Daily Pivots: (S1) 1.0752; (P) 1.0779; (R1) 1.0815; More….

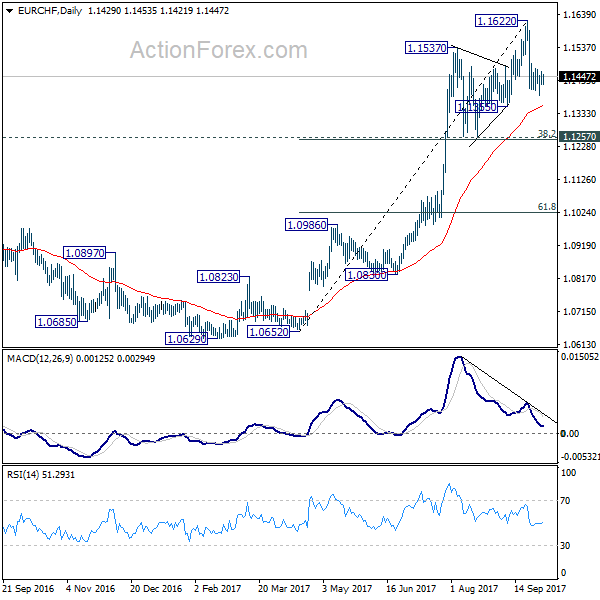

Intraday bias in EUR/CHF remains neutral for the moment. With 1.0839 resistance intact, outlook remains bearish and further decline is expected. On the downside, break of 1.0694 will resume larger fall from 1.1149. Next target is 61.8% projection of 1.0985 to 1.0715 from 1.0839 at 1.0672 first. Break will target 100% projection at 1.0569 next.

In the bigger picture, rebound from 1.0505 (2020 low) should have completed at 1.1149 already. The three-wave corrective structure argues that the downtrend from 1.2004 (2018 high) is not over yet. Medium term outlook will now stay bearish as long as 55 week EMA (now at 1.0863) holds. Break of 1.0505 low would be seen at a later stage.