Daily Pivots: (S1) 0.9540; (P) 0.9555; (R1) 0.9563; More…

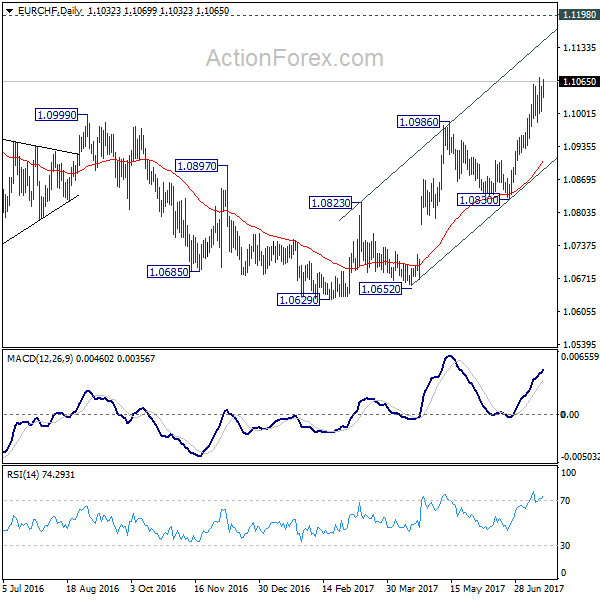

Intraday bias in EUR/CHF stays neutral at this point. With 0.9601 resistance intact, larger down trend is still in favor to continue. On the downside, break of 0.9513 support will confirm this bearish case and target 0.9407 low. Nevertheless, break of 0.9601 resistance will turn bias back to the upside for stronger rebound to 0.9646 resistance and above.

In the bigger picture, medium term outlook is staying bearish as the pair is capped well below falling 55 W EMA (now at 0.9839). Down trend from 1.2004 (2018 high) is in favor to continue. Sustained break of 0.9407 will target 61.8% projection of 1.1149 to 0.9407 from 1.0095 at 0.9018. For now, this will remain the favored case as long as 0.9670 support turned resistance holds, in case of strong rebound.