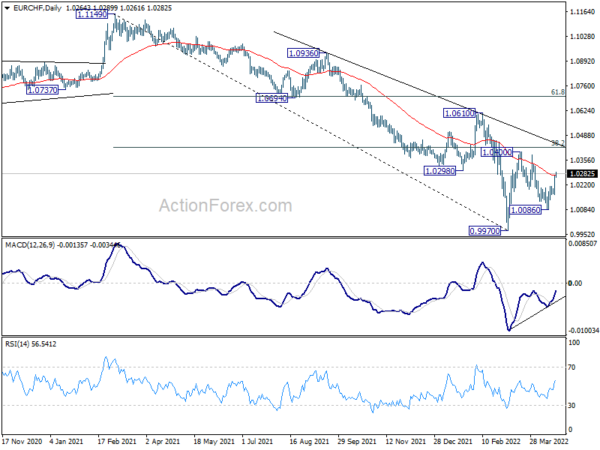

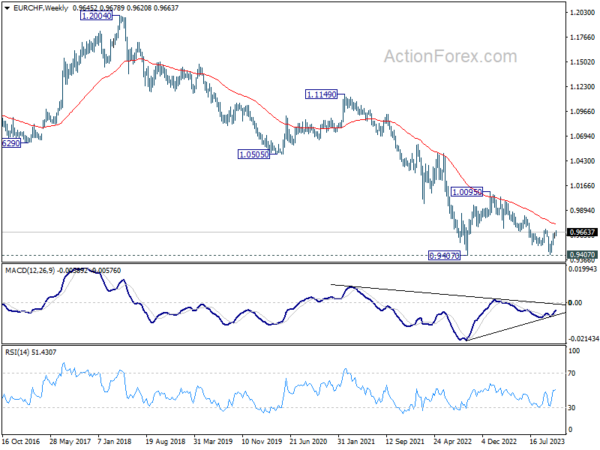

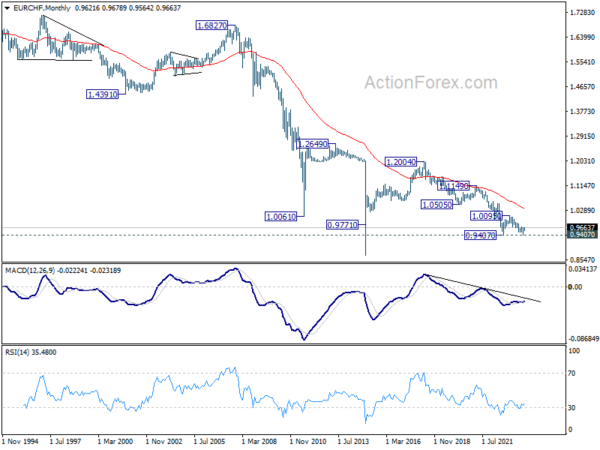

In the bigger picture, long term down trend from 1.2004 (2018 high) is now extending. Next target is 61.8% projection of 1.2004 to 1.0505 to 1.1149 at 1.0223. On the upside, break of 1.0694 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of rebound.