Daily Pivots: (S1) 0.9629; (P) 0.9664; (R1) 0.9714; More….

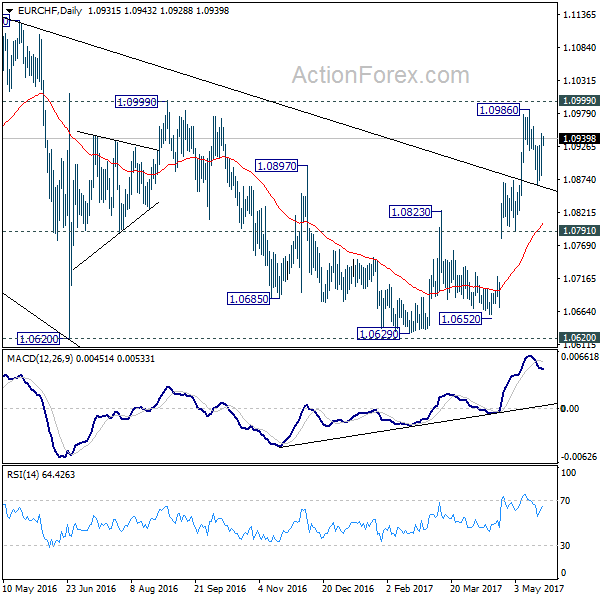

EUR/CHF is staying in range of 0.9550/9698 and intraday bias remains neutral first. Further decline is still in favor. On the downside, break of 0.9550 will resume larger down trend to 100% projection of 1.1149 to 0.9970 from 1.0513 at 0.9334. On the upside, however, firm break of 0.9698 will confirm short term bottoming. Bias will be turned back to the upside for rebound, towards 55 day EMA (now at 0.9838).

In the bigger picture, long term down trend from 1.2004 (2018 high) is still in progress. Next target is 138.2% projection of 1.2004 to 1.0505 to 1.1149 at 0.9033. On the upside, break of 0.9970 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of strong rebound.