Daily Pivots: (S1) 0.9864; (P) 0.9880; (R1) 0.9912; More….

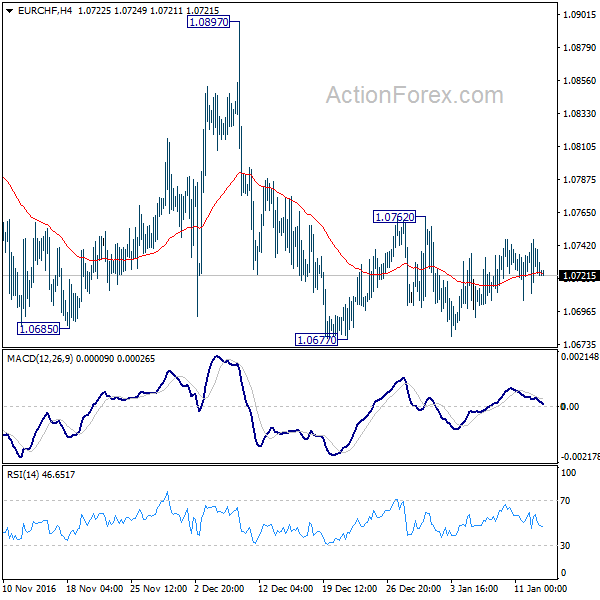

Intraday bias in EUR/CHF is neutral for the moment. On the upside, firm break of 0.9905 minor resistance will confirm short term bottoming. More importantly, corrective pattern from 1.0095 should have then completed. Bias will be flipped back to the upside for 1.0067/95 resistance zone. In case of another fall, downside should be contained by 38.2% retracement of 0.9407 to 1.0095 at 0.9832.

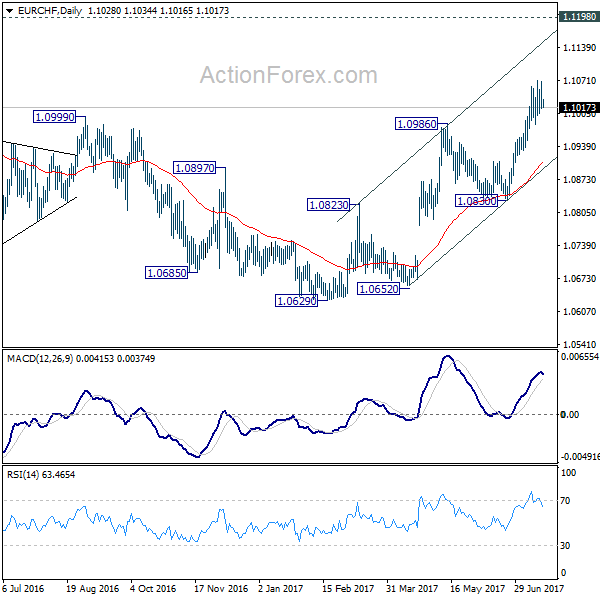

In the bigger picture, the rejection by 55 week EMA (now at 1.0025) mixed up the outlook. On the upside, sustained trading above 55 week EMA will raise the chance of bullish trend reversal. Rise from 0.9407 should then target 1.0505 cluster resistance (2020 low at 1.0505, 61.8% retracement of 1.1149 to 0.9407 at 1.1484). However, firm break of 0.9832 support will revive medium term bearishness and bring retest of 0.9407 low instead.