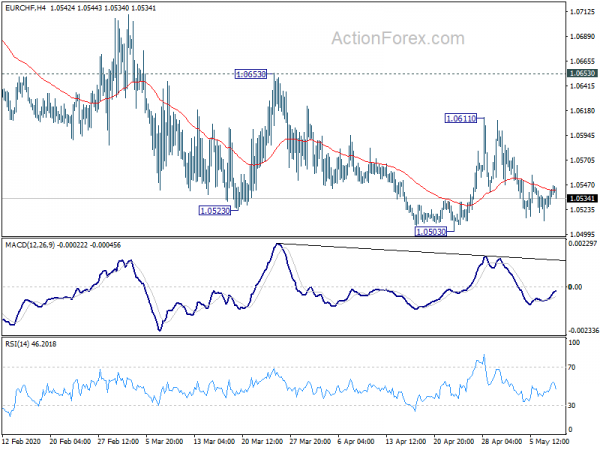

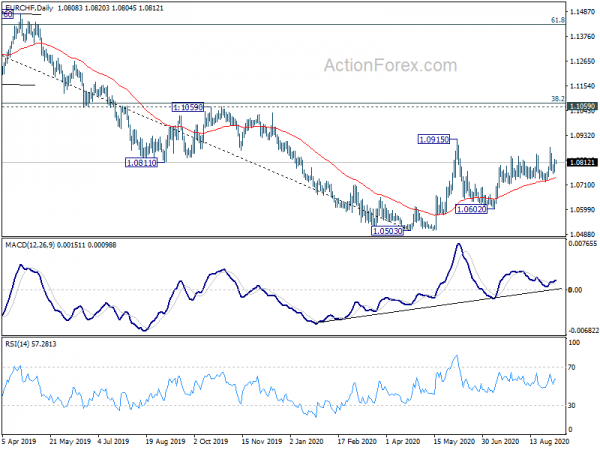

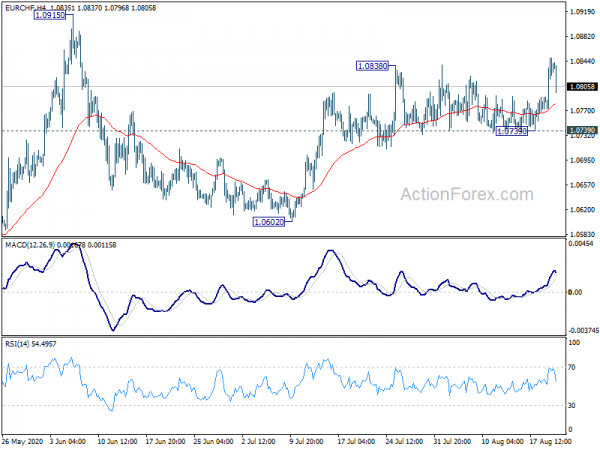

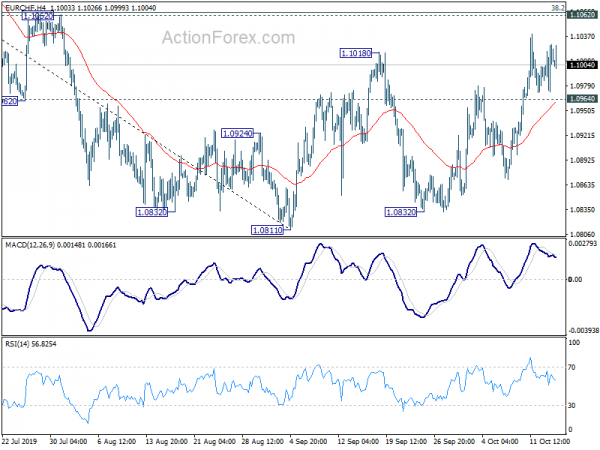

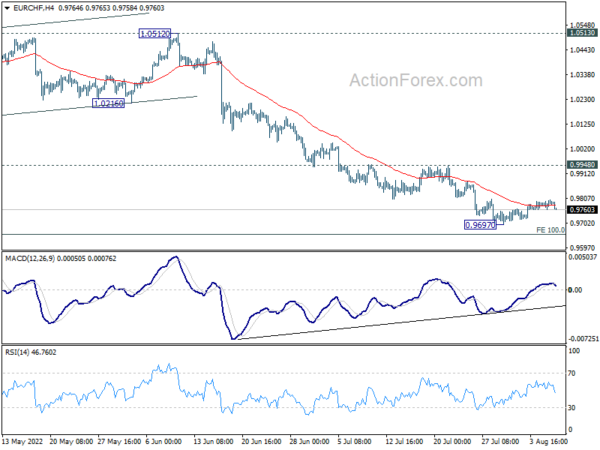

Daily Pivots: (S1) 1.0530; (P) 1.0536; (R1) 1.0548; More…

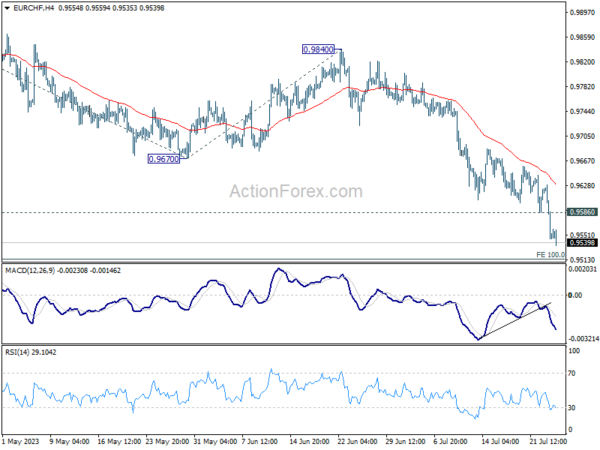

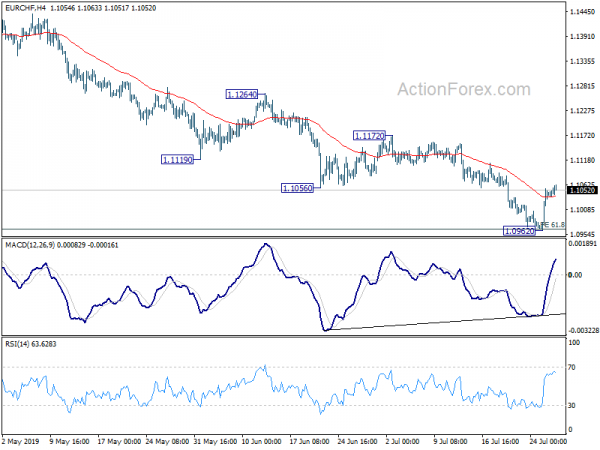

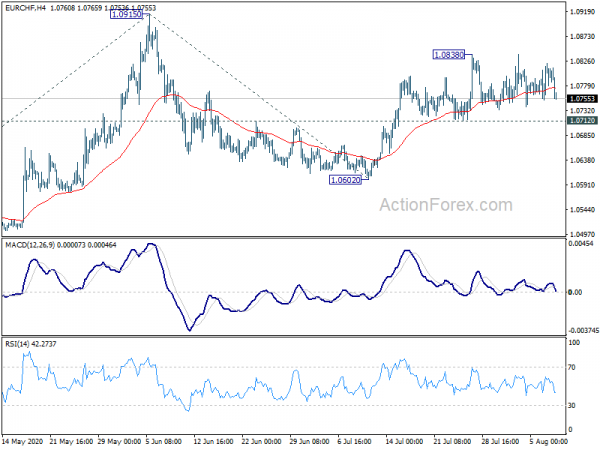

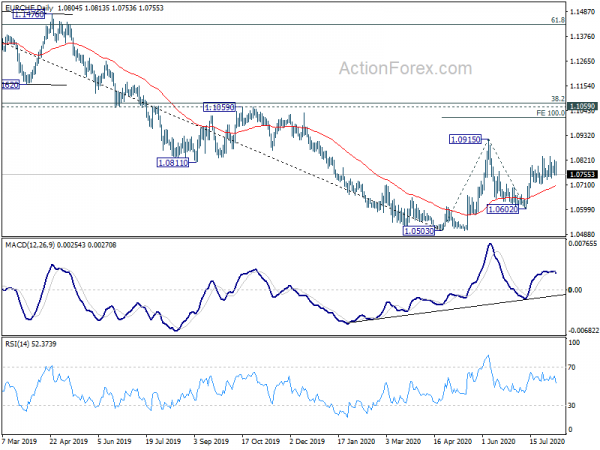

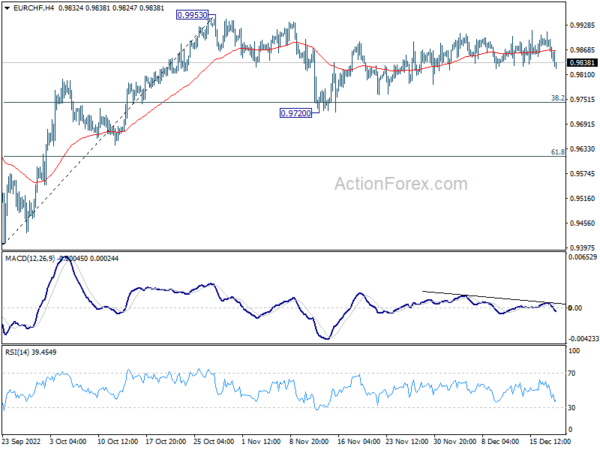

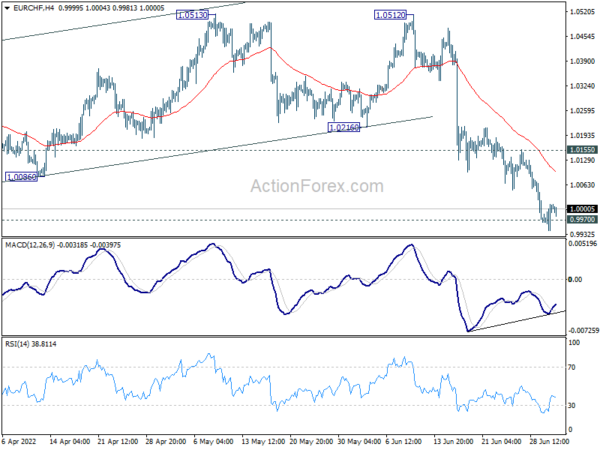

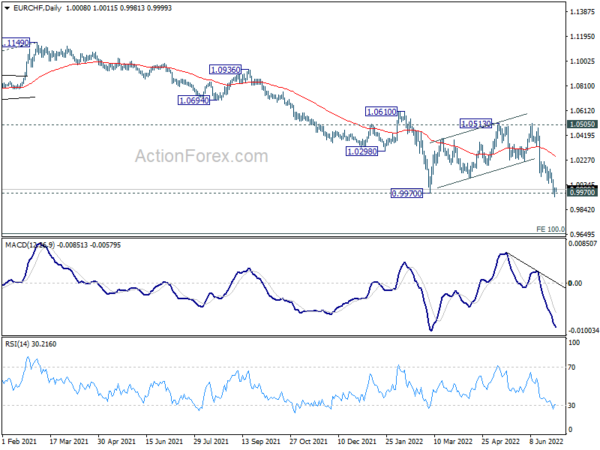

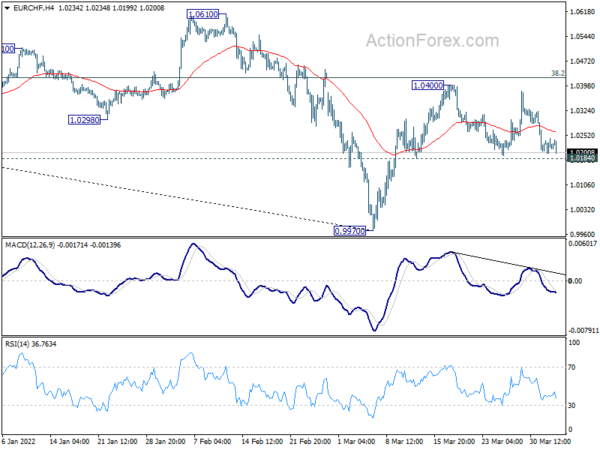

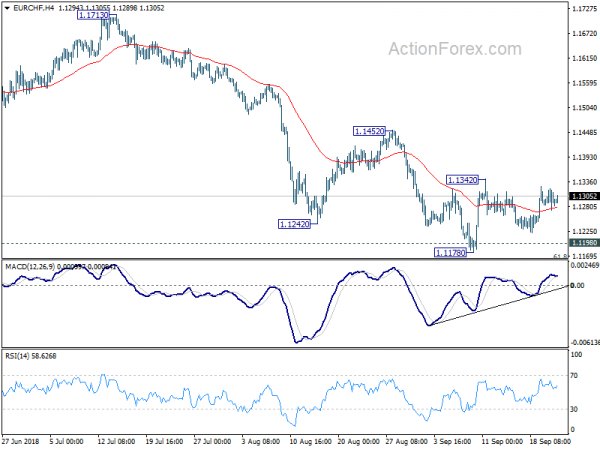

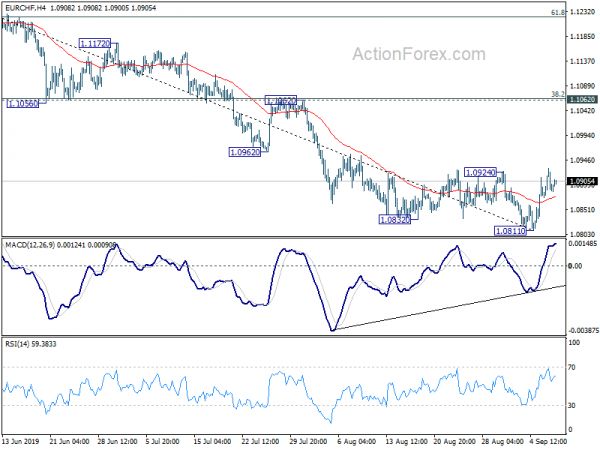

Intraday bias in EUR/CHF remains neutral for the moment and consolidation from 1.0503 might extend. But in case of another rise, upside should be limited by 1.0653 resistance to bring down trend resumption. On the downside, break of 1.0503 will target 100% projection of 1.1476 to 1.0811 from 1.1059 at 1.0394.

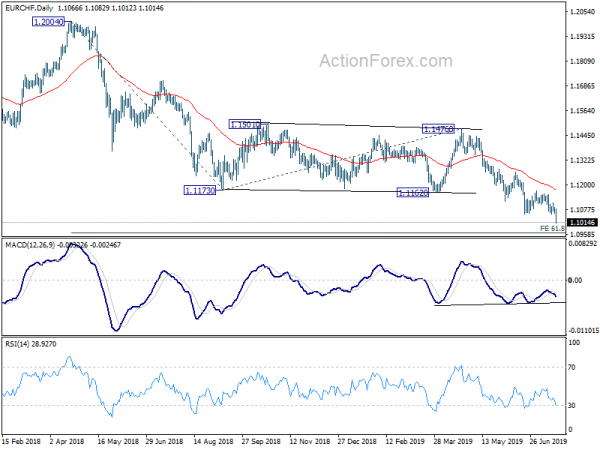

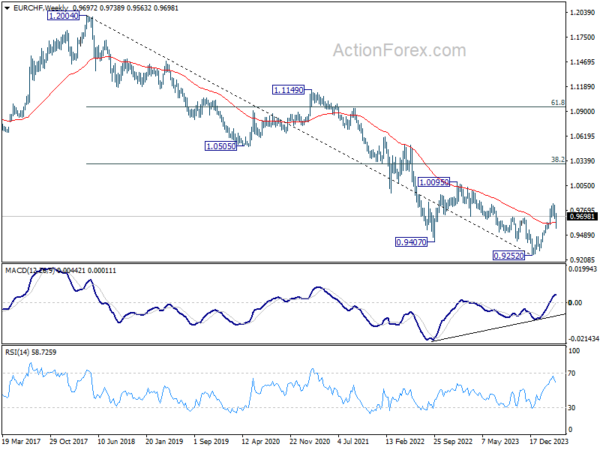

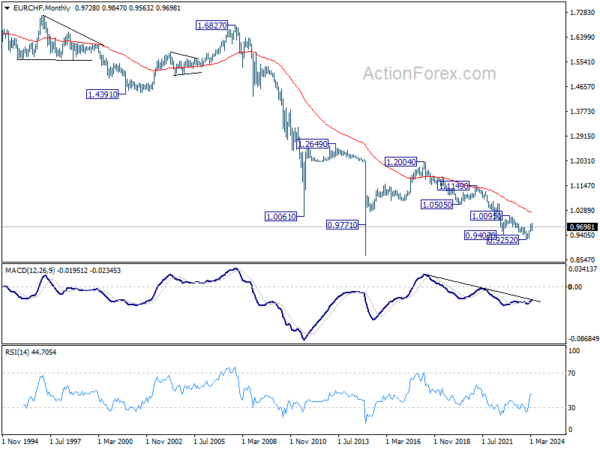

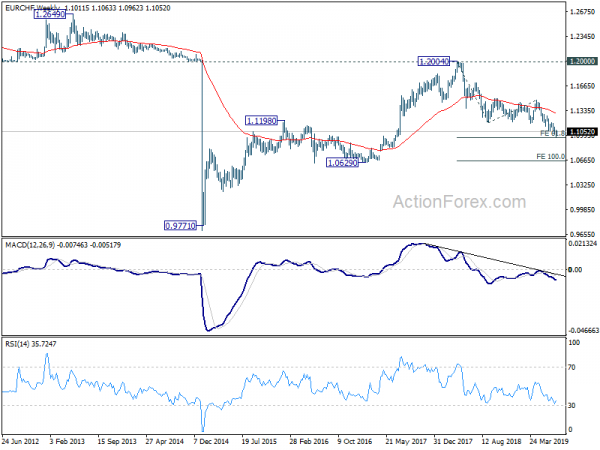

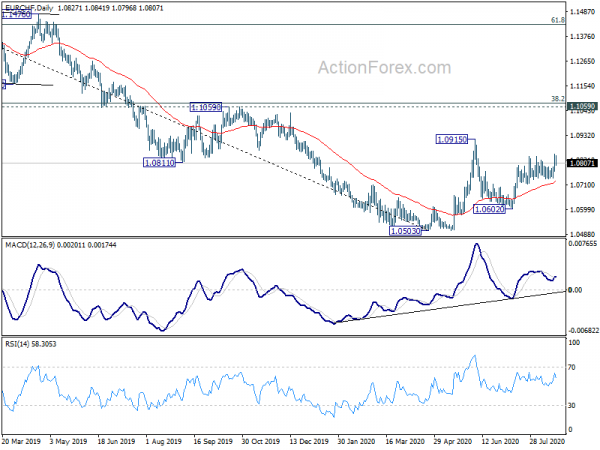

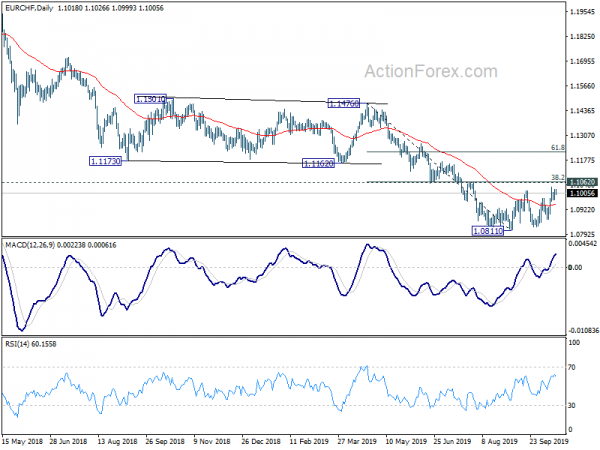

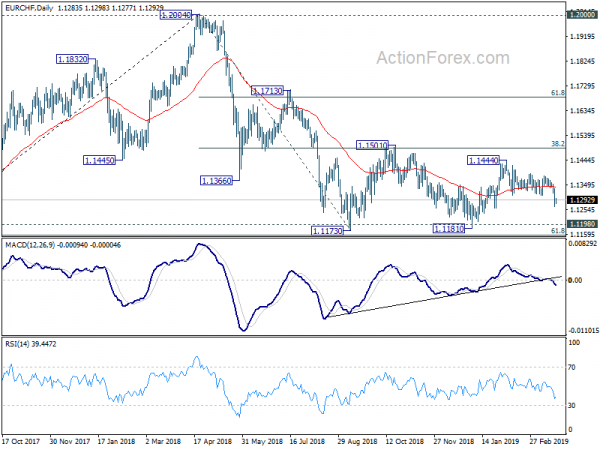

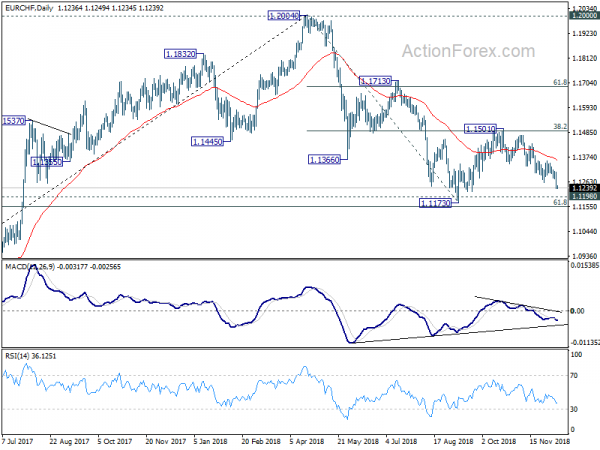

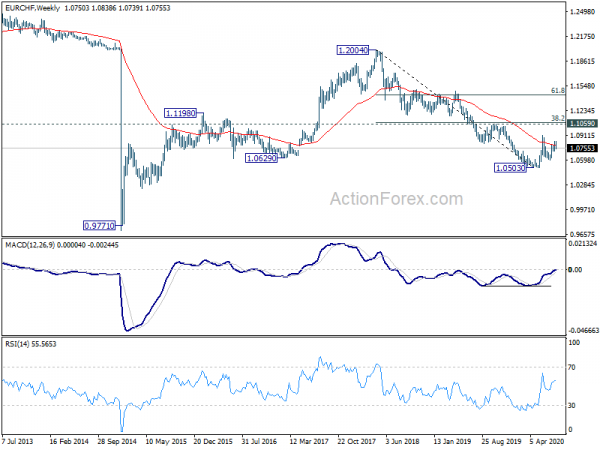

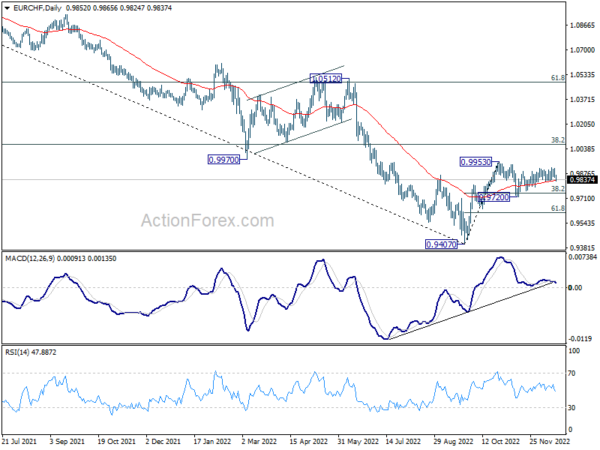

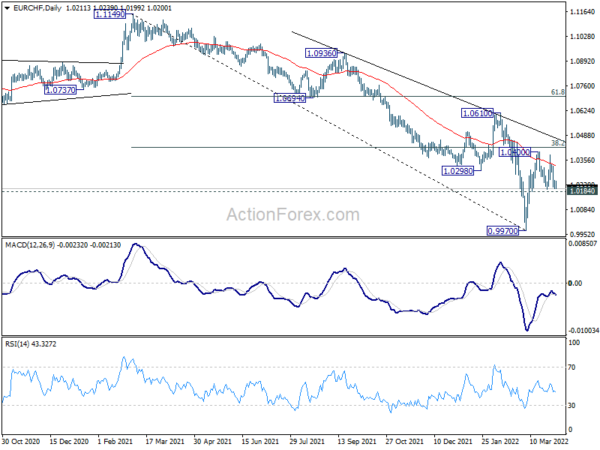

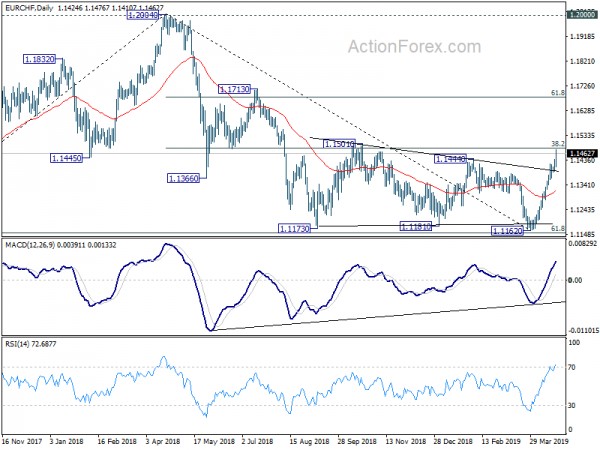

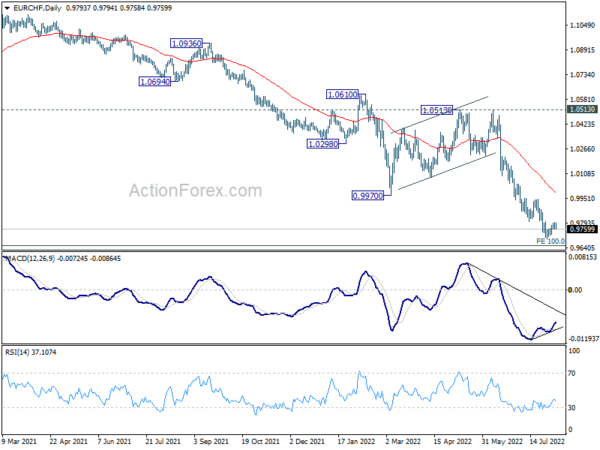

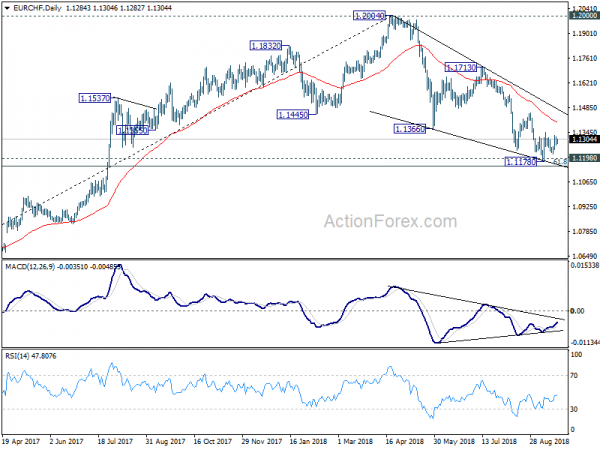

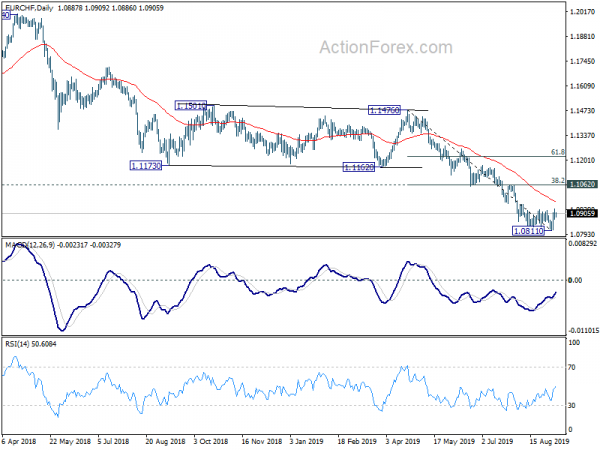

In the bigger picture, down trend from 1.2004 is (2018 high) is still in progress for parity next. In any case, outlook will remain bearish as long as 1.0653 resistance holds. However, considering bullish convergence condition in daily MACD, firm break of 1.0653 resistance will indicate medium term bottoming. Strong rebound would then be seen back to 1.0811/1059 resistance zone.