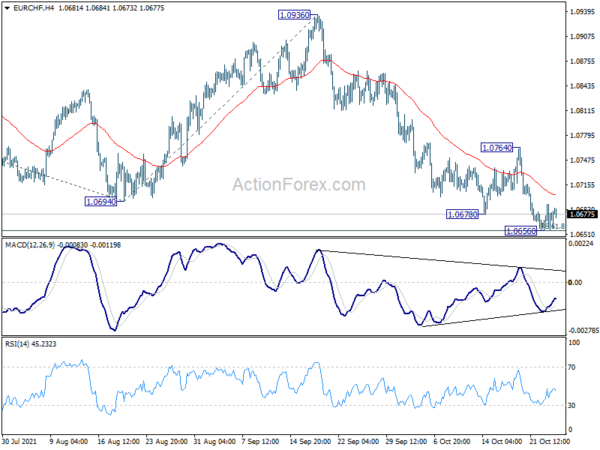

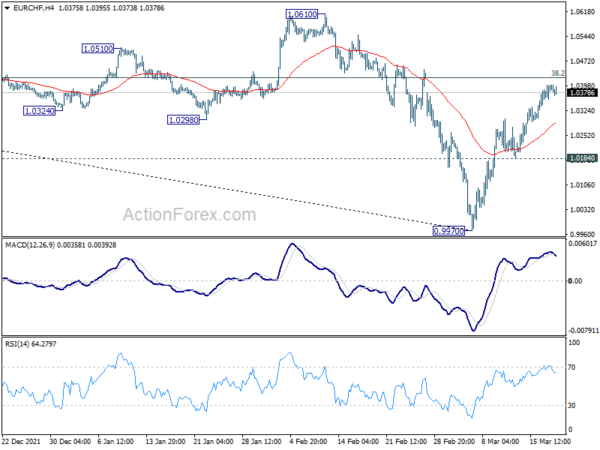

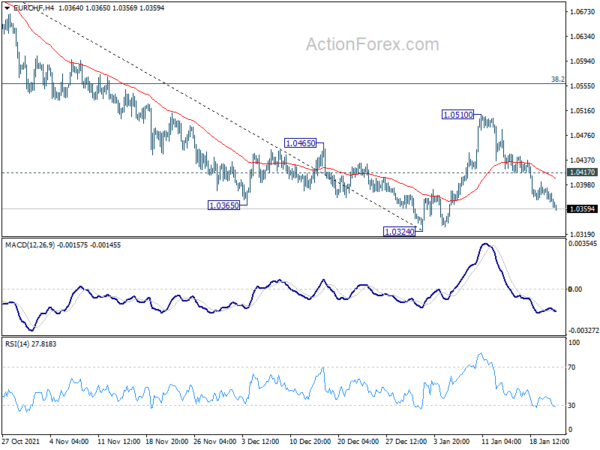

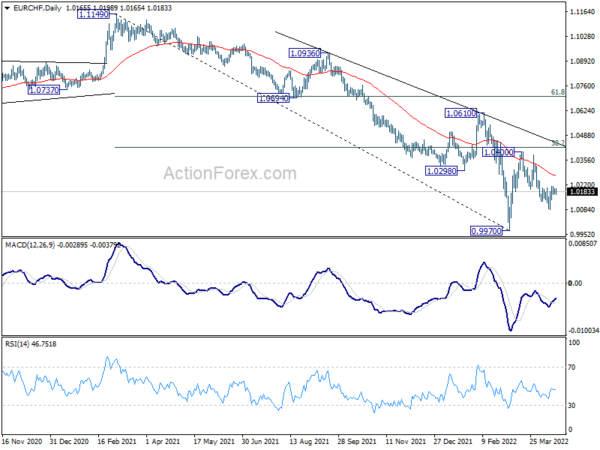

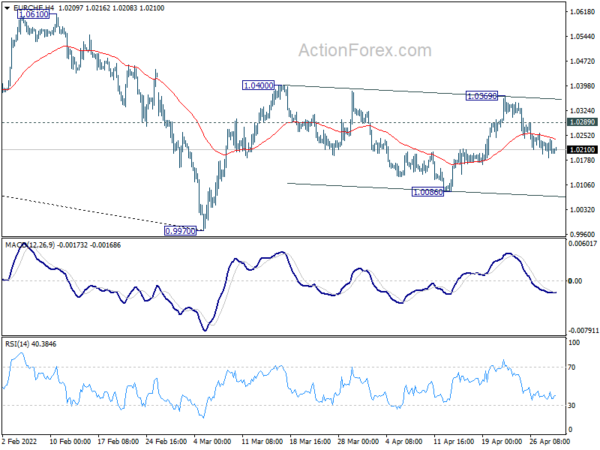

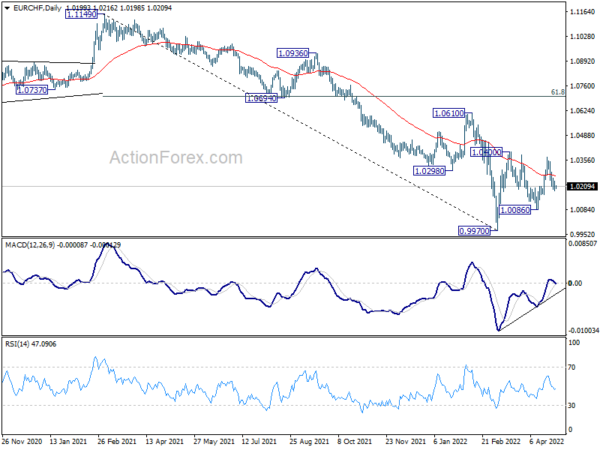

Daily Pivots: (S1) 1.0661; (P) 1.0677; (R1) 1.0695; More….

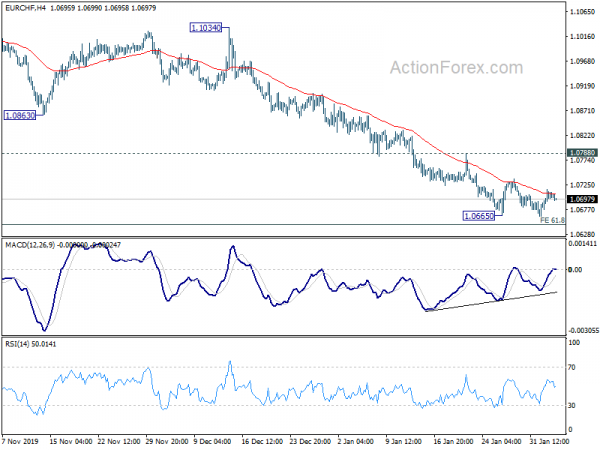

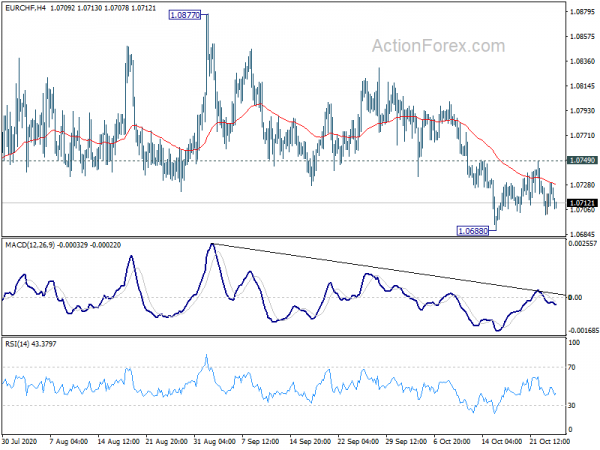

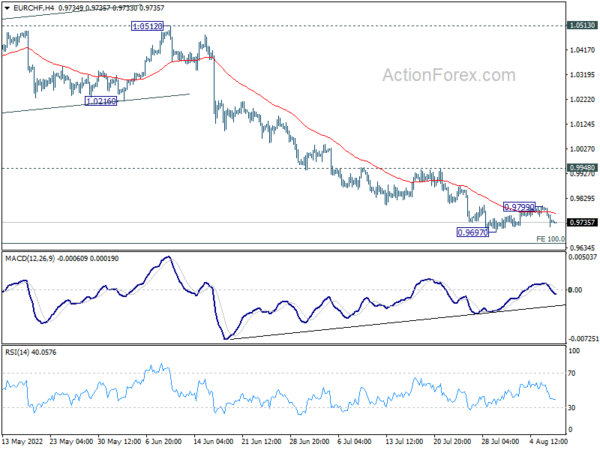

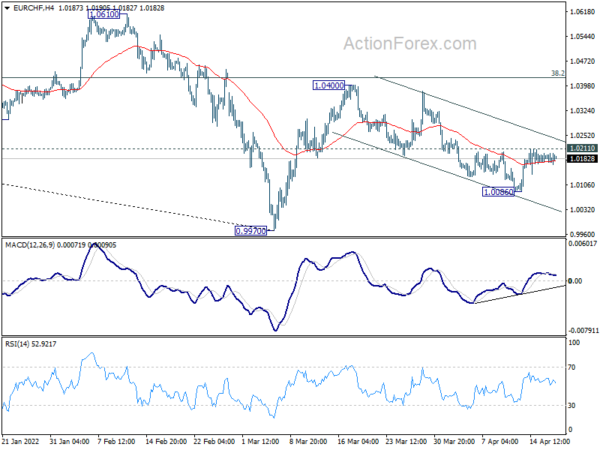

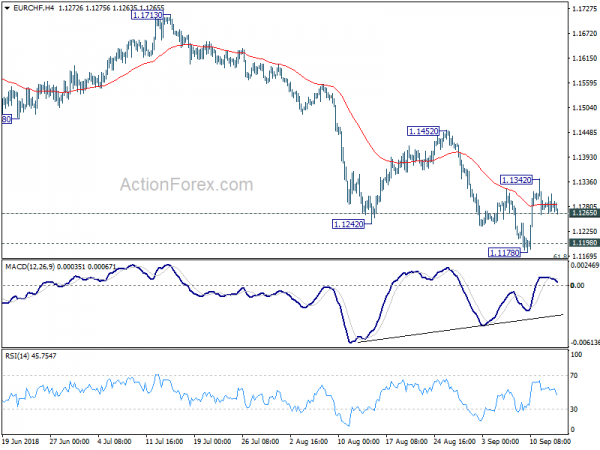

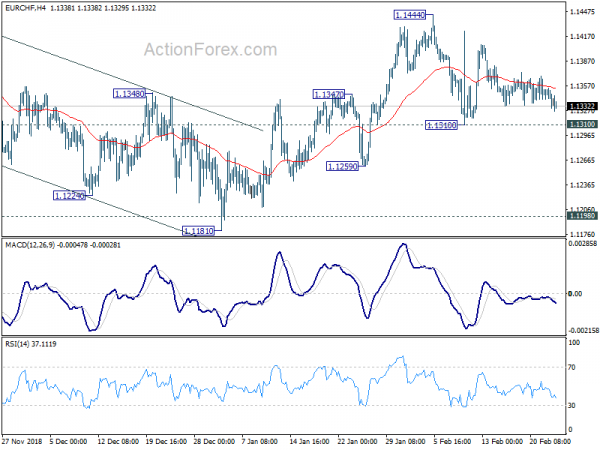

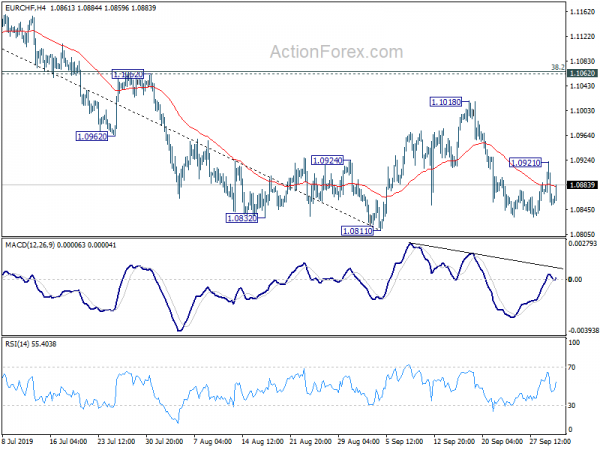

Intraday bias in EUR/CHF remains neutral for the moment. On the upside, break of 1.0764 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish. On the downside, break of 1.0656 will resume larger fall from 1.1149 to 100% projection of 1.1149 to 1.0694 from 1.0936 at 1.0481.

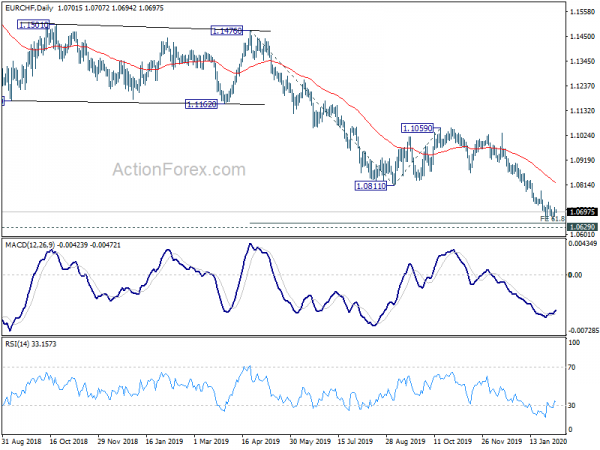

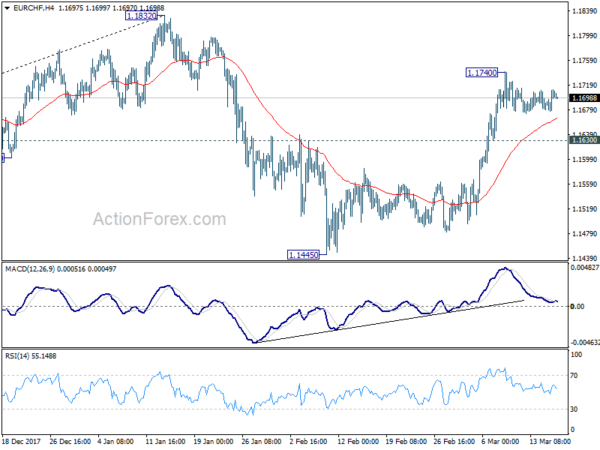

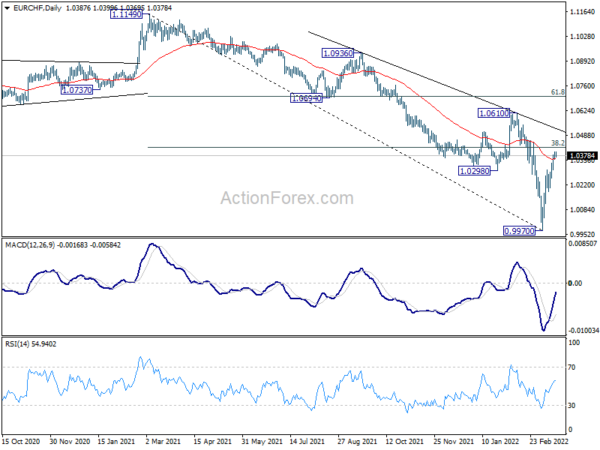

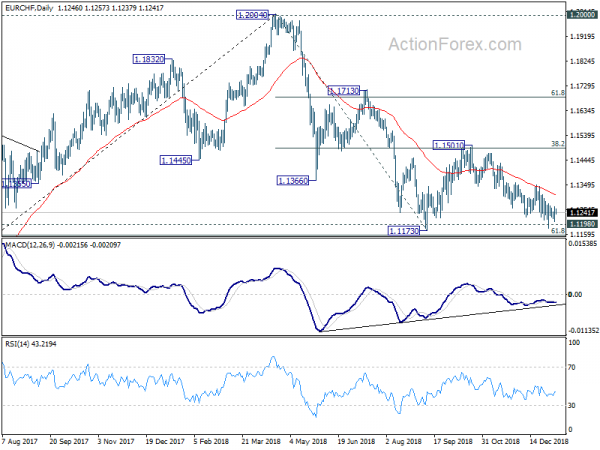

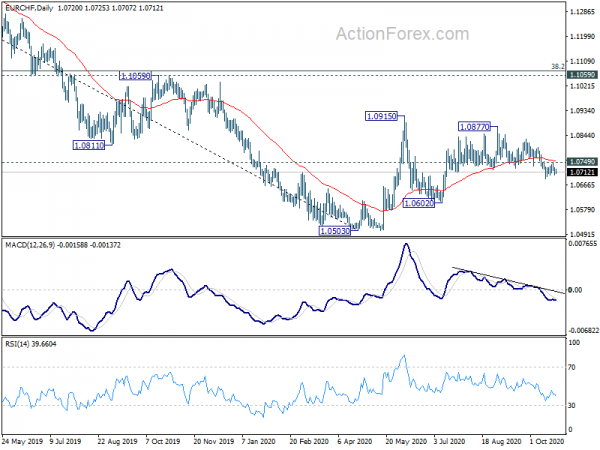

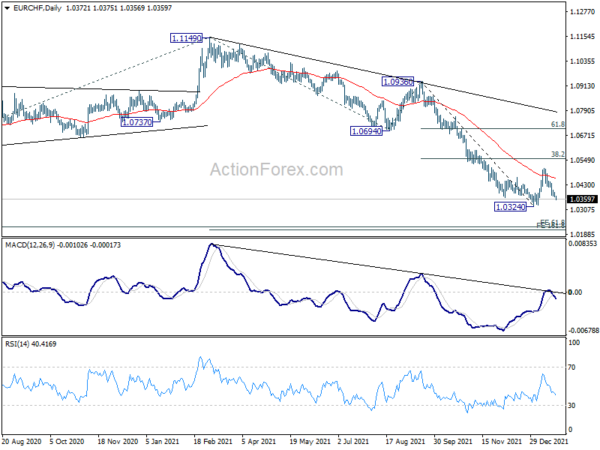

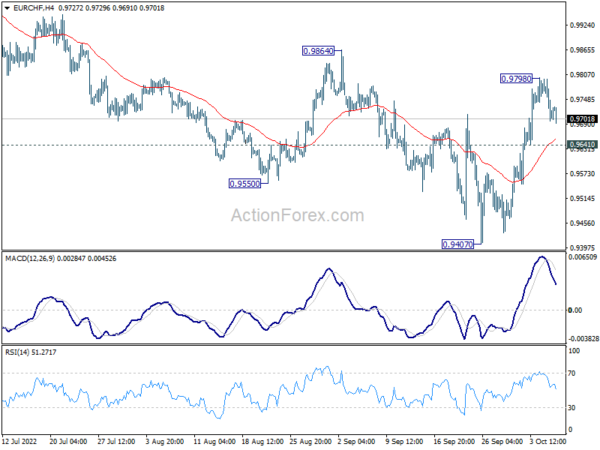

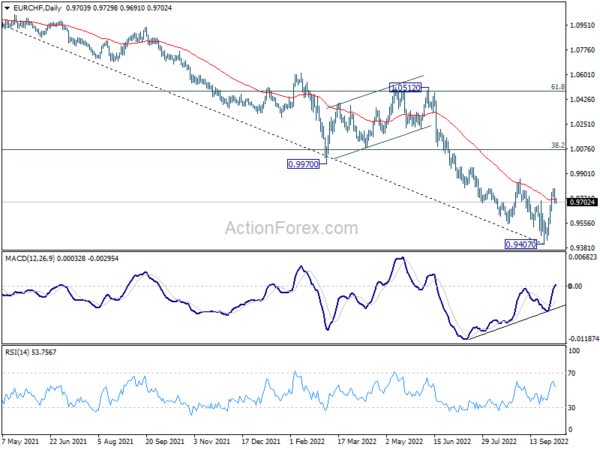

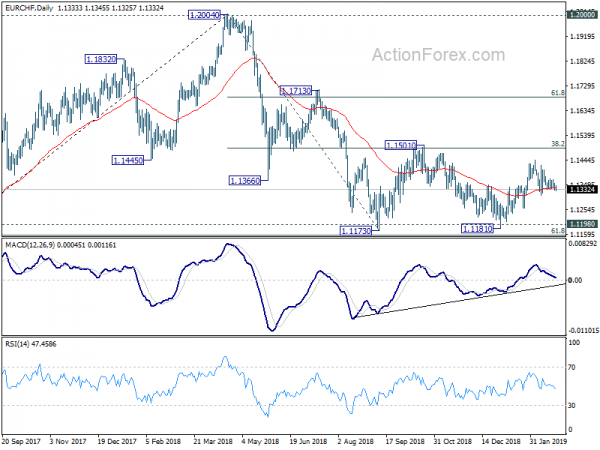

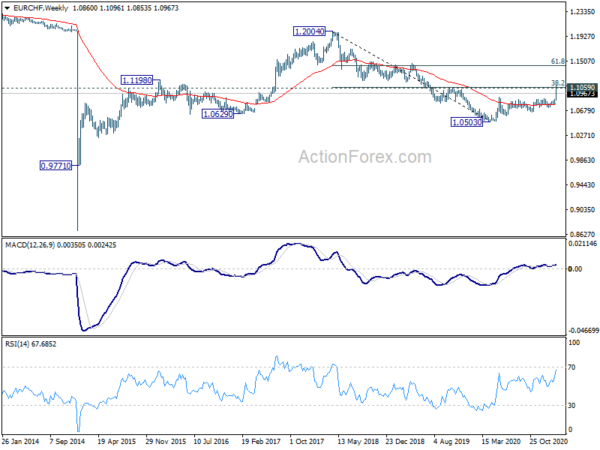

In the bigger picture, the rejection by 55 week EMA maintains medium term bearishness. Fall from 1.1149 (2021 high) is currently seen as the second leg of the patter from 1.0505 (2020 low) first. Hence, in case of deeper fall, we’d look for strong support from 1.0505 to bring rebound. However, sustained break of 1.0505 will resume the long term down trend from 1.2004 (2018 high). Also, medium term outlook will now be neutral at best as long as 1.0936 resistance holds.