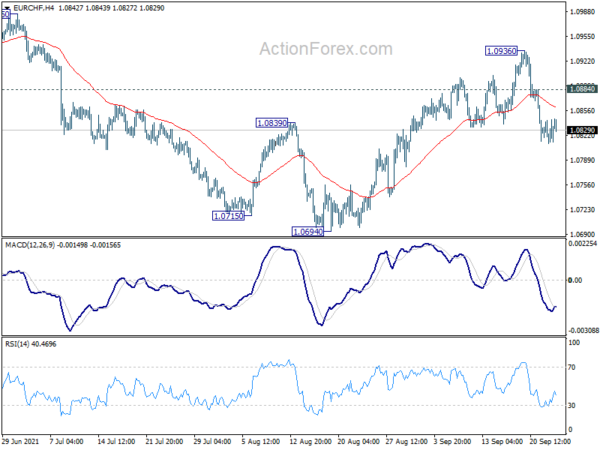

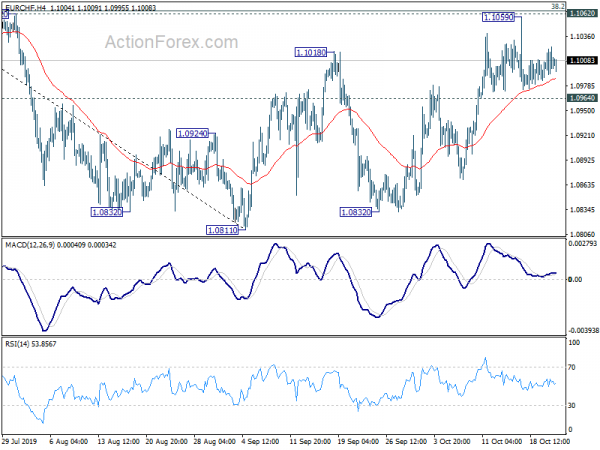

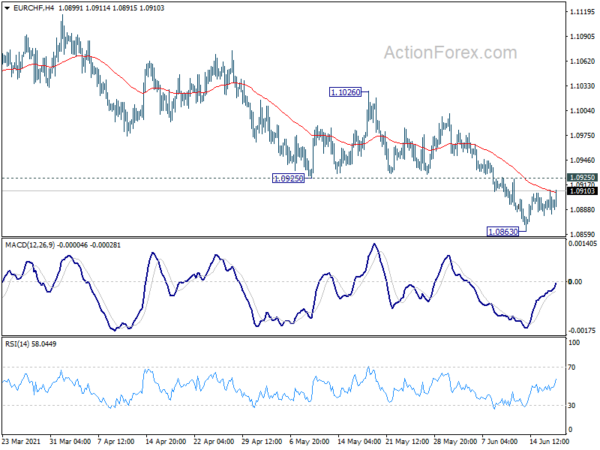

Daily Pivots: (S1) 1.0813; (P) 1.0829; (R1) 1.0845; More….

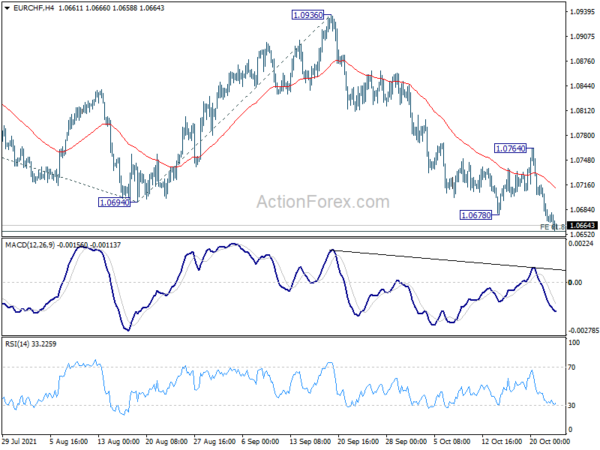

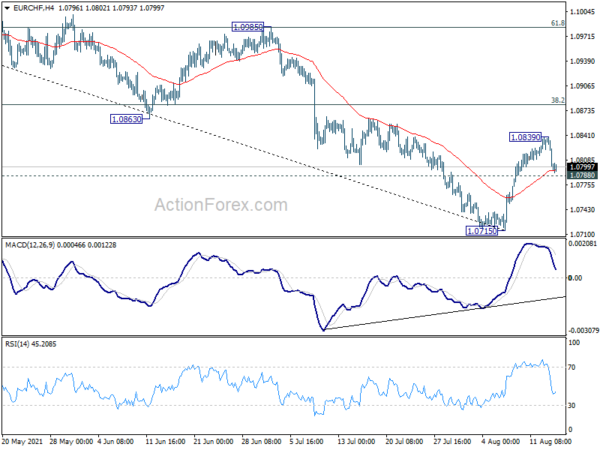

Intraday bias in EUR/CHF stays mildly on the downside at this point. Rebound from 1.0694 could have completed at 1.0936 already. Deeper fall would be seen back to retest 1.0694 low. Break there will resume whole decline from 1.1149. On the upside, break of 1.0884 minor resistance will turn bias back to the upside for 1.0936 again.

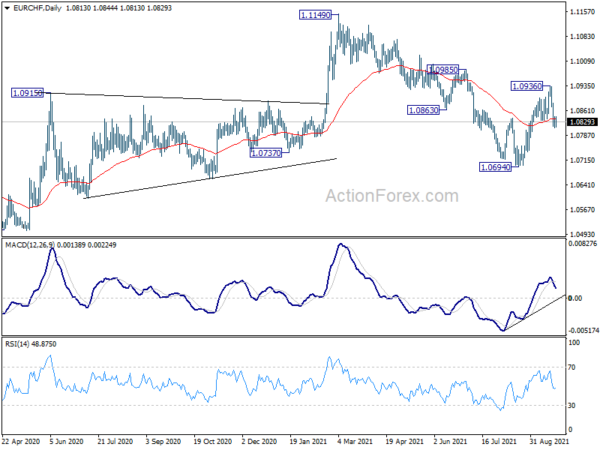

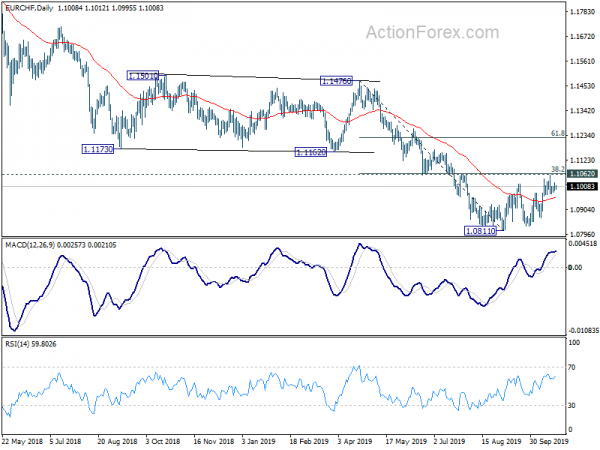

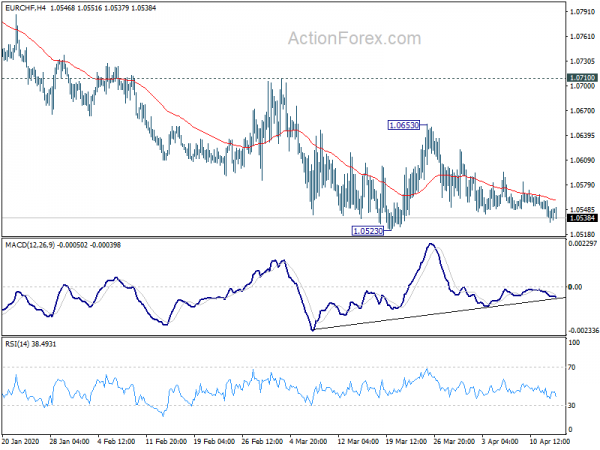

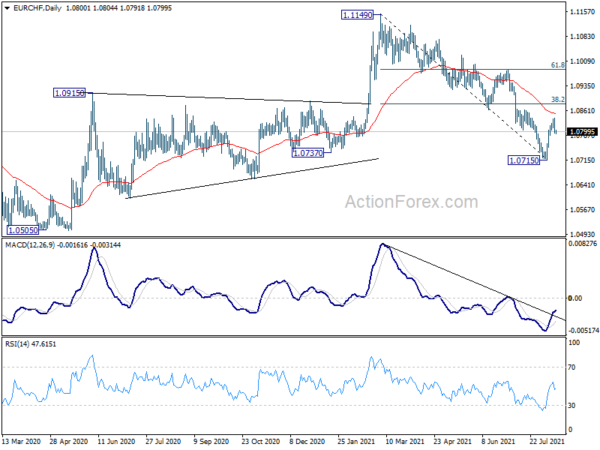

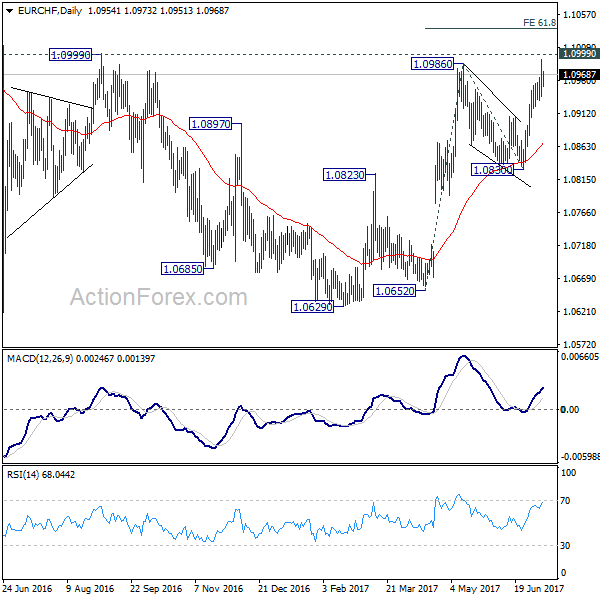

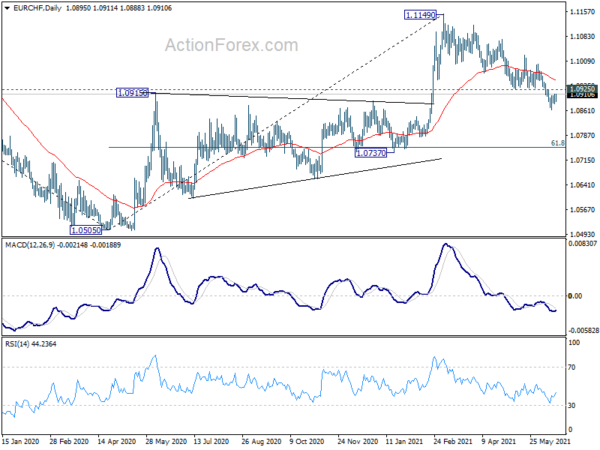

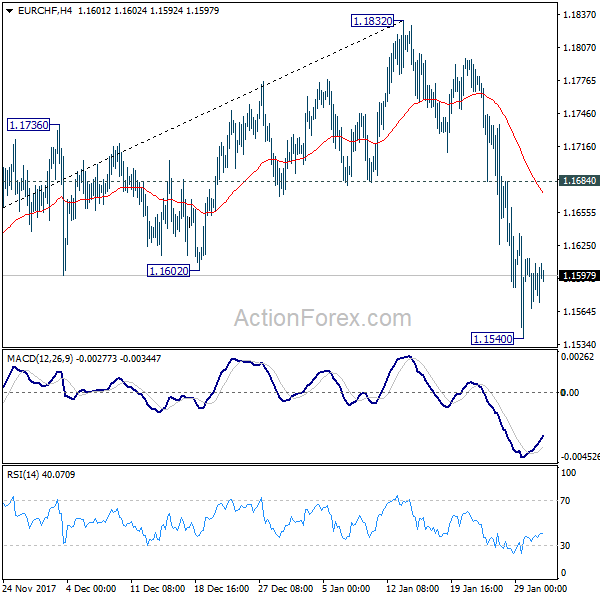

In the bigger picture, the stronger than expected rebound from 1.0694 and break of 55 week EMA (now at 1.0861) mixes up the medium term outlook. On the upside, break of 1.1149 will resume the whole rise from 1.0505 (2020 low). On the downside, break of 1.0694 will revive some medium term bearishness for 1.0505 and below.